- Share.Market

- 9 min read

- 23 Apr 2025

Introduction

The Short Strangle is a popular options strategy designed to profit when the underlying asset stays within a specific price range. While it offers attractive returns in sideways markets, the major drawback is its unlimited risk. If the market moves sharply in either direction, traders can incur substantial losses, underscoring the need for strong risk management when using this approach.

As Mark Douglas wisely states in The Disciplined Trader book,

“Successful trading is 80% money management and only 20% strategy.”

This raises an important question:

Is there a way to profit from range-bound markets without taking on unlimited risk?

One possible answer is the Iron Condor.

Key Takeaways – Iron Condor Strategy

- Iron Condor Basics: A neutral options strategy that involves selling OTM (Out of the Money) calls and puts. It works best in range-bound, low-volatility markets and offers limited risk with the potential to earn from time decay.

- When to Use It: Ideal scenarios are when you expect the market to stay within a range and volatility to remain low. The goal is for all the options you sell to expire worthless.

- Setup & Payoff: Learn how to choose the right strike prices, calculate breakeven points, and figure out the maximum profit—which is the net premium you receive.

- Pros, Cons & Comparisons: Discover why traders like this strategy for its limited risk and steady returns. Understand its limitations, and see how it stacks up against similar strategies like the Short Strangle in terms of risk and reward.

What is an Iron Condor?

An Iron Condor is a neutral options strategy that profits when the underlying asset’s price stays within a specific range. The strategy involves four positions: two short options (a call and a put) and two long options (a call and a put) to limit the potential for loss.

Setup:

- Sell 1 OTM Call Option

- Buy 1 OTM Call Option (further OTM)

- Sell 1 OTM Put Option

- Buy 1 OTM Put Option (further OTM)

All options should have the same expiry and the same underlying asset.

The core idea is to collect premiums from the two short positions, while the long options act as a hedge to limit your risk in case the market moves outside the range of the short strikes.

Ideal Use Case Scenarios

Scenario 1: Expecting Low Volatility and Sideways Movement

Suppose Nifty is trading at 24,100 and has been oscillating between 23,500 and 24,500 for a few weeks. There is no major economic or geopolitical event expected before expiry, and implied volatility is relatively low. In this scenario, you would deploy an Iron Condor strategy.

You could:

- Sell a 24,500 CE (expecting resistance)

- Buy a 25,000 CE (further out-of-the-money)

- Sell a 23,500 PE (expecting support)

- Buy a 23,000 PE (further out-of-the-money)

This setup assumes that Nifty will stay between 23,500 and 24,500 until expiration. As long as the price remains within this range, you will profit from time decay and erosion of implied volatility.

Scenario 2: Post-Event Volatility Crush

Imagine a situation where the market anticipates a major event, like an economic report or earnings release. The implied volatility (IV) spikes before the event, but once the event passes and the market remains stable, IV drops rapidly. In such cases, the Iron Condor is an excellent strategy because you can sell options when premiums are high and benefit from the post-event drop in volatility.

How Does an Iron Condor Strategy Work?

Strategy Setup:

- Sell 1 OTM Call Option

- Buy 1 OTM Call Option (further OTM)

- Sell 1 OTM Put Option

- Buy 1 OTM Put Option (further OTM)

All positions have the same expiry and the same underlying asset.

Key Calculations

- Net Premium Collected = Premium Received from Short Call + Premium Received from Short Put − Premium Paid for Long Call − Premium Paid for Long Put

- Maximum Profit = Net Premium Collected (occurs when the underlying expires between the short call and short put strike prices)

- Maximum Loss = Difference between adjacent strike prices − Net Premium Collected (i.e., the spread between strikes on either the call or put side, minus the net premium)

- Breakeven Points:

- Upper Breakeven = Strike Price of Short Call + Net Premium Collected

- Lower Breakeven = Strike Price of Short Put − Net Premium Collected

Example: Iron Condor Setup

Let’s say Nifty is currently trading at 24,000, and based on technical analysis, it has strong support around 23,500 and major resistance near 24,500. There are no significant economic events or earnings announcements expected before expiry, and overall market volatility is low.

Given this neutral outlook, you anticipate Nifty will remain range-bound between 23,500 and 24,500 until expiry. This presents an ideal scenario to deploy the Iron Condor strategy, aiming to capitalize on time decay (theta) while keeping risk defined on both sides.

