Share Market Weekly

- Share.Market

- 5 min read

- 09 Jan 2026

Highlights

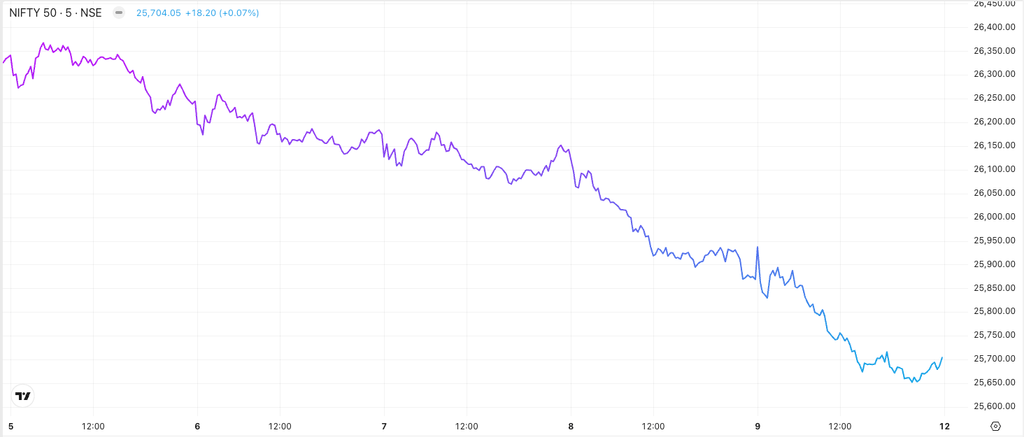

Nifty 50 🔽 2.45%

| Monday | 🔻 0.30% |

| Tuesday | 🔻 0.27% |

| Wednesday | 🔻 0.14% |

| Thursday | 🔻 1.01% |

| Friday | 🔻 0.75% |

What moved the market?

