- Share.Market

- 8 min read

- 24 Apr 2025

Introduction

In range-bound market conditions, options traders often seek strategies that effectively balance risk and reward. While high-reward setups like the Short Straddle or Strangle can be tempting, they expose traders to unlimited risk. Conversely, defined-risk strategies like the Iron Condor offer greater protection but typically come with lower reward potential.

This is where the Butterfly Spread stands out—offering a low-risk, high-reward structure for traders expecting limited price movement.

As legendary trader Paul Tudor Jones once said:

“The most important rule of trading is to play great defense, not great offense.”

When comparing strategies like the Iron Condor and Iron Butterfly, there are key distinctions:

- The Iron Condor provides a wider profit range.

- The Butterfly Spread, while narrower in range, offers a superior risk-to-reward ratio.

Despite these differences, all of these neutral strategies share a common requirement:

The underlying must remain within a defined range for the trade to be profitable

Key Takeaways

- Butterfly Basics: A neutral, defined-risk strategy designed to profit from minimal movement in the underlying. Ideal for low-volatility environments, it combines both long and short spreads.

- When to Use It: The Butterfly Spread is ideal when you expect the underlying asset to remain close to a specific price level until expiry. This strategy is most profitable if the underlying closes exactly at the strike price of the sold options.

- Setup & Payoff: Learn how to construct the strategy with proper strike prices, calculate max profit/loss, breakeven points, and understand where the strategy shines.

- Pros, Cons & Comparisons: Understand how the Butterfly Spread compares to Iron Condors, especially in terms of capital efficiency and risk/reward dynamics.

What is a Butterfly Spread?

A Butterfly Spread is a neutral options trading strategy designed to profit from low volatility in the underlying asset. It involves using either calls or puts to create a “tent-shaped” payoff profile. The strategy works best when the underlying closes near the middle strike at expiry.

Call Butterfly Spread: Setup

The Call Butterfly involves three strike prices and four option contracts:

- Buy 1 In-the-Money (ITM) Call Option – Lower Strike

- Sell 2 At-the-Money (ATM) Call Options – Middle Strike

- Buy 1 Out-of-the-Money (OTM) Call Option – Higher Strike

✅ All options must have the same expiry date and be on the same underlying asset.

Ideal Use Case Scenarios

Scenario 1: Expecting Minimal Movement

Let’s say Nifty is trading at 24,000 and has been showing signs of consolidation near this level. There are no upcoming earnings or major macro events. Volatility is low, and technical indicators show consolidation. You expect Nifty to stay close to 24,000 until expiry.

A Butterfly Spread with strikes centered at 24,000 is an ideal setup. You could:

- Buy 23,800 CE

- Sell 2 × 24,000 CE

- Buy 24,200 CE

Maximum profit is achieved when the index closes near 24,000.

Scenario 2: Post-Volatility Crush Anticipation

Suppose a major event just concluded—elections or RBI policy—and the market reacts with very little price movement. Implied volatility, which spiked pre-event, is now expected to drop. This is an opportune time to enter a Butterfly, as premiums are elevated and you’re betting on reduced movement.

How Does a Butterfly Spread Work?

Strategy Setup Recap (Call Butterfly):

- Buy 1 Lower Strike Call

- Sell 2 Middle Strike Calls

- Buy 1 Higher Strike Call

All positions are for the same expiry.

Key Calculations

- Net Debit (Cost of Trade) = Total Premium Paid − Total Premium Received

- Maximum Profit = Difference between strikes − Net Debit

- Maximum Loss = Net Debit

- Breakeven Points:

- Lower Breakeven = Lower Strike + Net Debit

- Upper Breakeven = Higher Strike − Net Debit

Butterfly Spread Strategy Example

Let’s say Nifty is trading at 24,000, and based on our technical view, it is likely to stay close to this level till expiry. There’s no major economic data or earnings news lined up, and implied volatility is relatively low.

Given this neutral-to-slightly bullish outlook, you expect Nifty to expire close to 24,000, making it an ideal setup to deploy a Long Call Butterfly Spread, a strategy that profits the most when the underlying closes near the middle strike at expiry.

Butterfly Spread Setup (Long Call Butterfly)

| Action | Option Type | Strike Price | Premium (Approx.) |

| Buy | Call (CE) | 23,800 | 170 |

| Sell | Call (CE) | 24,000 | 100 × 2 = 200 |

| Buy | Call (CE) | 24,200 | 50 |

Key Calculations

- Net Premium Paid = 170 (Buy 23,800 CE) + 50 (Buy 24,200 CE) − 200 (Sell 24,000 CE x2)

= 220 − ₹200 = 20 (Debit) - Lot Size (Nifty) = 75

- Net Debit (Max Loss) = 20 × 75 = ₹1,500

- Maximum Profit = (Middle Strike − Lower Strike − Net Debit) × Lot Size

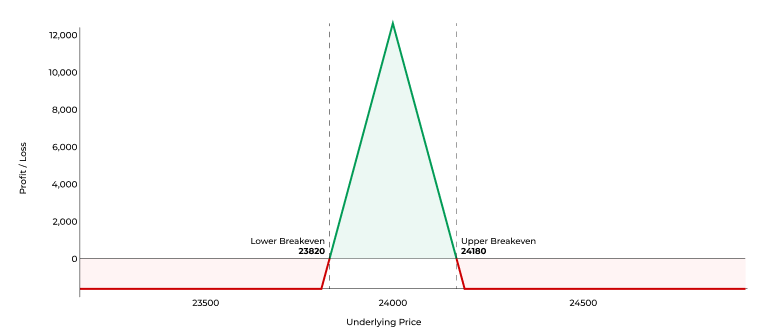

= (24,000 − 23,800 − 20) × 75 = 180 × 75 = ₹13,500 - Breakeven Points:

- Lower BEP = 23,800 + 20 = 23,820

- Upper BEP = 24,200 − 20 = 24,180

Symmetrical, with maximum profit at 24,000; losses capped on both sides.

