Share Market Weekly

- Share.Market

- 4 min read

- 26 Dec 2025

Highlights

Nifty 50 26,042.30 🔼 0.29%

| Monday | 🔼 0.79% |

| Tuesday | 🔼 0.02% |

| Wednesday | 🔻 0.13% |

| Friday | 🔻 0.38% |

What moved the market?

Top Gainers & Top Losers

| Nifty Metal | 🔼 3.01% | Nifty PSU Bank | 🔻 0.37% |

| Nifty Realty | 🔼 1.82% | Nifty Consumer Durables | 🔻 0.12% |

| Nifty Commodities | 🔼 1.48% | Nifty Media | 🔻 0.01% |

Markets this week

| Nifty Midcap 150 | 22,190.75 (🔼 0.20%) |

| Nifty Smallcap 250 | 16,614.05 (🔼 1.26%) |

| India VIX | 9.15 (🔻 3.89%) |

Stocks in the Spotlight

Top Gainers

| Name of the company | Movement |

| Jupiter Wagons Ltd. | 🔼 33.54% |

| Hindustan Copper Ltd. | 🔼 22.72% |

| Rail Vikas Nigam Ltd. | 🔼 21.56% |

| Indian Railway Finance Corporation Ltd. | 🔼 17.25% |

| Ircon International Ltd. | 🔼 16.84% |

Top Losers

| Name of the company | Movement |

| Coforge Ltd. | 🔻9.33% |

| Kajaria Ceramics Ltd. | 🔻7.52% |

| Dixon Technologies (India) Ltd. | 🔻7.08% |

| Chennai Petroleum Corporation Ltd. | 🔻6.71% |

| Siemens Energy India Ltd. | 🔻4.44% |

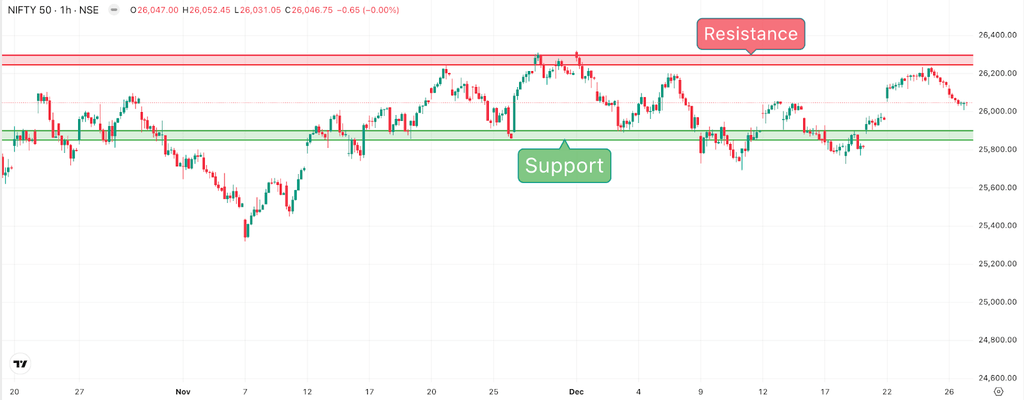

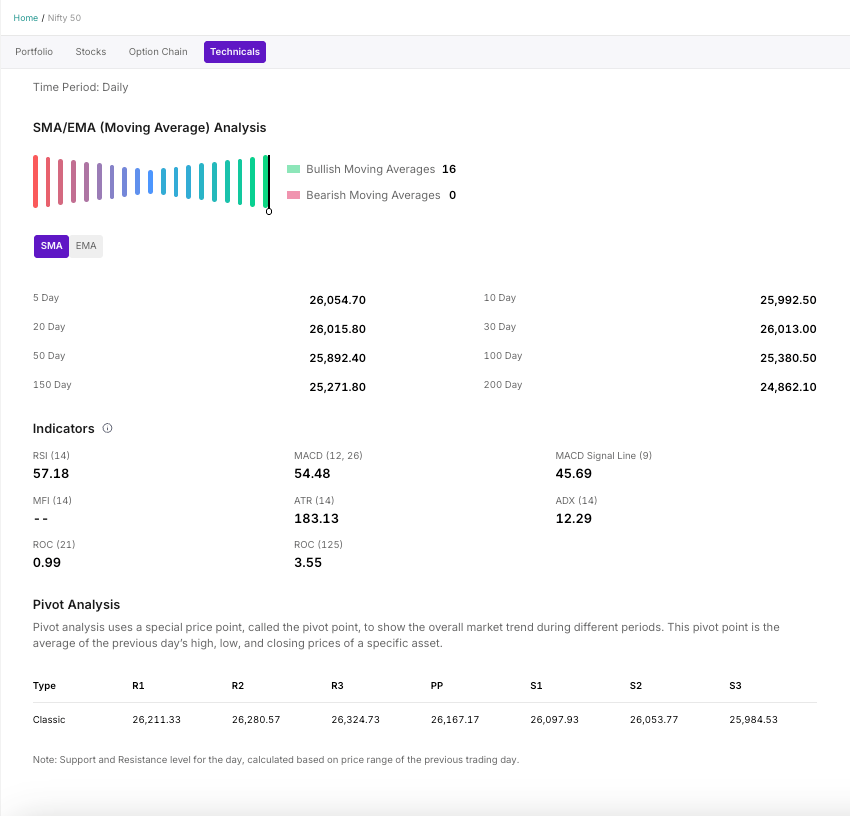

Technical Analysis

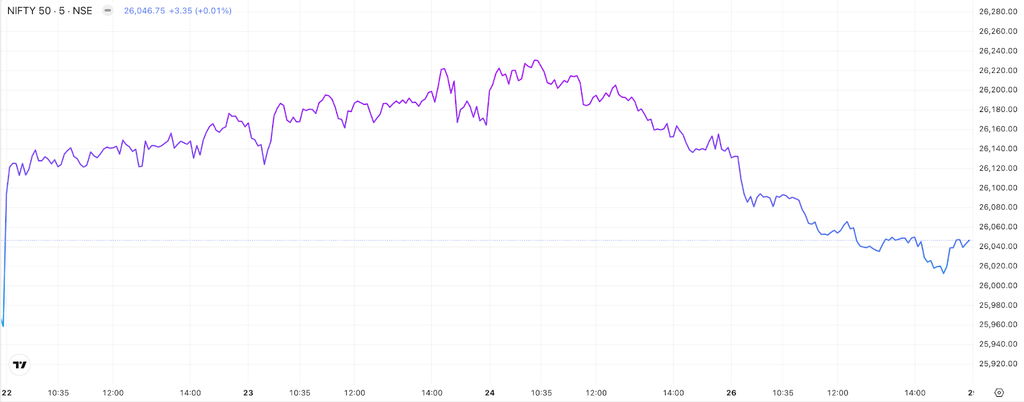

Nifty 50 ended the week marginally higher by 0.29% (+75.90 points) at 26,042. After a gap-up opening and a strong rally on Monday, the index entered a consolidation phase for the rest of the week, with daily closes mostly in the negative.

For the upcoming sessions:

- Immediate Resistance: 26,250 – 26,300

- Immediate Support: 25,900 – 25,850

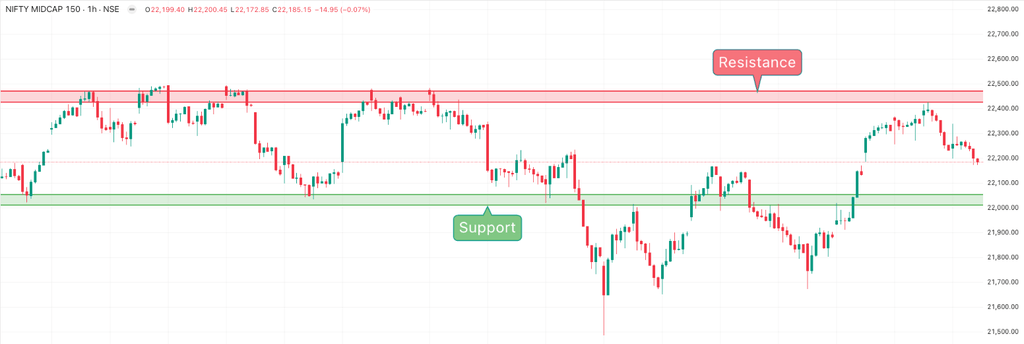

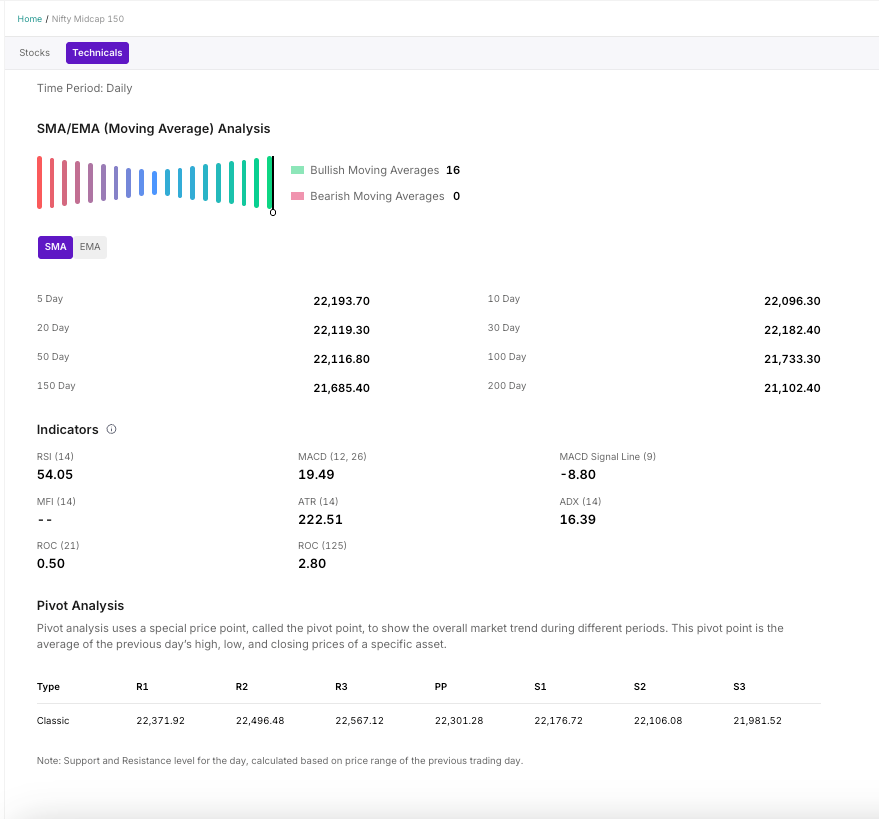

The Nifty Midcap 150 index closed at 22,190.75 marking a slight gain of 44.60 points from the previous week’s close. For the upcoming sessions:

- Immediate Resistance: 22,400 – 22,450

- Significant Support: 22,050 – 22,000

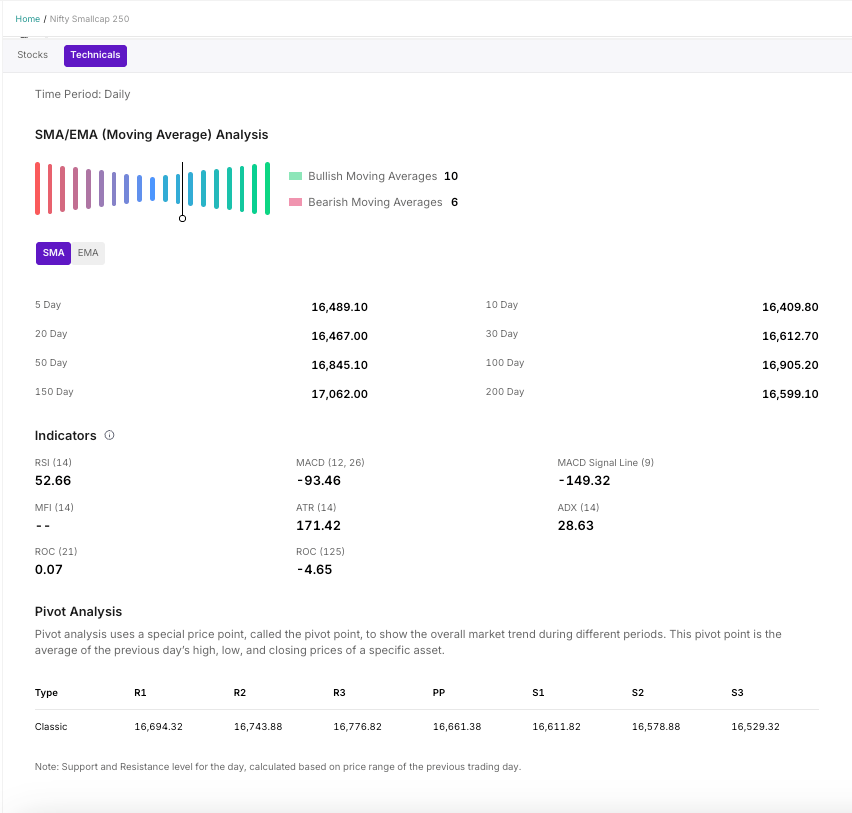

The Nifty Smallcap 250 gained about 1.26% this week, ending at 16,614 on Friday.

For the upcoming sessions:

- Key Resistance Level: 16,800 – 16,850

- Key Support Level: 16,500 – 16,450

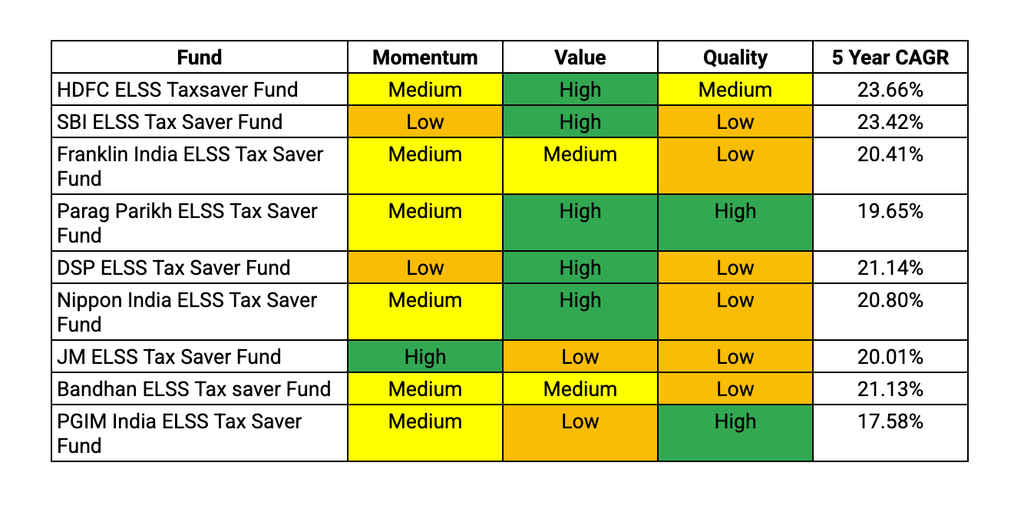

CRISP Insight: Most consistent ELSS Funds and their investment style

This Week’s Spotlight Story

A deep dive into the headline that defined market conversations.

India’s Forex Reserves Rose by USD 4.36 Billion

India’s foreign exchange reserves rose by USD 4.36 billion to reach USD 693.32 billion for the week ending 19 December 2025, according to data released by the Reserve Bank of India (RBI).

The Reserve Bank of India routinely monitors developments in the foreign exchange market and undertakes interventions when necessary to preserve orderly trading conditions. These interventions aim to moderate undue volatility in the rupee’s exchange rate and are not guided by any fixed exchange rate target or band.

That’s a wrap for this week.

As the markets pause to catch their breath, we’ll be back next week with sharper insights and stories to help you invest intelligently.