Top Gainers & Top Losers

| Nifty Consumer Durables | 🔼 0.98% | Nifty Oil & Gas | 🔻 5.76% |

| Nifty Energy | 🔻 5.14% | ||

| Nifty Infra | 🔻 4.74% |

Markets this week

| Nifty Midcap 150 | 21,985.90 (🔻 2.63%) |

| Nifty Smallcap 250 | 16,209.45 (🔻 3.49%) |

| India VIX | 10.93 (🔼 15.66%) |

Stocks in the Spotlight

Top Gainers

| Name of the company | Movement |

| Ipca Laboratories Ltd. | 🔼 12.18% |

| Netweb Technologies India Ltd. | 🔼 9.46% |

| Emcure Pharmaceuticals Ltd. | 🔼 7.67% |

| Solar Industries India Ltd. | 🔼 6.93% |

| Tata Elxsi Ltd. | 🔼 6.62% |

Top Losers

| Name of the company | Movement |

| Premier Energies Ltd. | 🔻15.19% |

| Ather Energy Ltd. | 🔻14.61% |

| Mahindra & Mahindra Ltd. | 🔻13.51% |

| Sapphire Foods India Ltd. | 🔻11.98% |

| Waaree Energies Ltd. | 🔻11.22% |

Technical Analysis

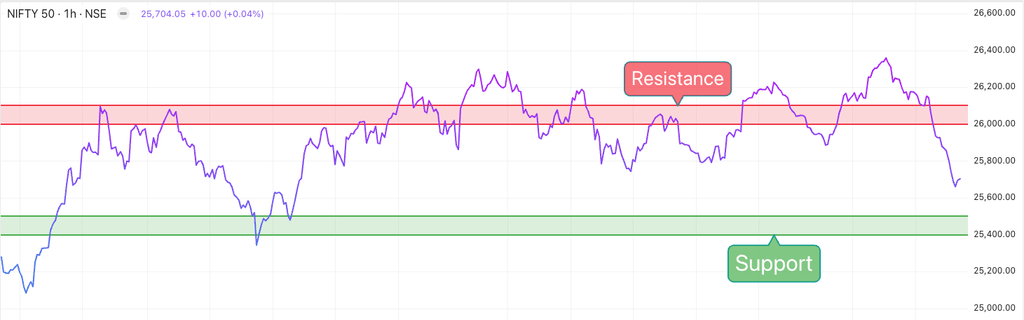

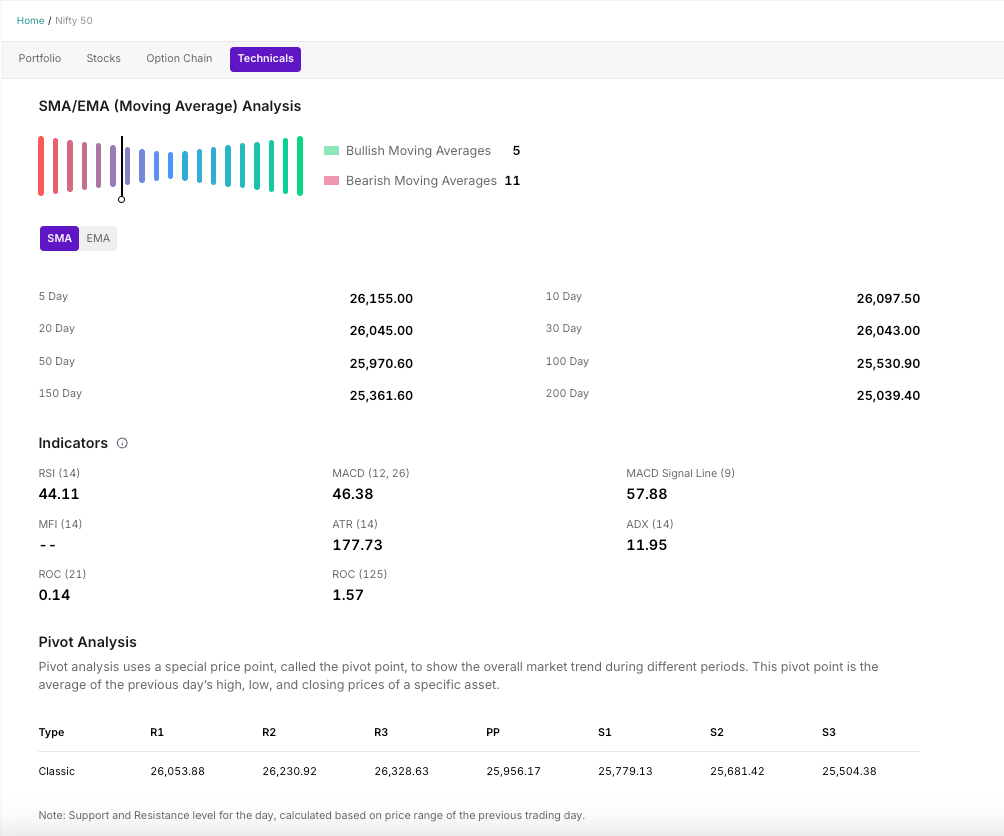

Nifty 50 ended the week on a bearish note, losing approximately –2.45% (-645 points) from its previous weekend close. While it touched a weekly high of 26,330 early in the week, it eventually slipped below the psychological 26,000 mark to close at 25,683.

