Share Market Weekly

- Share.Market

- 4 min read

- 16 Jan 2026

Highlights

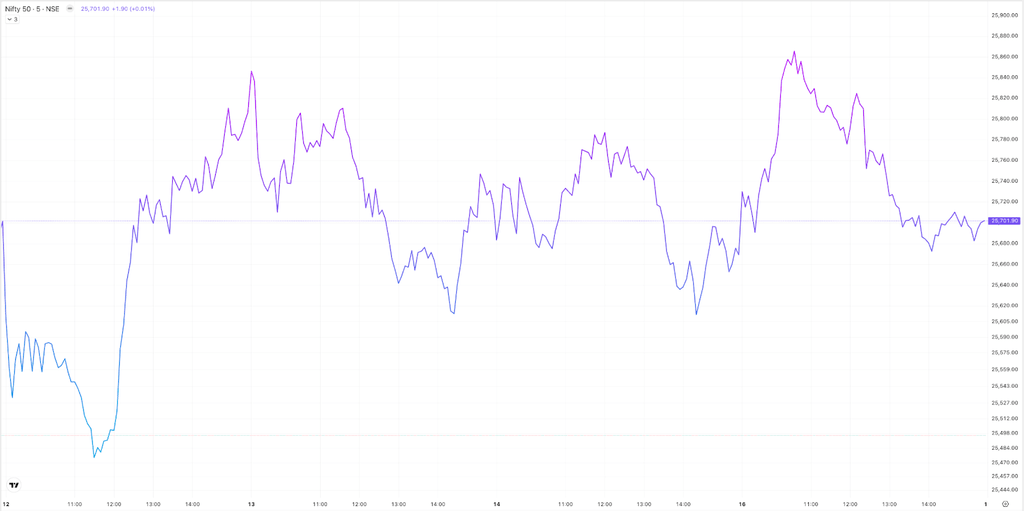

Nifty 50 25,694.35 🔼 0.04%

| Monday | 🔼 0.42% |

| Tuesday | 🔻 0.22% |

| Wednesday | 🔻 0.26% |

| Friday | 🔼 0.11% |

What moved the market?

