Share Market Weekly

- Share.Market

- 4 min read

- 10 Oct 2025

Highlights

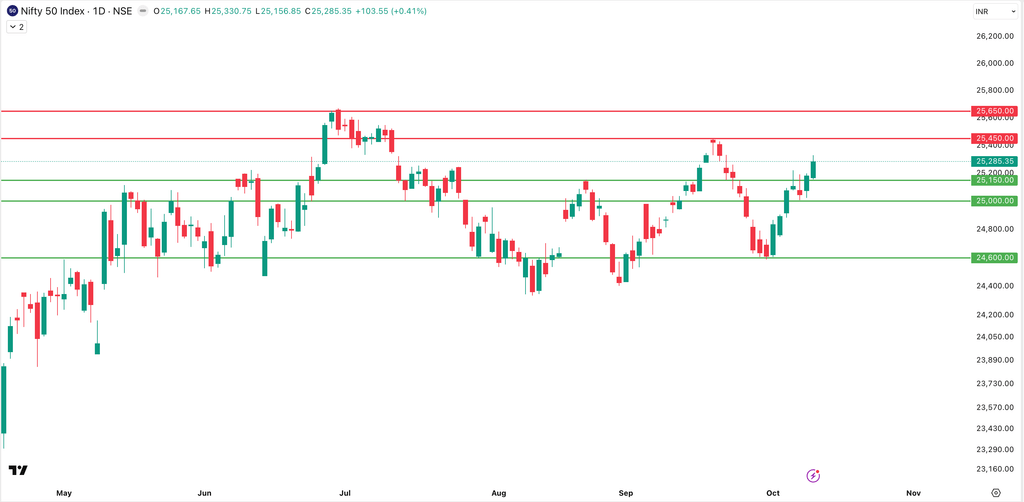

Nifty 50 25,285.35 🔼 1.81%

| Monday | 🔼 0.74% |

| Tuesday | 🔼 0.12% |

| Wednesday | 🔻 0.25% |

| Thursday | 🔼 0.54% |

| Friday | 🔼 0.41% |

What moved the market?

