Share Market Weekly

- Share.Market

- 5 min read

- 14 Nov 2025

Highlights

Nifty 50 25,910.05 🔻 0.57%

| Monday | 🔼 0.32% |

| Tuesday | 🔼 0.47% |

| Wednesday | 🔼 0.70% |

| Thursday | 🔼 0.01% |

| Friday | 🔼 0.12% |

What moved the market?

Top Gainers & Top Losers

| Nifty IT | 🔼 2.91% | Nifty Media | 🔻 3.45% |

| Nifty Auto | 🔼 2.37% | Nifty Realty | 🔻 2.08% |

| Nifty Pharma | 🔼 2.18% | Nifty Consumer Durables | 🔻 1.34% |

Markets this week

| Nifty Midcap 150 | 22,331.25 (🔼 0.88%) |

| Nifty Smallcap 250 | 17,081.45 (🔻 1.38%) |

| India VIX | 11.94 (🔻 5.61%) |

Stocks in the Spotlight

Top Gainers

| Name of the company | Movement | Factors | ||||

| Momentum | Value | Quality | Low Vol | Sentiment | ||

| Data Patterns (India) Ltd. | 🔼 18.63% | 5/5 | 1/5 | 4/5 | 3/5 | 3/5 |

| Vodafone Idea Ltd. | 🔼 18.02% | 4/5 | 1/5 | N/A | 2/5 | 3/5 |

Top Losers

| Name of the company | Movement | Factors | ||||

| Momentum | Value | Quality | Low Vol | Sentiment | ||

| Transformers & Rectifiers (India) Ltd. | 🔻21.33% | 2/5 | 3/5 | 5/5 | 2/5 | N/A |

