Share Market Weekly

- Share.Market

- 4 min read

- 21 Nov 2025

Highlights

Nifty 50 26,068.15 🔼 0.74%

| Monday | 🔼 0.40% |

| Tuesday | 🔻 0.40% |

| Wednesday | 🔼 0.55% |

| Thursday | 🔼 0.54% |

| Friday | 🔻 0.47% |

What moved the market?

Top Gainers & Top Losers

| Nifty Infra | 🔼 1.06% | Nifty Metal | 🔻 3.79% |

| Bank Nifty | 🔼 1.02% | Nifty Realty | 🔻 3.45% |

| Nifty Private Bank | 🔼 0.96% | Nifty Media | 🔻 2.91% |

Markets this week

| Nifty Midcap 150 | 22,151.15 (🔻 1.09%) |

| Nifty Smallcap 250 | 16,723.75 (🔻 2.32%) |

| India VIX | 13.63 (🔼 12.55%) |

Stocks in the Spotlight

Top Gainers

| Name of the company | Movement | Factors | ||||

| Momentum | Value | Quality | Low Vol | Sentiment | ||

| Narayana Hrudayalaya Ltd. | 🔼 14.97% | 3/5 | 2/5 | 5/5 | 5/5 | 4/5 |

| Jaiprakash Power Ventures Ltd. | 🔼 11.54% | 4/5 | N/A | 2/5 | 3/5 | N/A |

Top Losers

| Name of the company | Movement | Factors | ||||

| Momentum | Value | Quality | Low Vol | Sentiment | ||

| Gujarat Mineral Development Corporation Ltd. | 🔻16.98% | 5/5 | 4/5 | 4/5 | 3/5 | N/A |