Top Gainers & Top Losers

| Nifty PSU Bank | 🔼 4.80% | Nifty Consumer Durables | 🔻 2.80% |

| Nifty Metal | 🔼 4.55% | Nifty Realty | 🔻 2.40% |

| Nifty IT | 🔼 2.79% | Nifty Pharma | 🔻 2.39% |

Markets this week

| Nifty Midcap 150 | 21,975.10 (🔻 0.05%) |

| Nifty Smallcap 250 | 16,207.30 (🔻 0.01%) |

| India VIX | 11.37 (🔼 4.03%) |

Stocks in the Spotlight

Top Gainers

| Name of the company | Movement |

| IFCI Ltd. | 🔼 23.79% |

| Angel One Ltd. | 🔼 17.94% |

| Vedanta Ltd. | 🔼 11.95% |

| Multi Commodity Exchange of India Ltd. | 🔼 11.64% |

| Chennai Petroleum Corporation Ltd. | 🔼 9.87% |

Top Losers

| Name of the company | Movement |

| Tejas Networks Ltd. | 🔻12.54% |

| Cohance Lifesciences Ltd. | 🔻10.50% |

| L&T Technology Services Ltd. | 🔻10.06% |

| GE Vernova T&D India Ltd. | 🔻9.55% |

| HBL Engineering Ltd. | 🔻9.36% |

Technical Analysis

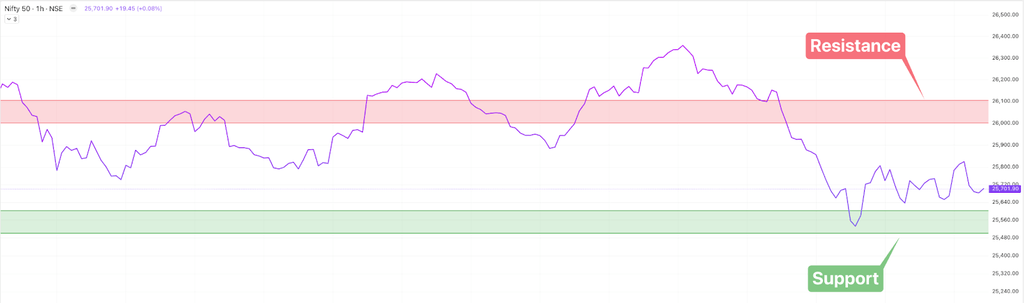

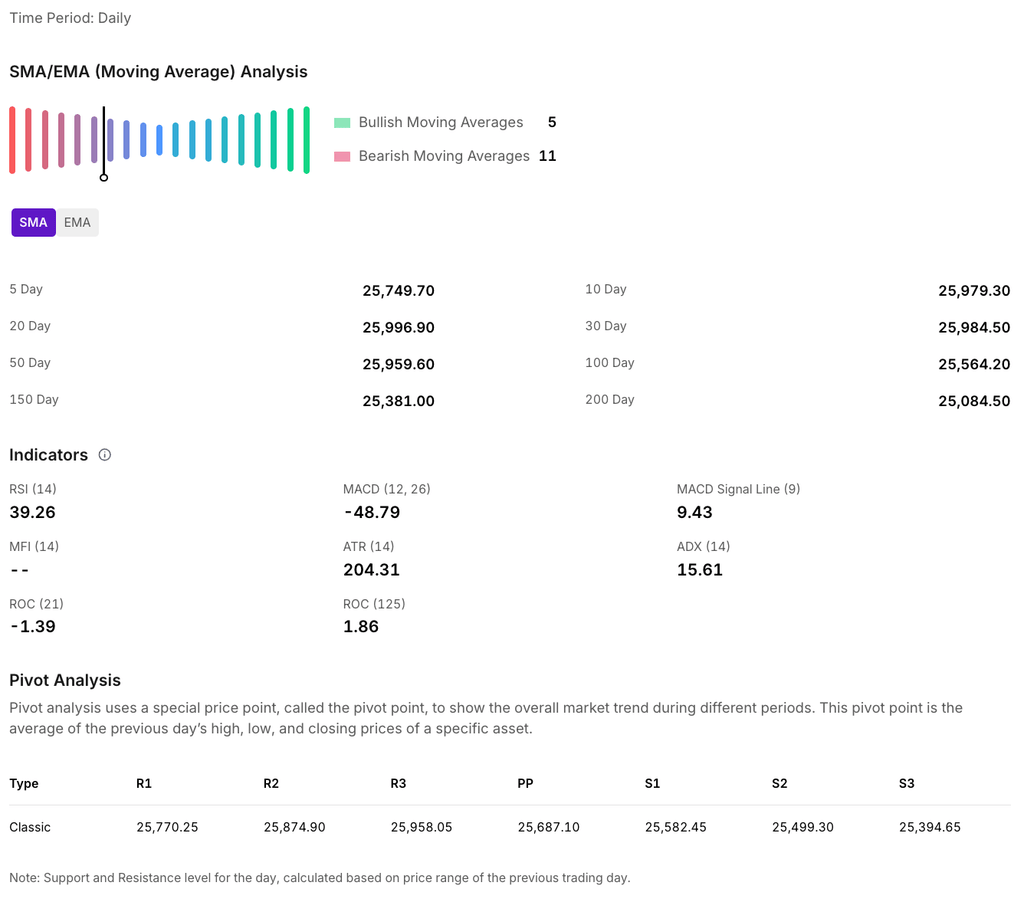

Nifty 50 ended the week on a bearish note, losing approximately –1.71% (-446 points) closing at 25,694.

