- Share.Market

- 9 min read

- 22 Apr 2025

Introduction

Most people assume the only way to earn money in the stock market is by buying stocks when prices rise. Some traders even profit when prices fall, by short selling. But what about times when the market is neither rising nor falling—just moving sideways within a narrow range?

This scenario often occurs around important market events when implied volatility (IV) is high, reflecting uncertainty. Traders anticipating minimal price movement after the event and a sharp drop in volatility (IV crush) can use an options strategy called the Short Straddle. This strategy allows you to capitalize specifically on periods of low market activity and volatility contraction. Essentially, the Short Straddle helps you profit when markets remain quiet, turning calm market conditions into trading opportunities.

Key Takeaways

- Short Straddle Basics: Learn about this neutral options strategy, which involves simultaneously selling an At-the-Money (ATM) Call and Put to benefit from high premiums and time decay in sideways markets.

- When to Use: Ideal when you expect the underlying to remain near the strike price until expiry, and implied volatility is high.

- Setup & Payoff: Learn how to select strikes, calculate breakevens, and understand profit/loss scenarios.

- Pros, Cons & Strategy Comparison: Explore the strengths and weaknesses of the Short Straddle and see how it compares to other option strategies.

What is a Short Straddle?

A Short Straddle is a two-leg, neutral options strategy that profits when the underlying stays very close to a specific price level.

Setup:

- Sell 1 ATM Call Option

- Sell 1 ATM Put Option

- Both options must have the same strike, same expiry, and the same underlying

The core idea is to collect premium from both the call and the put, and hope the market stays at or very close to the strike price. You earn maximum profit when both options expire worthless at the strike.

Ideal Use Case Scenarios

Scenario 1: Tight Range Expectation Near Expiry

Suppose Nifty has been hovering around 24,000 for a few days. There’s no upcoming news, volume is drying up, and indicators suggest low volatility. You’re not expecting much directional movement before expiry.

This is a good setup for a Short Straddle. You could:

- Sell 1 lot of 24,000 CE

- Sell 1 lot of 24,000 PE

This trade assumes Nifty will stay very close to 24,000. Because both legs are ATM, you collect maximum premium upfront, making this strategy highly sensitive to time decay. Every passing hour, especially near expiry, works in your favor—provided the market doesn’t move much.

Scenario 2: Post-Event Volatility Crush with Low Movement Bias

Let’s say there’s an RBI policy event scheduled mid-week. Leading up to the announcement, implied volatility (IV) rises across the board. After the announcement, there are no surprises, and the market resumes trading quietly.

If you believe:

- The event is unlikely to cause major market moves

- IV will drop sharply after the event

Then a Short Straddle can be highly effective.

You initiate the position after the event, when IV is still slightly elevated. Since the market has likely “priced in” the event, there’s a good chance of sideways movement. With both options at the same strike, you maximize the benefit of a volatility crush and rapid time decay.

How Does a Short Straddle Work?

Strategy Setup

- Sell 1 ATM Call Option

- Sell 1 ATM Put Option

- Same expiry, same underlying

Example Scenario

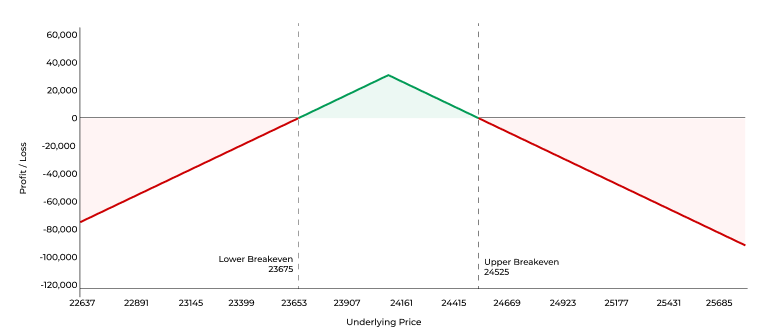

Let’s assume Nifty is currently at 24,100 and is expected to trade in a range due to high IV and no major upcoming events. A Short Straddle is initiated at the 24,100 strike:

| Action | Option Type | Strike Price | Premium |

| Sell | Call (CE) | 24,100 | 200 |

| Sell | Put (PE) | 24,100 | 225 |

Key Calculations

- Net Premium Collected = Call Premium + Put Premium = 200 + 225 = 425 points

- Lot Size = 75

- Net Credit = 425 × 75 = ₹31,875

- Maximum Profit = ₹31,875 (when both options expire worthless at 24,100)

- Maximum Loss = Unlimited beyond breakeven levels

- Breakeven Points:

- Upper Breakeven = 24,100 + 425 = 24,525

- Lower Breakeven = 24,100 − 425 = 23,675

Margin requirement – 2,30,000 (Approx)

Expiry Scenarios and Outcomes

Scenario 1 – Nifty expires at 24,100 ( Both CE and PE expire worthless)

No intrinsic value for either leg

Net P&L = ₹31,875 (Maximum Profit)

Scenario 2 – Nifty expires at 24,525 (call option hits breakeven)

CE is ITM by 425 pts → Loss = 425 Points

PE is worthless

Net P&L = (−425 + 425 ) × 75 = ₹0 (Upper Breakeven)

Scenario 3 – Nifty expires at 24,600 (we start losing on the call side)

CE is ITM by 500 pts → Loss = 500 Points

PE is worthless

Net P&L = (−500 + 425) × 75 = −₹5,625 (Loss)

Scenario 4 – Nifty expires at 24,900 (call option loss increases)

CE is ITM by 800 pts → Loss = 800 Points

PE is worthless

Net P&L = (−800 + 425) × 75 = −₹28,125 (Loss)

