- Share. Market

- 10 min read

- 02 May 2025

Introduction

When traders expect significant market movements but are uncertain of the direction, simple buy-and-hold strategies may not suffice. While directional bets like buying a call or put offer potential, they require correctly predicting the direction, which can be challenging

Whether the market breaks out or breaks down, both strategies aim to benefit from substantial directional movement.

As famous investor George Soros once said:

“It’s not whether you’re right or wrong that’s important, but how much you make when you’re right.”

Understanding the difference between Long Straddle and Long Strangle can help us to choose the better setup based on our view of volatility, movement magnitude, and risk appetite.

Key Takeaways –

- Long Straddle Basics: A high-volatility strategy where traders buy an ATM Call and an ATM Put simultaneously. Profits are realized from sharp moves in either direction.

- Long Strangle Basics: A cost-effective alternative to the Long Straddle, the Long Strangle involves buying an Out-of-the-Money (OTM) Call and an OTM Put. While it requires a larger move in the underlying asset to become profitable, it offers a lower upfront premium and reduced risk exposure.

- When to Use Them: Ideal before events like earnings reports, budget announcements, or any time a major move (not necessarily directional) is expected.

- Setup & Payoff Understanding: Learn how to construct both strategies, calculate breakevens, understand maximum loss (premium paid), and explore unlimited profit scenarios.

- Strategy Comparison: Understand the trade-offs between Long Straddle and Long Strangle in terms of cost, risk, breakeven points, and market expectations.

What is a Long Straddle?

A Long Straddle is an options strategy where a trader buys both a Call and a Put option at the same strike price (typically ATM – At The Money) and same expiry date.

It’s a pure volatility bet:

We don’t care whether the underlying goes up or down—we just want it to move big.

If the underlying moves sharply in either direction, we get a profit.

Long Straddle Setup

- Buy 1 ATM Call Option

- Buy 1 ATM Put Option

(Both on the same underlying, same expiry.)

What is a Long Strangle?

A Long Strangle is similar to a Straddle, but a little different:

Here, we buy an OTM Call and an OTM Put.

It’s cheaper than a Straddle because both options are out-of-the-money.

But it needs a larger move in the underlying to become profitable.

Long Strangle Setup

- Buy 1 OTM Call Option (above current price)

- Buy 1 OTM Put Option (below current price)

(Both with the same expiry.)

Scenario 1: Major Event Incoming — Expectation of Large Movement

Events like general elections, Union budgets, central bank policy meetings (RBI decisions), court verdicts, or geopolitical developments can inject massive uncertainty into the market.

Before such major events, implied volatility (IV) often rises sharply as traders position themselves for a potential move.

However, while the market agrees that “something big” might happen, the direction of the move remains highly uncertain.

This environment creates a perfect setup for Long Straddle or Long Strangle strategies.

Example:

Suppose Nifty is trading at 24,000, and the election results are about to be announced.

Traders expect either:

- A strong rally if a stable government is formed

- A sharp fall if the results are fractured or surprising

We don’t know the direction, but we are confident that volatility and large price swings are inevitable.

In this case:

- Long Straddle Setup:

- Buy 24,000 CE

- Buy 24,000 PE

- Buy 24,000 CE

- ➔ Costs are higher (because both options are At-the-Money), but only a moderate move is needed to start making profits.

- Long Strangle Setup:

- Buy 24,200 CE

- Buy 23,800 PE

- Buy 24,200 CE

- ➔ Cheaper to enter (as OTM options are less expensive), but needs a bigger move outside the 23,800–24,200 range for profits to kick in.

Both strategies aim to capture the volatility explosion, but our choice depends on whether we prefer:

- Paying a higher premium but requiring a smaller move (Straddle)

- Paying a lower premium but needing a larger breakout (Strangle)

Scenario 2: Pre-Event Spike in Volatility

In many cases, implied volatility (IV) rises before a big event (like elections or corporate earnings).

This happens because traders bid up option prices in anticipation of future movement.

Although buying options during periods of high implied volatility (IV) can be costly, a significant move in the underlying asset after the event can still lead to profits. This is because the option’s delta—its sensitivity to price movement—can outweigh the negative impact of an IV crush.

Thus:

- Long Straddles and Long Strangles are excellent tools when we expect not just higher volatility but sharp post-event movement.

- However, be cautious if we think movement will be small after the event, because options will lose value quickly due to volatility crush (IV falling post-event).

Scenario 3: Earnings Announcements for Large-Cap Stocks

For traders working with large-cap stocks (e.g., Reliance, HDFC Bank, Infosys), quarterly earnings can be pivotal events.

