Share Market Weekly

- Share.Market

- 5 min read

- 19 Dec 2025

Highlights

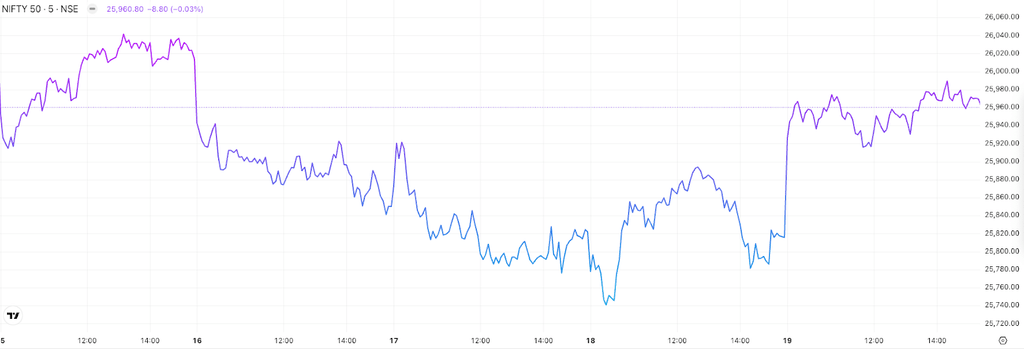

Nifty 50 25,966.40 🔽 0.31%

| Monday | 🔻 0.08% |

| Tuesday | 🔻 0.64% |

| Wednesday | 🔻 0.16% |

| Thursday | 🔻 0.01% |

| Friday | 🔼 0.58% |

What moved the market?

