Share Market Weekly

- Share.Market

- 4 min read

- 23 Jan 2026

Highlights

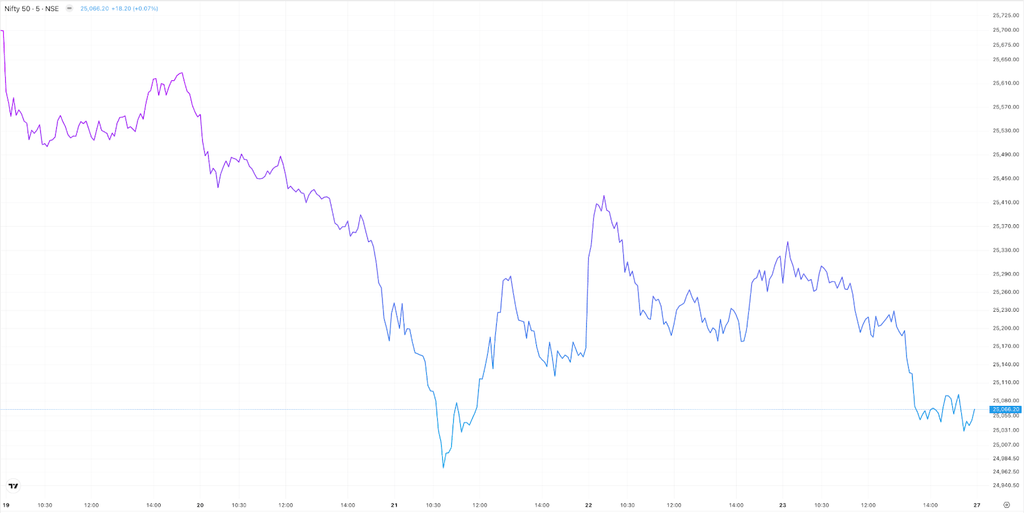

Nifty 50 25,048.65 🔻 2.51%

| Monday | 🔻 0.42% |

| Tuesday | 🔻 1.38% |

| Wednesday | 🔻 0.30% |

| Thursday | 🔼 0.53% |

| Friday | 🔻 0.95% |

What moved the market?

