Share Market Weekly

- Share.Market

- 5 min read

- 05 Dec 2025

Highlights

Nifty 50 26,186.45 🔻 0.07%

| Monday | 🔻 0.10% |

| Tuesday | 🔻 0.55% |

| Wednesday | 🔻 0.18% |

| Thursday | 🔼 0.18% |

| Friday | 🔼 0.59% |

What moved the market?

Top Gainers & Top Losers

| Nifty IT | 🔼 3.58% | Nifty Consumer Durables | 🔻 3.73% |

| Nifty Auto | 🔼 0.88% | Nifty Energy | 🔻 2.76% |

| Nifty Metal | 🔼 0.58% | Nifty Oil & Gas | 🔻 2.48% |

Markets this week

| Nifty Midcap 150 | 22,207.90 (🔻 0.94%) |

| Nifty Smallcap 250 | 16,494.90 (🔻 1.99%) |

| India VIX | 10.32 (🔻 13.78%) |

Stocks in the Spotlight

Top Gainers

| Name of the company | Movement | Factors | ||||

| Momentum | Value | Quality | Low Vol | Sentiment | ||

| Hindustan Copper Ltd. | 🔼 14.13% | 5/5 | 1/5 | 5/5 | 4/5 | N/A |

| Birlasoft Ltd. | 🔼 12.97% | 2/5 | 4/5 | 5/5 | 5/5 | 2/5 |

Top Losers

| Name of the company | Movement | Factors | ||||

| Momentum | Value | Quality | Low Vol | Sentiment | ||

| Kaynes Technology India Ltd. | 🔻21.89% | 4/5 | 1/5 | 4/5 | 3/5 | 3/5 |

| Transformers & Rectifiers (India) Ltd. | 🔻16.39% | 1/5 | 4/5 | 5/5 | 2/5 | N/A |