| Cohance Lifesciences Ltd. | 🔻14.97% | 1/5 | 2/5 | 5/5 | 5/5 | 1/5 |

Technical Analysis

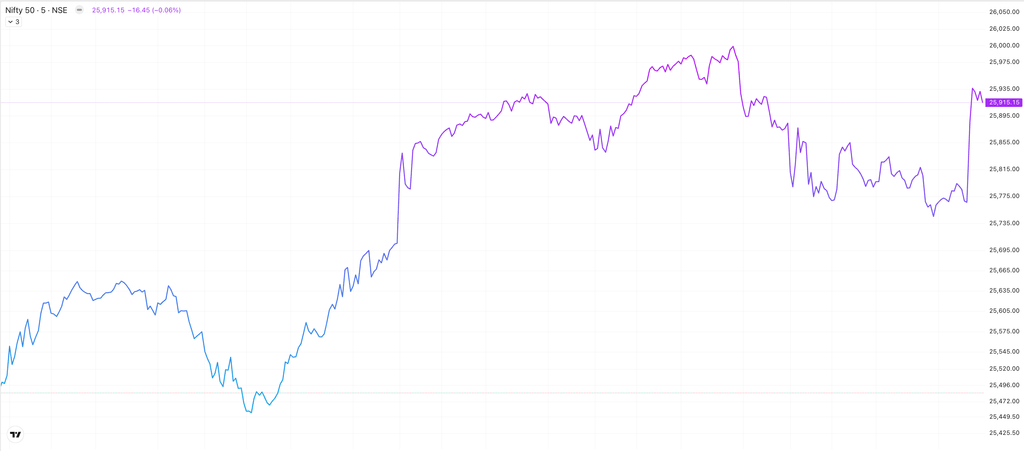

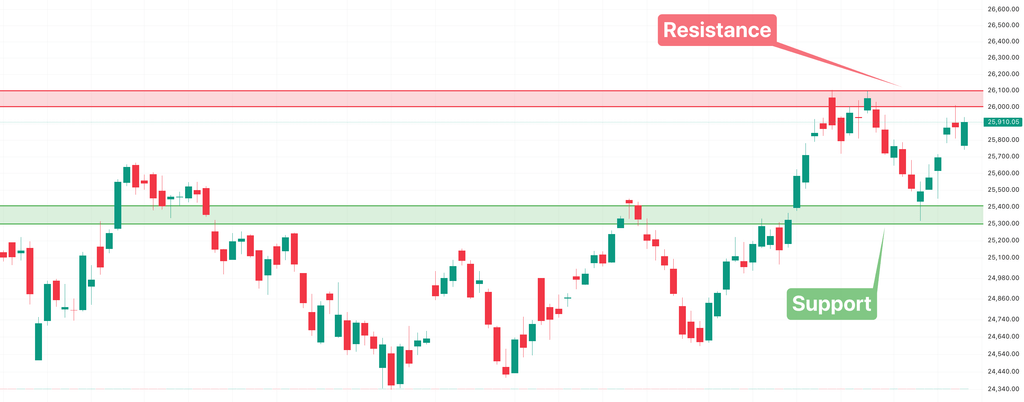

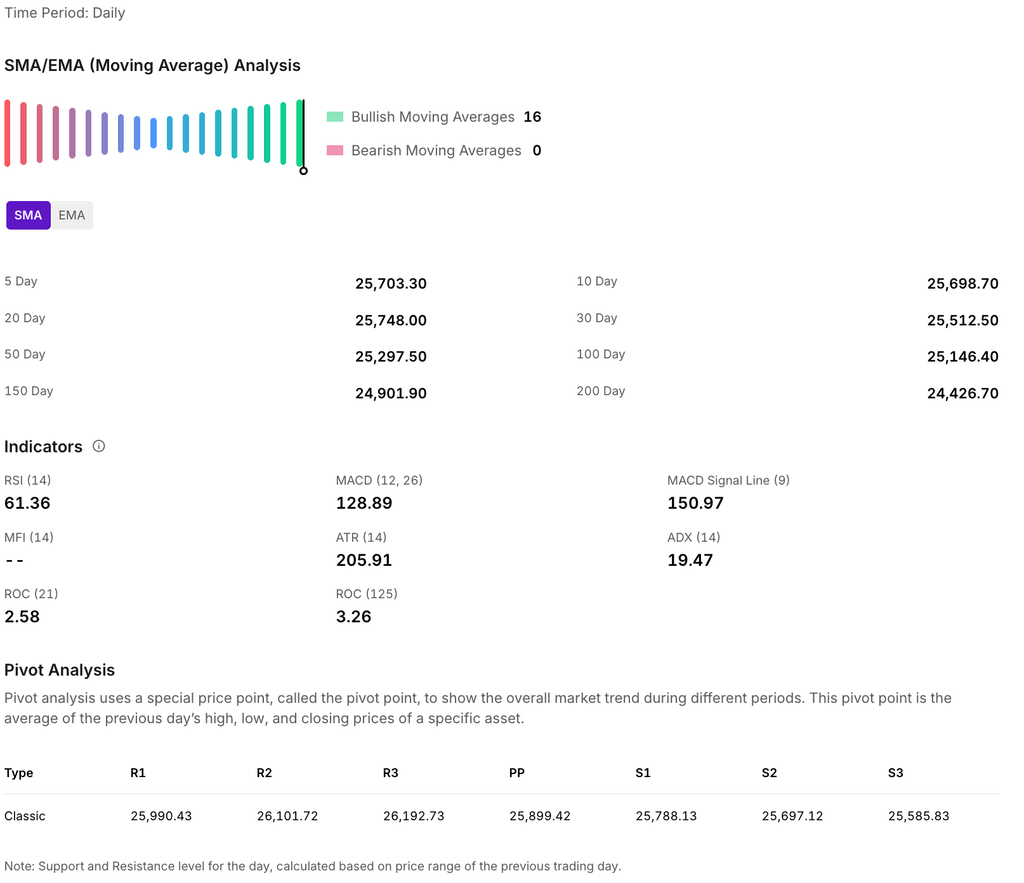

The Nifty 50 held strong this week, gaining 1.22% to close at 25,910.10. The index gained 312.6 points this week.

For the upcoming sessions:

- Immediate Resistance: 26,000 – 26,100

- Immediate Support: 25,300 – 25,400

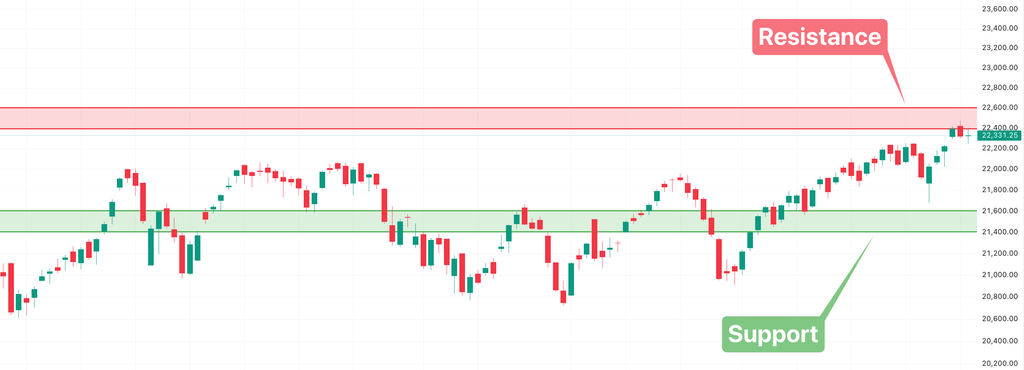

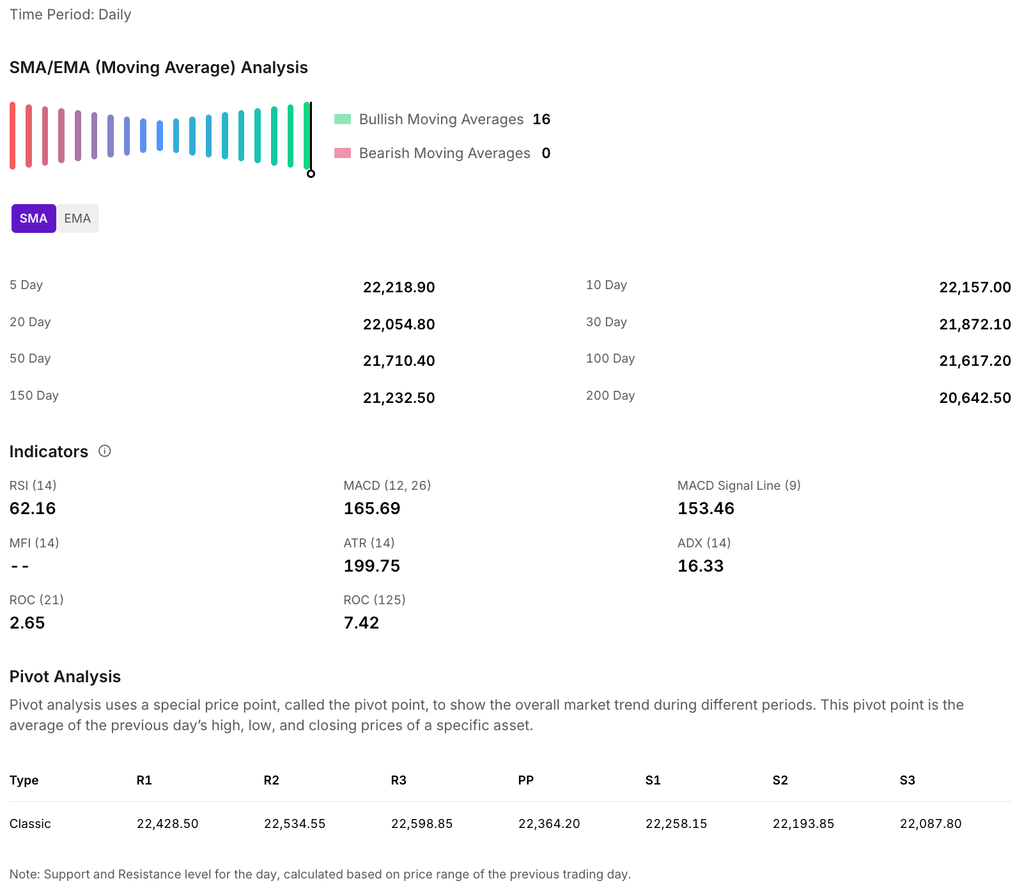

The Nifty Midcap 150 index demonstrated resilience this week, closing with a gain of approximately 0.88% to finish at 22,311.25. For the upcoming sessions:

- Immediate Resistance: 22,400 – 22,600

- Significant Support: 21,400 – 21,600

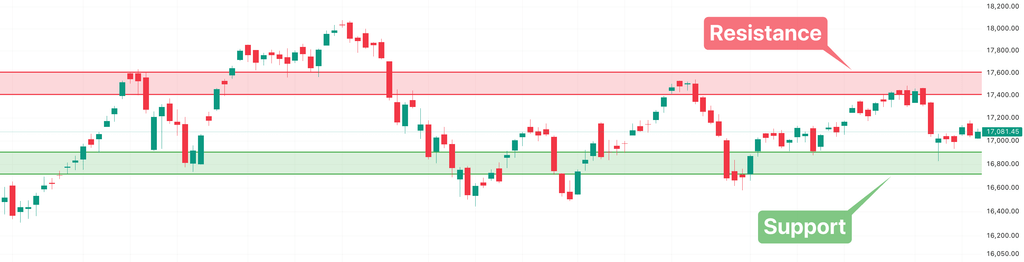

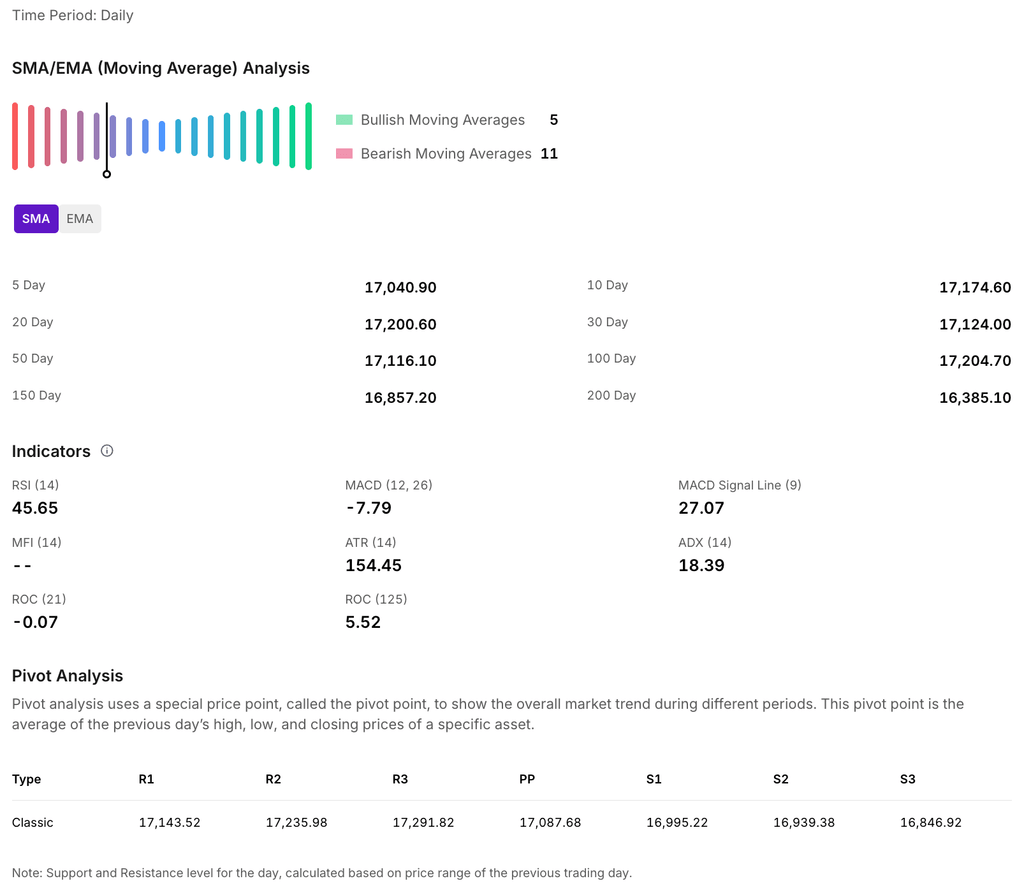

The Nifty Smallcap 250 fell about 1.38% this week, ending at 17,081.45 on Friday.

For the upcoming sessions:

- Key Breakout Level: 17,400

- Key Breakdown Level: 16,900

| CRISP Insight: Most consistent Large Cap Funds and their investment styles | ||||

| Investment Style of Portfolio | ||||

| Scheme | Momentum | Value | Quality | 5Y Returns (%) |

| ICICI Prudential Large Cap Fund | Medium | Medium | Medium | 21.85 |

| HDFC Large Cap Fund | Medium | High | Low | 21.6 |

| Aditya Birla Sun Life Large Cap Fund | Medium | Medium | Low | 19.4 |

| Invesco India Largecap Fund | High | Low | Medium | 18.77 |

| DSP Large Cap Fund | Low | High | Medium | 18.61 |

| JM Large Cap Fund | High | High | Low | 16.7 |

| Baroda BNP Paribas Large Cap Fund | Medium | Low | Medium | 18.33 |

| SBI Large Cap Fund | Medium | Low | High | 18.93 |

| All data as of September 30, 2025. Style categorization for Quality, Value, and Momentum is based on a 5-year weighted average ofportfolio factor scores, assessed relative to both category peers and the benchmark. Funds with risk categorized as too high as perCRISP not considered. For detailed methodology, refer to this link. |

This Week’s Spotlight Story

A deep dive into the headline that defined market conversations.

Government Approves Rs 25,060 Crore Export Promotion Mission

The Union Cabinet has greenlit the ₹25,060 crore Export Promotion Mission (EPM), setting the stage for a major shift in India’s export policy. Targeted at boosting MSMEs, first-time exporters, and labor-intensive sectors, EPM introduces a unified digital framework to make Indian goods globally competitive and support “Make in India” efforts. Built on collaboration between key ministries, industry bodies, and state governments, the Mission consolidates fragmented export schemes into two integrated sub-schemes. The EPM tackles bottlenecks like costly trade finance, high compliance expenses, and limited market access, while providing tools for certification and global branding.

With special focus on sectors hit by global tariff hikes like textiles, leather, gems & jewellery, engineering goods, and marine products, EPM aims to stabilise export orders, protect jobs, and open new markets. By enabling digital processing from application to disbursal, it will make export support seamless for businesses across India. The Mission is projected to widen export opportunities beyond traditional hubs, boost employment in manufacturing and logistics, and anchor India’s drive for inclusive, tech-enabled, and future-ready trade growth.

That’s a wrap for this week.

As the markets pause to catch their breath, we’ll be back next week with sharper insights and stories to help you invest intelligently.