Share Market Weekly

- Share.Market

- 4 min read

- 02 Jan 2026

Highlights

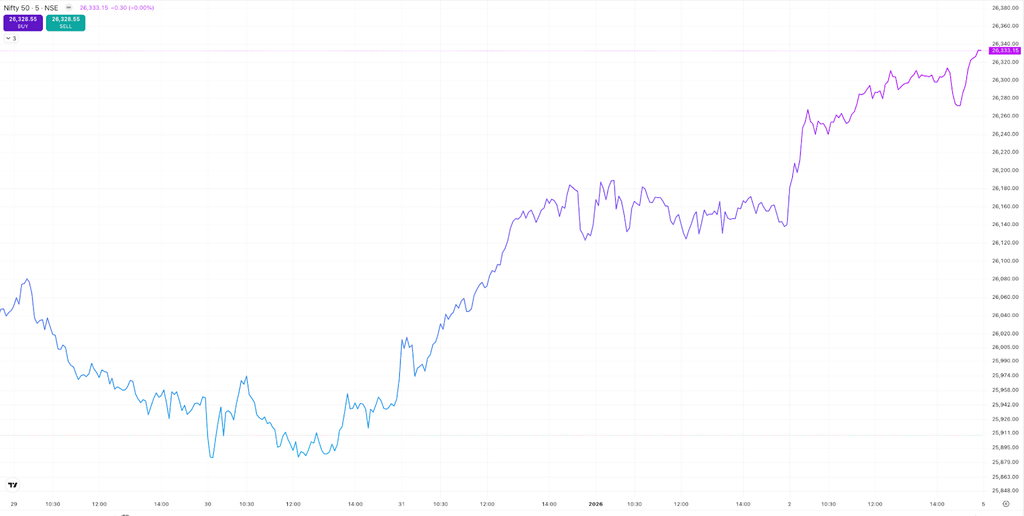

Nifty 50 26,328.55 🔼 1.10%

| Monday | 🔻 0.38% |

| Tuesday | 🔻 0.01% |

| Wednesday | 🔼 0.74% |

| Thursday | 🔼 0.06% |

| Friday | 🔼 0.70% |

What moved the market?

