Share Market Weekly

- Share.Market

- 4 min read

- 24 Oct 2025

Highlights

Nifty 50 25,795.15 🔼 1.86%

| Monday | 🔼 0.52% |

| Tuesday | 🔼 0.10% |

| Thursday | 🔼 0.09% |

| Friday | 🔻 0.37% |

What moved the market?

Top Gainers

| Nifty FMCG | 🔼 2.92% | Nifty Infra | 🔼 1.84% |

| Nifty Realty | 🔼 2.79% | Nifty Consumer Durables | 🔼 1.72% |

| Nifty Private Bank | 🔼 2.19% | Nifty Oil & Gas | 🔼 1.69% |

Markets this week

| Nifty Midcap 150 | 21,890.90 (🔼 0.43%) |

| Nifty Smallcap 250 | 17,219.00 (🔼 0.98%) |

| India VIX | 11.59 (🔼 10.07%) |

Stocks in the Spotlight

Top Gainers

| Name of the company | Movement | Factors | ||||

| Momentum | Value | Quality | Low Vol | Sentiment | ||

| Shipping Corporation of India Ltd. | 🔼 19.90% | 4/5 | N/A | 5/5 | 4/5 | N/A |

| Sammaan Capital Ltd. | 🔼 12.80% | 4/5 | 1/5 | 1/5 | 3/5 | N/A |

Top Losers

| Name of the company | Movement | Factors | ||||

| Momentum | Value | Quality | Low Vol | Sentiment | ||

| Jindal Saw Ltd. | 🔻10.46% | 1/5 | 5/5 | 3/5 | 4/5 | N/A |

| Poonawalla Fincorp Ltd. | 🔻10.17% | 5/5 | 1/5 | 1/5 | 4/5 | 5/5 |

Technical Analysis

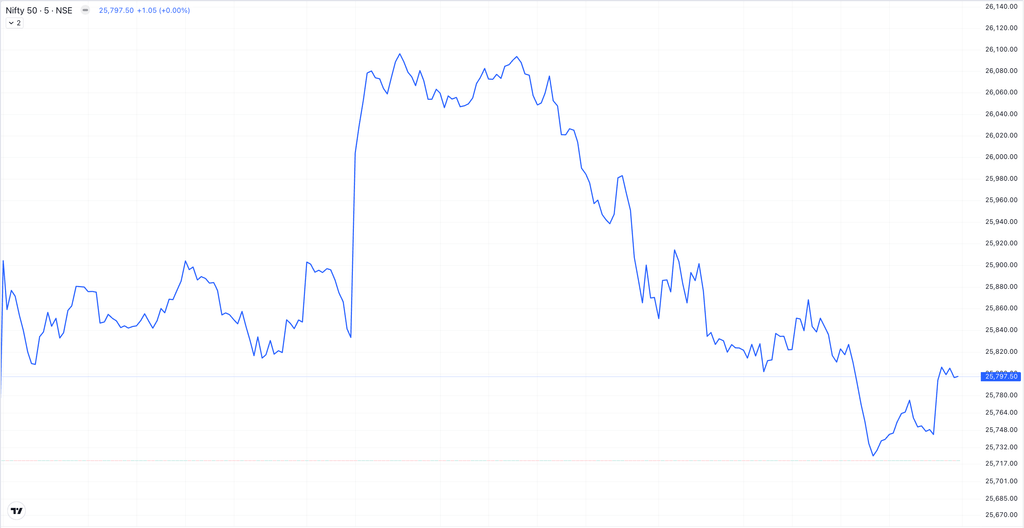

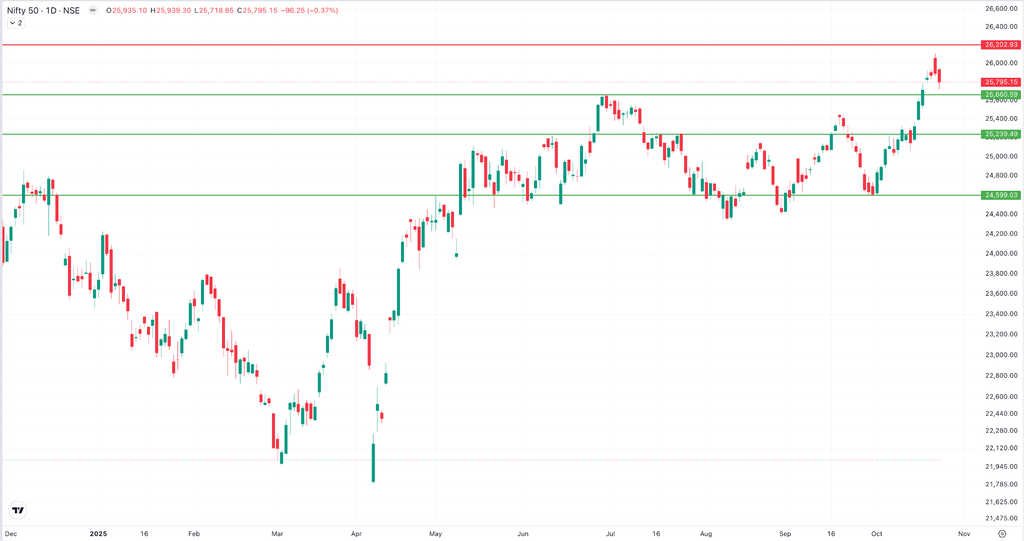

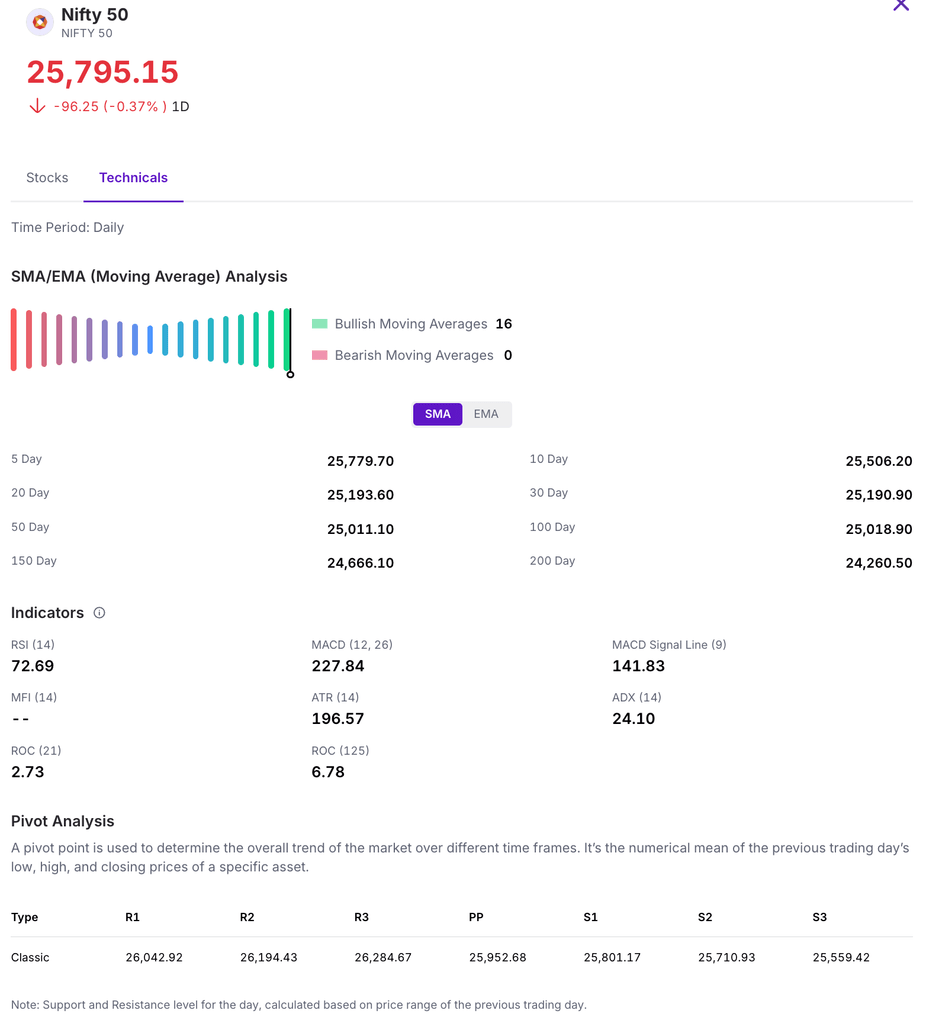

The Nifty 50 gained 1.86% this week, inching closer to the significant 26,000 mark. Despite the overall weekly advance, the index closed lower on Friday at 25,795.15. For the upcoming sessions, the next nearest resistance zone is projected at 26,000 – 26,100, while the immediate support zone is estimated to be around 25,500 – 25,600.