Top Gainers & Top Losers

| Nifty FMCG | 🔻 0.92% | Nifty Realty | 🔻 11.33% |

| Nifty Metal | 🔻 1.05% | Nifty Consumer Durables | 🔻 6.55% |

| Nifty IT | 🔻 2.17% | Nifty Media | 🔻 4.18% |

Markets this week

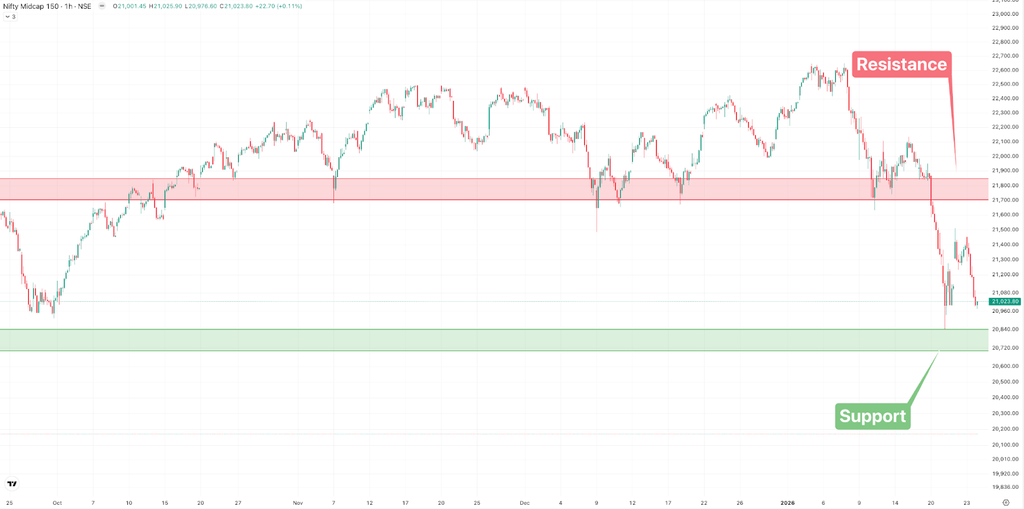

| Nifty Midcap 150 | 21,008.55 (🔻 4.40%) |

| Nifty Smallcap 250 | 15,314.60 (🔻 5.51%) |

| India VIX | 14.19 (🔼 24.80%) |

Stocks in the Spotlight

Top Gainers

| Name of the company | Movement |

| Jindal Saw Ltd. | 🔼 14.92% |

| Hindustan Zinc Ltd. | 🔼 9.56% |

| CreditAccess Grameen Ltd. | 🔼 7.18% |

