Share Market Weekly

- Share.Market

- 4 min read

- 17 Oct 2025

Highlights

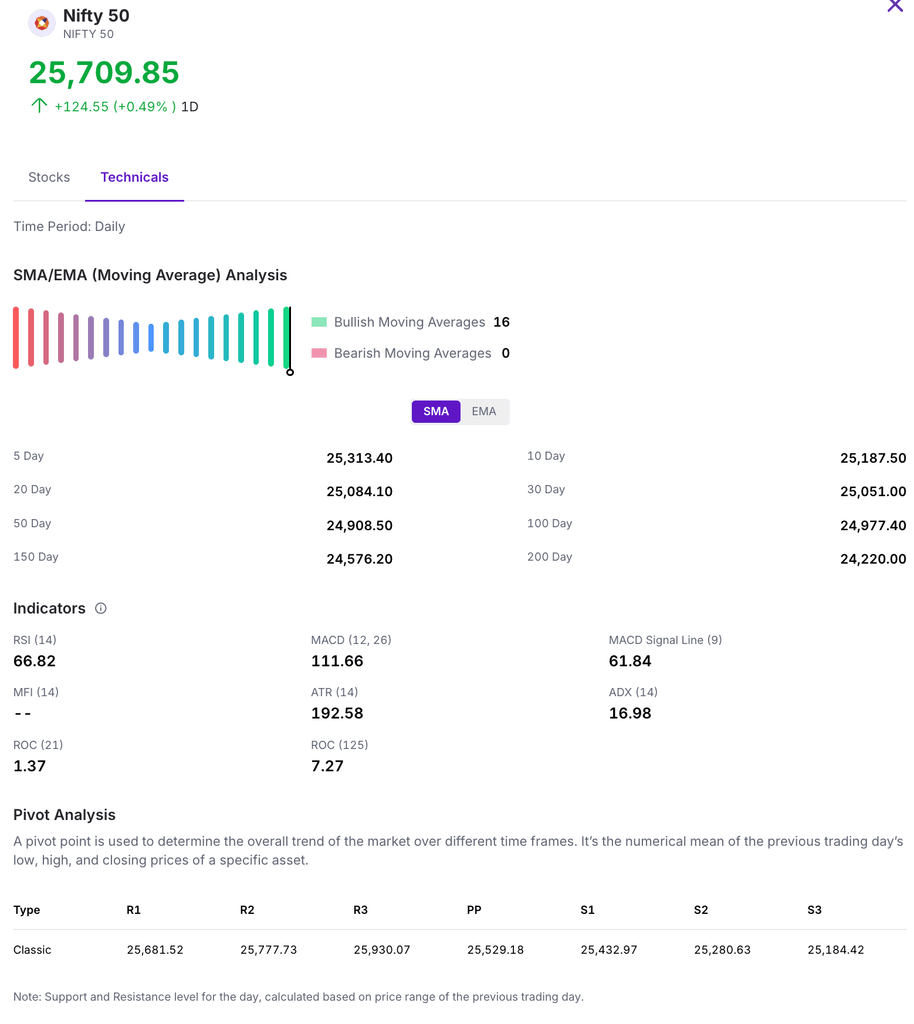

Nifty 50 25,709.85 🔼 2.65%

| Monday | 🔻 0.23% |

| Tuesday | 🔻 0.32% |

| Wednesday | 🔼 0.71% |

| Thursday | 🔼 1.03% |

| Friday | 🔼 0.49% |

What moved the market?

