Share Market Weekly

- Share.Market

- 4 min read

- 28 Nov 2025

Highlights

Nifty 50 26,202.95 🔻0.05%

| Monday | 🔻 0.42% |

| Tuesday | 🔻 0.29% |

| Wednesday | 🔼 1.24% |

| Thursday | 🔼 0.04% |

| Friday | 🔻0.05% |

What moved the market?

Top Gainers & Top Losers

| Nifty Auto | 🔼 1.24% | Nifty Realty | 🔻 2.26% |

| Nifty Pharma | 🔼 1.19% | Nifty Consumer Durables | 🔻 1.83% |

| Nifty Private Bank | 🔼 1.03% | Nifty Energy | 🔻 1.62% |

Markets this week

| Nifty Midcap 150 | 22,395.40 (🔻 0.09%) |

| Nifty Smallcap 250 | 16,732.60 (🔻 1.29%) |

| India VIX | 11.62 (🔻3.01 %) |

Stocks in the Spotlight

Top Gainers

| Name of the company | Movement | Factors | ||||

| Momentum | Value | Quality | Low Vol | Sentiment | ||

| Aditya Birla Capital Ltd. | 🔼 9.21% | 5/5 | 4/5 | 1/5 | 5/5 | 5/5 |

| Ashok Leyland Ltd | 🔼 8.12% | 5/5 | 3/5 | 2/5 | 5/5 | 5/5 |

Top Losers

| Name of the company | Movement | Factors | ||||

| Momentum | Value | Quality | Low Vol | Sentiment | ||

| Chennai Petroleum Corporation | 🔻14.88% | 5/5 | 5/5 | 4/5 | 3/5 | N/A |

| Transformers & Rectifiers (India) Ltd. | 🔻13.44% | 2/5 | 3/5 | 5/5 | 2/5 | N/A |

