Share Market Weekly

- Share.Market

- 4 min read

- 31 Oct 2025

Highlights

Nifty 50 25,722.10 🔻 0.57%

| Monday | 🔼 0.66% |

| Tuesday | 🔻 0.11% |

| Wednesday | 🔼 0.45% |

| Thursday | 🔻 0.68% |

| Friday | 🔻 0.60% |

What moved the market?

Top Gainers & Top Losers

| Nifty PSU Bank | 🔼 4.22% | Nifty Healthcare Index | 🔻 2.28% |

| Nifty Metal | 🔼 3.71% | Nifty Auto | 🔻 1.54% |

| Nifty Oil & Gas | 🔼 2.77% | Nifty Pharma | 🔻 1.51% |

Markets this week

| Nifty Midcap 150 | 22,045.95 (🔼 0.34%) |

| Nifty Smallcap 250 | 17,313.90 (🔼 0.16%) |

| India VIX | 12.15 (🔼 7.62%) |

Stocks in the Spotlight

Top Gainers

| Name of the company | Movement | Factors | ||||

| Momentum | Value | Quality | Low Vol | Sentiment | ||

| Chennai Petroleum Corporation Ltd. | 🔼 31.14% | 4/5 | 5/5 | 4/5 | 4/5 | N/A |

| Five-Star Business Finance Ltd. | 🔼 21.57% | 1/5 | 5/5 | 5/5 | 4/5 | 1/5 |

Top Losers

| Name of the company | Movement | Factors | ||||

| Momentum | Value | Quality | Low Vol | Sentiment | ||

| Cohance Lifesciences Ltd. | 🔻15.03% | 1/5 | 2/5 | 5/5 | 5/5 | 1/5 |

| Aditya Birla Sun Life AMC Ltd. | 🔻10.50% | 5/5 | 4/5 | 4/5 | 5/5 | 1/5 |

Technical Analysis

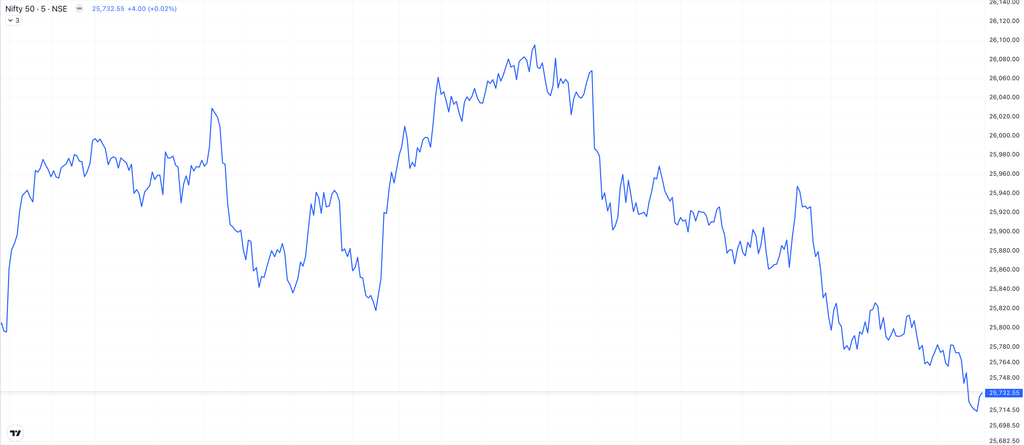

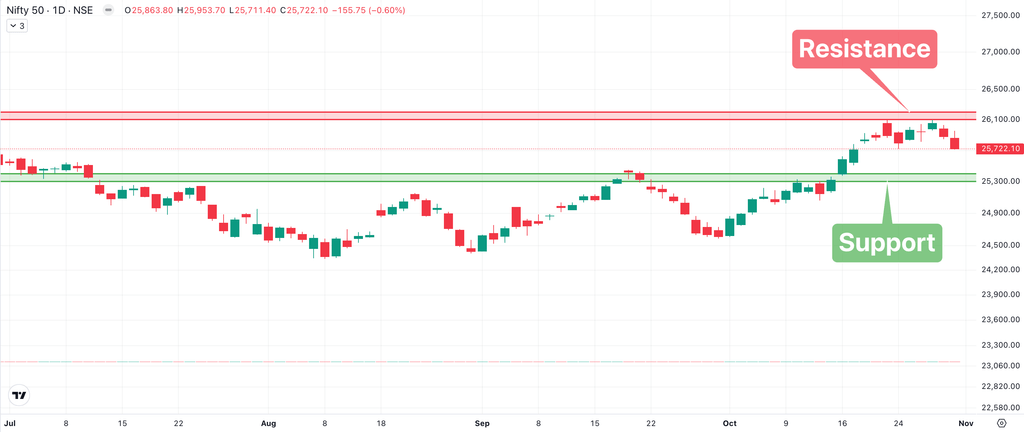

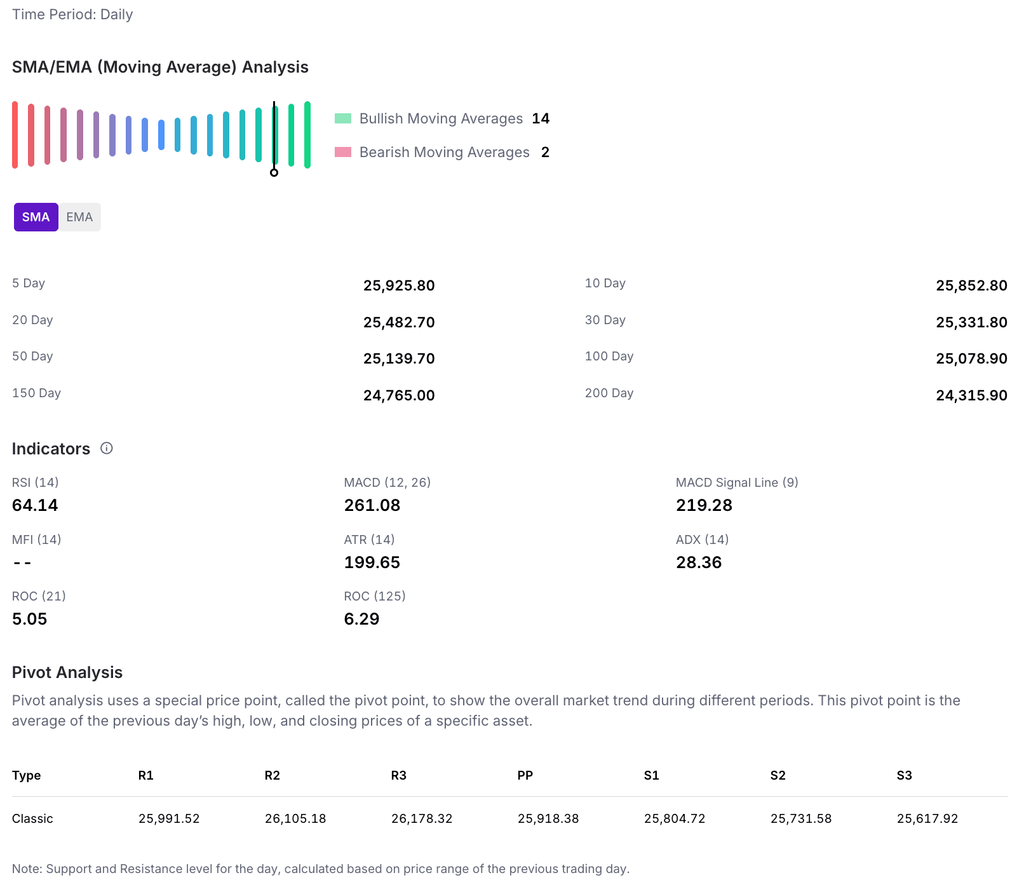

The Nifty 50 paused this week, falling 0.57% to close at 25,722.10. The index lost 146 points on Friday alone.

For the upcoming sessions:

- Immediate Resistance: 26,000 – 26,100

- Immediate Support: 25,200 – 25,300

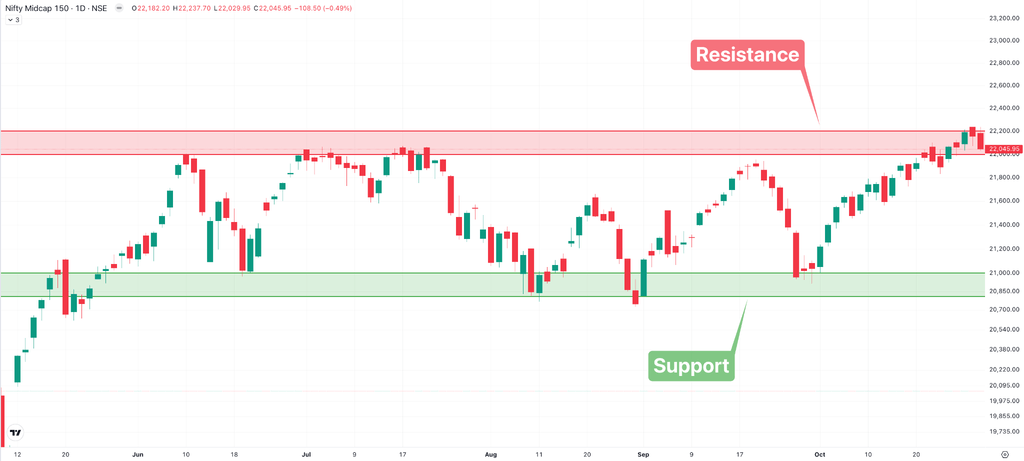

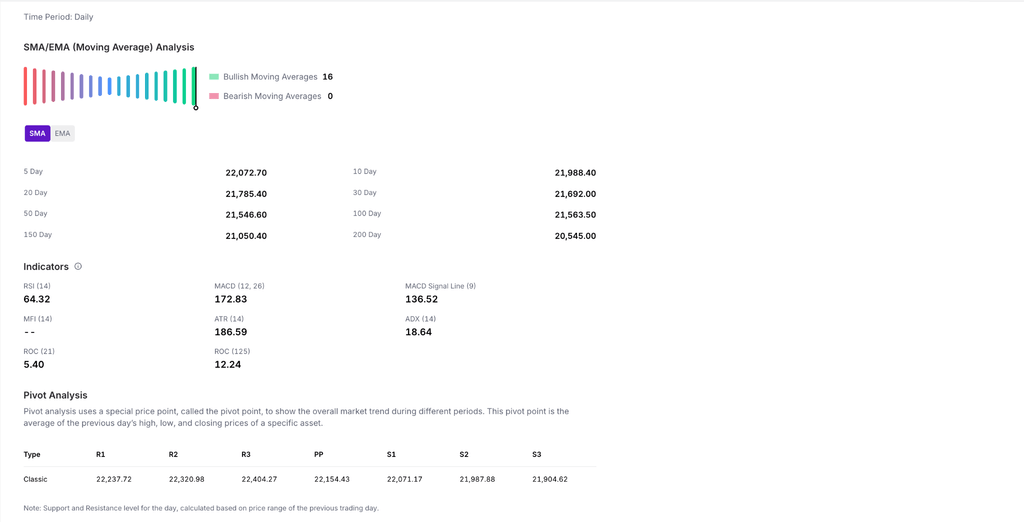

The Nifty Midcap 150 index demonstrated resilience this week, closing with a gain of approximately 0.34% to finish at 22,045.95. This was despite experiencing a decline of 108.5 points on Friday.

For the upcoming sessions:

- Immediate Resistance: 22,000 – 22,200

- Significant Support: 20,800 – 21,000

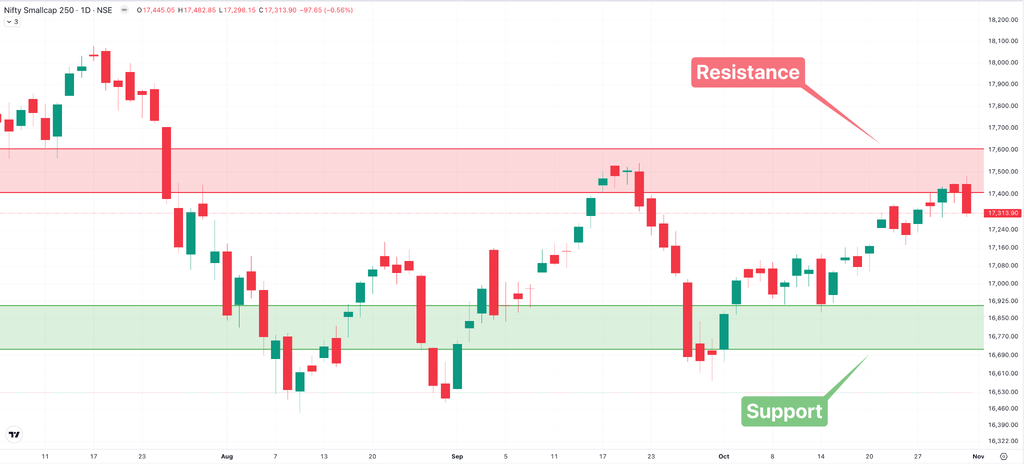

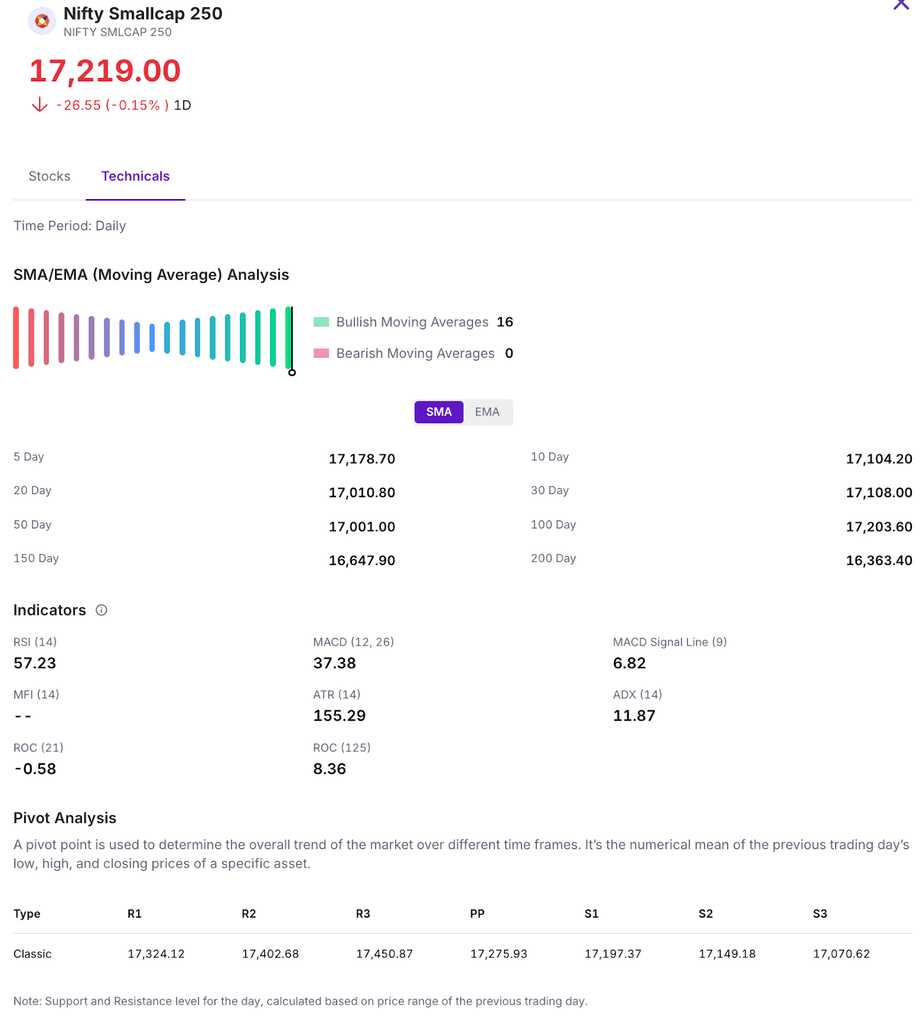

The Nifty Smallcap 250 gained about 0.16% this week, ending at 17,313.90 on Friday.

For the upcoming sessions:

- Key Breakout Level: 17,400

- Key Breakdown Level: 16,900

This Week’s Spotlight Story

A deep dive into the headline that defined market conversations.

India’s April-September Fiscal Deficit Widens to ₹5.73 Lakh Crore, Hits 36.5% of FY26 Target

India’s fiscal deficit for the first half of the financial year has widened significantly to ₹5.73 lakh crore, reaching 36.5% of the government’s full-year target of ₹15.69 lakh crore for FY26. This increase reflects a sharp rise from the 29.4% recorded during the same period last year, signaling increased government expenditure even as revenues lag behind expectations. Led by the Ministry of Finance, the government’s data reveals that total receipts during April to September stood at ₹16.95 lakh crore, accounting for 49.6% of the annual budget estimate. Tax revenues comprised ₹12.29 lakh crore, while non-tax revenues, bolstered by a higher dividend transfer from the Reserve Bank of India, contributed ₹4.6 lakh crore. Overall expenditure was ₹23.03 lakh crore, or 45.5% of the budgeted amount, indicating an active capital and revenue spending approach to support growth and infrastructure initiatives.

Despite healthy capital expenditure, concerns remain about the slower pace of revenue collection, with tax revenues standing at 43.3% of the budget estimate. The revenue deficit, however, has reduced sharply to ₹27,147 crore or 5.2% of the budget estimate, showing fiscal consolidation efforts. This fiscal data underscores the balancing act India faces as it pursues sustained growth to become the world’s third-largest economy by 2030.

Buzz

What is a Morning Star Pattern: Meaning and Significance

This article explains the Morning Star candlestick pattern, a technical analysis tool that traders use to spot a potential shift from a downtrend to an uptrend in the market.

That’s a wrap for this week.

As the markets pause to catch their breath, we’ll be back next week with sharper insights and stories to help you invest intelligently.