Expiry Scenarios and Outcomes

Scenario 1: Nifty closes at 24,000 (Middle Strike)

- 23,800 CE: ITM by 200 → 200 Intrinsic Value

- 24,000 CE (x2): ITM by 0 → ₹0

- 24,200 CE: OTM → ₹0

- Net P&L: (₹200 − ₹20) × 75 = ₹13,500 (Max Profit)

Scenario 2: Nifty closes at 24,100

- 23,800 CE: ITM by 300 → 300 Intrinsic Value

- 24,000 CE (x2): ITM by 100 → 200 Points

- 24,200 CE: OTM → ₹0

- Net Intrinsic Value: 300 − 200 = 100

- Net P&L: (100 − 20) × 75 = ₹6,000

Scenario 3: Nifty closes at 23,800 (Lower Strike)

- 23,800 CE: ATM → ₹0

- 24,000 CE (x2): OTM → ₹0

- 24,200 CE: OTM → ₹0

- Net P&L = −₹1,500 (Max Loss)

Scenario 4: Nifty closes at 24,200 (Upper Strike)

- 23,800 CE: ITM by 400 → 400 Intrinsic Value

- 24,000 CE (x2): ITM by 200 → 400 Points

- 24,200 CE: ATM → ₹0

- Net Intrinsic Value: 400 − 400 = 0

- Net P&L = −₹1,500 (Max Loss)

Payoff Summary Table

| Nifty Expiry Level | CE Outcome | Net P&L (Per Lot) |

| 24,000 | Max profit zone | ₹13,500 (Max Profit) |

| 24,100 | Slightly ITM | ₹6,000 (Partial Profit) |

| 23,800 | At Lower Strike | −₹1,500 (Max Loss) |

| 24,200 | At Upper Strike | −₹1,500 (Max Loss) |

Advantages of the Butterfly Spread

- Defined Risk and Reward: The Butterfly Spread is a limited-risk, limited-reward strategy. Both potential loss and gain are predefined, making it ideal for traders who prefer structured risk management over open-ended exposure.

- Cost-Effective Trade Setup: Compared to strategies like the Long Straddle or Strangle, the Butterfly Spread requires significantly less premium outlay. This makes it attractive for traders seeking directional neutrality with capital efficiency.

- Maximum Profit at a Specific Target: This strategy performs best when the underlying closes exactly at the middle strike, allowing traders to benefit from accurate range-bound predictions. It’s perfect for low-volatility environments or expiry-day trading setups.

- Benefits from Time Decay (Theta): As expiry approaches, the time value of the sold options decays rapidly. If the underlying remains near the middle strike, the net value of the spread increases due to this favorable theta decay.

- Neutral-to-Slightly Directional Outlook: You can set up a Call Butterfly (if slightly bullish) or Put Butterfly (if slightly bearish), giving you the flexibility to align the trade with your market bias while still keeping risk defined.

Risks of the Butterfly Spread

- Limited Profit Range: The strategy profits only within a narrow price window around the middle strike. A sharp move in either direction can lead to the position ending in a loss, even though risk is capped.

- Sensitive to Strike Selection: The effectiveness of the Butterfly Spread hinges on accurate strike selection. A misjudged center strike or improper wing width can dramatically reduce profitability or result in avoidable losses.

- Not Ideal in High Volatility: In highly volatile environments, the probability of the underlying closing near the middle strike drops, making the strategy less effective.

Comparison: Butterfly Spread vs Iron Condor

| Feature | Butterfly Spread | Iron Condor |

| Market View | Neutral to slightly directional near a specific level | Neutral within a broader defined range |

| Options Used | Buy 1 ITM, Sell 2 ATM, Buy 1 OTM (same type, e.g., all Calls) | Sell 1 OTM Call + Put, Buy further OTM Call + Put |

| Premium Structure | Net Debit (you pay to enter the trade) | Net Credit (you receive premium upfront) |

| Breakeven Range | Narrow (near center strike) | Wider (between outer breakeven points) |

| Max Profit | At center strike, predefined and limited | Between short strikes, predefined and limited |

| Max Loss | Limited to net premium paid | Limited to (spread − net credit) |

| Theta (Time Decay) | Positive near center; negative if far OTM | Strongly positive; works well as expiry approaches |

| Volatility Sensitivity | Profits from IV drop after entry; avoid in high IV | Also benefits from IV crush; safer in volatile markets |

| Best Case Scenario | Underlying closes exactly at the middle strike | Underlying stays within the short strikes range |

| Use Case | When expecting consolidation near a specific price point | When expecting sideways movement within a broader range |

Conclusion

The Butterfly Options Strategy is perfect for traders expecting minimal movement in the market. It offers an outstanding risk-to-reward ratio, requires low capital, and suits range-bound, low-volatility conditions. While it demands precise strike selection and timing, its limited downside makes it an attractive tool for experienced and well-prepared options traders.

FAQs:

A defined-risk options strategy that combines long and short positions to profit from minimal movement in the underlying.

No, the maximum loss is limited to the net debit paid to enter the trade.

It can be—if the trader understands how options pricing works. It’s low-risk but requires accurate market reading and planning.