Top Gainers & Top Losers

| Nifty Realty | 🔼 6.67% | Nifty Media | 🔻 2.34% |

| Nifty FMCG | 🔼 3.90% | Nifty IT | 🔻 0.80% |

| Nifty Financial Services | 🔼 3.31% |

Markets this week

| Nifty Midcap 150 | 21,782.30 (🔼 1.42%) |

| Nifty Smallcap 250 | 17,067.55 (🔼 0.79%) |

| India VIX | 11.63 (🔼 12.80%) |

Stocks in the Spotlight

Top Gainers

| Name of the company | Movement | Factors | ||||

| Momentum | Value | Quality | Low Vol | Sentiment | ||

| Whirlpool of India Ltd. | 🔼 21.00% | 5/5 | 3/5 | 5/5 | 4/5 | 3/5 |

| Force Motors Ltd. | 🔼 14.81% | 5/5 | N/A | 5/5 | 2/5 | N/A |

Top Losers

| Name of the company | Movement | Factors | ||||

| Momentum | Value | Quality | Low Vol | Sentiment | ||

| SKF India Ltd. | 🔻54.65% | 5/5 | 3/5 | 5/5 | 5/5 | 1/5 |

| Tata Motors Ltd. | 🔻41.77% | 3/5 | 5/5 | 4/5 | 5/5 | 4/5 |

Technical Analysis

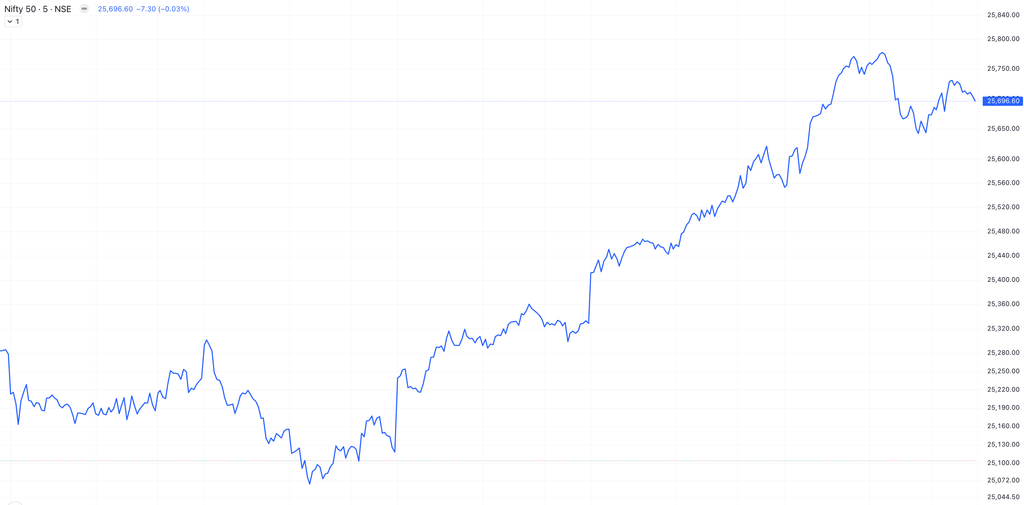

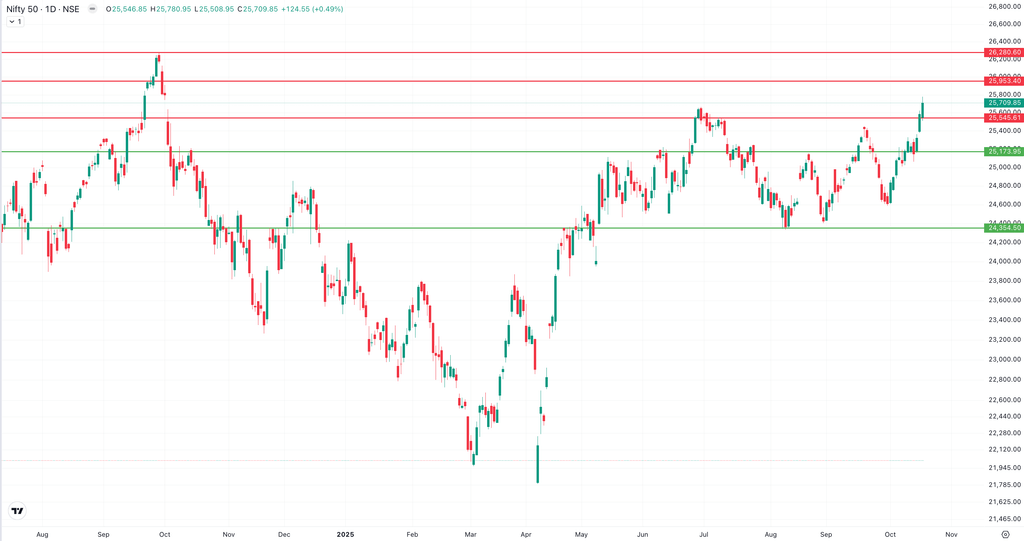

The Nifty 50 gained 2.65% this week, breaching the key 25,000 level and closing above both 20 & 50-day SMAs. The index is inching close to 26,000 mark. The next nearest resistance Zone at 25,900 – 26,000 and support zone is at around 25,100 – 25,200