- Immediate Resistance: 26,000 – 26,100

- Immediate Support: 25,500 – 25,600

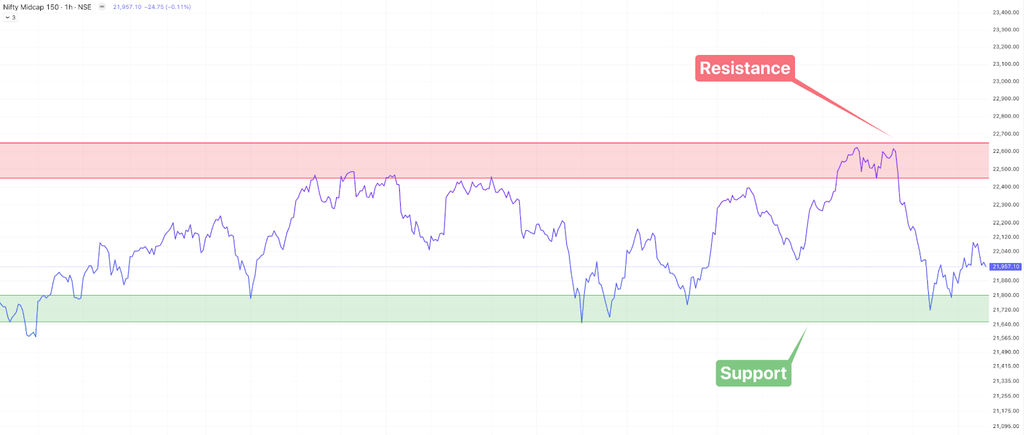

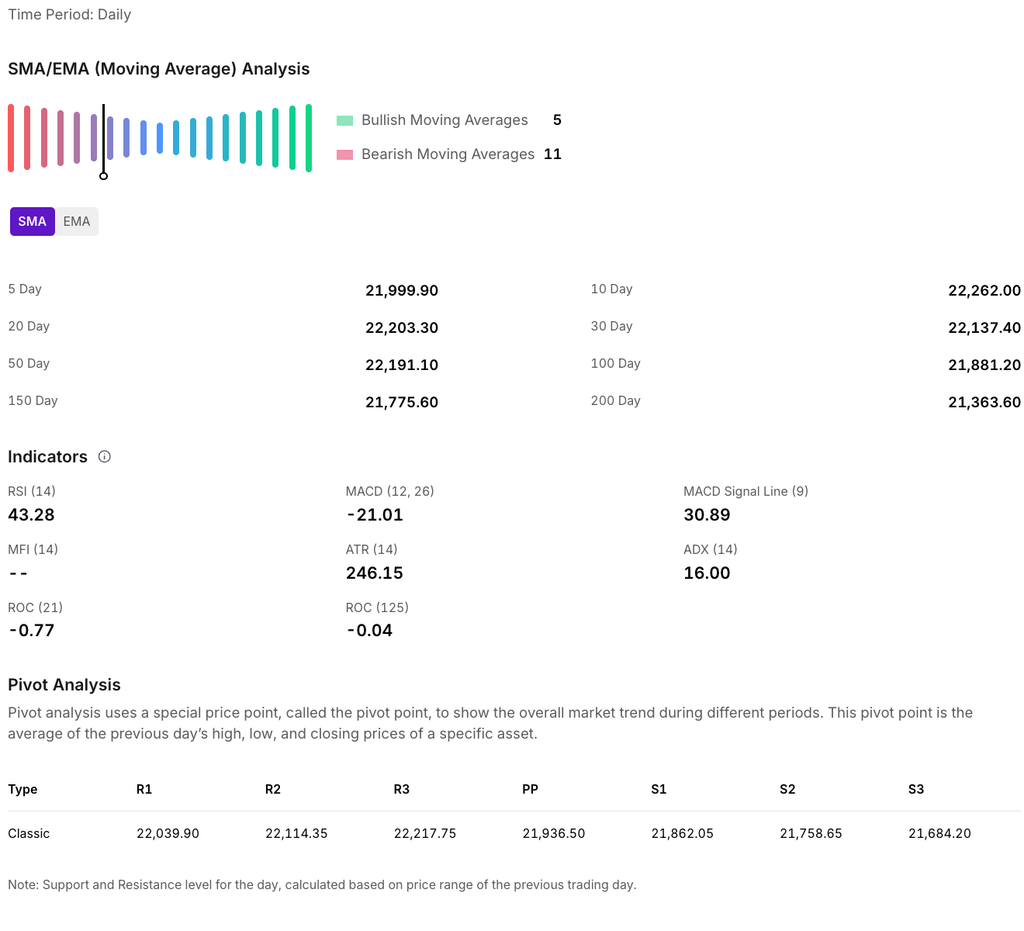

The Nifty Midcap 150 index closed at 21,975.10, marking a sharp decline of 631 points (-2.79%).