- Immediate Resistance: 26,00 – 26,100

- Immediate Support: 25,500 – 25,400

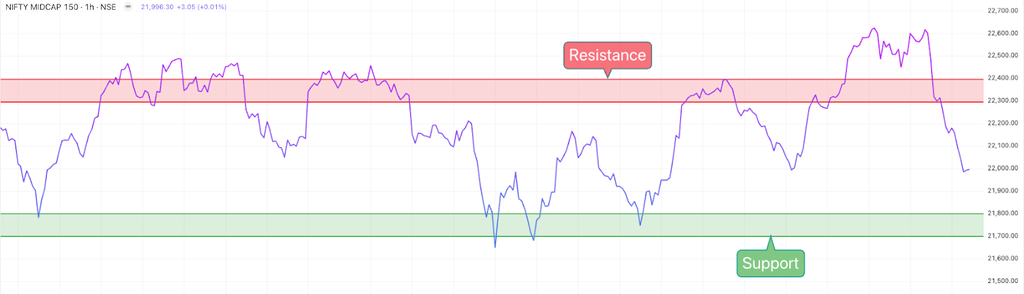

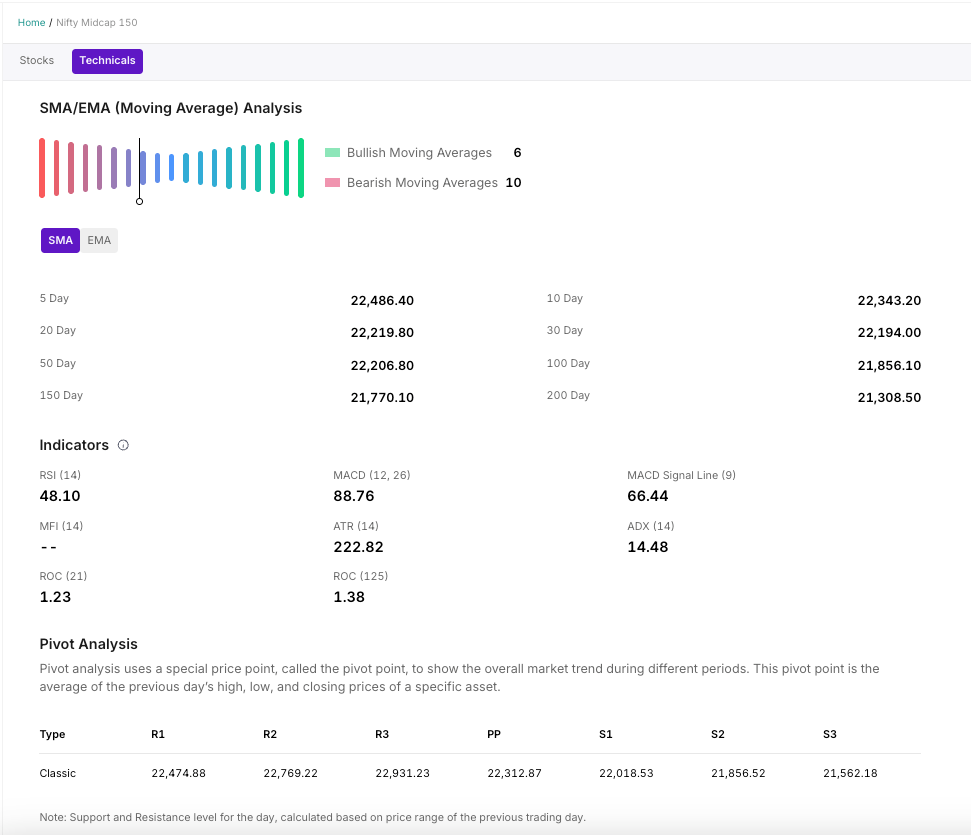

The Nifty Midcap 150 index closed at 21,987.15, marking a sharp decline of 591.90 points (-2.62%) from the previous week’s close of 22,579.05. Despite hitting a new 52-week high of 22,650.05 mid-week, aggressive profit-booking and global uncertainty led to a steep correction toward the weekend.