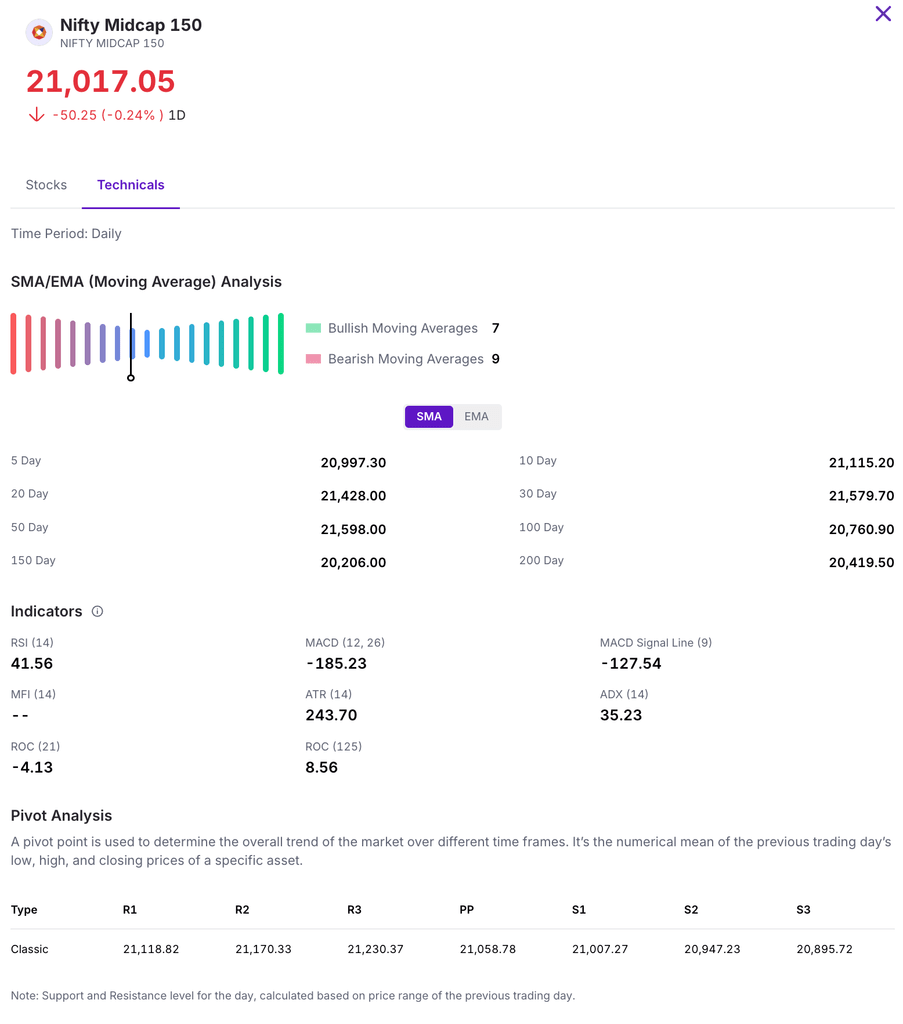

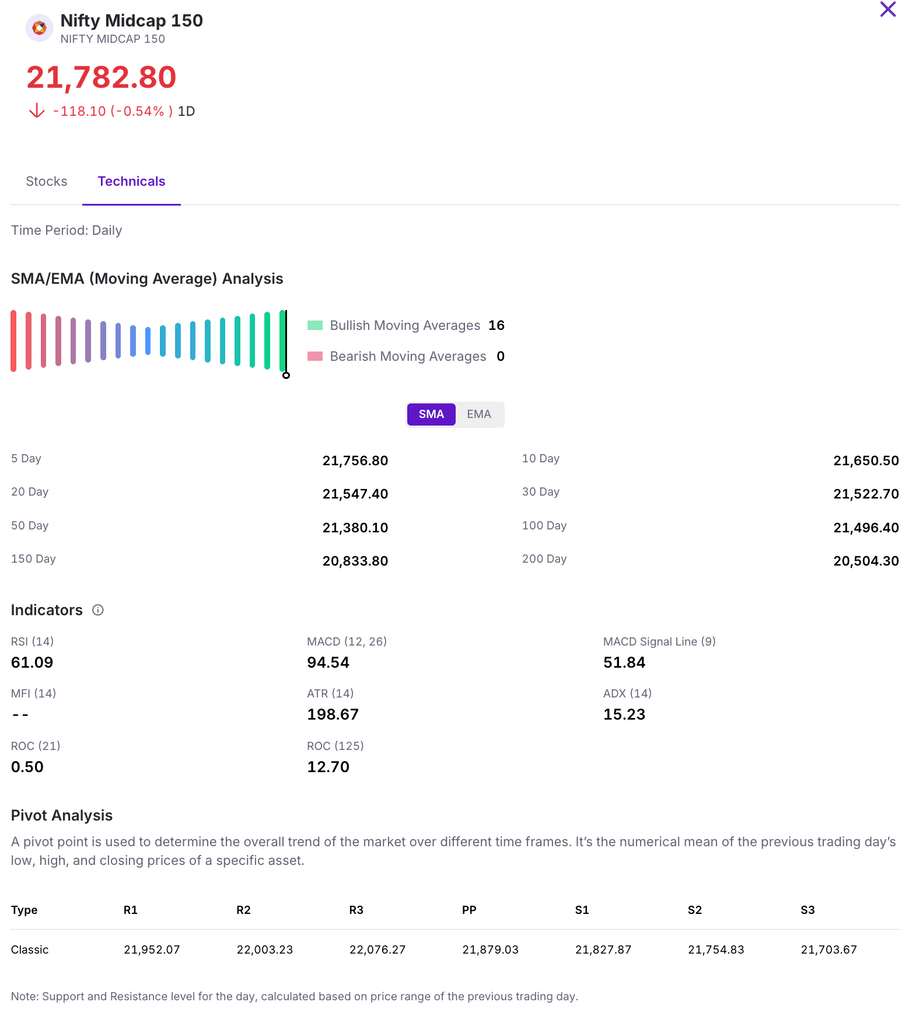

The Nifty Midcap 150 index demonstrated resilience this week, closing with a notable gain of approximately 1.42% to finish at 21,782, despite experiencing a decline on Friday.

Looking ahead, the next significant support for the index is in the 21,400 to 21,500 zone. On the upside, a sustained break above the immediate resistance at 22,000 could clear the path for a potential move towards the 22,500 level.