| Valor Estate Ltd. | 🔻10.96% | 1/5 | N/A | 2/5 | 3/5 | N/A |

Technical Analysis

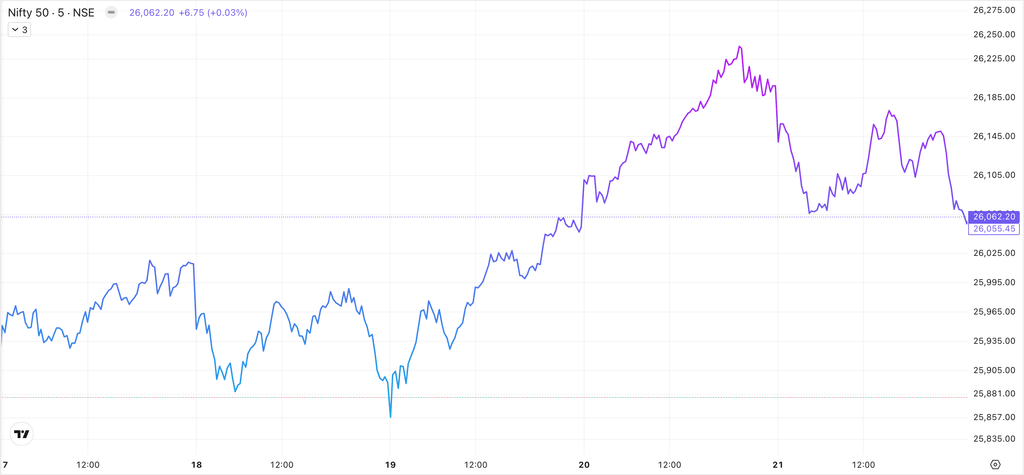

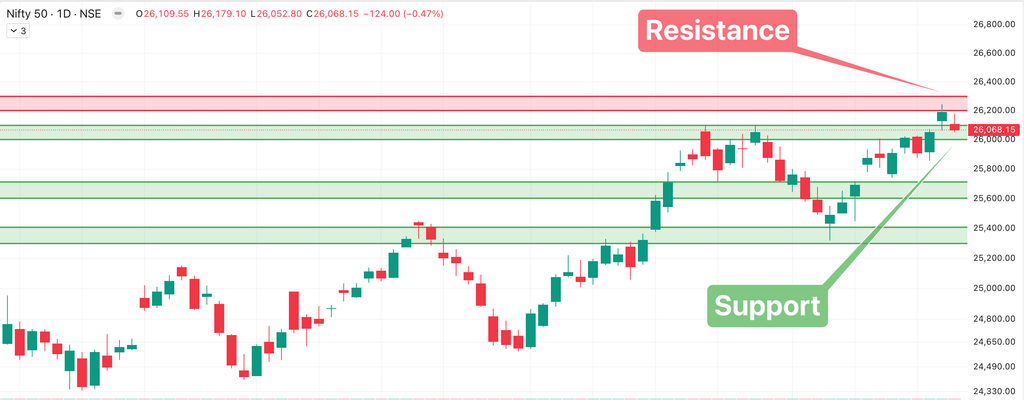

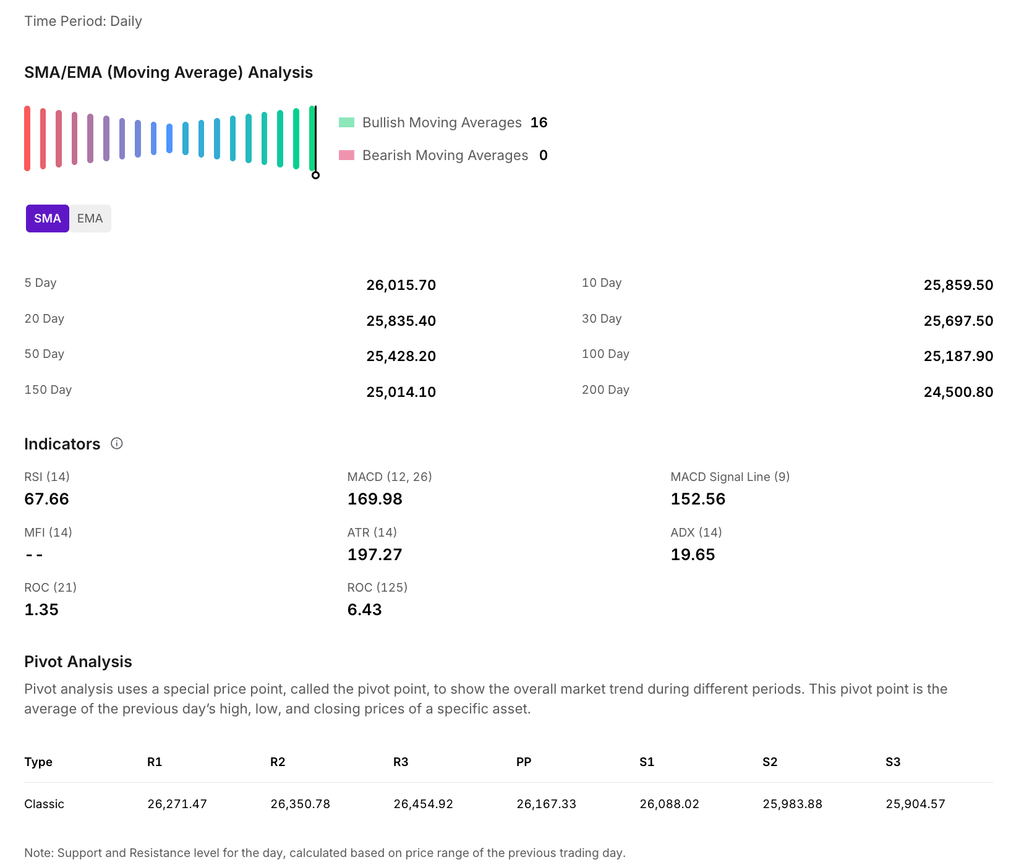

The Nifty 50 closed in green this week, gaining 0.74% to close at 26,068.15. The index gained 192.35 points this week.