Before earnings:

- Options premiums expand due to uncertainty.

- Traders don’t know if the company will beat or miss estimates.

Deploying a Long Straddle (ATM options) or Long Strangle (OTM options) right before earnings—betting on big swings—can be a smart move, especially if we expect:

- Surprise results

- Unexpected guidance

- Major strategic announcements

Scenario 4: Anticipation of Global Macro Events

Global events like:

- U.S. Fed rate decisions

- Crude oil price shocks

- Currency devaluation (Rupee crash)

- Geopolitical tensions (wars, sanctions)

can impact the Indian markets (Nifty, BankNifty) significantly.

If we are expecting a large movement based on global triggers, but aren’t sure whether it will be up or down, Long Straddles and Strangles allow us to position ourselves smartly without choosing a side.

How Do These Strategies Work?

(Setup & Key Calculations)

Strategy Setup Recap

| Strategy | Options Purchased |

| Long Straddle | ATM Call + ATM Put |

| Long Strangle | OTM Call + OTM Put |

Both involve paying the net premium upfront (debit strategies).

Maximum loss is limited to the total premium paid.

Maximum profit is unlimited if the price makes a big move.

Key Calculations

- Net Debit (Total Premium Paid) = Premium of Call + Premium of Put

- Maximum Loss = Net Debit (if price stays near current level)

- Maximum Profit = Unlimited (on either side)

- Breakeven Points:

- For Long Straddle:

- Upper BEP = Strike Price + Net Debit

- Lower BEP = Strike Price − Net Debit

- Upper BEP = Strike Price + Net Debit

- For Long Strangle:

- Upper BEP = Higher Strike + Net Debit

- Lower BEP = Lower Strike − Net Debit

- Upper BEP = Higher Strike + Net Debit

- For Long Straddle:

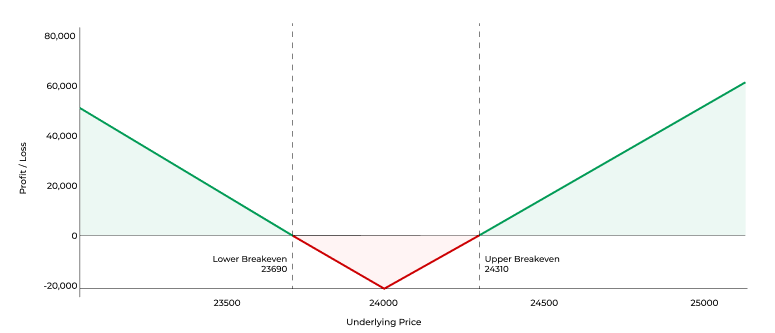

Long Straddle Example (Nifty)

Suppose Nifty is at 24,000.

- Buy 24,000 CE @ 150

- Buy 24,000 PE @ 160

Net Debit = 150 + 160 = 310 points

Breakevens:

- Upper BEP = 24,000 + 310 = 24,310

- Lower BEP = 24,000 – 310 = 23,690

We will start making profits at expiry if Nifty moves above 24,310 or below 23,690.

- Long Straddle: Narrower breakeven but higher cost.

Payoff Diagrams

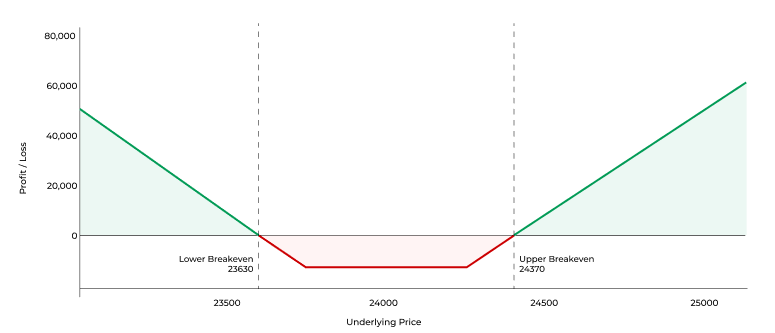

Long Strangle Example (Nifty)

Suppose Nifty is at 24,000.

- Buy 24,200 CE @ 80

- Buy 23,800 PE @ 90

Net Debit = 80 + 90 = 170 points

Breakevens:

- Upper BEP = 24,200 + 170 = 24,370

- Lower BEP = 23,800 − 170 = 23,630

Here, we need a bigger move, but the cost is lower.

Payoff Diagrams

Long Strangle: Wider breakeven but lower cost.

