- Share.Market

- 8 min read

- 08 Apr 2025

Introduction

In options trading, bearish strategies like buying a Put Option or deploying a Bear Put Spread are common choices when you expect the market to decline. However, buying a Put outright comes with a premium cost, while vertical spreads cap your profits. Also, if the market remains sideways and above your breakeven, you will be in the loss. What if you’re confident the market will drop slightly or consolidate around a support level and want to structure a trade that benefits from this view?

That’s when the Put Ratio Spread comes into play.

This strategy involves buying one at-the-money or in-the-money Put and selling two out-of-the-money Puts with the same expiry. The objective? To benefit from limited bearish moves, time decay, and potential range-bound action, without a heavy cost. But be aware: losses can pile up beyond a certain point if the market crashes. Let’s break it down in detail.

Key Takeaways

- Put Ratio Spread Basics: Understand how to choose optimal strike prices and construct the Put Ratio Spread with a strategic mix of long and short Puts.

- Best Use Scenarios: Learn when to deploy the Put Ratio Spread based on market trends, support levels, and volatility conditions.

- Trade Setup & Payoff: Learn how to set up the trade, identify the ideal payoff zone, and calculate breakeven points and potential losses.

- Strategy Advantages & Risks: Discover the benefits of a low-cost, time-decay-friendly setup along with the key risks and comparison with similar strategies.

What is a Put Ratio Spread?

A Put Ratio Spread is an advanced, directionally bearish to neutral options strategy that consists of:

- Buying 1 Put Option at a higher strike (ITM or ATM)

- Selling 2 Put Options at a lower strike (OTM)

- All options have the same expiry and underlying

Scenario 1: Market Approaching a Strong Support Zone

Imagine the Nifty has been in a steady decline—say, from 22,600—and is now approaching a key technical or psychological support level around 22,000. Historically, this level has acted as a floor for price action, attracting buyers. And currently, Nifty is at 22,100. In such situations, you’re not outright bullish, but you believe the downside is limited.

A Put Ratio Spread allows you to structure a trade that profits if the index either:

- Holds steady near the support,

- Dips slightly and then rebounds, or

- Consolidates within a tight range just above or around the lower strike.

This setup is highly effective in this scenario because:

- You collect premiums from the two short Puts,

- Time decay works in your favor, especially as expiry nears.

It’s a smart way to capitalize on your expectation that the support will hold without paying for an expensive long Put.

Scenario 2: Mild Bearish Outlook Without Expecting a Breakdown

There are times when the market feels extended or overbought after a rally. Indicators like RSI or stochastic oscillators may be flashing overbought signals, and momentum might have slowed. In this case, you have a mildly bearish view—you expect a dip or pullback, but you don’t anticipate a sharp correction.

Using a Put Ratio Spread here allows you to:

- Maximize profit from a downside move until the market expires near or above the short strike

- Earn small profit during a sideways market and if the market moves upward, when you make a credit spread

Scenario 3: Elevated Implied Volatility Ahead of Key Events

In the lead-up to significant market-moving events, such as earnings releases, central bank announcements, or geopolitical developments, implied volatility (IV) typically rises sharply. This surge in option premiums can make traditional debit strategies less attractive due to inflated costs.

If you expect that:

- The event will pass without major disruption, or

- The market will remain within a limited range following the announcement,

…then deploying a Put Ratio Spread can be a highly strategic move.

Here’s why this approach is effective:

- You’re selling more options than you’re buying, allowing you to capitalize on elevated premiums.

- A post-event drop in IV (a common occurrence) accelerates time decay on your short Puts, boosting your mark-to-market gains.

- The trade is typically entered for a net credit or minimal cost, offering a defined profit zone and limited risk on one side.

This strategy is well-suited for expressing a neutral-to-slightly bearish view while taking advantage of the anticipated volatility crush that often follows major events.

How Does a Put Ratio Spread Work?

Strategy Setup

- Buy 1 ATM/ITM Put Option

- Sell 2 OTM Put Options (same expiry)

Key Calculations

- Net Premium = (Premiums Received from 2 Short Puts − Premium Paid for Long Put)

- Maximum Profit = Difference between higher and lower strikes + Net Premium (if expired at lower strike)

- Maximum Loss = Unlimited below breakeven

- Breakeven Point = Lower Strike − (Net Credit or Net Debit)

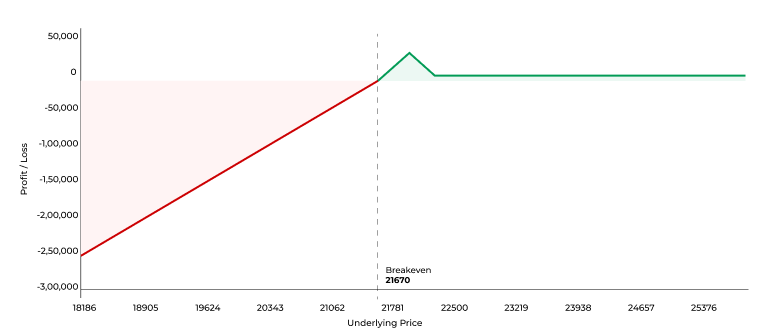

Example: Nifty Put Ratio Spread

Let’s say Nifty is currently trading at 22,100 and has been continuously falling from the 22,500 level. You believe it may drift lower toward the 22,000–21,900 zone (a strong support area), but you don’t expect it to break down significantly below that level before expiry.