Top Gainers & Top Losers

| Nifty IT | 🔼 5.03% | Nifty Media | 🔻 2.65% |

| Nifty Private Bank | 🔼 4.91% | Nifty FMCG | 🔻 0.25% |

| Bank Nifty | 🔼 3.61% | Nifty Auto | 🔻 0.18% |

Markets this week

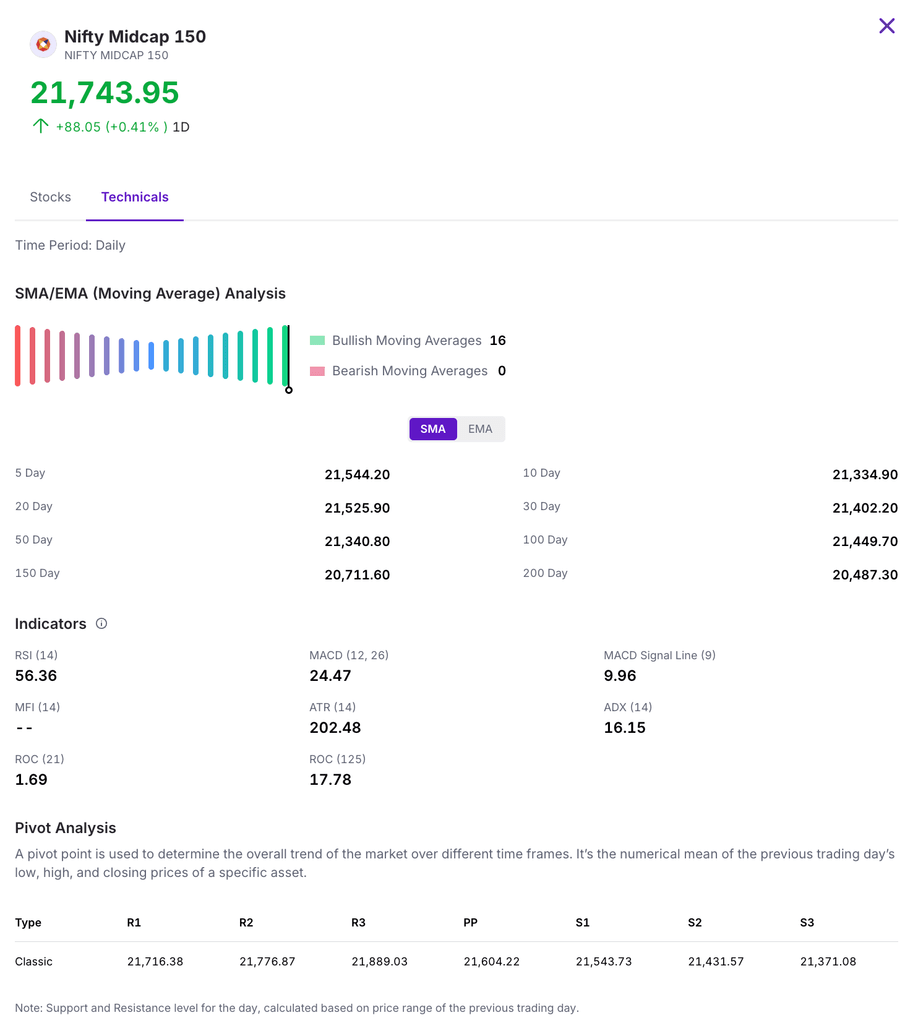

| Nifty Midcap 150 | 21,743.95 (🔼 2.47%) |

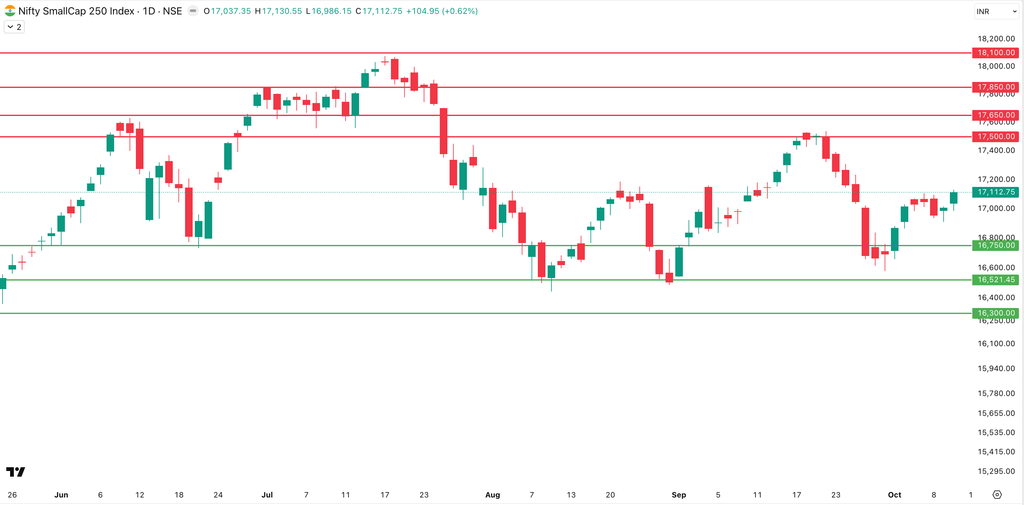

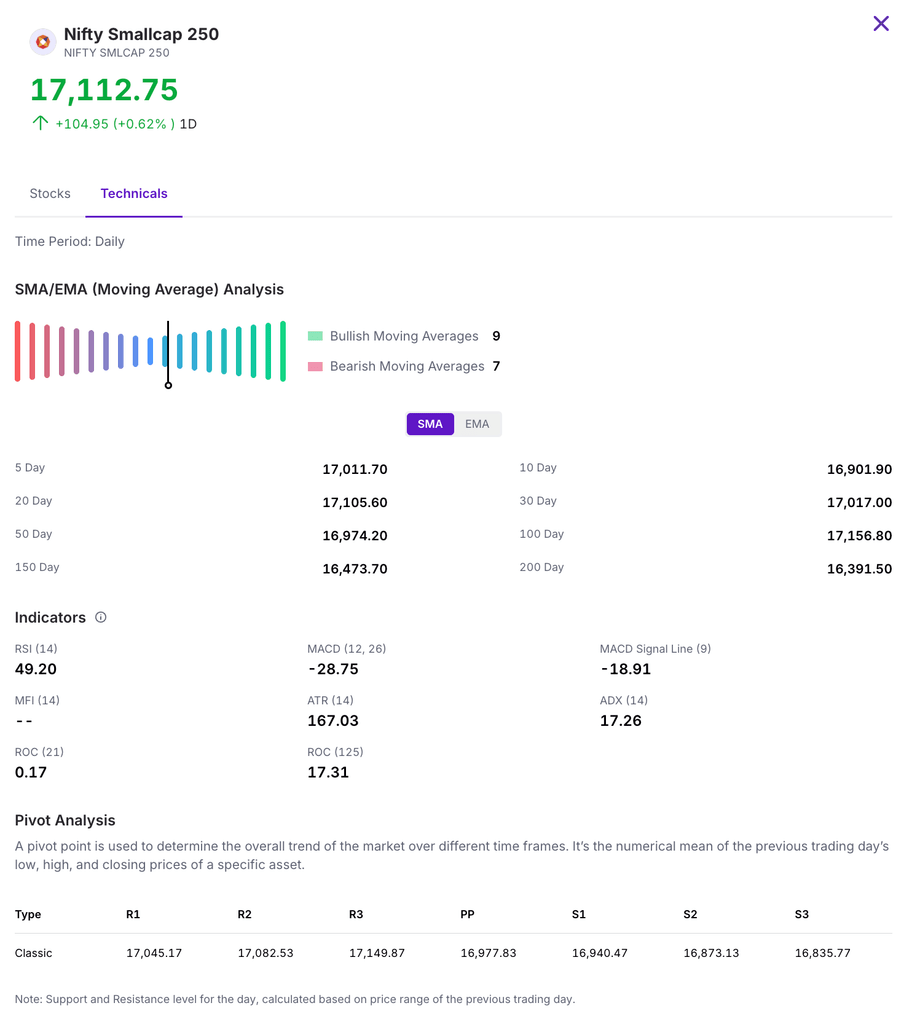

| Nifty Smallcap 250 | 17,112.75 (🔼 1.44%) |

| India VIX | 10.10 (🔻 1.85%) |

Stocks in the Spotlight

Top Gainers

| Name of the company | Movement | Factors | ||||

| Momentum | Value | Quality | Low Vol | Sentiment | ||

| Tata Consumer Products Ltd. | 🔼 15.93% | 4/5 | 3/5 | 5/5 | 5/5 | 3/5 |

| PG Electroplast Ltd. | 🔼 14.70% | 1/5 | 1/5 | 4/5 | 2/5 | 1/5 |

Top Losers

| Name of the company | Movement | Factors | ||||

| Momentum | Value | Quality | Low Vol | Sentiment | ||

| Tata Investment Corporation Ltd. | 🔻 12.15% | 4/5 | NA | 4/5 | 4/5 | NA |

| Ola Electric Mobility Ltd. | 🔻 11.01% | 3/5 | 1/5 | 1/5 | 1/5 | 4/5 |

Technical Analysis

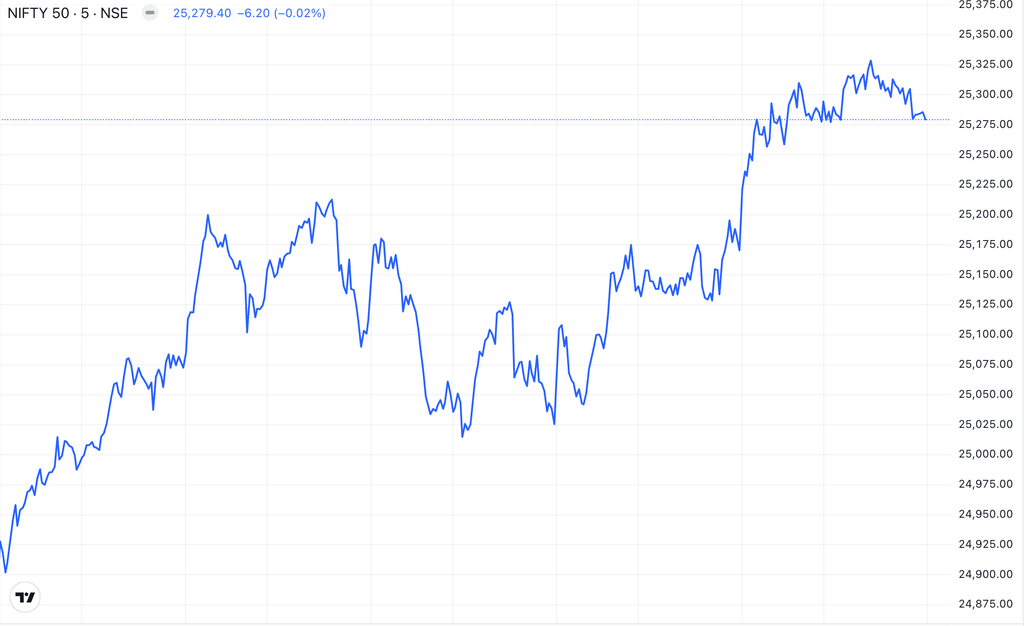

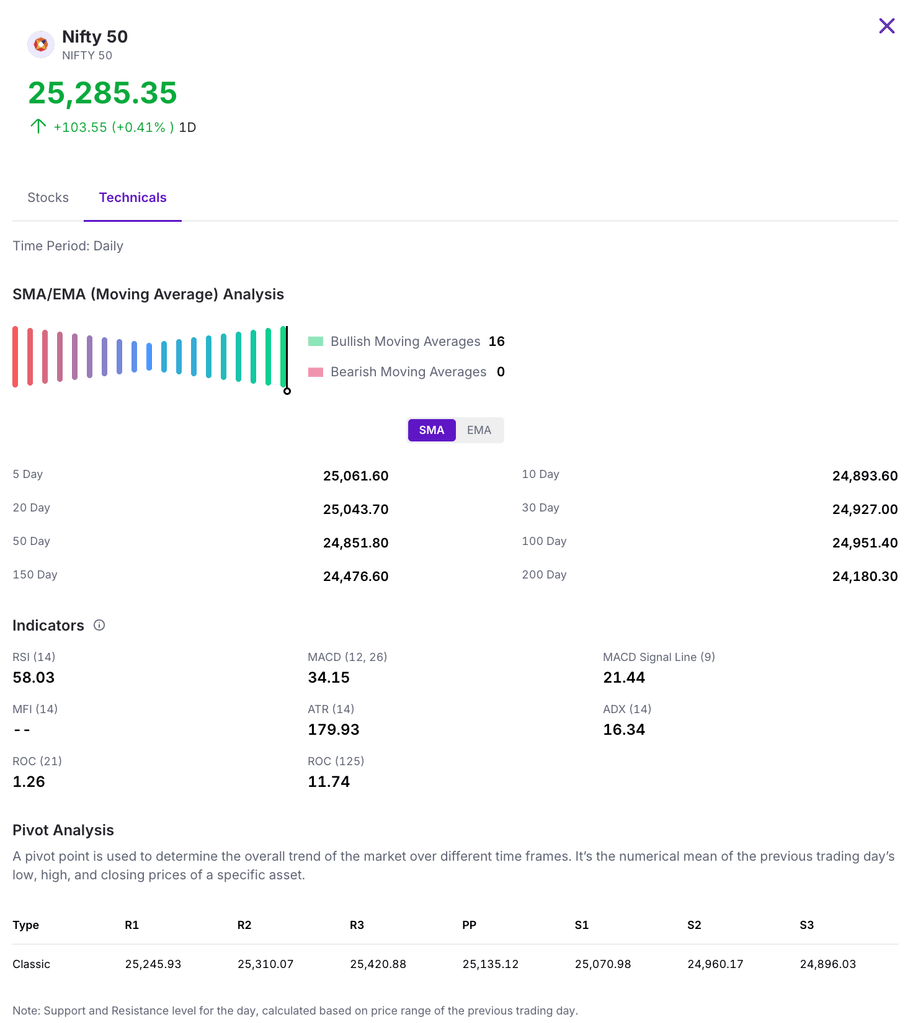