Technical Analysis

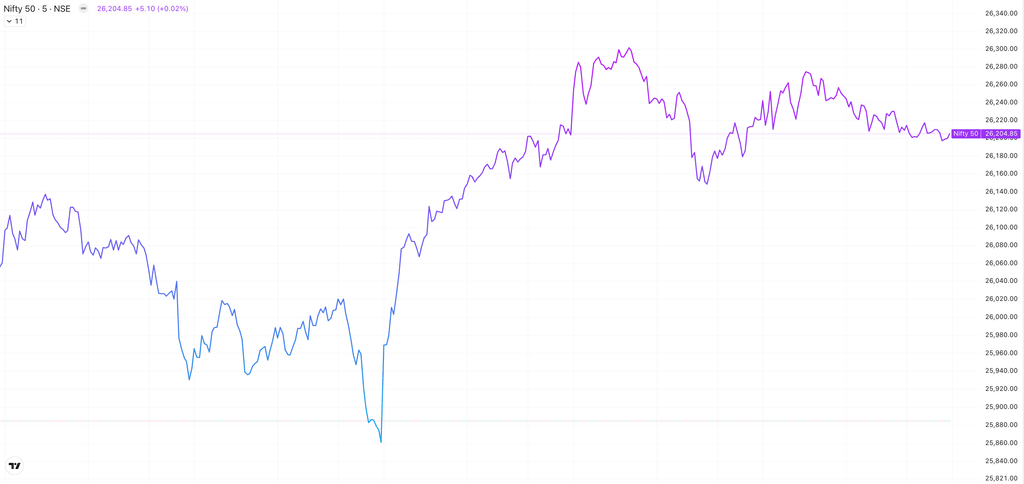

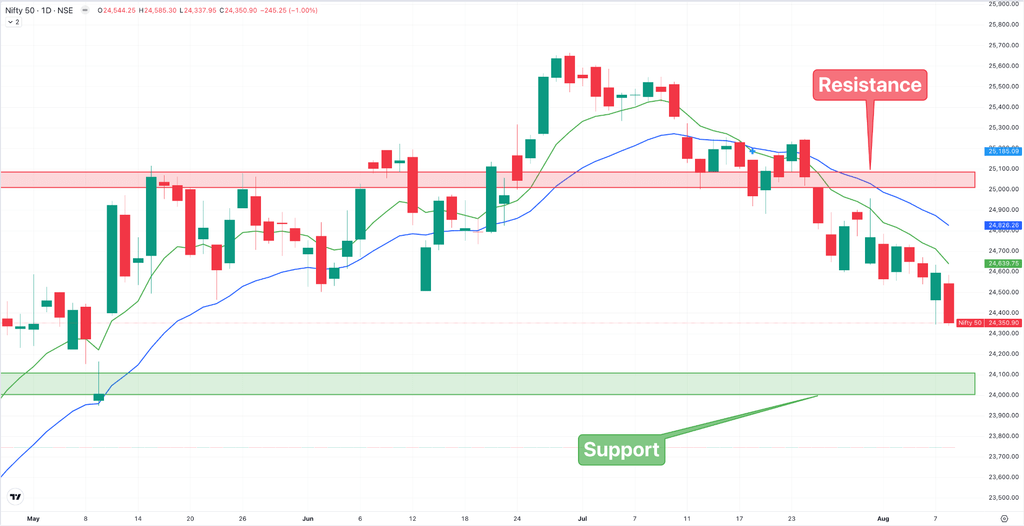

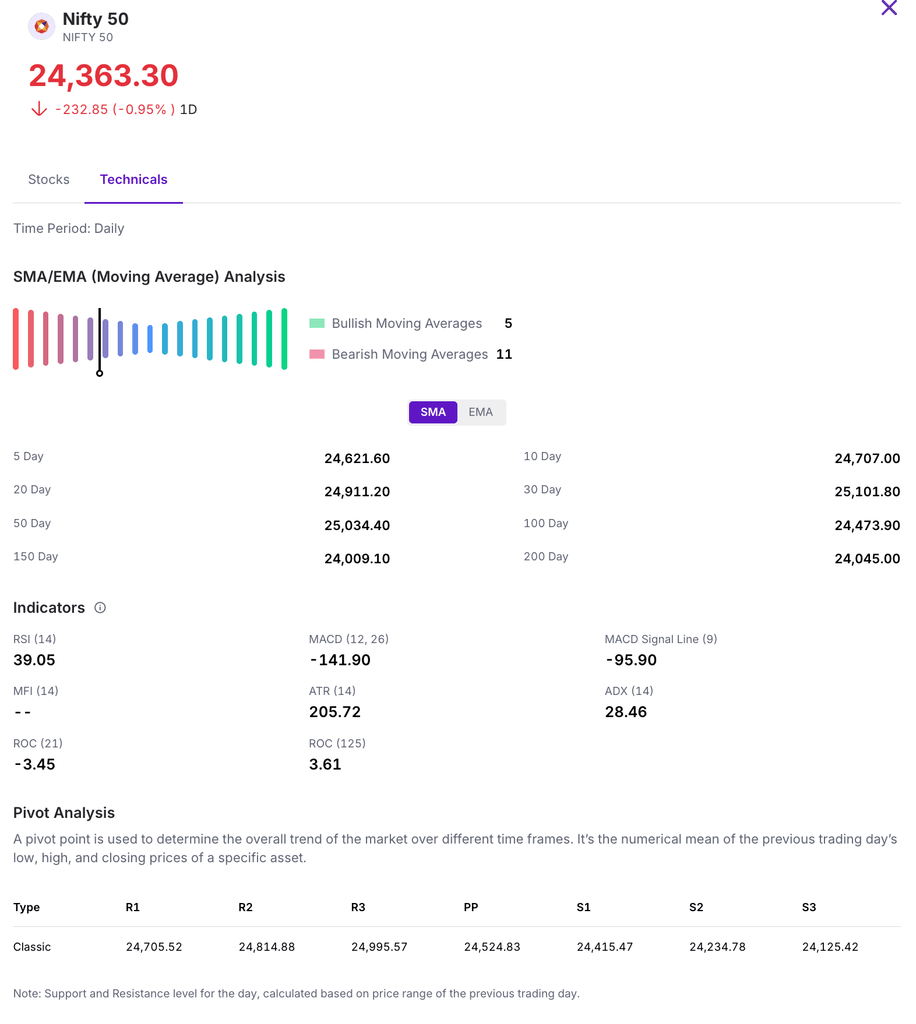

The Nifty 50 was week this week, gaining 0.58% to close at 26,202. The index gained 150 this week.

For the upcoming sessions:

- Immediate Resistance: 26,200 – 26,300

- Immediate Support: 25,700 – 25,800

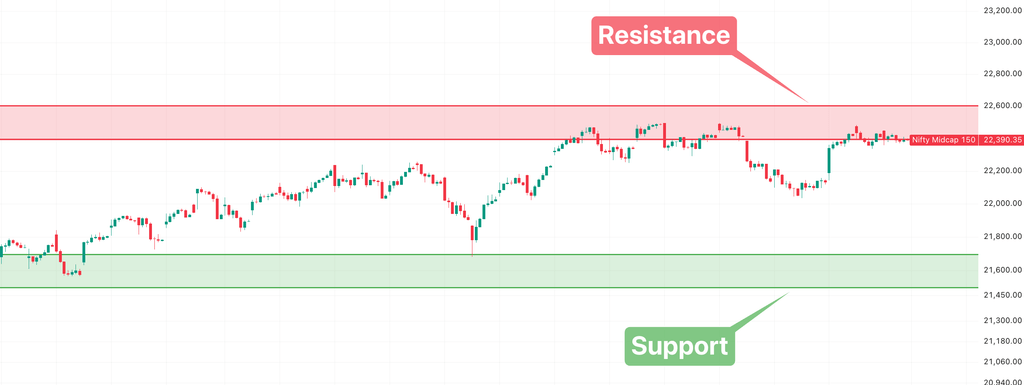

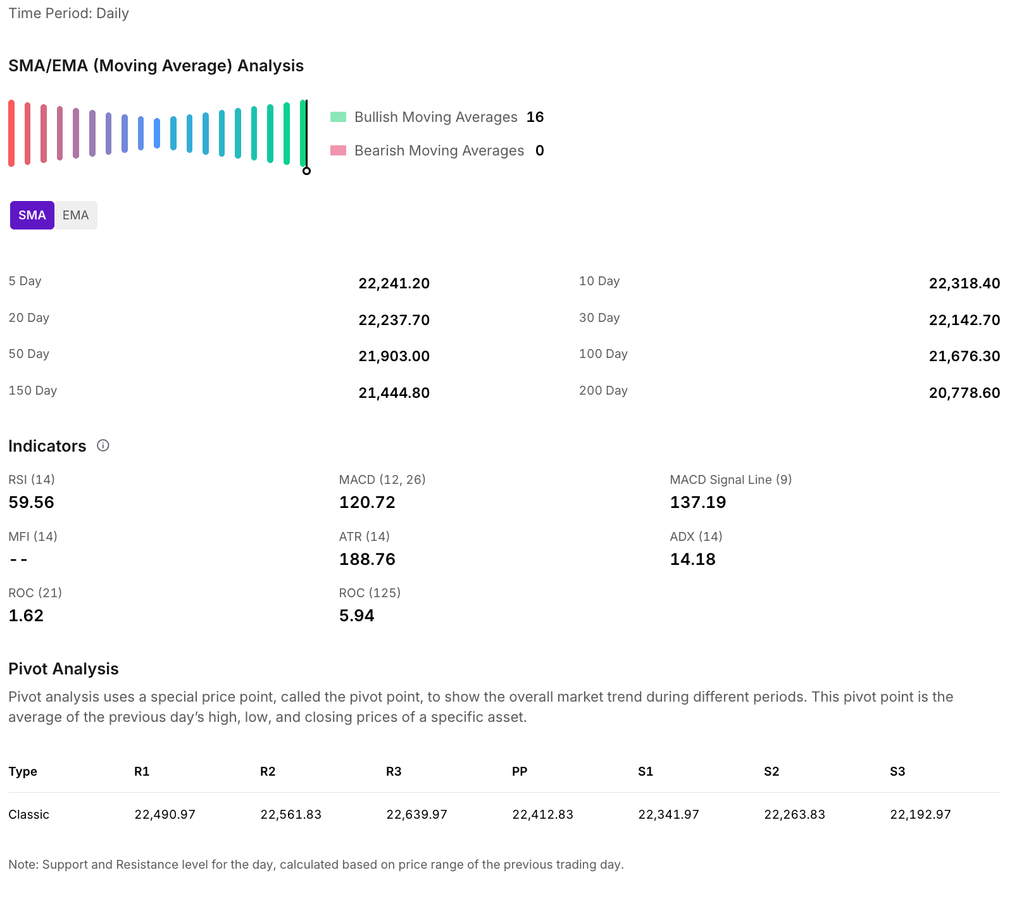

The Nifty Midcap 150 index demonstrated resilience this week, closing with a loss of approximately 0.09% to finish at 22,395.40.

For the upcoming sessions:

- Immediate Resistance: 22,000 – 22,200

- Significant Support: 20,800 – 21,000

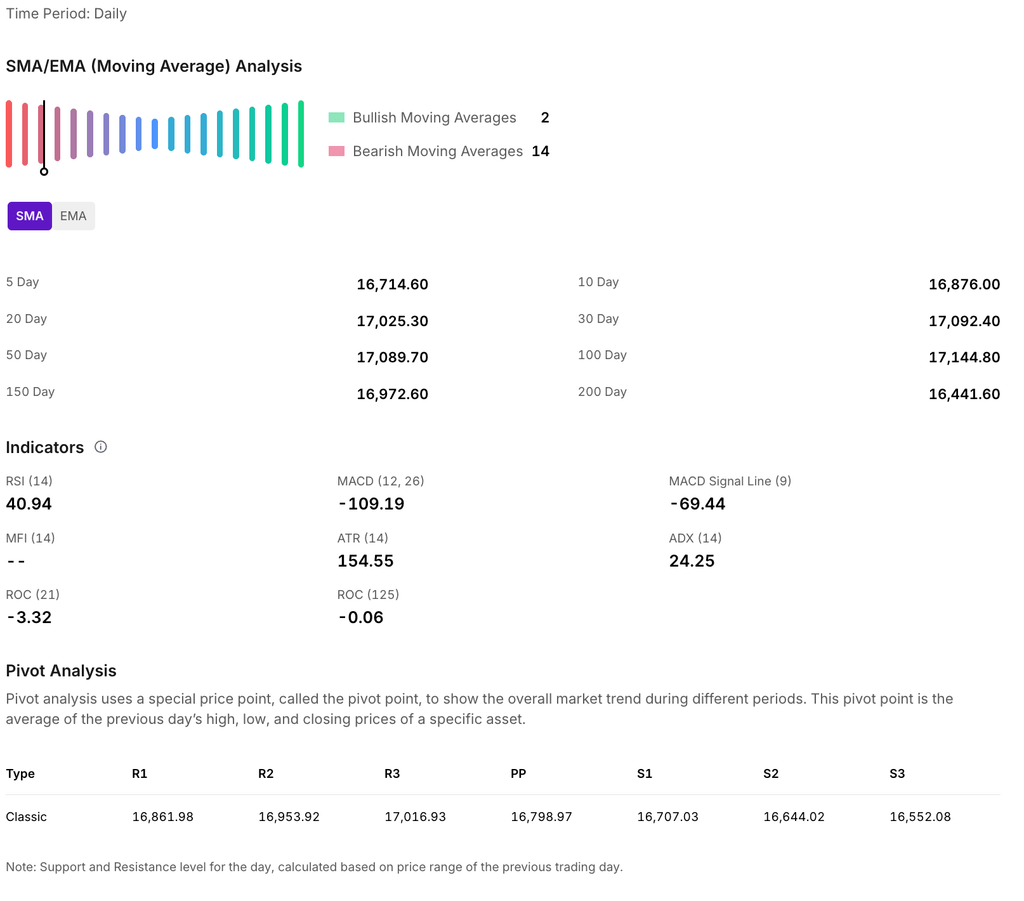

The Nifty Smallcap 250 fell about 1.29% this week, ending at 16,732 on Friday.

For the upcoming sessions:

- Key Breakout Level: 17,400

- Key Breakdown Level: 16,500

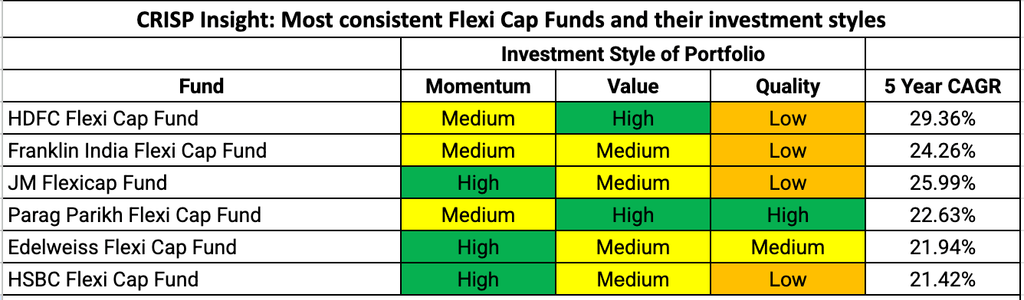

CRISP Insight: Most Consistent Large & Mid Cap Funds And Their Investment Styles

This Week’s Spotlight Story

A deep dive into the headline that defined market conversations.

India Eyes Global Leadership with $100 Billion EFTA Investment & Trade Expansion

Union Minister Piyush Goyal, addressing the 98th FICCI AGM, highlighted a robust roadmap for India’s economic ascent, anchored by the recent conclusion of balanced trade agreements with key partners like Australia, the UAE, the UK, and the EFTA bloc. Central to this strategy is a landmark USD 100 billion investment commitment from the EFTA bloc, specifically aimed at catalyzing India’s precision manufacturing and innovation capabilities. Goyal emphasized that self-reliance remains at the core of India’s economic ethos, noting that the government is actively negotiating with 14 other groups representing nearly 50 nations, including the US and EU, to build resilient, transparent supply chains and trusted global partnerships.

Positioning India as a future leader in emerging technologies, the Minister pointed to the USD 12 billion Research, Development, and Innovation (RDI) fund and the ₹76,000 crore Semiconductor Mission as critical drivers for advancing deep-tech, AI, and robotics. Leveraging the PESTLE framework, he outlined strategic steps to reduce external dependence, including the historic Atomic Energy Bill 2025 and ongoing ease-of-business reforms like Jan Vishwas 3.0. Goyal urged the industry to shed legacy mindsets and leverage India’s cost-competitiveness and youthful STEM talent pool, asserting that these collective efforts are vital for India to emerge as a developed, self-reliant economic power by 2047.

That’s a wrap for this week.

As the markets pause to catch their breath, we’ll be back next week with sharper insights and stories to help you invest intelligently.