- Immediate Resistance:22,300 – 22,400

- Significant Support: 21,700 – 21,800

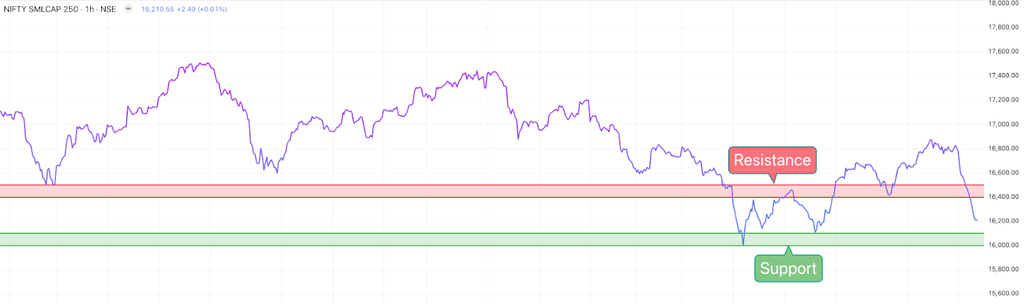

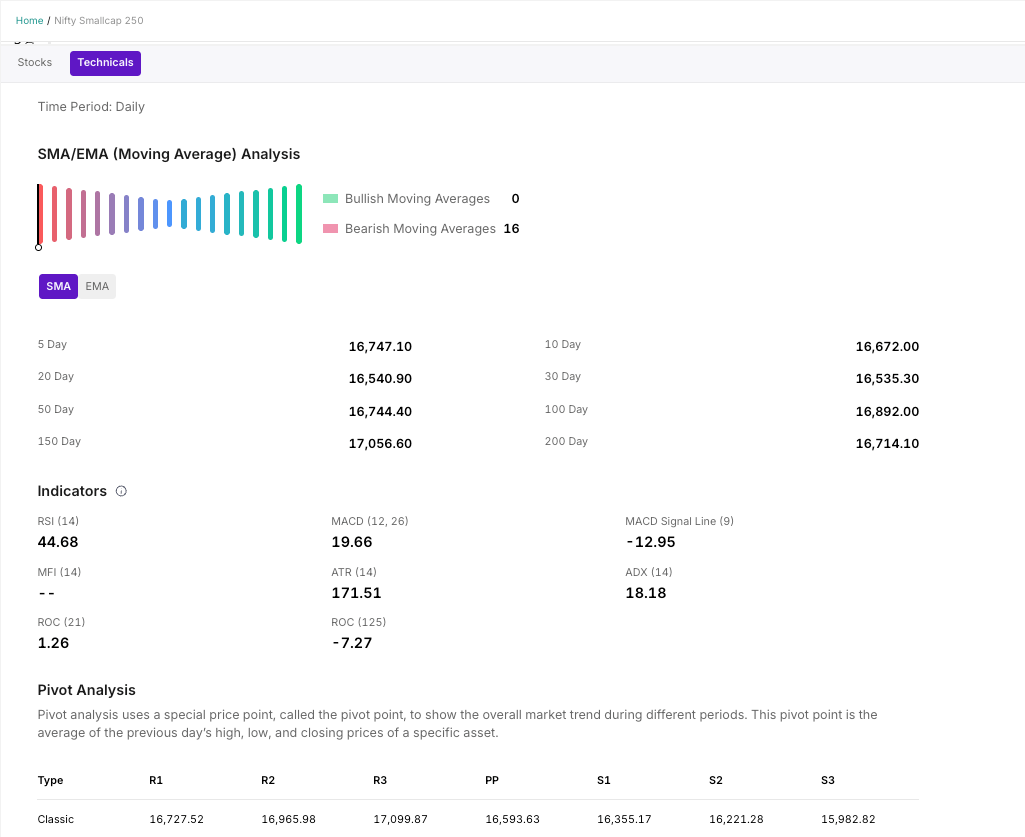

The Nifty Smallcap 250 index closed the week at 16,209, marking a decline of approximately 586 points (-3.49%)from the previous week’s close. The index initially showed resilience, hitting a weekly high of 16,893.40, but aggressive selling in the final two sessions dragged it below the key psychological support of 16500.