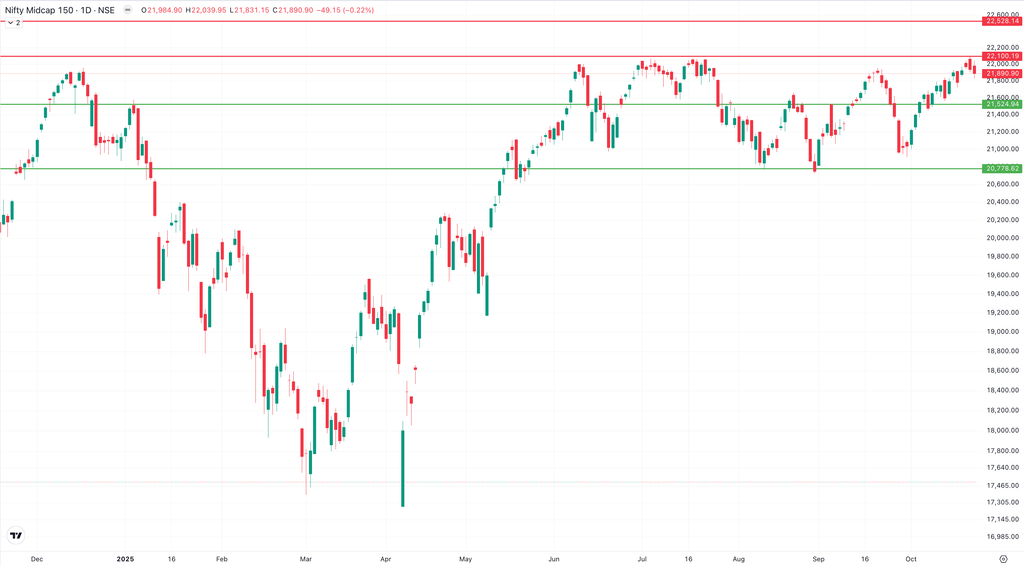

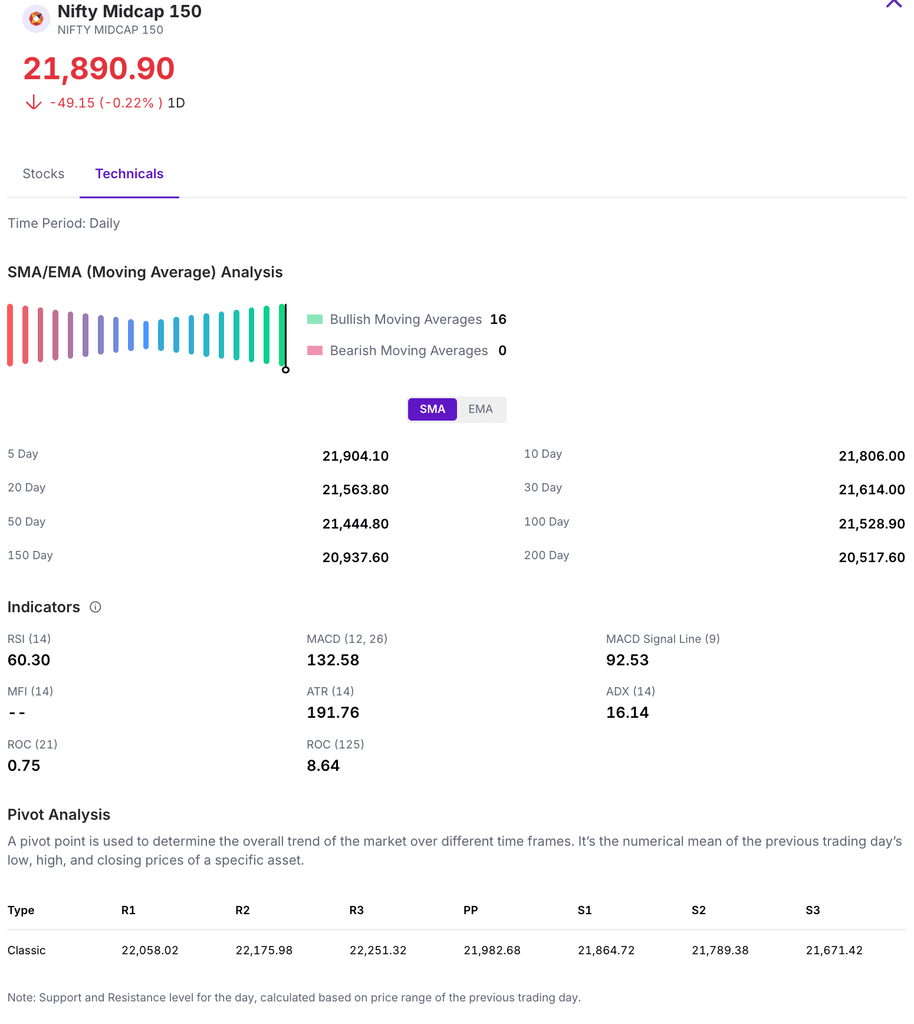

The Nifty Midcap 150 index demonstrated resilience this week, closing with a notable gain of approximately 0.43% to finish at 21,890.90, despite experiencing a decline on Friday.

Looking ahead, the next significant support for the index is in the 21,400 to 21,500 zone, while on the upside, a sustained break above the immediate resistance at 21,900 to 22,000 could clear the path for a potential move towards the 22,500 level.