Advantages of Long Straddle vs Long Strangle

Long Straddle: Advantages

1. Profits from Any Large Move – Regardless of Direction

The Long Straddle is a pure volatility play. It profits when the underlying makes a significant move, either upward or downward. Since it involves buying both a Call and a Put at the same At-the-Money (ATM) strike, you’re covered on both sides.

You don’t need to predict direction—only that movement is coming.

2. Requires Less Movement to Breakeven

Because both options are At-the-Money, the breakeven points are closer to the current market price compared to a Strangle. This means the underlying doesn’t have to move as much to reach profitability.

Ideal when you’re expecting moderate volatility or are unsure of the move’s magnitude.

3. Simplifies Volatility Bets Without Strike Selection Complexity

With both options at the same strike, the Long Straddle removes the need to carefully choose upper and lower strikes like in a Strangle. It’s a straightforward, clean setup when your forecast is simple: “The market will move, and soon.”

Excellent for events like RBI decisions, earnings, or macro policy shifts where the timing of the move is near-certain.

Long Strangle: Advantages

1. Lower Cost of Entry

The Long Strangle uses Out-of-the-Money (OTM) options, making it a cheaper alternative to the Straddle. Because both options are priced lower, your total premium outlay is reduced.

Great for cost-sensitive traders or those managing limited capital.

2. Smaller Capital at Risk

Lower premiums mean your maximum potential loss is smaller, giving you more flexibility in trade sizing and risk management.

Perfect for situations where you expect volatility but want to limit downside exposure.

3. Better for Extreme Volatility Scenarios

The Strangle is more suited when you anticipate a large breakout or breakdown well beyond the normal trading range.

While it needs a bigger move to break even, the low cost makes potential profits very attractive relative to the risk.

Ideal for highly uncertain scenarios like election results, global crisis events, or major legal rulings.

Risks of Long Straddle and Long Strangle

1. Limited to Total Premium Paid

Both the Long Straddle and Long Strangle are debit strategies—meaning we pay a net premium upfront to enter the trade.

If the underlying asset does not move enough in either direction by expiry, both options decay in value, leading to a maximum loss equal to the total premium paid.

The upside is that your risk is capped—you can’t lose more than the premium you’ve paid. The drawback is that if the market remains stagnant, you could lose the entire amount invested in the trade.

2. Loss Occurs if Underlying Doesn’t Move Enough

The main enemy for both strategies is market stagnation.

If:

- Nifty remains stuck in a tight range.

- The actual price movement is smaller than anticipated.

➔ Both the Call and Put lose value simultaneously.

➔ Neither side gains enough intrinsic value to offset the premium paid.

In such cases, the trader incurs a loss, regardless of how low the implied volatility was at entry.

3. Time Decay (Theta) Hurts if Market Remains Range-Bound

As time passes, option premiums decay, especially when the underlying doesn’t move.

Theta decay becomes more pronounced as the expiration date draws closer.

- Even if IV remains high, if there’s no price movement, time decay erodes the value of both Call and Put options.

- As a result, both Long Straddles and Strangles are very sensitive to time.

The longer the underlying stays stagnant, the worse the P&L becomes.

Thus, timing the entry point is crucial — entering too early before the move happens can lead to unnecessary premium erosion.

Comparison: Long Straddle vs Long Strangle

| Feature | Long Straddle | Long Strangle |

| Strike Prices | Same ATM for Call and Put | Different OTM for Call and Put |

| Premium Cost | Higher | Lower |

| Movement Needed | Smaller | Larger |

| Breakeven Distance | Narrow | Wider |

| Risk | Limited to premium | Limited to premium |

| Best Used When | Moderate to High Volatility expected | Very High Volatility expected |

Conclusion

Both Long Straddle and Long Strangle are powerful directional options strategies for capitalizing on big market movements.

- If we expect a big movement but a moderate one, a Long Straddle might suit us better.

- If we expect a very big move but want a cheaper setup, a Long Strangle can be ideal.

Understanding the trade-off between cost and movement requirement is the key to choosing the right strategy for our market view.

FAQs

1. Which is better: Long Straddle or Long Strangle?

It depends—Straddle suits moderate volatility with moderate movement; Strangle suits very high volatility expectations with extreme moves.

2. Can I lose all the premiums paid?

Yes, if the market doesn’t move enough beyond breakeven points before expiry.

3. Are these strategies good for beginners?

They are simple to understand but require good volatility prediction skills. Risk is limited, but understanding time decay is crucial.