| Federal Bank Ltd. | 🔼 3.07% |

| Tech Mahindra Ltd. | 🔼 1.83% |

Top Losers

| Name of the company | Movement |

| Kalyan Jewellers India Ltd. | 🔻21.45% |

| Godrej Properties Ltd. | 🔻18.41% |

| OneSource Specialty Pharma Ltd. | 🔻18.39% |

| IIFL Finance Ltd. | 🔻17.75% |

| Authum Investment & Infrastructure Ltd. | 🔻17.33% |

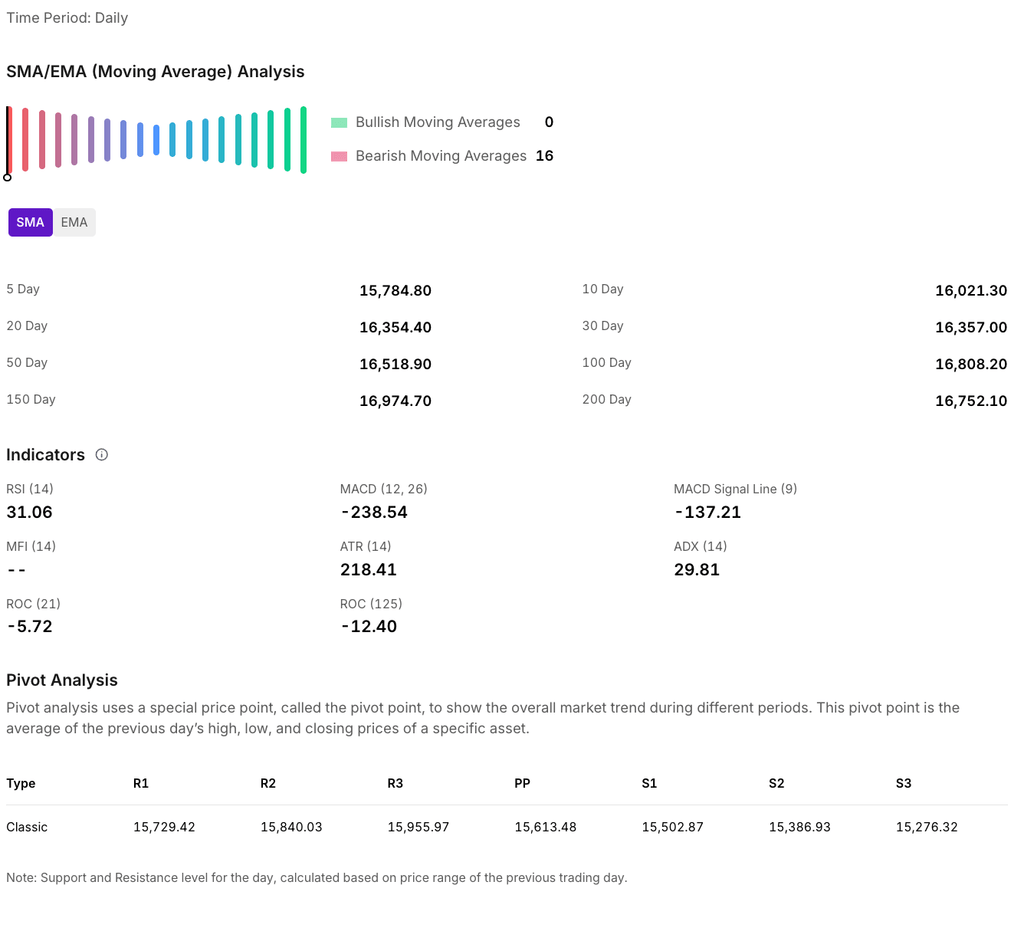

Technical Analysis

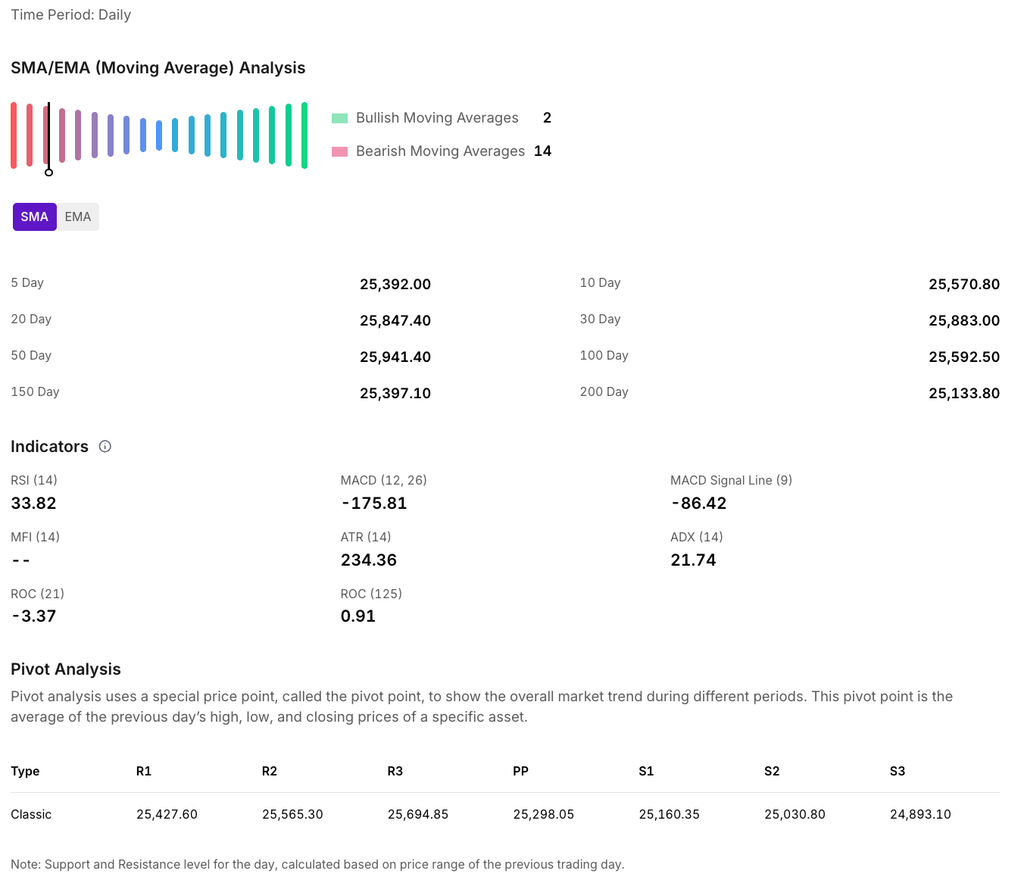

Nifty 50 ended the week on a bearish note, losing approximately –2.40% (-616 points), closing at 25,694.