Iron Condor Setup

| Action | Option Type | Strike Price | Premium (Approx.) |

| Sell | Call (CE) | 24,500 | 110 |

| Buy | Call (CE) | 24,700 | 72 |

| Sell | Put (PE) | 23,500 | 100 |

| Buy | Put (PE) | 23,300 | 70 |

Key Calculations

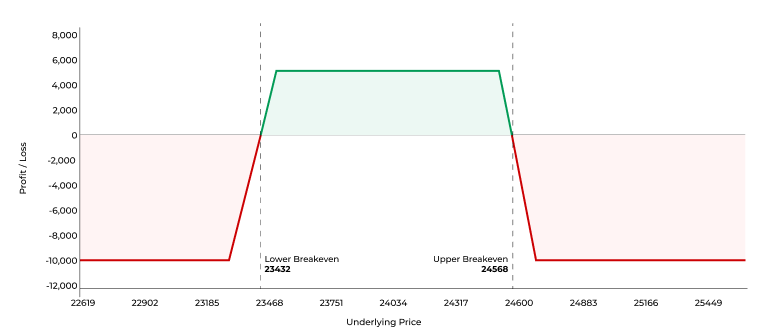

- Total Premium Collected = 110 (CE) + 100 (PE) − 72 (CE) − 70 (PE) = 68

- Lot Size (Nifty) = 75

- Net Credit = ₹68 × 75 = ₹5,100

- Upper Breakeven = 24,500 + 68 = 24,568

- Lower Breakeven = 23,500 − 68 = 23,432

- Maximum Profit = ₹5,100 (if Nifty stays between 23,500 and 24,500)

- Maximum Loss = (Strike Spread − Net Premium) × Lot Size = (200 − 68) × 75 = ₹9,900

The final margin requirement for an Iron Condor is lower than that of a Short Strangle because the Iron Condor is fully hedged, and the maximum loss is predefined.

Expiry Scenarios and Detailed Outcomes

Scenario 1: Nifty closes at 24,100

- 24,500 CE (Sell): Out-of-the-money, expires worthless

- 24,700 CE (Buy): Out-of-the-money, expires worthless

- 23,500 PE (Sell): Out-of-the-money, expires worthless

- 23,300 PE (Buy): Out-of-the-money, expires worthless

Net P&L: ₹68 × 75 = ₹5,100 (Maximum Profit)

Scenario 2: Nifty closes at 24,500

- 24,500 CE (Sell): At-the-money, expires worthless

- 24,700 CE (Buy): Out-of-the-money, expires worthless

- 23,500 PE (Sell): Out-of-the-money, expires worthless

- 23,300 PE (Buy): Out-of-the-money, expires worthless

Net P&L: ₹5,100 (Maximum Profit)

Scenario 3: Nifty closes at 24,600

- 24,500 CE (Sell): In-the-money by 100 points → Loss = 100

- 24,700 CE (Buy): Out-of-the-money, expires worthless

- 23,500 PE (Sell): Out-of-the-money, expires worthless

- 23,300 PE (Buy): Out-of-the-money, expires worthless

Net P&L: (−100 + 68) × 75 = −₹2,400

Scenario 4: Nifty closes at 24,700

- 24,500 CE (Sell): In-the-money by 200 points → Loss = 200

- 24,700 CE (Buy): At-the-money, limits loss

- 23,500 PE (Sell): Out-of-the-money, expires worthless

- 23,300 PE (Buy): Out-of-the-money, expires worthless

Net P&L: (−200 + 68) × 75 = −₹9,900 (Maximum Loss)

Scenario 5: Nifty closes at 23,400

- 23,500 PE (Sell): In-the-money by 100 points → Loss = 100

- 23,300 PE (Buy): Out-of-the-money, expires worthless

- 24,500 CE (Sell): Out-of-the-money, expires worthless

- 24,700 CE (Buy): Out-of-the-money, expires worthless

Net P&L: (−100 + 68) × 75 = −₹2,400

Scenario 6: Nifty closes at 23,300

- 23,500 PE (Sell): In-the-money by 200 points → Loss = 200

- 23,300 PE (Buy): At-the-money, limits loss

- 24,500 CE (Sell): Out-of-the-money, expires worthless

- 24,700 CE (Buy): Out-of-the-money, expires worthless

Net P&L: (−200 + 68) × 75 = −₹9,900 (Maximum Loss)