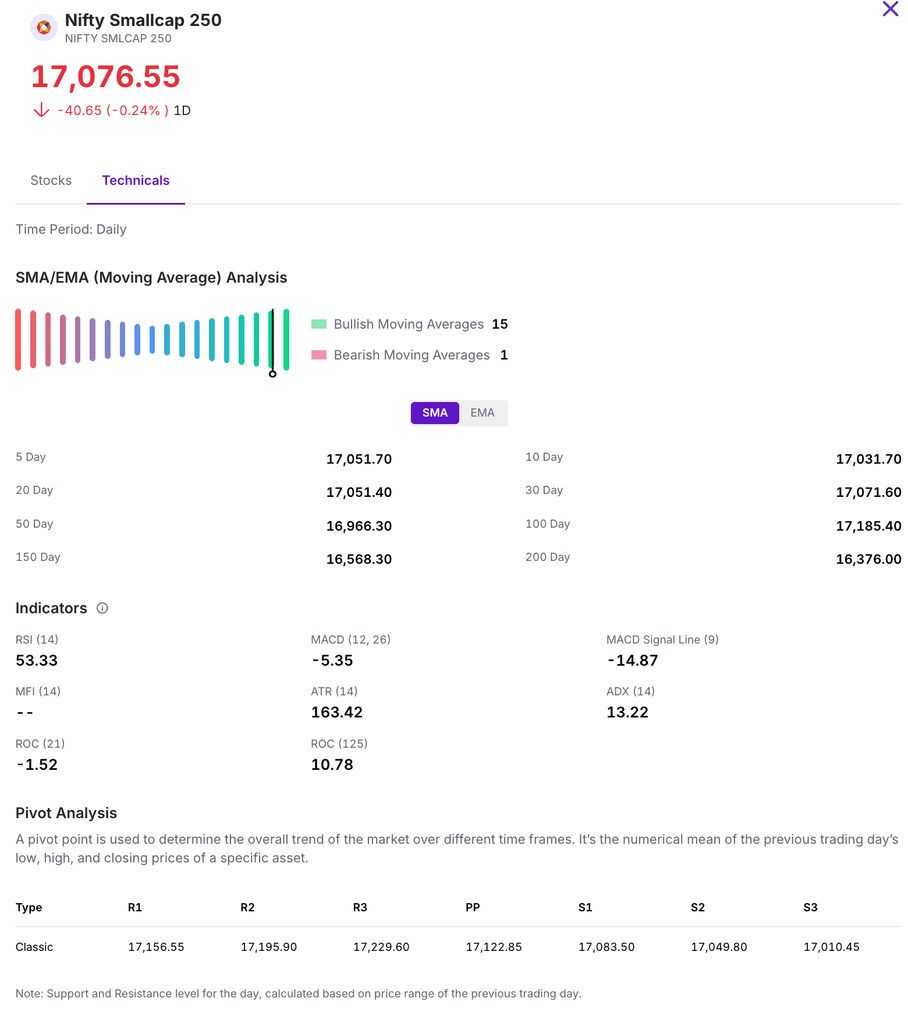

The Nifty Smallcap 250 gained about 0.71% this week, ending at 17,076 on Friday. A breakout above 17,200 or a breakdown below 16,750 will be key to determining the next leg of its momentum.

This Week’s Spotlight Story

A deep dive into the headline that defined market conversations.

Silver’s Supercharge: Why the Industrial Engine Fuels Explosive Growth

Silver is unique due to its dual identity: it acts as both a safe-haven asset like gold and an indispensable industrial metal. While global economic anxiety and low interest rates support its investment value, over half of annual demand is fueled by manufacturing.

This industrial demand is “supercharged” by the clean energy revolution. Silver’s unmatched electrical conductivity makes it irreplaceable in solar panels (now consuming nearly 20% of global supply) and Electric Vehicles (EVs), alongside advanced electronics like 5G and AI.

This relentless demand has created a structural supply crisis. For four years, global demand has exceeded supply, systematically draining above-ground inventories. This deepening physical deficit is the critical ingredient that positions silver for a potentially much more explosive long-term rally than gold.

Buzz

Equity Ratio: Meaning, Formula, Calculation, & Benefits

The equity ratio reveals a company’s financial stability by proportion of assets funded by equity It’s a key tool for investors to assess risk.

That’s a wrap for this week.

As the markets pause to catch their breath, we’ll be back next week with sharper insights and stories to help you invest intelligently.