- Immediate Resistance: 25,300 – 25,400

- Immediate Support: 25,000 – 25,100

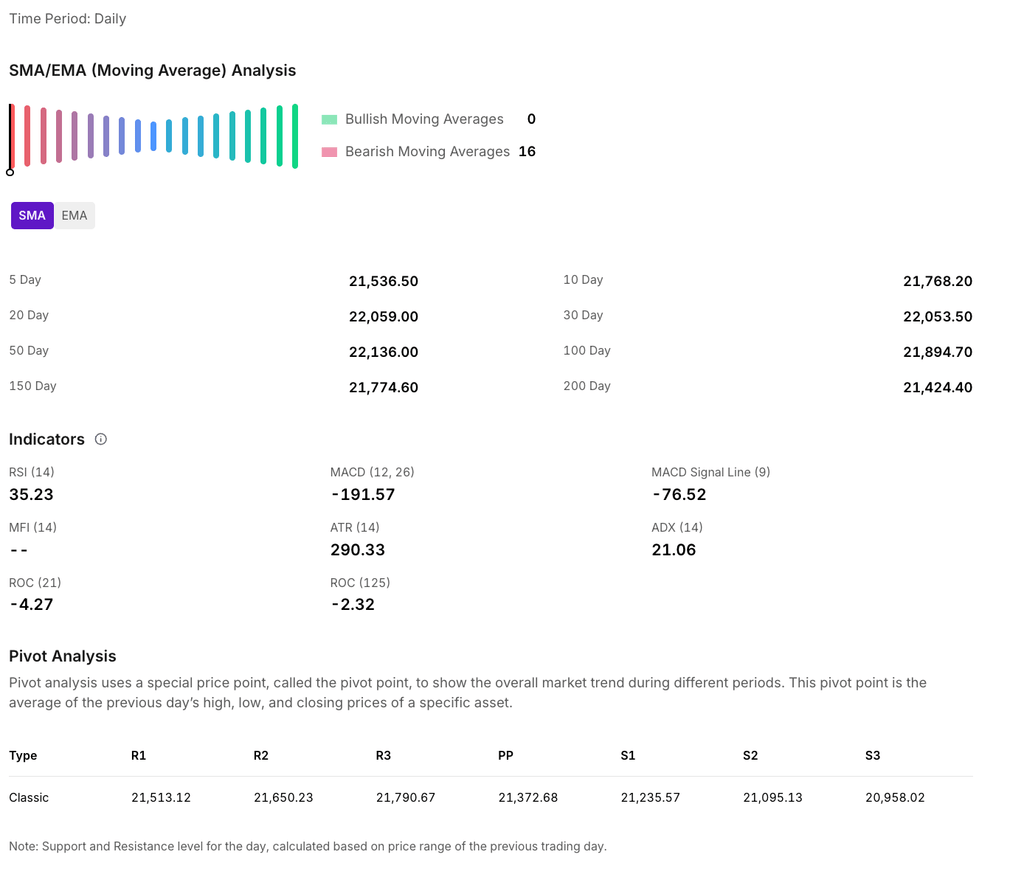

The Nifty Midcap 150 index closed at 21,008.55, marking a sharp decline of 956.9 points (-4.36%).

- Immediate Resistance: 21,700 – 21,850

- Significant Support: 20,700 – 20,850

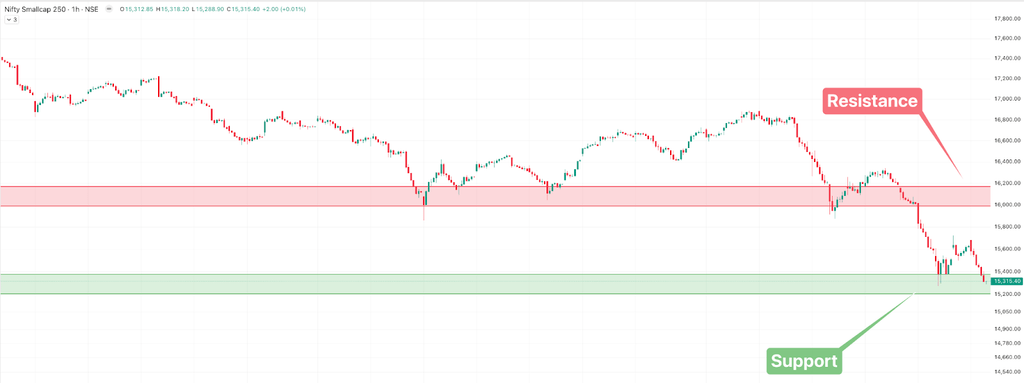

The Nifty Smallcap 250 index closed flat this week at 15,314.60.