Scenario 5 – Nifty expires at 23,675 (put option hits breakeven)

PE is ITM by 425 pts → Loss = 425 Points

CE is worthless

Net P&L = (−425 + 425) × 75 = ₹0 (Lower Breakeven)

Scenario 6 – Nifty expires at 23,600 (we start losing on the put side)

PE is ITM by 500 pts → Loss = 500 Points

CE is worthless

Net P&L = (−500 + 425) × 75 = −₹5,625 (Loss)

Scenario 7 – Nifty expires at 23,100 (put option loss increases)

PE is ITM by 1,000 pts → Loss = 1,000 Points

CE is worthless

Net P&L = (−1,000 + 425) × 75 = −₹43,125 (Loss)

Payoff Summary Table

| Nifty Expiry Level | CE Outcome | PE Outcome | Net P&L (Per Lot) |

| 24,100 | ATM (worthless) | ATM (worthless) | ₹31,875 (Max Profit) |

| 24,525 | ITM by 425 pts | OTM | ₹0 (Breakeven) |

| 24,600 | ITM by 500 pts | OTM | −₹5,625 |

| 24,900 | ITM by 800 pts | OTM | −₹28,125 |

| 23,675 | OTM | ITM by 425 pts | ₹0 (Breakeven) |

| 23,600 | OTM | ITM by 500 pts | −₹5,625 |

| 23,100 | OTM | ITM by 1,000 pts | −₹43,125 |

Advantages & Risks of the Short Straddle

✅ Advantages of the Short Straddle

1. Time Decay Works in Your Favor

Since you’re selling both an At-The-Money (ATM) Call and Put option, the position is Theta-positive. As time passes, options lose value (especially closer to expiry), and this time decay works in your favor. If the underlying stays near the strike price, you get to keep most or all of the premium.

2. Maximum Profit at ATM Spot

Unlike Short Strangle, which benefits from a range, the Short Straddle achieves maximum profit if the underlying stays exactly at the strike price. If you have high conviction that the market will consolidate around a specific level , this strategy can offer better returns than a Strangle.

3. Benefit from Volatility Drop (IV Crush)

If implied volatility (IV) drops after you’ve entered the trade, both the Call and Put premiums shrink, even if the spot hasn’t moved much. This IV crush helps in exiting the position early with gains, especially if the entry was taken during high IV conditions.

⚠️ Risks of the Short Straddle

1. Unlimited Loss on Either Side

This is a naked strategy, meaning there’s no protection if the market moves sharply in either direction. If the price breaks out or breaks down significantly, losses can grow unlimitedly since you’re short both options.

2. Higher Sensitivity Near ATM

Because both options are sold ATM, even small moves in the underlying can lead to larger MTM fluctuations compared to a Short Strangle. You don’t have any breathing room — the risk zone starts immediately from the current market level.

3. Overnight Gap Risk

Similar to Strangles, a gap up or gap down at market open due to overnight news, global events, or unexpected announcements can lead to significant losses. The market may open well beyond your breakeven levels, not giving you a chance to react in time.

4. Requires Constant Monitoring & Risk Management

A Short Straddle cannot be left unattended. You’ll need to watch for movement, especially near expiry. If the spot starts moving away from the strike or if IV expands, you may need to adjust the position: roll strikes, convert to a Strangle, or hedge with Futures or additional options.

5. Vulnerable to Volatility Expansion

If IV increases after entering the trade, option premiums rise, causing mark-to-market losses even without much price movement. Events like RBI policy, Fed meetings, election results, or macro news can suddenly spike volatility.

Comparison: Short Strangle vs Short Straddle

| Feature | Short Strangle | Short Straddle |

| Market View | Sideways within a wider range | Sideways with minimal movement |

| Options Used | 1 OTM Call + 1 OTM Put (same expiry) | 1 ATM Call + 1 ATM Put (same expiry) |

| Premium Collected | Lower (due to OTM strikes) | Higher (ATM strikes have a higher premium) |

| Breakeven Range | Wider | Narrower |

| Max Profit | Limited to net premium | Higher than strangle (due to higher premium) |

| Max Loss | Unlimited beyond breakeven (on both sides) | Unlimited beyond breakeven (on both sides) |

| Best Case Scenario | Market stays between short strikes | Market expires exactly at ATM strike |

| Risk Management | Easier due to wider breakeven | A tighter range makes it more sensitive |

| Use Case | When expecting low volatility in a range | When expecting extremely low volatility |

Conclusion

The Short Straddle is a powerful tool when you believe the market will stay quiet and boring. It’s a way to profit just by time passing, as long as prices don’t move too much.

But with that potential reward comes higher risk. Because you’re exposed on both sides, a sharp move can cause big losses. That’s why this strategy is best used by traders who:

- Understand option behavior

- Monitor trades actively

- Avoid using this around major events

Used wisely, though, the Short Straddle can be a great way to generate consistent return in sideways markets.

FAQs

Not ideal for beginners. The Short Straddle carries unlimited risk on both sides and requires active monitoring, adjustment skills, and market experience. It’s better suited for advanced traders with strong risk management.

Yes, we can:

– Convert it to an Iron Fly by buying OTM options as a hedge

– Use tight stop-losses

– Exit or adjust positions if there’s a breakout or spike in volatility

– Avoid holding near major events like budget, RBI policy, or earnings

Yes, theoretically. If the market makes a sharp move in either direction, losses can be unlimited, especially on the call side. Always use risk-defined strategies or hedges when possible

Short Strangle gives a wider breakeven range and slightly lower profit potential, but also lower risk. If you’re unsure about exact range-bound levels, the Strangle may be safer.