Share Market Weekly

- Share.Market

- 4 min read

- 12 Dec 2025

Highlights

Nifty 50 26,046.95 🔼 0.23%

| Monday | 🔻 0.86% |

| Tuesday | 🔻 0.47% |

| Wednesday | 🔻 0.32% |

| Thursday | 🔼 0.55% |

| Friday | 🔼 0.57% |

What moved the market?

Top Gainers & Top Losers

| Nifty Metal | 🔼 2.64% | Nifty Mediaa | 🔻 3.60% |

| Nifty Commodities | 🔼 1.39% | Nifty FMCG | 🔻 0.83% |

| Nifty IT | 🔼 1.19% | Nifty Healthcare Index | 🔻 0.50% |

Markets this week

| Nifty Midcap 150 | 22,152.10 (🔼 0.10%) |

| Nifty Smallcap 250 | 16,396.85 (🔻 1.36%) |

| India VIX | 10.11 (🔻 9.89%) |

Stocks in the Spotlight

Top Gainers

| Name of the company | Movement |

| Transformers & Rectifiers (India) Ltd. | 🔼 14.65% |

| Hindustan Zinc Ltd. | 🔼 13.06% |

| Vodafone Idea Ltd. | 🔼 8.99% |

| GE Vernova T&D India Ltd. | 🔼 8.76% |

| Home First Finance Company India Ltd. | 🔼 8.27% |

Top Losers

| Name of the company | Movement |

| Reliance Infrastructure Ltd. | 🔻21.89% |

| Kaynes Technology India Ltd. | 🔻16.39% |

| InterGlobe Aviation Ltd. | 🔻21.89% |

| Data Patterns (India) Ltd. | 🔻16.39% |

| Reliance Power Ltd. | 🔻16.39% |

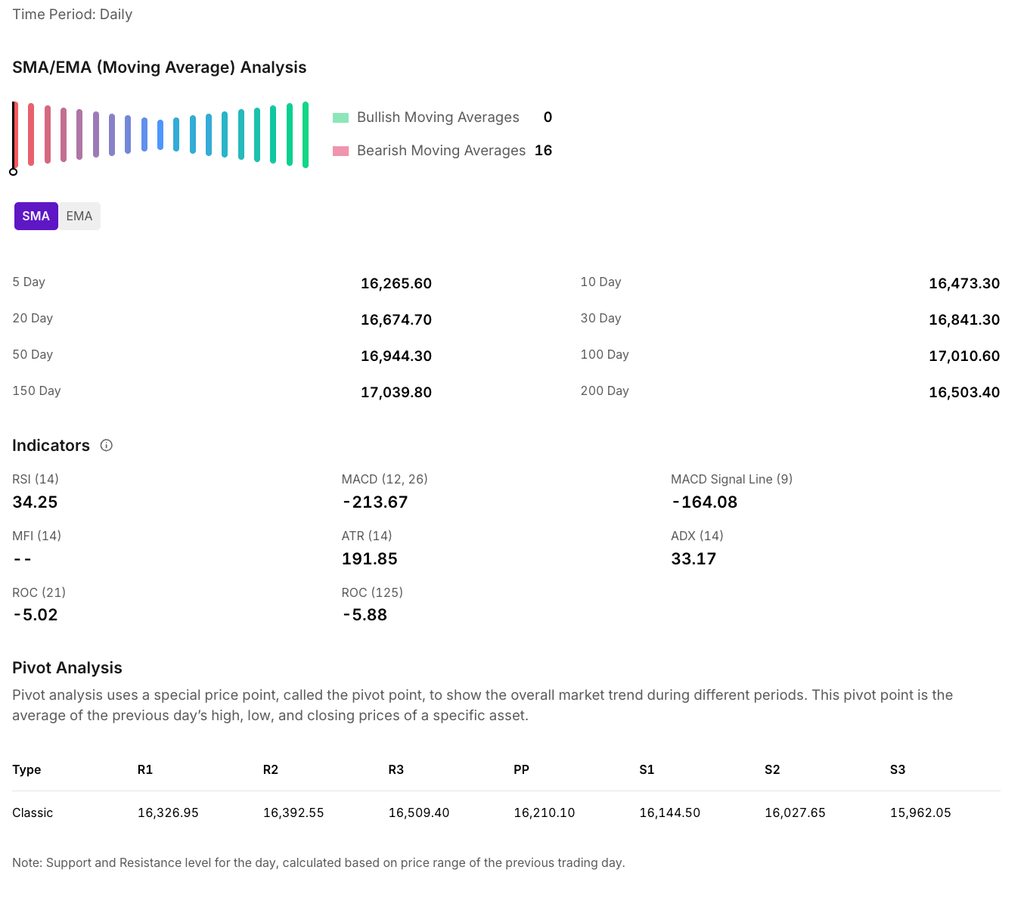

Technical Analysis

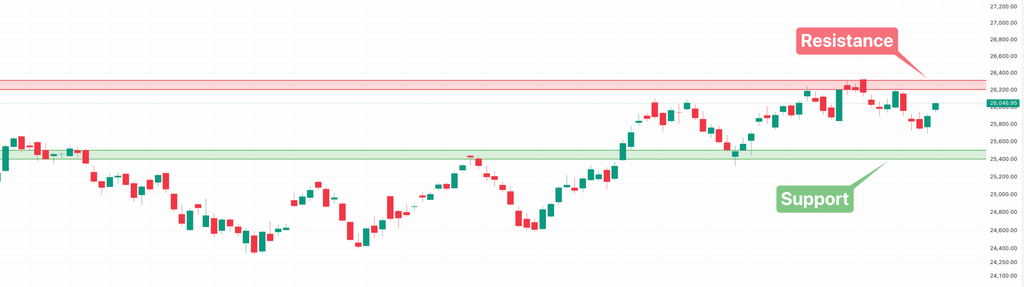

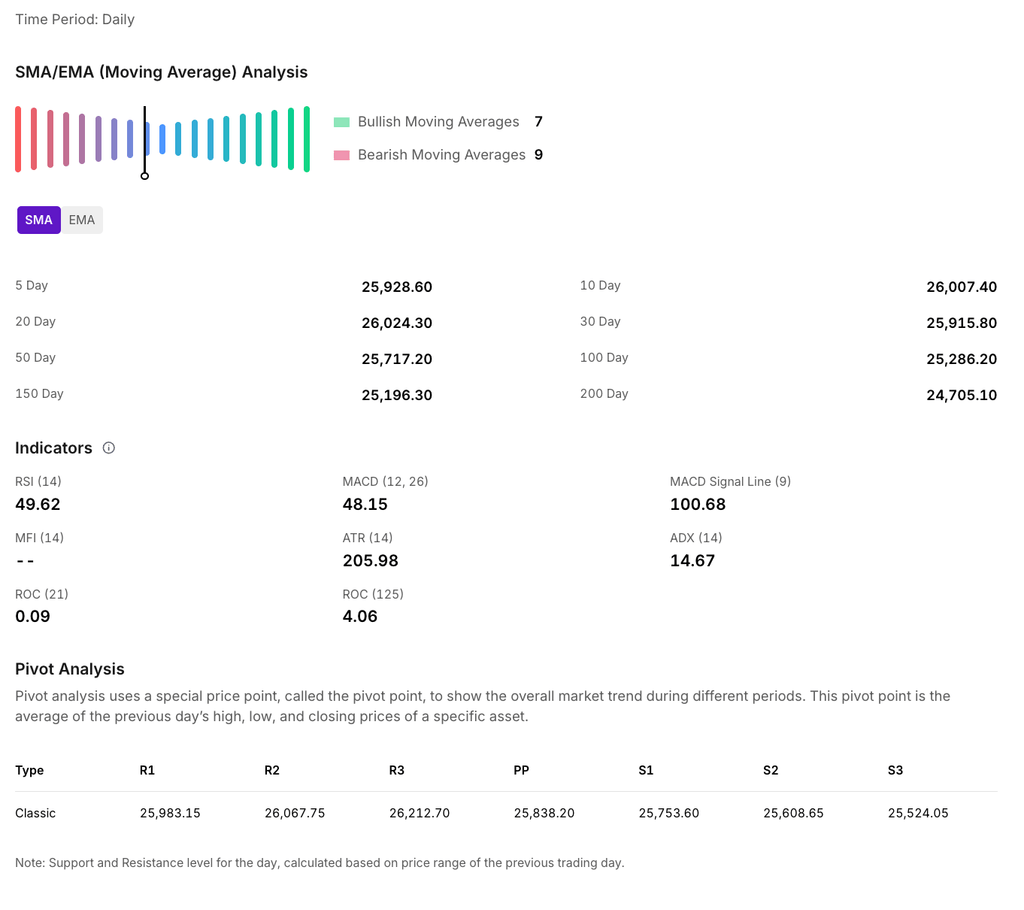

Nifty 50

The Nifty 50 concluded the week in positive, demonstrating notable resilience by a modest 0.23%. The index closed at 26,046.95, reflecting a marginal loss of just 18.85 points over the week.

