Share Market Weekly

- Share.Market

- 6 min read

- 03 Oct 2025

Highlights

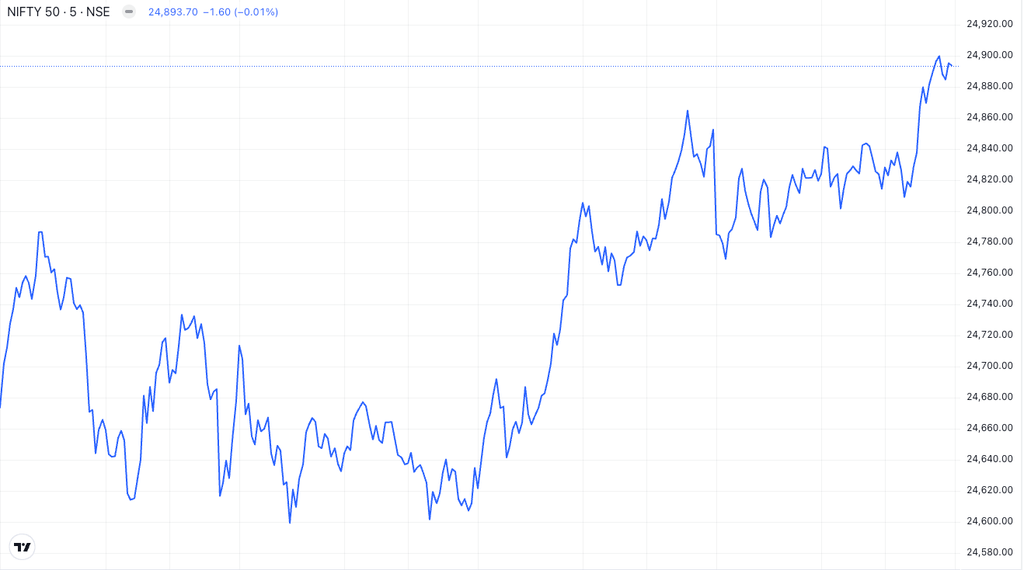

Nifty 50 24,894.25 🔻 0.65%

| Monday | 🔻 0.08% |

| Tuesday | 🔻 0.10% |

| Wednesday | 🔼 0.92% |

| Friday | 🔼 0.23 |

What moved the market?