- Immediate Resistance:22,450 – 22,650

- Significant Support: 21,650 – 21,800

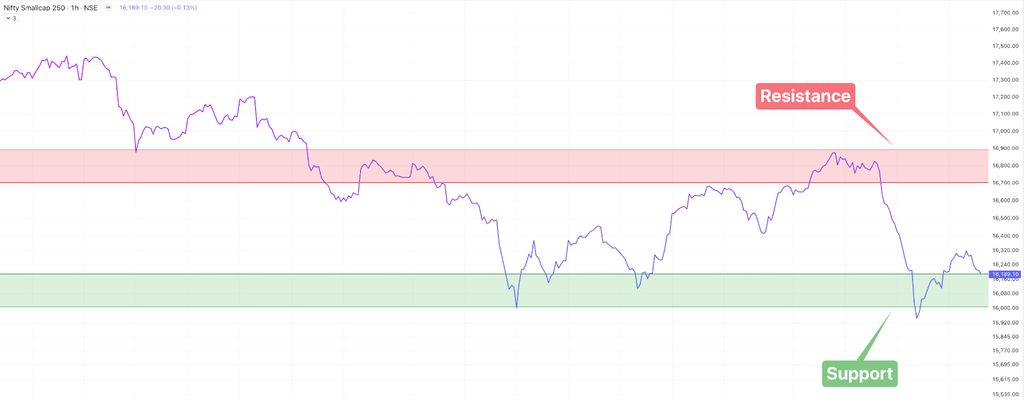

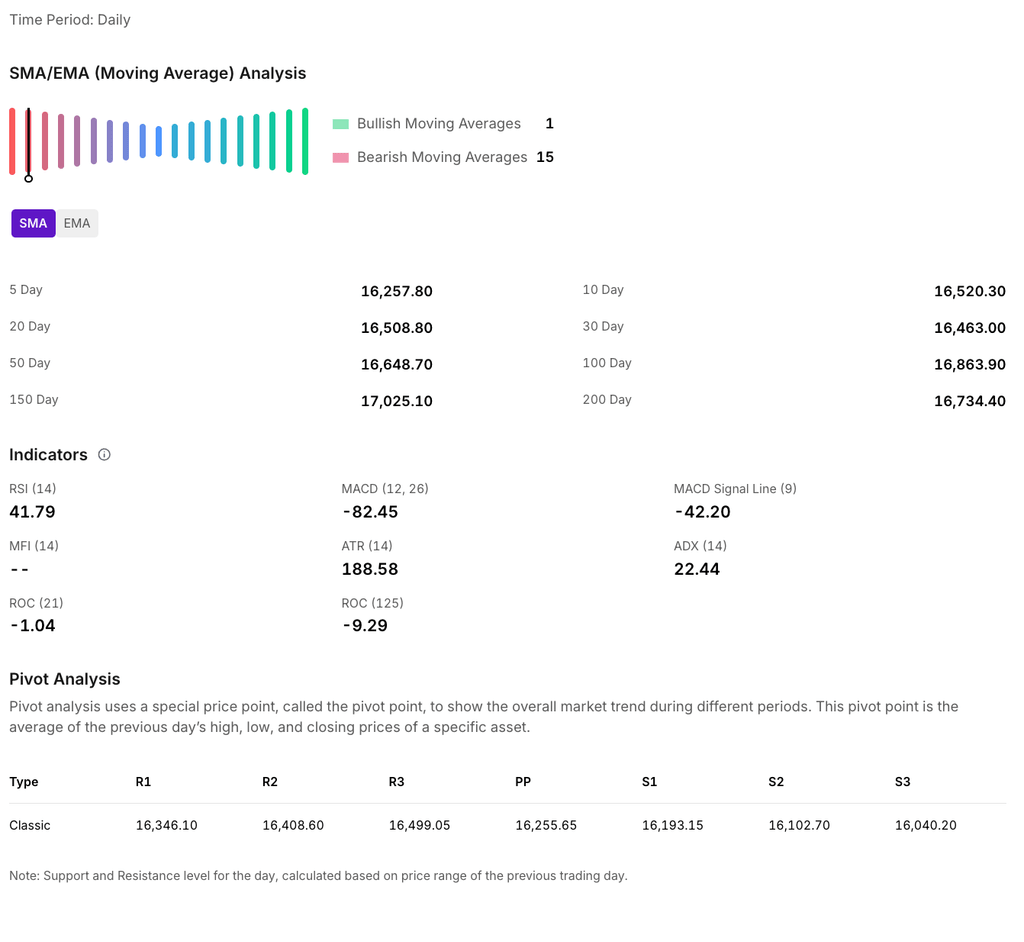

The Nifty Smallcap 250 index closed flat this week at 16,207.