For the upcoming sessions:

- Immediate Resistance: 26,200 – 26,300

- Immediate Support: 25,400 – 25,500

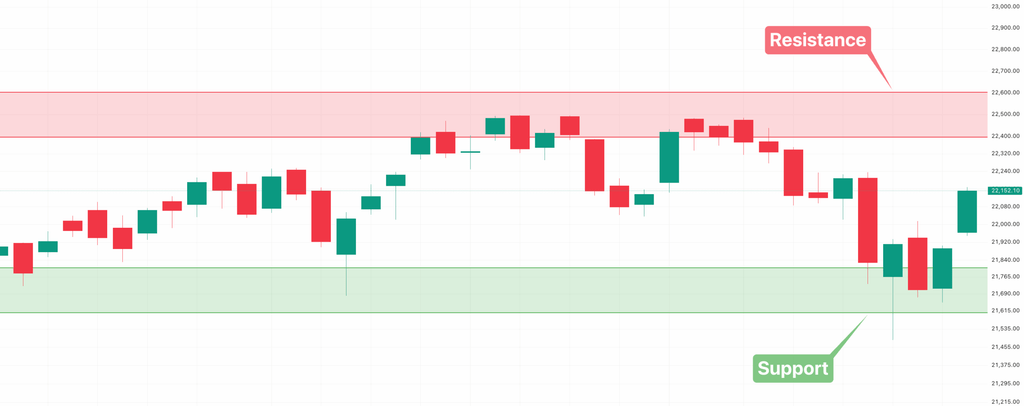

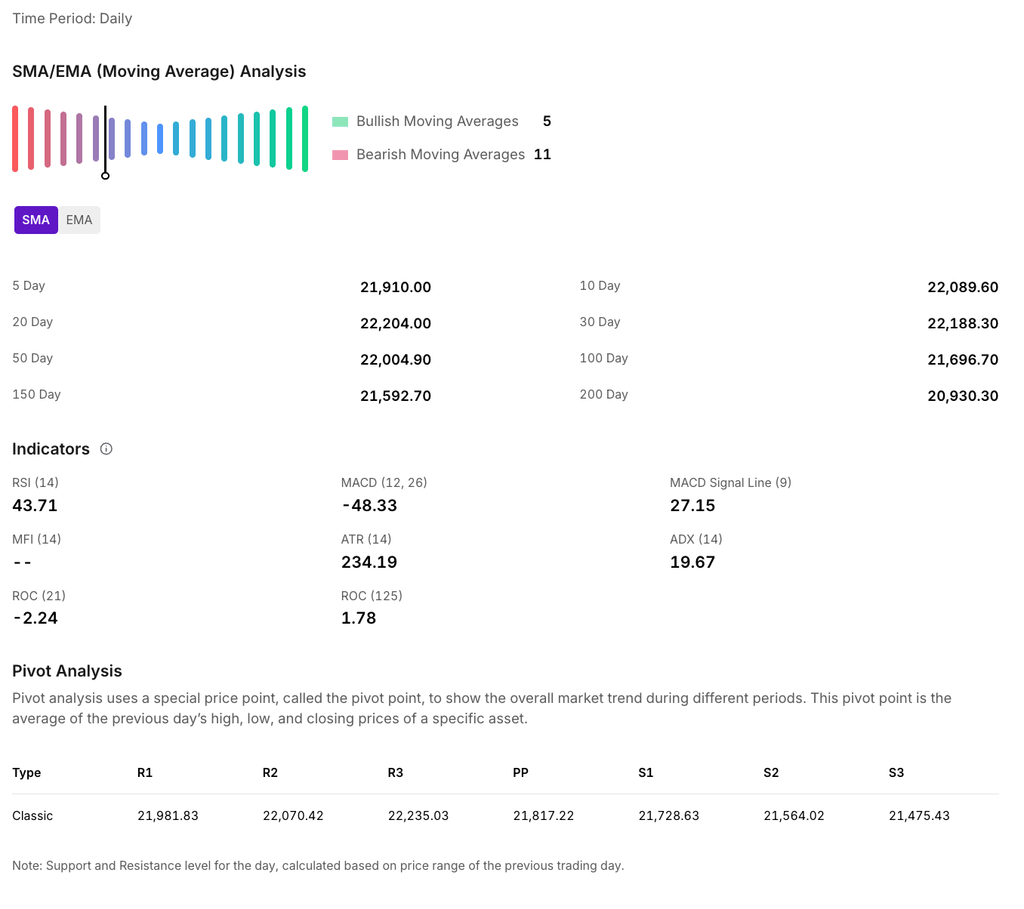

Nifty Midcap 150

The Nifty Midcap 150 index closed at 22,152.10, gaining roughly 22 points this week. For the upcoming sessions:

- Immediate Resistance: 22,400 – 22,600

- Significant Support: 21,600 – 21,800

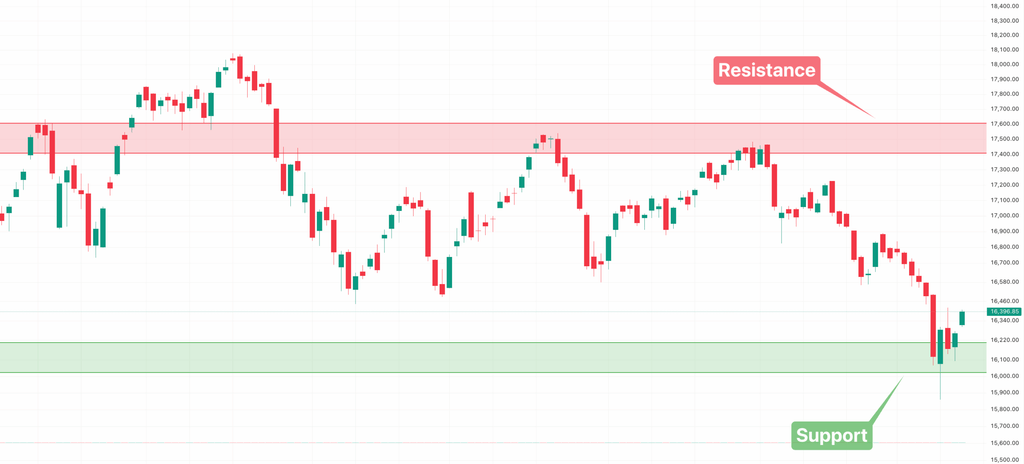

Nifty Smallcap 250

The Nifty Smallcap 250 fell about 3.66% this week, ending at 16,396.85 on Friday.

For the upcoming sessions:

- Key Resistance Level: 17,400 – 17,600

- Key Support Level: 16,000 – 16,200

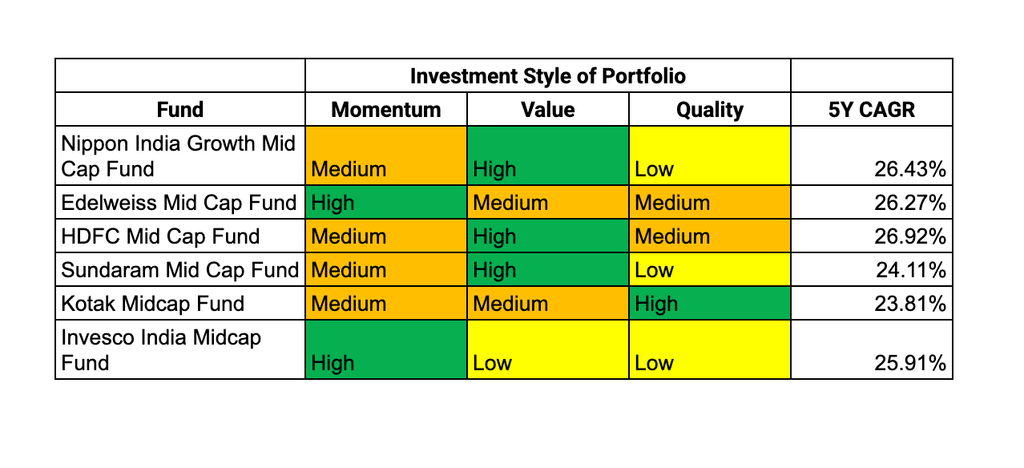

CRISP Insight: Most consistent Mid Cap Funds and their investment styles

portfolio factor scores, assessed relative to both category peers and the benchmark. Funds with risk categorized as too high as per

CRISP not considered. For detailed methodology, refer to this link.

This Week’s Spotlight Story

A deep dive into the headline that defined market conversations.

Rupee Hit Record Low Amid Foreign Outflows And Trade‑Deal Uncertainty

The rupee weakened to a new all‑time low around 90.4 per US dollar this week, dragged down by sustained foreign investor outflows from Indian equities and government bonds, and uncertainty around pending trade agreements. At the same time, bond yields climbed as traders demanded higher returns despite the RBI’s recent 25 bps rate cut and liquidity measures.

The rupee’s slide, came days after Governor Sanjay Malhotra described a “rare Goldilocks period” of strong growth and benign prices following the December Monetary Policy Committee meeting.

That’s a wrap for this week.

As the markets pause to catch their breath, we’ll be back next week with sharper insights and stories to help you invest intelligently.