Top Gainers & Top Losers

| Nifty Metal | 🔼 2.16% | Nifty IT | 🔻 2.98% |

| Nifty PSU Bank | 🔼 2.04% | Nifty Consumer Durables | 🔻 2.20% |

| Nifty Private Bank | 🔼 1.25% | Nifty Pharma | 🔻 1.91% |

Markets this week

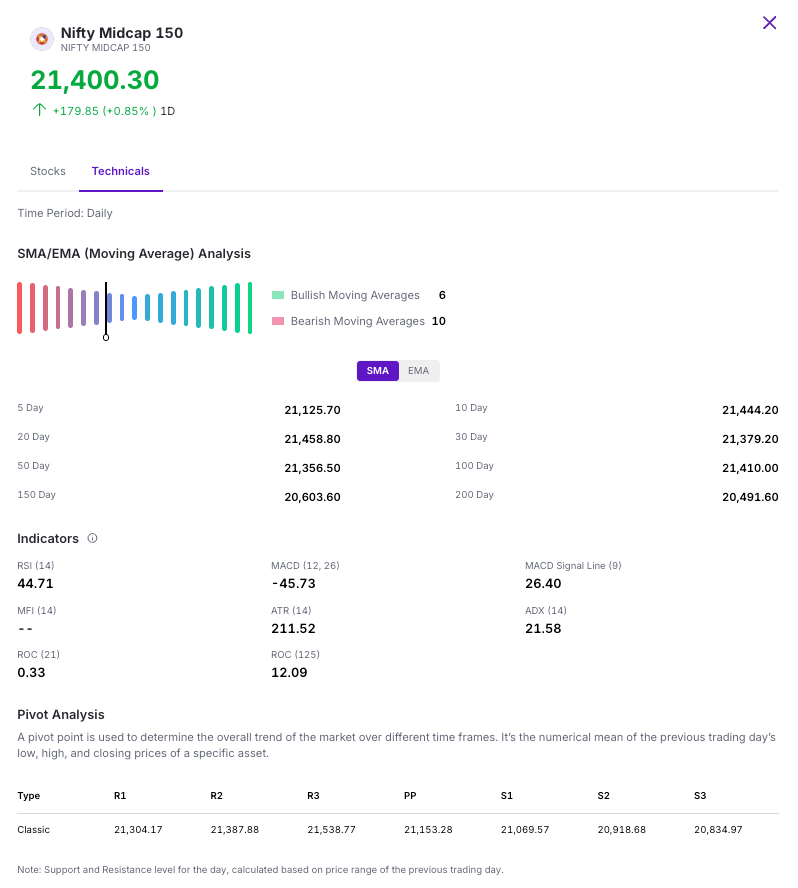

| Nifty Midcap 150 | 21,400.30 (🔻 0.57%) |

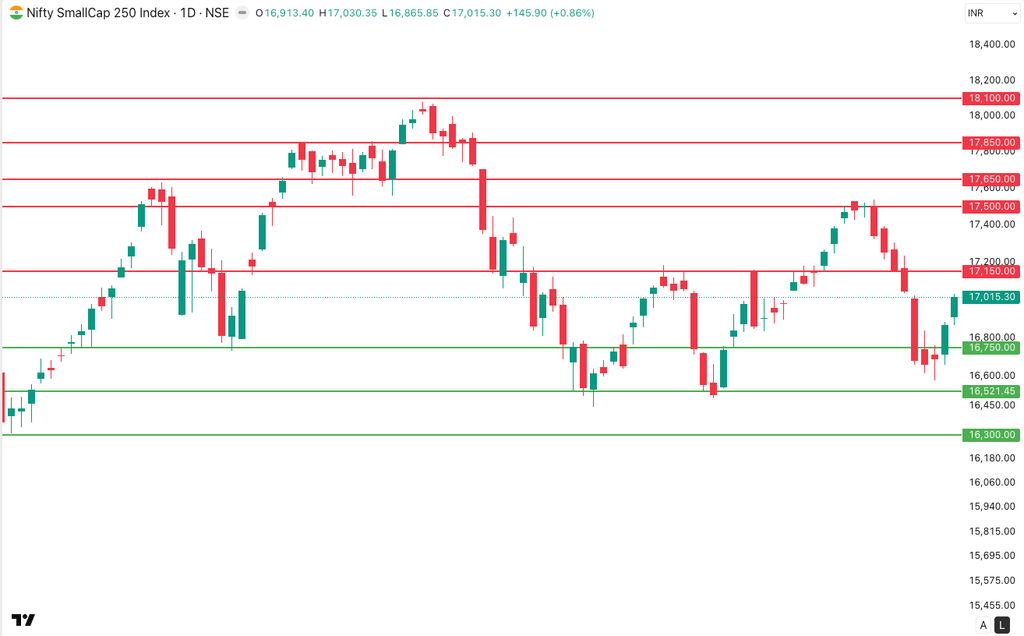

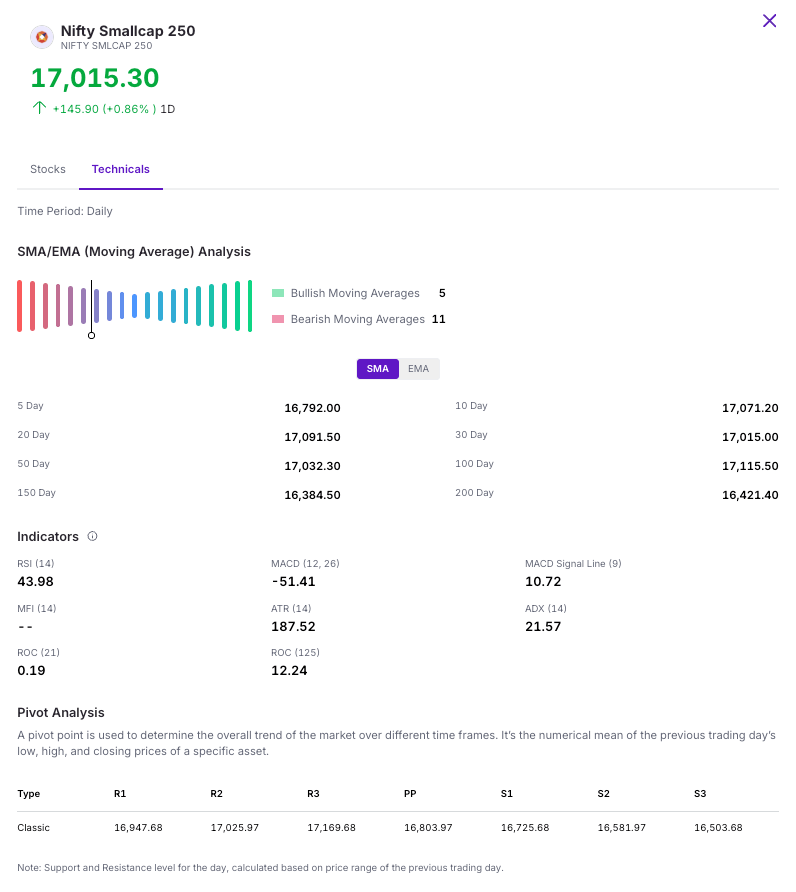

| Nifty Smallcap 250 | 17,015.30 (🔻 0.86%) |

| India VIX | 10.06 (🔻 4.73%) |

Stocks in the Spotlight

Top Gainers

| Name of the company | Movement | Factors | ||||

| Momentum | Value | Quality | Low Vol | Sentiment | ||

| Sammaan Capital Ltd. | 🔼 20.98% | 4/5 | 1/5 | 1/5 | 3/5 | NA |