For the upcoming sessions:

- Key Resistance Level: 16,700 – 16,900

- Key Support Level: 16,000 – 16,200

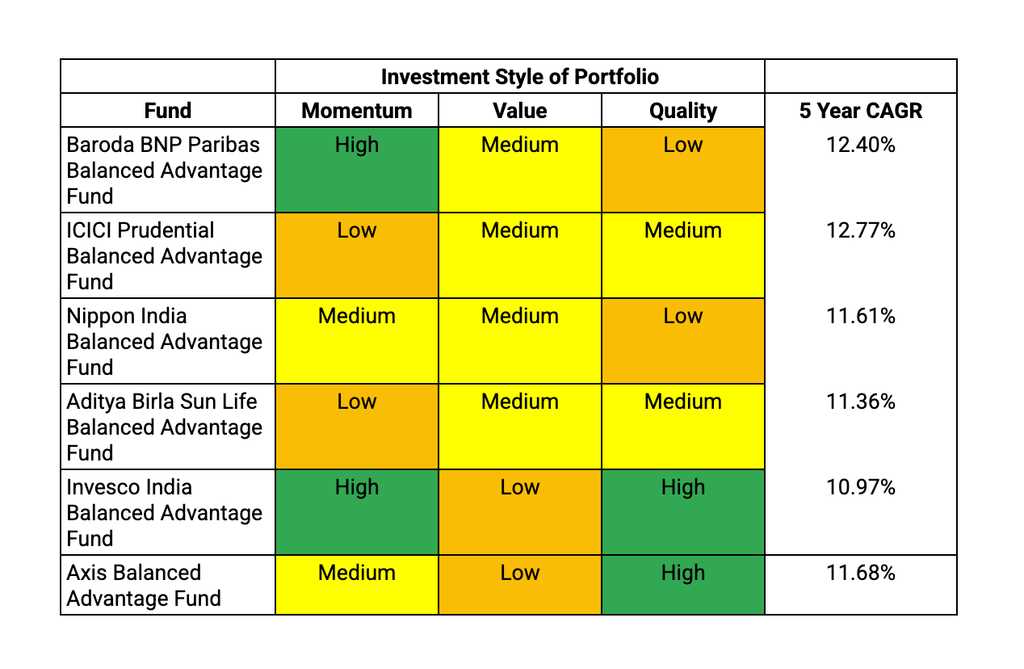

CRISP Insight: Most consistent Balanced Advantage Funds and their investment styles

portfolio factor scores, assessed relative to both category peers and the benchmark. Funds with risk categorized as too high as per

CRISP not considered. For detailed methodology, refer to this link.

This Week’s Spotlight Story

A deep dive into the headline that defined market conversations.

India’s Cumulative Exports Estimated At USD 634.26 Billion in April-December 2025

India’s overall exports (Merchandise and Services combined) are estimated at US$ 634.26 Billion during the period of April-December 2025. This represents a growth of 4.33% compared to US$ 607.93 Billion recorded during the same period in the previous year, according to the trade estimates released by the Ministry of Commerce & Industry.

The growth in merchandise exports is supported by significant performance in key sectors. Cumulative merchandise exports for April-December 2025 reached US$ 330.29 Billion, registering a positive growth of 2.44%. Notably, Non-Petroleum exports for the period were valued at US$ 288.16 Billion, marking an increase of 5.51%. Major drivers fueling merchandise export growth in December 2025 include Electronic Goods, which rose by 16.78%, Meat, Dairy & Poultry products (30.16%), Marine Products (11.73%), and Drugs & Pharmaceuticals (5.65%).

On the broader trade front, the cumulative value of imports for April-December 2025 is estimated at US$ 730.84 Billion, registering a growth of 4.95%. The services sector continues to contribute significantly, with estimated exports of US$ 303.97 Billion for the April-December period, compared to US$ 285.53 Billion in the previous year. Consequently, the services trade surplus for the period is estimated at US$ 151.74 Billion

That’s a wrap for this week.

As the markets pause to catch their breath, we’ll be back next week with sharper insights and stories to help you invest intelligently.