For the upcoming sessions:

- Key Resistance Level: 16,000 – 16,150

- Key Support Level: 15,200 – 15,350

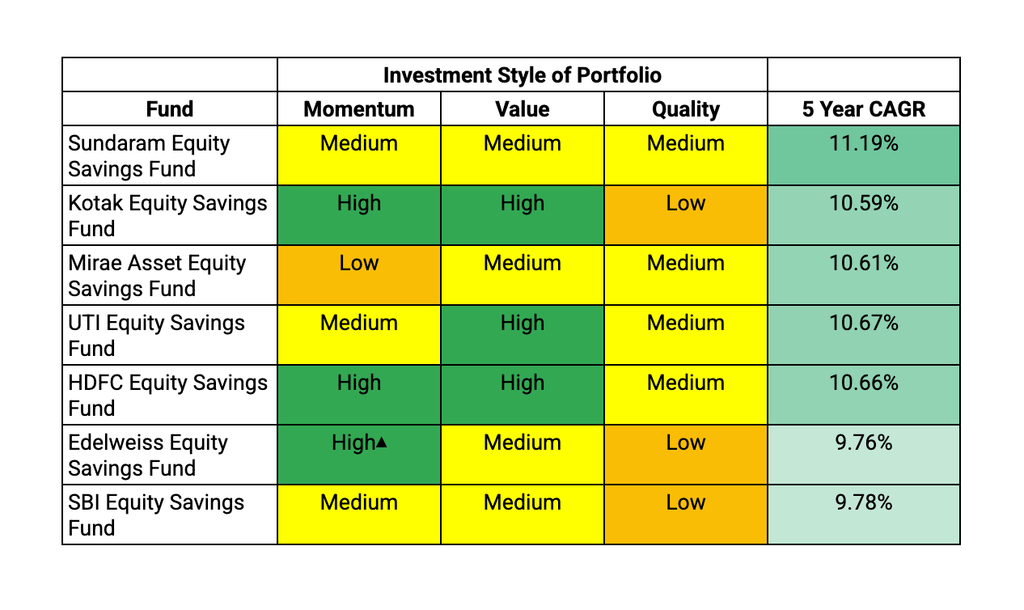

CRISP Insight: Most consistent Equity Savings Funds and their investment styles

This Week’s Spotlight Story

A deep dive into the headline that defined market conversations.

India ranks 16th among 154 countries on the Responsible Nations Index

India has gained a noteworthy position by ranking 16th out of 154 countries in the first-ever Responsible Nations Index (RNI), a new international index developed to understand how countries use their power responsibly with respect to their citizens, the environment, and the world at large. The framework of the index was launched by the World Intellectual Foundation (WIF), and it relies on the most widely accepted international data sources, like the World Bank, the United Nations, and the World Justice Project, to measure the behaviour of nations in three dimensions: internal responsibility, environmental responsibility, and international behaviour. Singapore topped the list, followed by Switzerland and Denmark.

The RNI highlights that economic power does not necessarily lead to sound national conduct, as many developing countries perform better than their richer counterparts in core areas such as social justice, environmental protection, and support for peace. China ranked 68th and the United States 66th, indicating that economic or military power does not necessarily lead to sound global responsibility rankings. In the case of India, the high ranking indicates progress in healthcare, social equity, environmental policies, and people-centred governance, but also highlights the areas where we still need to focus to achieve sustainable and balanced growth.

That’s a wrap for this week.

As the markets pause to catch their breath, we’ll be back next week with sharper insights and stories to help you invest intelligently.