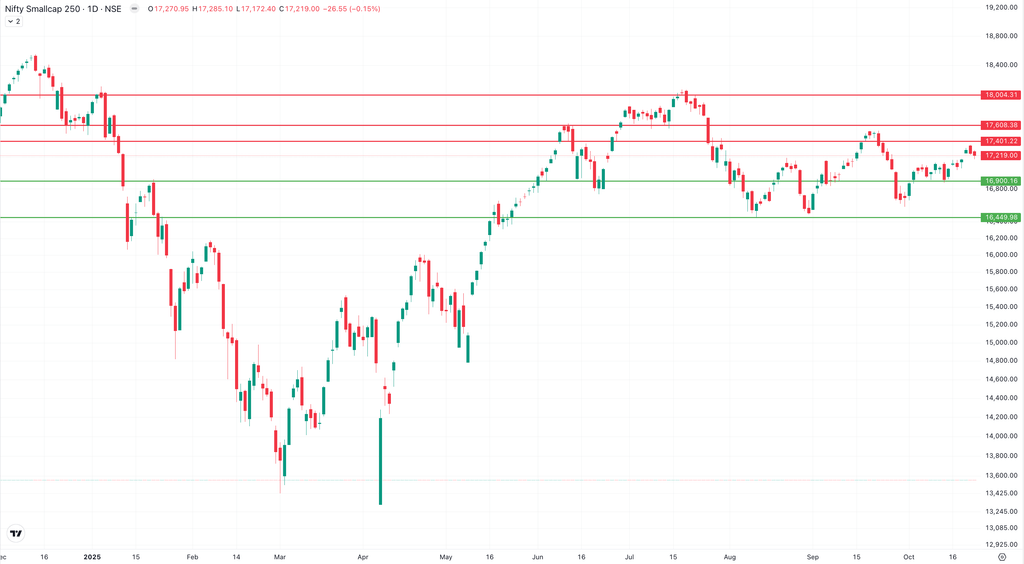

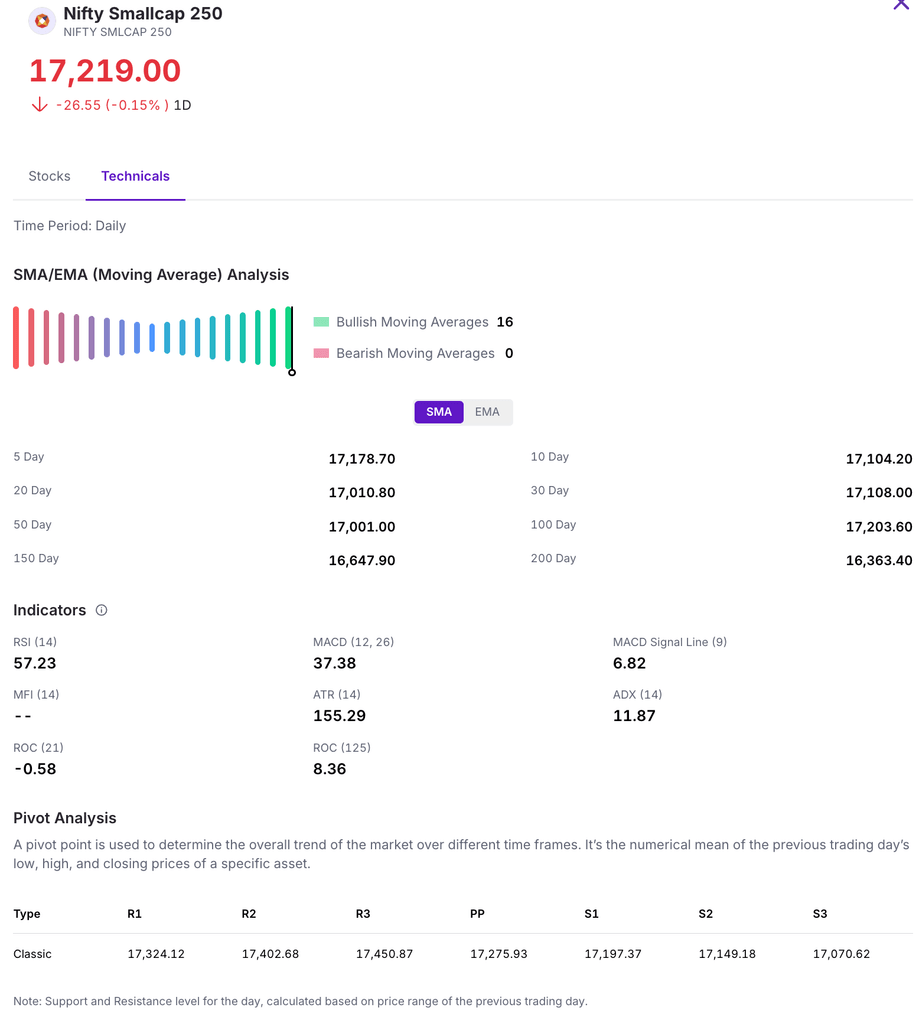

The Nifty Smallcap 250 gained about 0.98% this week, ending at 17,219 on Friday. A breakout above 17,400 or a breakdown below 16,900 will be key to determining the next leg of its momentum.

This Week’s Spotlight Story

A deep dive into the headline that defined market conversations.

Aatmanirbhar Bharat: How India’s Rs 79,000 Crore Boost Recharges Domestic Defence

The Centre recently cleared major defense proposals worth approximately Rs 79,000 crore to significantly strengthen the capabilities of the Indian Armed Forces. This investment serves to immediately boost defense preparedness while aligning with the government’s self-reliance push, known as the Aatmanirbhar Bharat vision, by prioritizing indigenously developed systems.

These decisions, led by Defence Minister Rajnath Singh, fund mission-critical modernization across all services. The Indian Army will acquire the Nag Missile System (Tracked) Mark-II and a Ground-Based Mobile Electronic Intelligence System. The Navy receives Landing Platform Docks and Advanced Lightweight Torpedoes. For the Air Force, a Collaborative Long-Range Target Saturation and Destruction System was approved. This substantial clearance enhances logistics, electronic intelligence gathering, and specialized combat across land, air, and maritime environments.

Buzz

Why the Silver Price is Soaring: The Hidden Boom Investors Can’t Ignore

The article explains the structural reasons behind the global surge in silver prices, driven by industrial demand, assesses the rally’s potential continuance, and warns Indian investors about the significant “hidden trap” of paying a steep domestic price premium.

That’s a wrap for this week.

As the markets pause to catch their breath, we’ll be back next week with sharper insights and stories to help you invest intelligently.