The Nifty 50 gained 0.9% this week, breaching the key 24,800 level and closing The Nifty 50 gained 1.57% this week, breaching the key 25,000 level and closing above both 20 & 50-day SMAs. The rally was primarily led by gains in IT, and banking stocks.the next nearest resistance Zone at 25,400 – 25,450 and support zone is at around 25,150 – 25,100

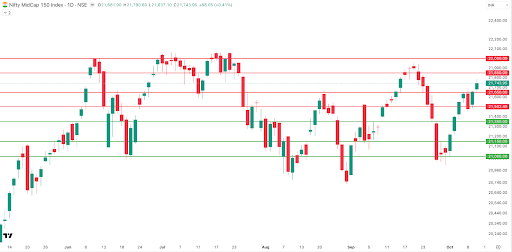

The Nifty Midcap 150 index showed resilience this week, gaining approximately 1.67% to close at 21,743. The index may found support around the 21,650 level. Should it dip below this, the next significant support lies in the 21,500 to 21,400 zone. On the upside, a sustained break above the immediate resistance at 21,850 could clear the path for a move towards the 22,000 mark.

The Nifty Smallcap 250 gained about 0.57% this week, ending at 17,112 on Friday. A breakout above 17,500 or a breakdown below 16,750 will be key to determining the next leg of its momentum.

This Week’s Spotlight Story

A deep dive into the headline that defined market conversations

US NDAA Bill Boosts Indian Pharma in Global Biotech Shift

The US Senate’s approval of the National Defense Authorization Act (NDAA) for 2026, which embeds the Biosecure Act, is set to reshape the global pharmaceutical supply chain.

The Act restricts US federal agencies from procuring biotech equipment and services from certain Chinese companies deemed a security risk.

This pivotal legislative change positions Indian Contract Development and Manufacturing Organizations (CDMOs) to significantly benefit.

As global supply chains seek alternatives to China, India, with its large number of USFDA-approved plants and cost advantages, is emerging as a preferred supplier.

Indian pharma stocks like Divi’s Labs and Laurus Labs have already seen gains, anticipating increased US demand for their biotech services and API/intermediate manufacturing. This strengthens India’s role in global healthcare.

Buzz

Muhurat Trading 2025: Date, Timings, & Nifty 50 Performance Analysis

In this piece, we have discussed Muhurat Trading in detail. Most importantly, we delve deeper into the 20-year performance analysis of Muhurat Trading to understand whether it’s just a symbolic ritual or if it really influences long-term returns for investors.

That’s a wrap for this week.

As the markets pause to catch their breath, we’ll be back next week with sharper insights and stories to help you invest intelligently.