Top Gainers & Top Losers

| Nifty Metal | 🔼 5.70% | Nifty FMCG | 🔻 3.72% |

| Nifty PSU Bank | 🔼 4.98% | Nifty IT | 🔻 0.65% |

| Nifty Commodities | 🔼 4.31% |

Markets this week

| Nifty Midcap 150 | 22,579.05 (🔼 1.75%) |

| Nifty Smallcap 250 | 16,795.75 (🔼 1.09%) |

| India VIX | 9.45 (🔼 3.28%) |

Stocks in the Spotlight

Top Gainers

| Name of the company | Movement |

| Transformers & Rectifiers (India) Ltd. | 🔼 16.56% |

| Force Motors Ltd. | 🔼 14.93% |

| Hindustan Copper Ltd. | 🔼 13.94% |

| Graphite India Ltd. | 🔼 13.19% |

| Ola Electric Mobility Ltd. | 🔼 12.99% |

Top Losers

| Name of the company | Movement |

| Godfrey Phillips India Ltd. | 🔻20.39% |

| ITC Ltd. | 🔻13.39% |

| PB Fintech Ltd. | 🔻6.68% |

| Radico Khaitan Ltd. | 🔻6.39% |

| Waaree Energies Ltd. | 🔻5.92% |

Technical Analysis

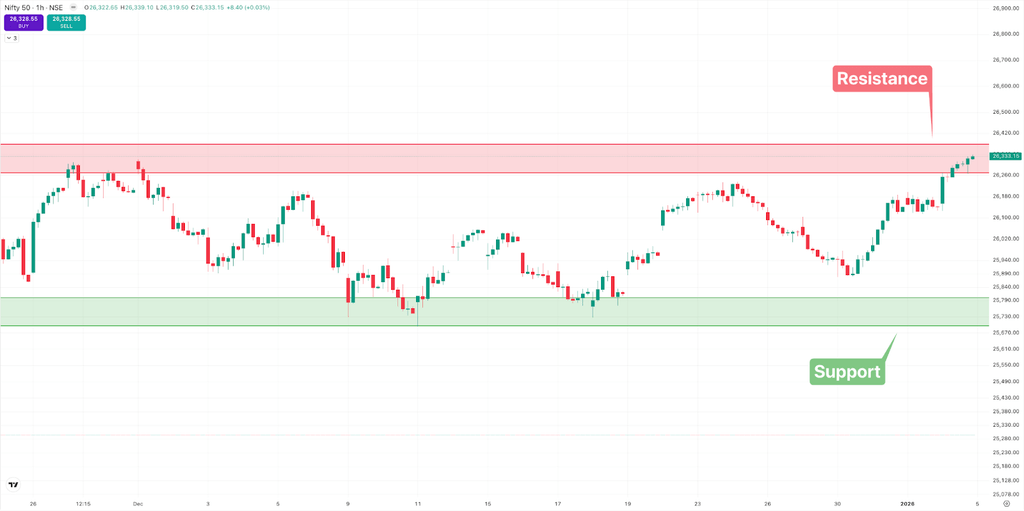

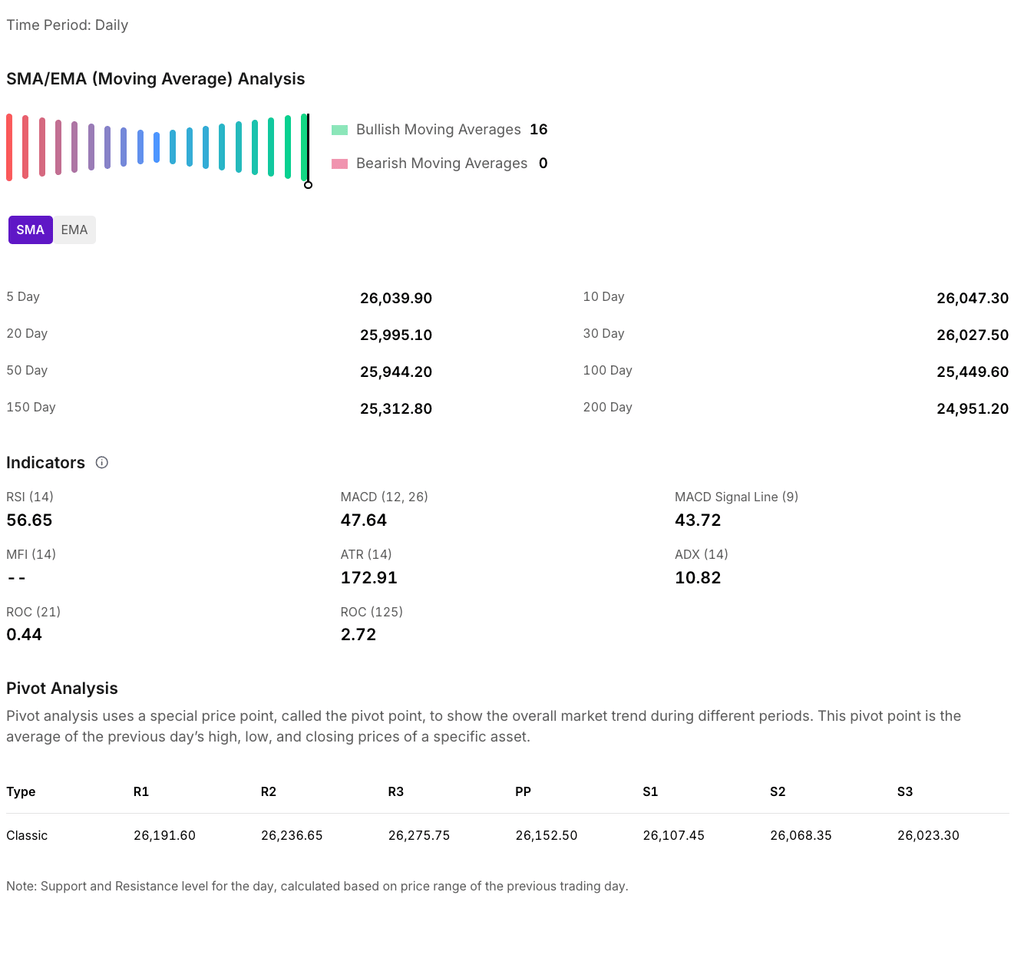

Nifty 50 ended the week making a new all time high by gaining 0.71% (+186 points) at 26,328.55.