Top Gainers & Top Losers

| Nifty Metal | 🔼 3.56% | Nifty Media | 🔻 1.23% |

| Nifty Consumer Durables | 🔼 2.96% | Nifty Private Bank | 🔻 0.22% |

| Nifty IT | 🔼 2.39% | Nifty Financial Services | 🔻 0.09% |

Markets this week

| Nifty Midcap 150 | 22,146.15 (🔼 2.02%) |

| Nifty Smallcap 250 | 16,407.70 (🔼 1.48%) |

| India VIX | 9.52 (🔻 12.74%) |

Stocks in the Spotlight

Top Gainers

| Name of the company | Movement |

| Reliance Infrastructure Ltd. | 🔼 33.96% |

| Transformers & Rectifiers (India) Ltd. | 🔼 22.91% |

| Reliance Power Ltd. | 🔼 14.97% |

| Praj Industries Ltd. | 🔼 12.75% |

| Hindustan Zinc Ltd. | 🔼 12.65% |

Top Losers

| Name of the company | Movement |

| Akzo Nobel India Ltd. | 🔻11.28% |

| Aditya Birla Lifestyle Brands Ltd. | 🔻9.64% |

| Indian Overseas Bank | 🔻8.14% |

| Ramkrishna Forgings Ltd. | 🔻7.98% |

| Aavas Financiers Ltd. | 🔻6.42% |

Technical Analysis

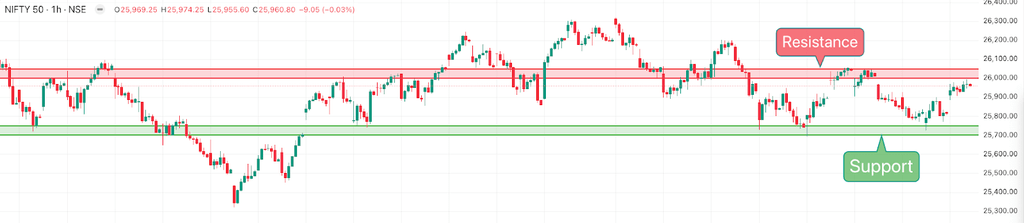

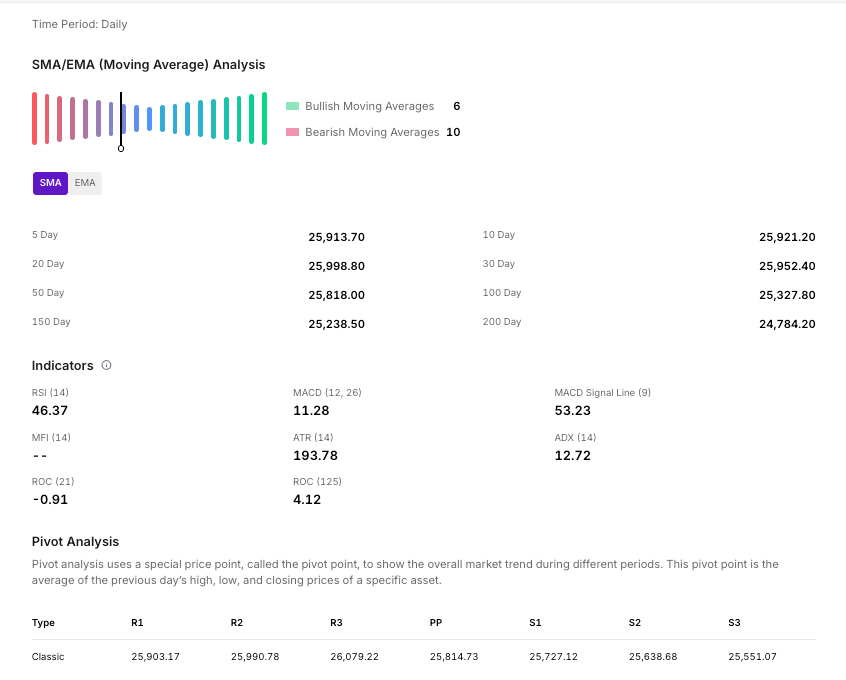

The Nifty 50 recorded a slight decline of 0.31% on a weekly closing basis. The index ended at 25,966.40, reflecting a marginal loss of just 80.55 points. Throughout the week, the Nifty remained in a phase of consolidation

For the upcoming sessions:

- Immediate Resistance: 26,000 – 26,050

- Immediate Support: 25,750 – 25,700

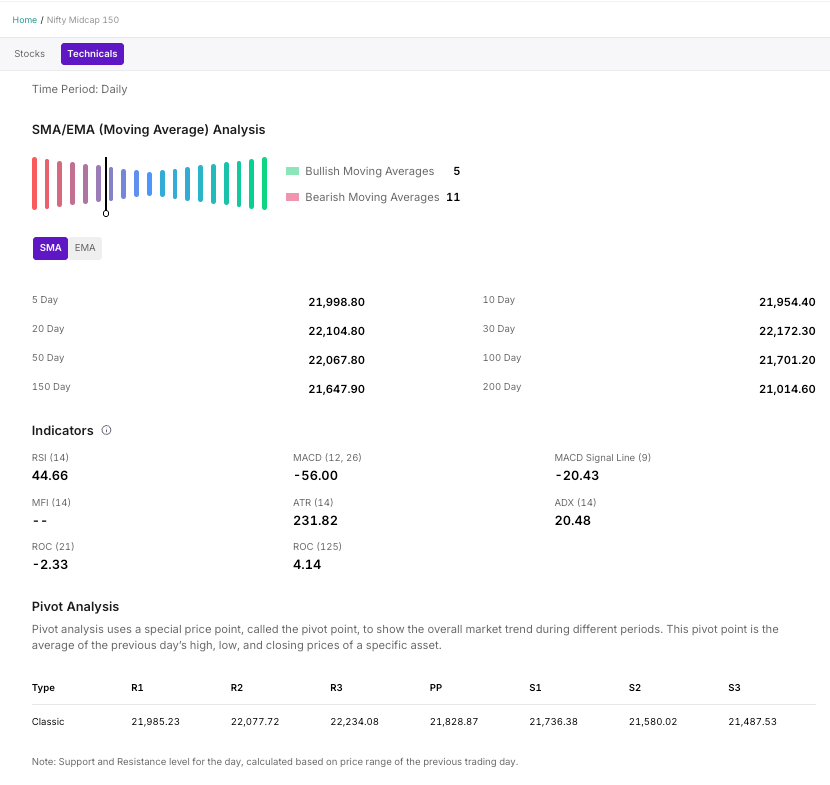

The Nifty Midcap 150 index closed at 22,146.15, marking a slight decline of 5 points from the previous week’s close. For the upcoming sessions:

- Immediate Resistance: 22,200 – 22,250

- Significant Support: 21,950 – 21,900

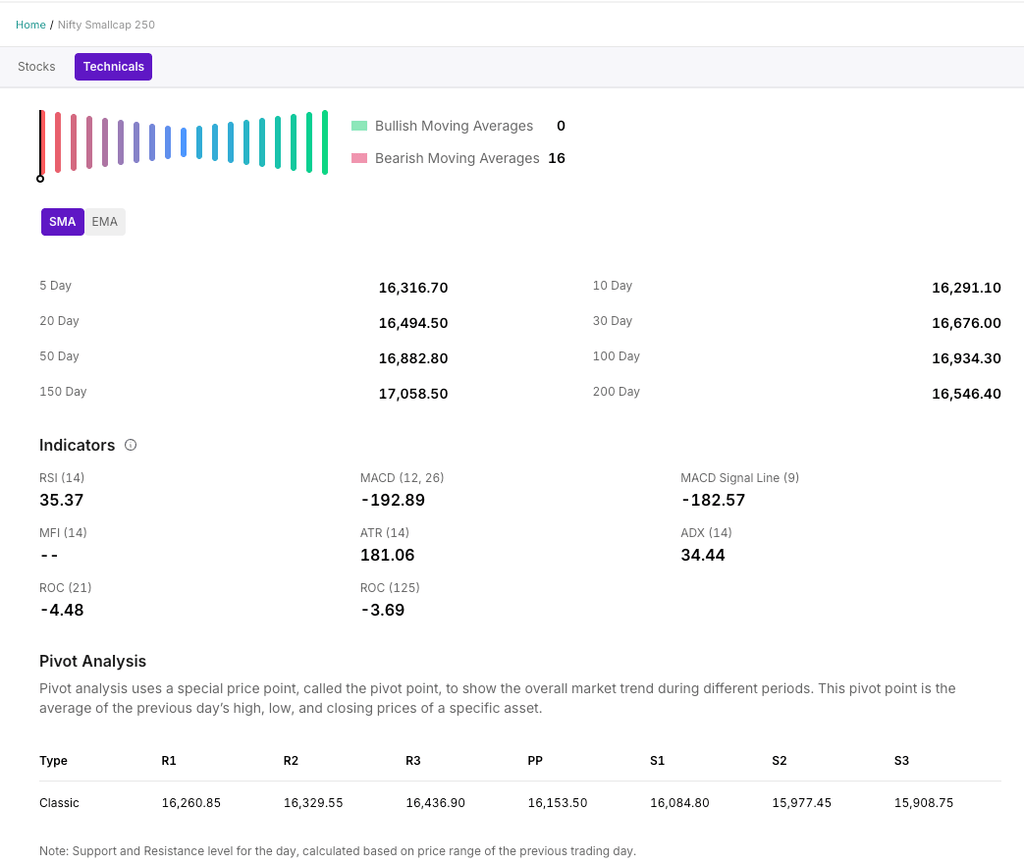

The Nifty Smallcap 250 gained about 0.07% this week, ending at 16,407.70 on Friday.

For the upcoming sessions:

- Key Resistance Level: 16,500 – 16,600

- Key Support Level: 16,100 – 16,050

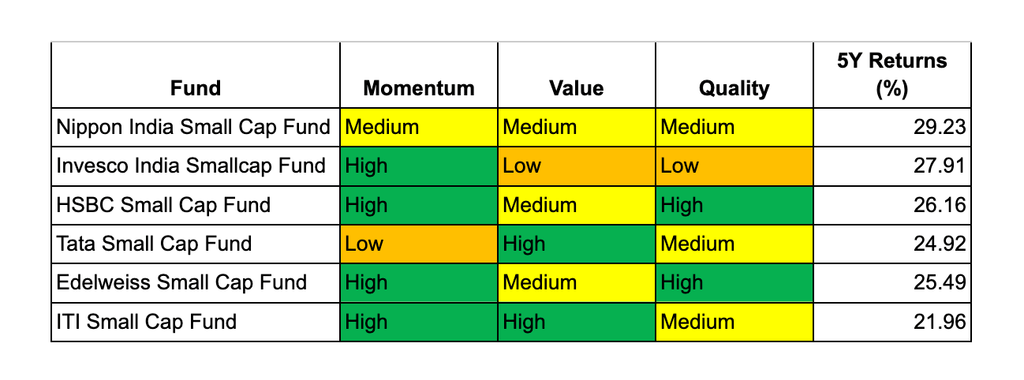

CRISP Insight: Most consistent Small Cap Funds and their investment styles

This Week’s Spotlight Story

A deep dive into the headline that defined market conversations.

India-Oman Comprehensive Economic Partnership Agreement

India and Oman signed a Comprehensive Economic Partnership Agreement (CEPA) on 18 December 2025 in Muscat during Prime Minister Narendra Modi’s visit, marking a milestone in India’s engagement with the Gulf region. Oman is described as a key gateway for Indian goods and services to the wider Middle East and Africa, with bilateral trade already above USD 10 billion and nearly seven lakh Indians living and working in the country.

The CEPA secures unprecedented tariff concessions: Oman has offered zero-duty access on 98.08% of its tariff lines, covering 99.38% of India’s exports, with immediate tariff elimination on 97.96% of lines. Labour‑intensive sectors such as gems and jewellery, textiles, leather, footwear, sports goods, plastics, furniture, agricultural products, engineering products, pharmaceuticals, medical devices and automobiles receive full tariff elimination, which is expected to boost exports and employment.

On the services side, the pact includes a comprehensive package, with Oman’s services imports at about USD 12.52 billion and India’s share just over 5%, indicating large untapped potential. The agreement is projected to generate jobs, support MSMEs, artisans and women‑led enterprises, expand exports and strengthen supply chains between the two nations.

That’s a wrap for this week.

As the markets pause to catch their breath, we’ll be back next week with sharper insights and stories to help you invest intelligently.