For the upcoming sessions:

- Key Resistance Level: 16,400 – 16,500

- Key Support Level: 16,000 – 16,100

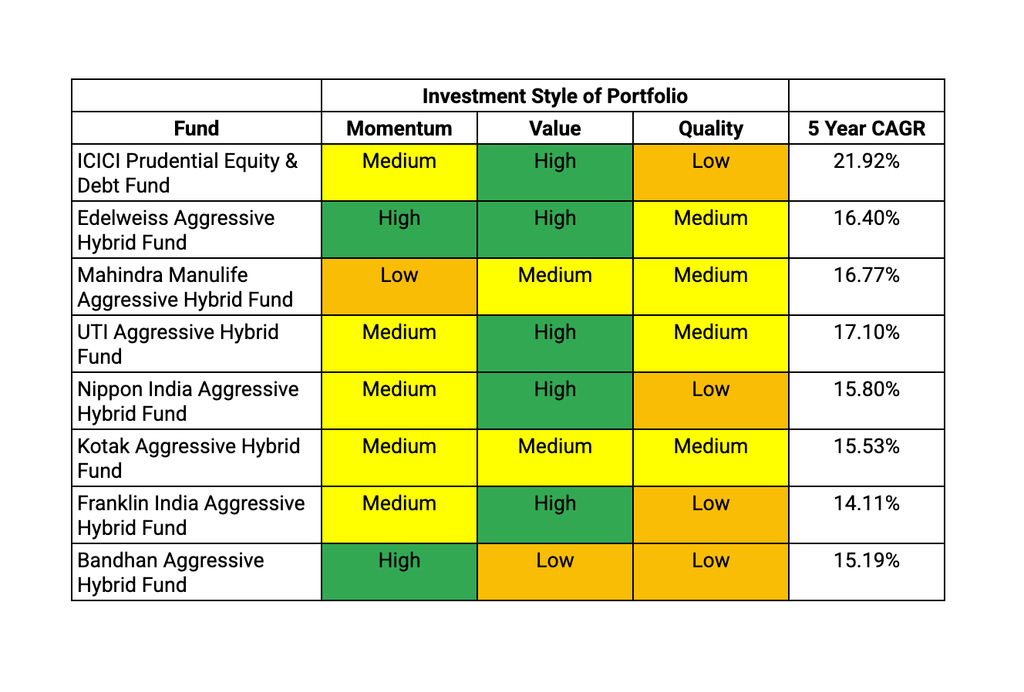

CRISP Insight: Most consistent Aggressive Hybrid Funds and their investment styles

portfolio factor scores, assessed relative to both category peers and the benchmark. Funds with risk categorized as too high as per

CRISP not considered. For detailed methodology, refer to this link.

This Week’s Spotlight Story

A deep dive into the headline that defined market conversations.

India’s Real GDP Estimated to Grow 7.4% in FY 2025-26

India’s economy is projected to accelerate in the coming fiscal year, with Real GDP estimated to grow by 7.4% in 2025-26, surpassing the 6.5% growth rate recorded in 2024-25, according to the First Advance Estimates released by the National Statistics Office (NSO).

The robust growth is primarily driven by a buoyant services sector, which has helped propel the Real Gross Value Added (GVA) growth to 7.3%. The segment comprising Financial, Real Estate & Professional Services and Public Administration, Defence & Other Services is estimated to witness substantial growth of 9.9%. Additionally, the Trade, Hotels, Transport, Communication & Services related to Broadcasting sector is projected to grow by 7.5%, while both Manufacturing and Construction are estimated to achieve a growth rate of 7.0%.

On the expenditure front, the economy displays positive momentum with Real Private Final Consumption Expenditure (PFCE) estimated to grow by 7.0%. Investment demand remains strong, with Gross Fixed Capital Formation (GFCF) estimated to grow at 7.8%, up from 7.1% in the previous fiscal year. In nominal terms, the GDP is estimated to attain a level of ₹357.14 lakh crore, registering an 8.0% growth over the previous year.

That’s a wrap for this week.

As the markets pause to catch their breath, we’ll be back next week with sharper insights and stories to help you invest intelligently.