For the upcoming sessions:

- Immediate Resistance: 26,200 – 26,300

- Immediate Support: 25,600 – 25,700

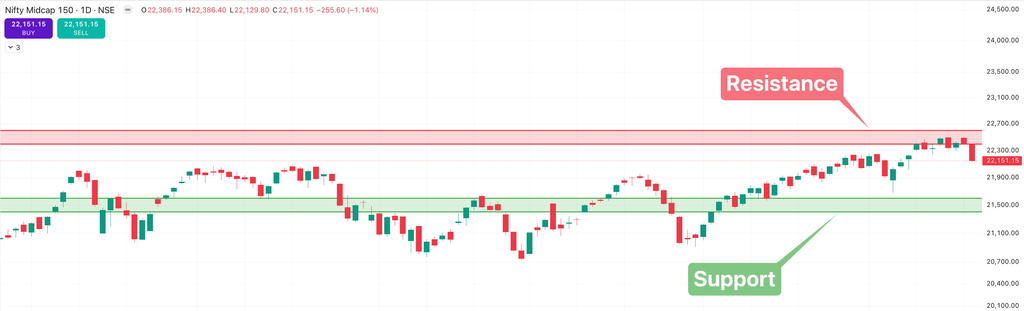

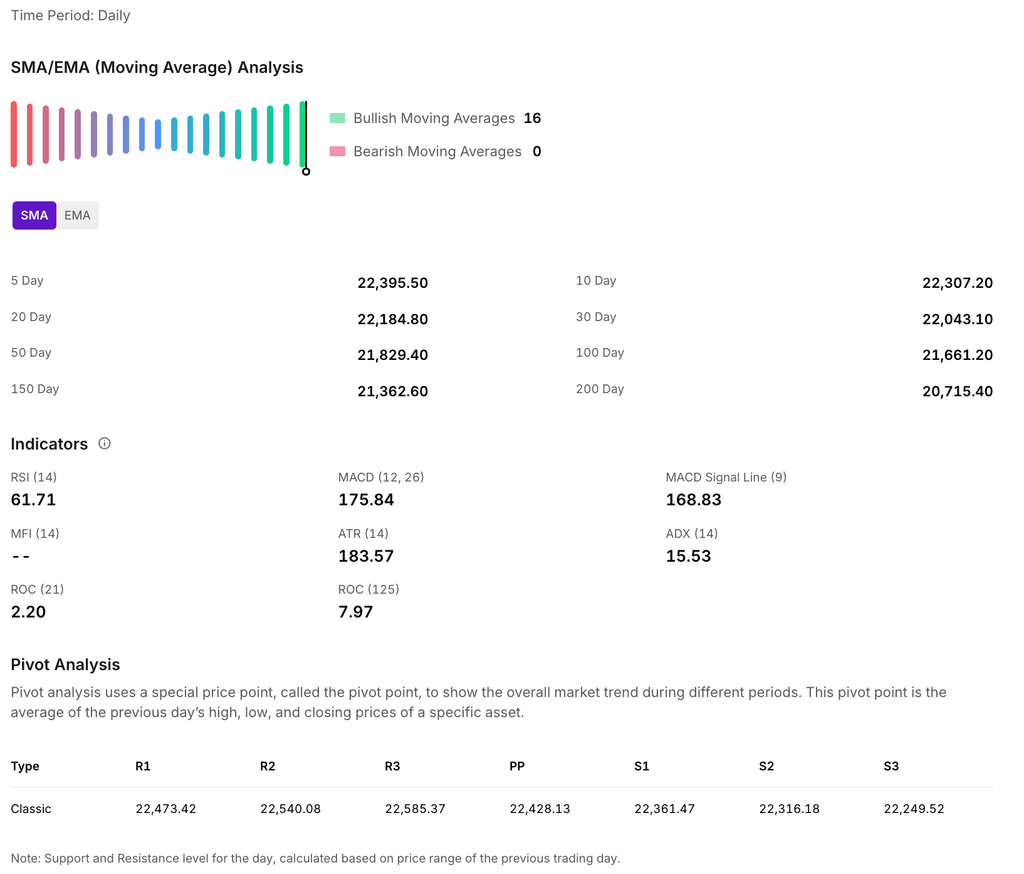

The Nifty Midcap 150 index closed at 22,151.15, losing approximately 243 points this week. For the upcoming sessions:

- Immediate Resistance: 22,400 – 22,600

- Significant Support: 21,400 – 21,600

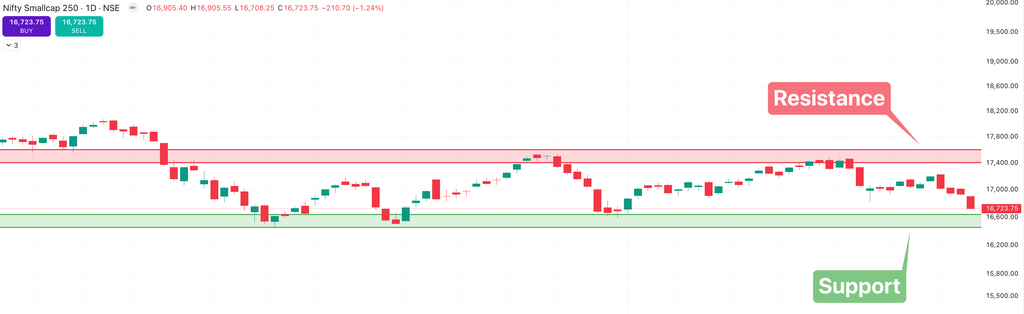

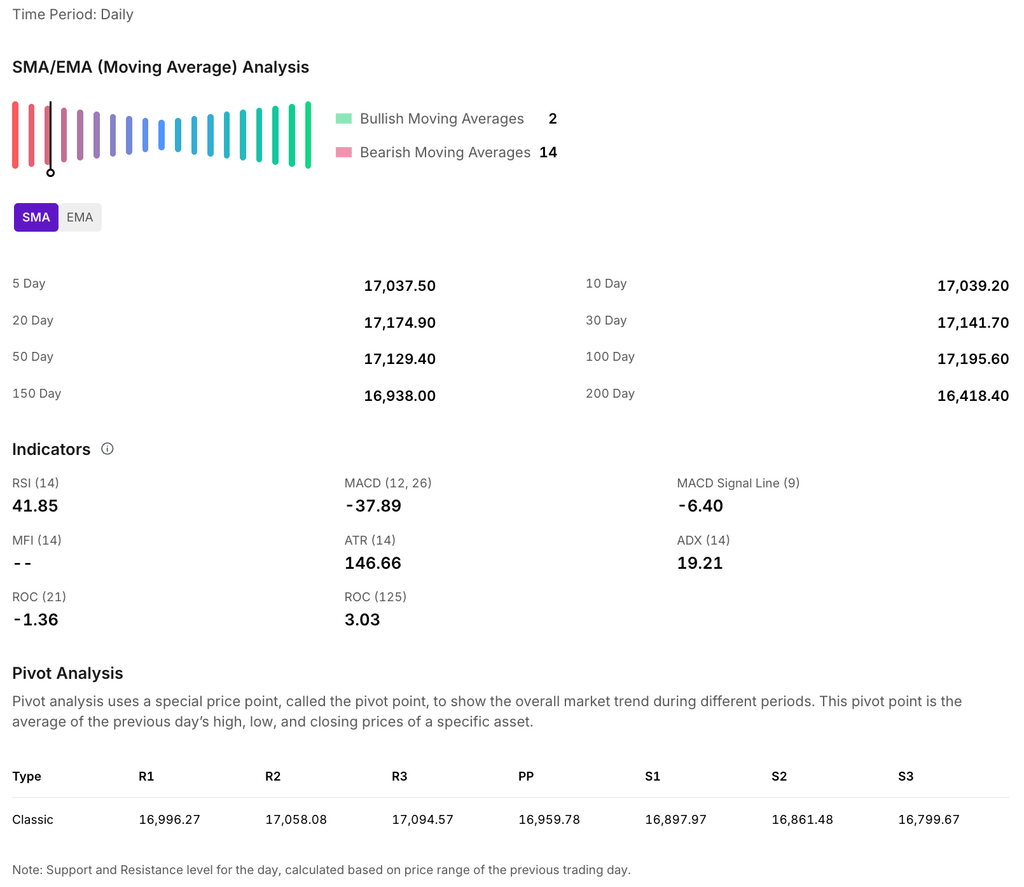

The Nifty Smallcap 250 fell about 2.32% this week, ending at 16,723.75 on Friday.

For the upcoming sessions:

- Key Breakout Level: 17,400

- Key Breakdown Level: 16,900

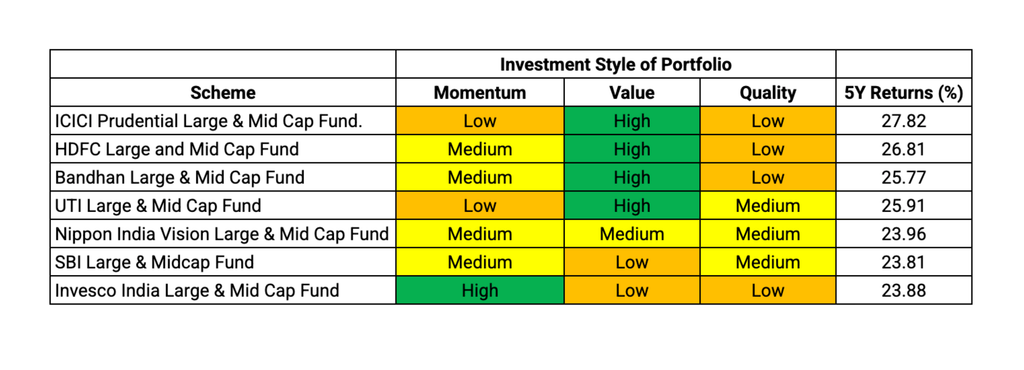

CRISP Insight: Most Consistent Large & Mid Cap Funds And Their Investment Styles

portfolio factor scores, assessed relative to both category peers and the benchmark. Funds with risk categorized as too high as per

CRISP not considered. For detailed methodology, refer to this link.

This Week’s Spotlight Story

A deep dive into the headline that defined market conversations.

India’s Trade Deficit Hit An All-Time High Of $41.68 Billion In October On Surging Gold Imports

India’s merchandise trade deficit soared to a record $41.68 billion in October 2025, the highest ever monthly gap, according to Commerce Ministry data. The spike was driven by a jump in gold imports to $14.72 billion amid festive-season demand, elevated global prices, and restocking by jewellers, even as merchandise exports slumped 11.8% year-on-year (YoY) to $34.38 billion. Total imports jumped to $76.06 billion, a 16.6% increase from last year, largely on account of precious metals and fertilizers, with gold and silver alone contributing a significant portion of the widening gap.

The steep rise in gold shipments was coupled with weak global demand for Indian goods due to higher US tariffs and overall slowdown in major markets, especially for key sectors like engineering, textiles, and chemicals. Exports to the US, India’s top trading partner, slipped further while global commodity trends and festival-related stockpiling exacerbated the situation. Non-oil and non-gem imports also continued to expand, pointing to robust domestic demand but adding to external imbalances.

That’s a wrap for this week.

As the markets pause to catch their breath, we’ll be back next week with sharper insights and stories to help you invest intelligently.