Technical Analysis

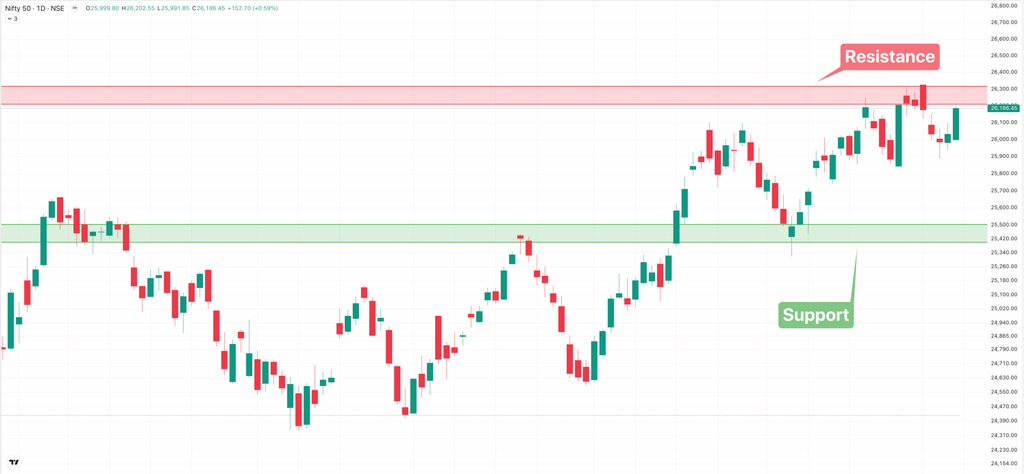

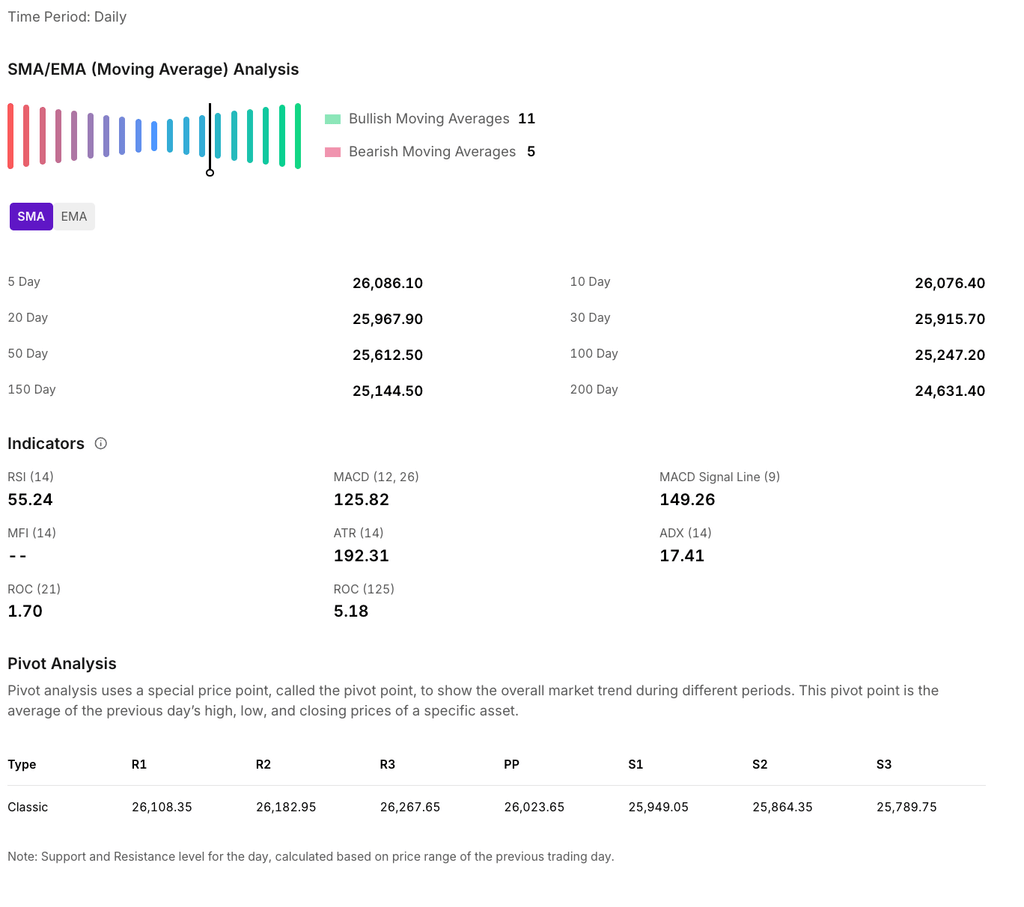

The Nifty 50 concluded the week in negative territory, demonstrating notable resilience by shedding a modest 0.07%. The index closed at 26,186.45, reflecting a marginal loss of just 18.85 points over the week.

For the upcoming sessions:

- Immediate Resistance: 26,200 – 26,300

- Immediate Support: 25,400 – 25,500

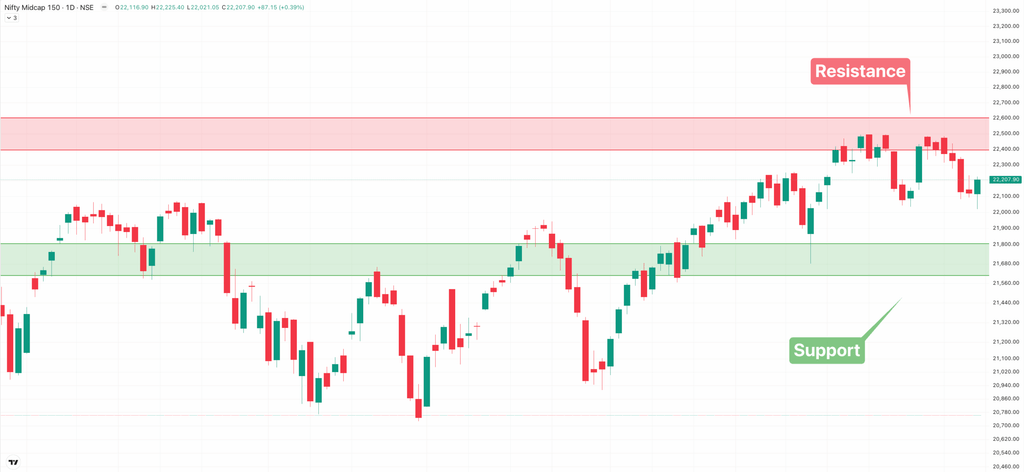

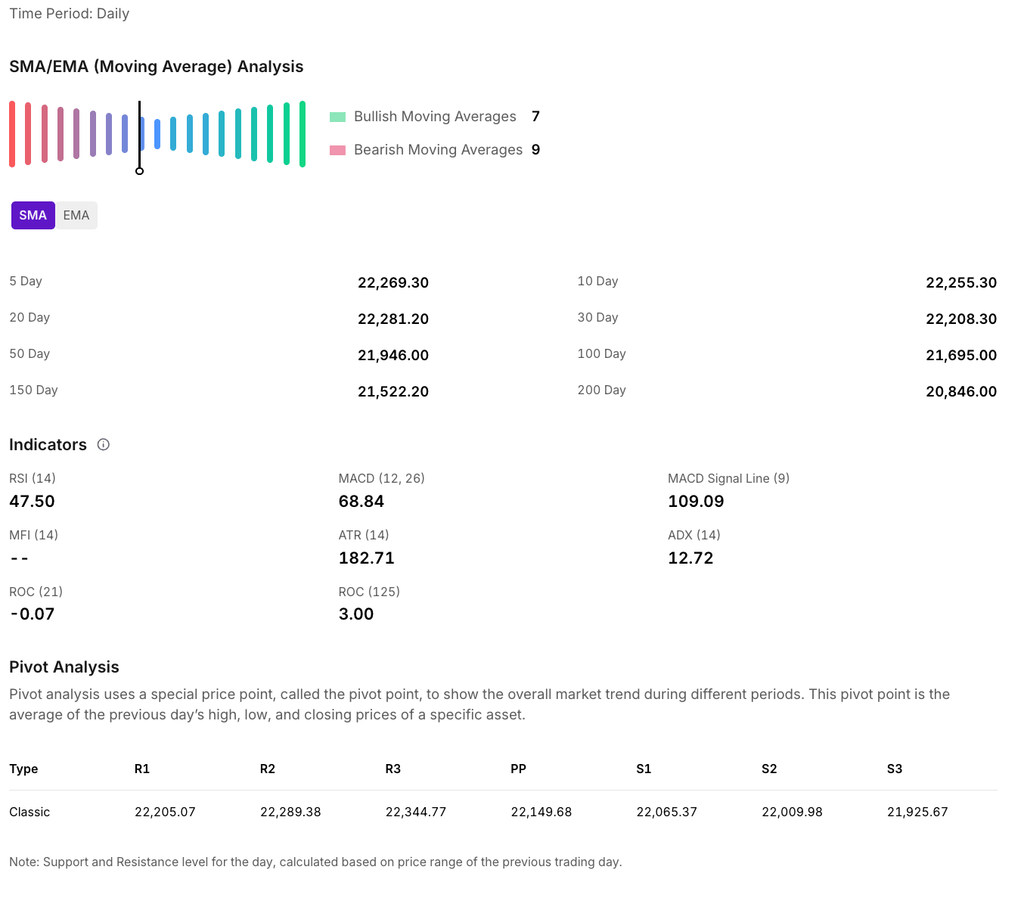

The Nifty Midcap 150 index closed at 22,207.90, losing approximately 211 points this week. For the upcoming sessions:

- Immediate Resistance: 22,400 – 22,600

- Significant Support: 21,600 – 21,800

The Nifty Smallcap 250 fell about 1.99% this week, ending at 16,494.90 on Friday.

For the upcoming sessions:

- Key Resistance Level: 17,400 – 17,600

- Key Support Level: 16,000 – 16,200

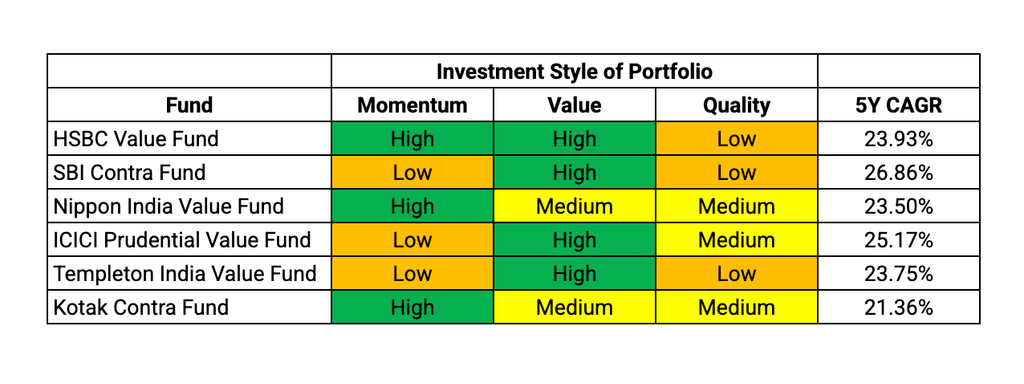

CRISP Insight: Most consistent Contra/Value Funds and their investment styles

This Week’s Spotlight Story

A deep dive into the headline that defined market conversations.

RBI Announced Repo Rate Cut, Signalled ‘Goldilocks’ Moment For India

The Reserve Bank of India’s Monetary Policy Committee (MPC) reduced the repo rate by 25 bps to 5.25% in a unanimous vote, while retaining a neutral stance. This is the fourth cut in 2025, leading to a 125 basis points rate cut this year. Governor Sanjay Malhotra also unveiled a liquidity package: ₹1 lakh crore of government bond purchases via Open Market Operations (OMOs) and a 3‑year USD/INR swap of $5 billion to inject durable liquidity and anchor market rates.

RBI raised its FY26 real GDP growth forecast to 7.3% and slashed its inflation outlook to 2%, with Malhotra calling the mix of high growth and ultra‑low inflation a “rare Goldilocks period” for India. A “Goldilocks period” describes an ideal economic scenario that is “just right,” where the economy is strong enough to generate robust growth but steady enough to prevent high inflation, avoiding both recession and overheating. Despite the domestic optimism, the rupee briefly breached the 90-mark against the dollar, prompting the Governor to clarify that the new forex swap is strictly for liquidity management rather than targeting a specific exchange rate. Meanwhile, the cumulative 1.25% rate reduction in 2025 is expected to act as a massive stimulus for the housing sector, significantly lowering EMI burdens and extending the real estate upcycle through the next fiscal year.

That’s a wrap for this week.

As the markets pause to catch their breath, we’ll be back next week with sharper insights and stories to help you invest intelligently.