Trade Setup

| Action | Strike | Premium |

| Buy 1 Put | 22,100 | 190 |

| Sell 2 Puts | 21,900 | 110 each |

- Net Premium = (2 × 110) − 190 = 30 points credit

- Lot Size = 75

Total Net Credit = 30 × 75 = ₹2,250

Payoff Scenarios at Expiry

Scenario 1: Nifty closes at 22,100 on Expiry Day or above (Sideways to Upward movement)

- All options expire worthless.

- Net P&L = ₹2,250 (Net Credit retained)

Scenario 2: Nifty closes at 21,900 on Expiry Day (Maximum Profit)

- 22,100 PE = 200 Points (Intrinsic Value )

- 21,900 PE = 0

- Net Payoff = 200 (from long Put) + 30 (credit) = 230

- Total Profit = 230 × 75 = ₹17,250

Scenario 3: Nifty closes at 21,800 on Expiry Day

- 22,100 PE IV = 300 Points (Intrinsic Value )

- 21,900 PE IV = 100 Points (Intrinsic Value ) × 2 = 200 Points

- Net Payoff = 300 − 200 + 30 = 130 Points

- Total Profit = 130 × 75 = ₹9,750

Scenario 4: Nifty closes at 21,700 on Expiry Day

- 22,100 PE IV = 400 Points (Intrinsic Value )

- 21,900 PE IV = 200 Points (Intrinsic Value ) × 2 = 400

- Net Payoff = 400 − 400 + 30 = 30 Points

- Total Profit = 30 × 75 = ₹2,250

Scenario 5: Nifty closes at 21,670 on Expiry Day (Breakeven Point)

- 22,100 PE IV = 430 Points (Intrinsic Value )

- 21,900 PE IV = 230 Points (Intrinsic Value ) × 2 = 460

- Net Payoff = 430− 460 + 30 = 0

- Total P&L = ₹0

Scenario 6: Nifty crashes to 21,600 on Expiry Day

- 22,100 PE IV = 500 Points (Intrinsic Value )

- 21,900 PE IV = 300 Points (Intrinsic Value ) × 2 = 600

- Net Payoff = 500 − 600 + 30 = −70

- Total Loss = 70 × 75 = −₹5,250

Payoff Summary Table

| Nifty Expiry Level | Outcome | Net P&L per Lot |

| ≥22,600 | Max Profit from Credit | +₹2,250 |

| 21,900 | Maximum Profit | +₹17,250 |

| 21,800 | Partial Profit | +₹9,750 |

| 21,700 | Reduced Profit | +₹2,250 |

| 21,670 | Breakeven | ₹0 |

| 21,600 | Loss Accelerates | −₹5,250 |

Advantages & Risks of the Put Ratio Spread

Advantages

- Profits from Time Decay (Theta Positive): Because you’re selling two options and buying just one, the position becomes net short Theta. This means time decay works in your favor, especially when the underlying stays within a narrow range. Every day that passes without a significant move adds to your potential profit.

- Defined Profit Zone with an Edge: The strategy is designed to generate the maximum profit if the underlying expires at or near the short Put strike. If the market moves as expected—declines slightly or consolidates around the support—your reward can be significantly higher than that of a single-leg or vertical spread strategy.

Risks

- Unlimited Risk Below Breakeven: The primary risk with this strategy is to the downside. If the underlying breaks below the breakeven point, losses can increase rapidly and are theoretically unlimited. This is because the additional short Put is uncovered and continues to gain intrinsic value as the market falls.

- Elevated Margin Requirements: Since you’re holding two short options against one long option, brokers will typically assign higher margin requirements. This can tie up more capital than a simple debit spread, and traders need to be aware of their available margin before initiating the position.

- Requires Active Monitoring: This is not a passive strategy. You must monitor the trade, especially if the price starts approaching or breaches the lower breakeven. Quick decision-making—whether to adjust, hedge, or exit—is crucial to prevent large drawdowns.

- Volatility Risk Post-Entry: While high implied volatility at entry is favorable, a rise in volatility after entry (especially during a falling market) can inflate the value of your short Puts. This may lead to temporary mark-to-market losses, even if the trade is still within your expected range.

Comparison: Put Ratio Spread vs Bear Put Spread

| Feature | Put Ratio Spread | Bear Put Spread |

| Market View | Mildly Bearish/Neutral | Bearish |

| Options Used | 1 Long Put + 2 Short Puts | 1 Long Put + 1 Short Put |

| Max Profit | At the short strike | Difference in strikes − debit |

| Max Loss | Unlimited | Defined |

| Capital Outlay | Credit / Debit | Debit |

Conclusion

The Put Ratio Spread is a smart choice when you’re mildly bearish or expect the market to find support after a decline. It offers a defined profit window and can be initiated with minimal capital outlay. However, traders must remain vigilant, as the downside risk is real and can be substantial if unhedged.

Used wisely, this strategy allows you to bet on consolidation or a shallow fall while profiting from time decay. But it’s not a passive play—monitor it actively, and consider adjustments if the market trends sharply downward.

FAQs

It involves buying 1 higher strike Put and selling 2 lower strike Puts of the same expiry

When you’re moderately bearish or expect the market to bounce near a support level.

Yes—there’s unlimited downside risk if the market crashes beyond breakeven. Hedges or stop-losses are recommended.

Absolutely. You can close or adjust the trade anytime before expiry, based on market movement or your P&L.

It’s better suited for intermediate traders comfortable with multi-leg strategies and risk management.