- Immediate Resistance: 26,250 – 26,380

- Immediate Support: 25,700 – 25,80

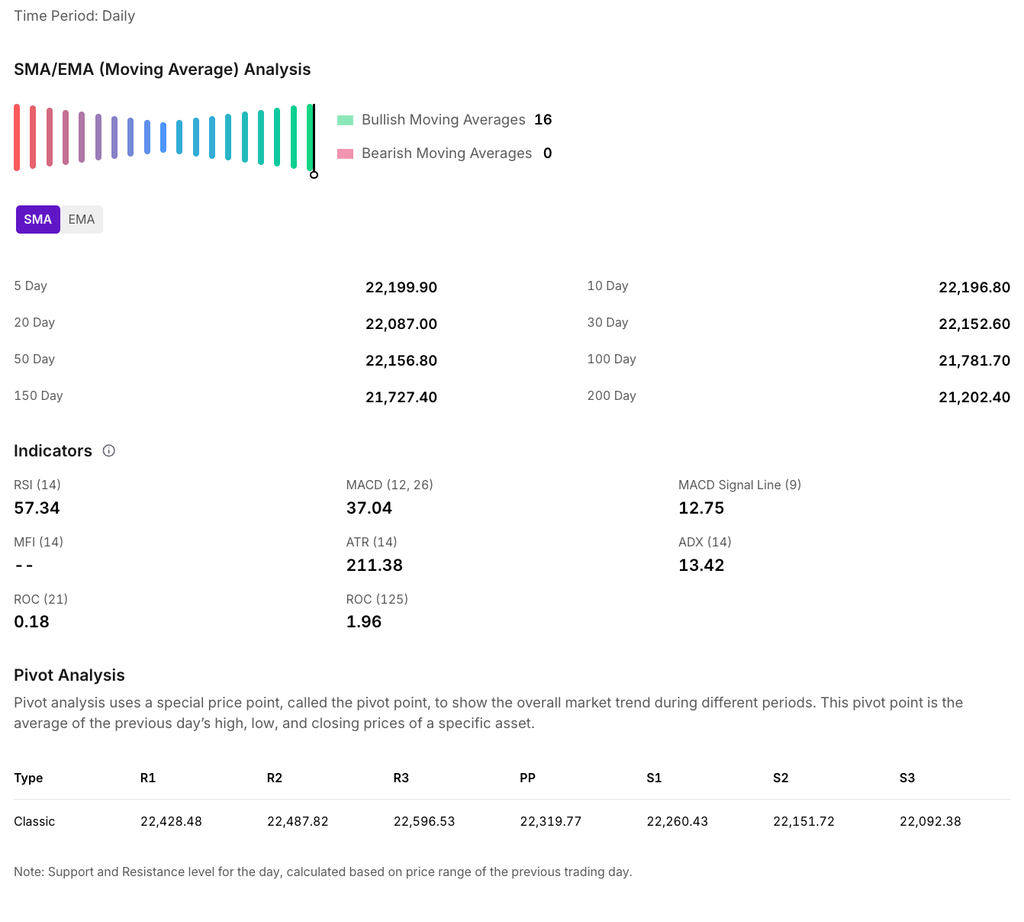

The Nifty Midcap 150 index closed at 22,579.05 marking a gain of 331 points from the previous week’s close. For the upcoming sessions:

- Immediate Resistance: 22,450 – 22,650

- Significant Support: 21,840 – 22,000

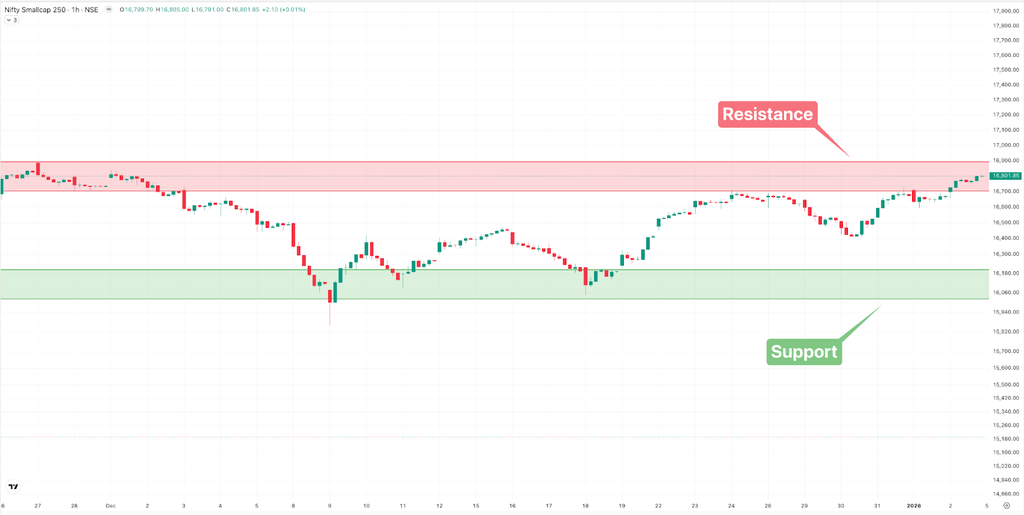

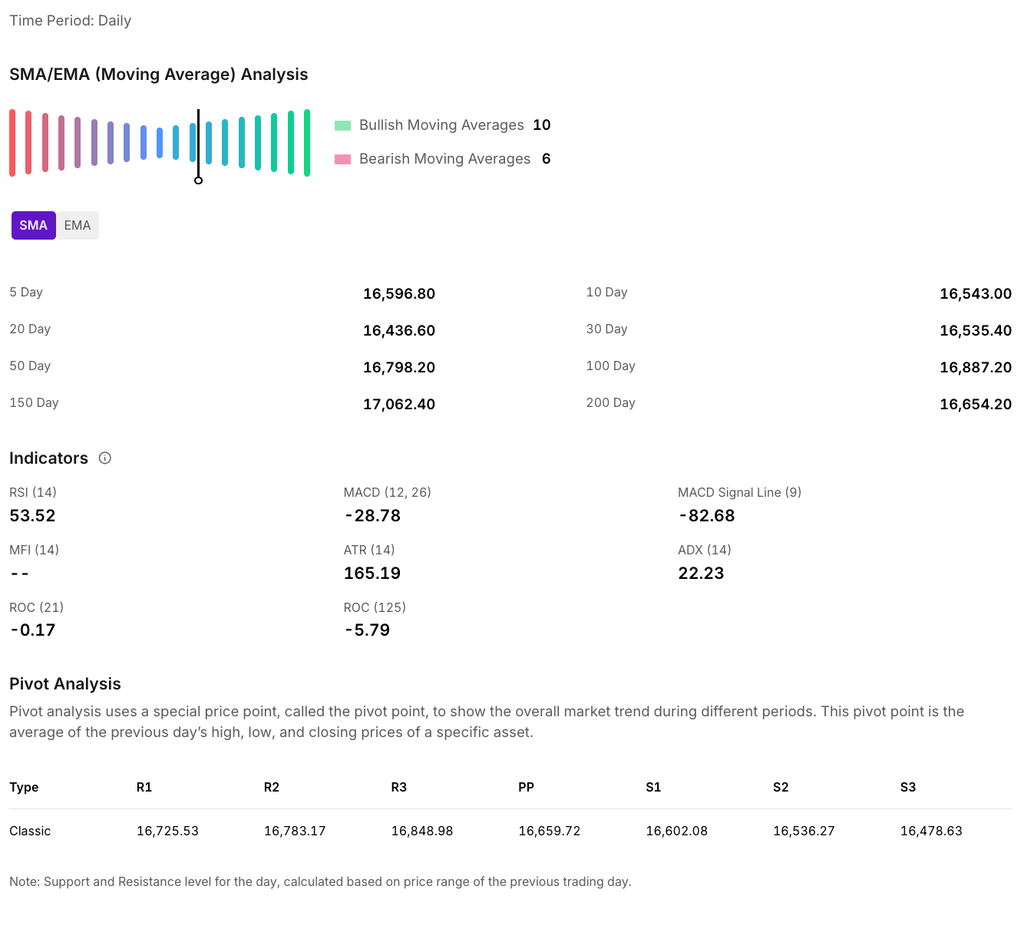

The Nifty Smallcap 250 gained about 0.91% this week, ending at 16,795.75 on Friday.

For the upcoming sessions:

- Key Resistance Level: 16,700 – 16,900

- Key Support Level: 16,000 – 16,200

This Week’s Spotlight Story

A deep dive into the headline that defined market conversations.

India’s IPO Market Shows Resilience with ₹1.78 Lakh Crore Raised in 2025

India’s IPO market remained vibrant in 2025, raising ₹1.78 lakh crore through 220 public issues, according to the National Stock Exchange (NSE) annual highlights.

While the total number of issues dipped from 268 in 2024 due to fewer SME offerings, mainboard IPOs surged to 103 from 90 the previous year, signaling a sustained appetite for larger listings. These mainboard issues mobilized ₹1.72 lakh crore, an 8% increase year-on-year, with Tata Capital Limited leading as the largest IPO at ₹15,512 crore.

Conversely, the SME segment saw activity moderate, raising ₹5,784 crore across 117 issues, down from 178 in 2024. Despite this mixed trend, the overall market displayed robust health, with equity fundraising totaling ₹4.19 lakh crore and debt issuances climbing 13% to ₹15.11 lakh crore.

That’s a wrap for this week.

As the markets pause to catch their breath, we’ll be back next week with sharper insights and stories to help you invest intelligently.