Payoff Summary Table

| Nifty Expiry Level | CE Outcome | PE Outcome | Net P&L (Per Lot) |

| 24,100 | OTM | OTM | ₹5,100 (Max Profit) |

| 24,500 | ATM | OTM | ₹5,100 (Max Profit) |

| 24,600 | ITM by 100 pts | OTM | −₹2,400 (Loss) |

| 24,700 | ITM by 200 pts | OTM | −₹9,900 (Max Loss) |

| 23,400 | OTM | ITM by 100 pts | −₹2,400 (Loss) |

| 23,300 | OTM | ITM by 200 pts | −₹9,900 (Max Loss) |

Advantages of the Iron Condor

- Limited Risk on Both Sides: Unlike the Short Strangle, the Iron Condor is a defined-risk strategy. The purchase of further OTM options (wings) caps your maximum loss, making it safer in case of a sudden breakout or breakdown in the market.

- Time Decay (Theta) Works in Your Favor: Since you’re selling both a Call and a Put option, the Iron Condor is Theta-positive. This means time decay works in your favor every day, especially as expiry nears and the premium of the sold options erodes.

- Ideal for Range-Bound Markets: This strategy performs best when the underlying stays within a well-defined range. If you expect the market to trade sideways between support and resistance levels, the Iron Condor allows you to earn income from premium collection.

- Can Benefit from IV Crush: If implied volatility drops after entering the position, option premiums shrink, leading to mark-to-market profits. This is especially useful if the position is opened during relatively high volatility conditions and held as volatility cools off.

Risks of the Iron Condor

- Lower Reward Compared to Naked Selling Strategies: While the Iron Condor limits your risk, it also limits your profit potential. The net credit collected is smaller than what you might earn with an unhedged Short Strangle or Straddle.

- Breakout Risk Still Exists (Though Capped): If the underlying moves sharply beyond the breakeven points, the strategy can still result in a loss. Though the risk is capped, you can still lose a significant amount, especially if the strike spread is wide.

- Requires Precise Strike Selection: The effectiveness of the Iron Condor heavily depends on smart strike selection. Setting the strikes too close can increase the chance of breaching; too far apart may reduce the net credit and reward potential.

- Limited Profit Range: The Iron Condor profits only if the underlying stays within a relatively narrow range. If the market becomes volatile or trends strongly in either direction, profits can quickly erode, and adjustments might be required.

Comparison: Short Strangle vs Iron Condor

| Feature | Short Strangle | Iron Condor |

| Market View | Sideways within a wider range | Sideways within a defined and tighter range |

| Options Used | 1 OTM Call + 1 OTM Put (same expiry) | 1 OTM Call + 1 OTM Put sold + further OTM Call & Put bought |

| Premium Collected | Higher (due to naked positions and no hedging) | Lower (due to buying protection legs) |

| Breakeven Range | Wider | Narrower (as net credit is smaller) |

| Max Profit | Limited to net premium collected | Limited to net premium collected |

| Max Loss | Unlimited beyond breakeven levels | Limited and predefined (strike spread − net premium) |

| Best Case Scenario | Market stays between short strikes | Market stays between inner short strikes |

| Risk Management | Needs active monitoring and adjustments | Easier with predefined max loss due to protective legs |

| Use Case | When expecting low volatility but okay with uncapped risk | When expecting low volatility and prefer defined risk |

Conclusion

The Iron Condor strategy is an excellent alternative for traders who want to limit risk while profiting from range-bound markets. By combining four legs (two short and two long options), the Iron Condor offers a well-defined risk/reward structure and is ideally suited for low-volatility environments. When used correctly, this strategy allows traders to earn steady profits with controlled risk exposure.

FAQs

An options strategy involving the sale of an OTM Call and Put, and the purchase of further OTM Calls and Puts, all with the same expiry.

No, the risk is limited to the difference between the strike prices of the sold and bought options, minus the premium collected.

While the Iron Condor is relatively low-risk, it’s important for beginners to understand how options work and to actively monitor their positions.