| Tata Investment Corporation Ltd. | 🔼 19.47% | 4/5 | NA | 4/5 | 5/5 | NA |

Top Losers

| Name of the company | Movement | Factors | ||||

| Momentum | Value | Quality | Low Vol | Sentiment | ||

| Firstsource Solutions Ltd. | 🔻 9.48% | 2/5 | 3/5 | 5/5 | 4/5 | 2/5 |

| Aditya Birla Real Estate Ltd. | 🔻 9.10% | 2/5 | 1/5 | 2/5 | 4/5 | 1/5 |

Technical Analysis

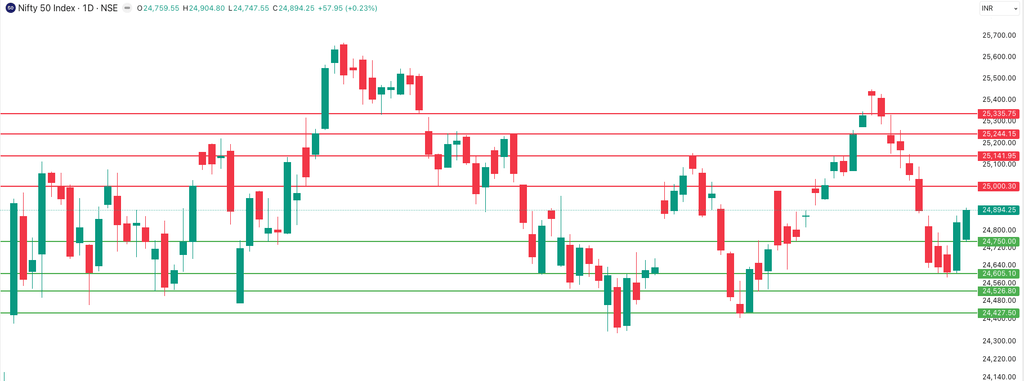

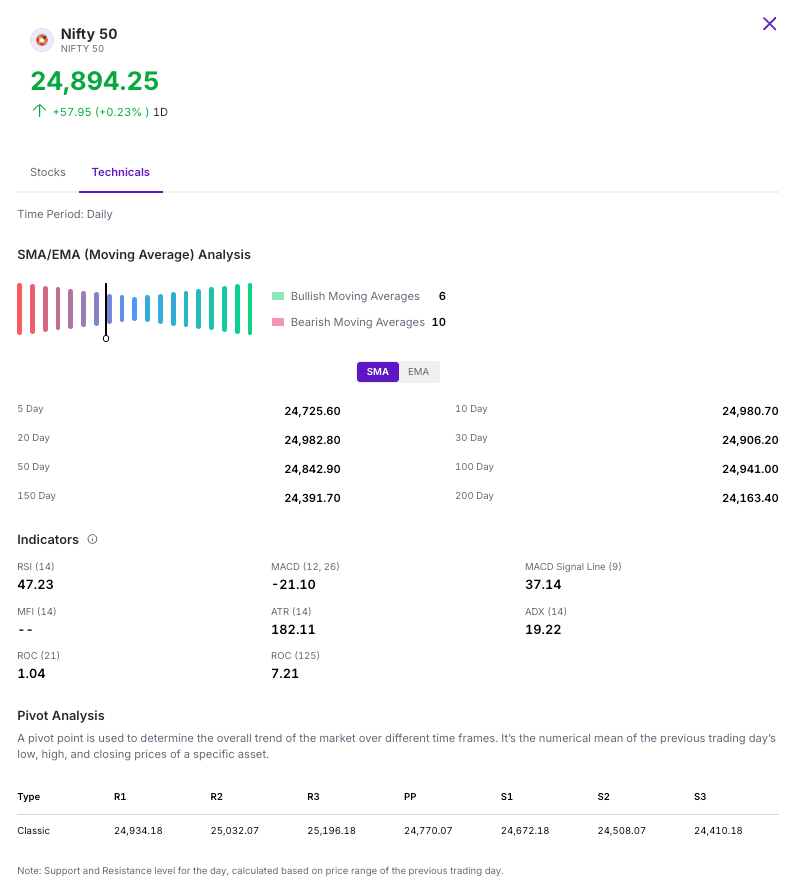

The Nifty 50 gained 0.9% this week, breaching the key 24,800 level and closing above its 50-day SMAs. The rally was primarily led by gains in metal, and banking stocks.the next nearest resistance at 25,000 and support is at around 24,750

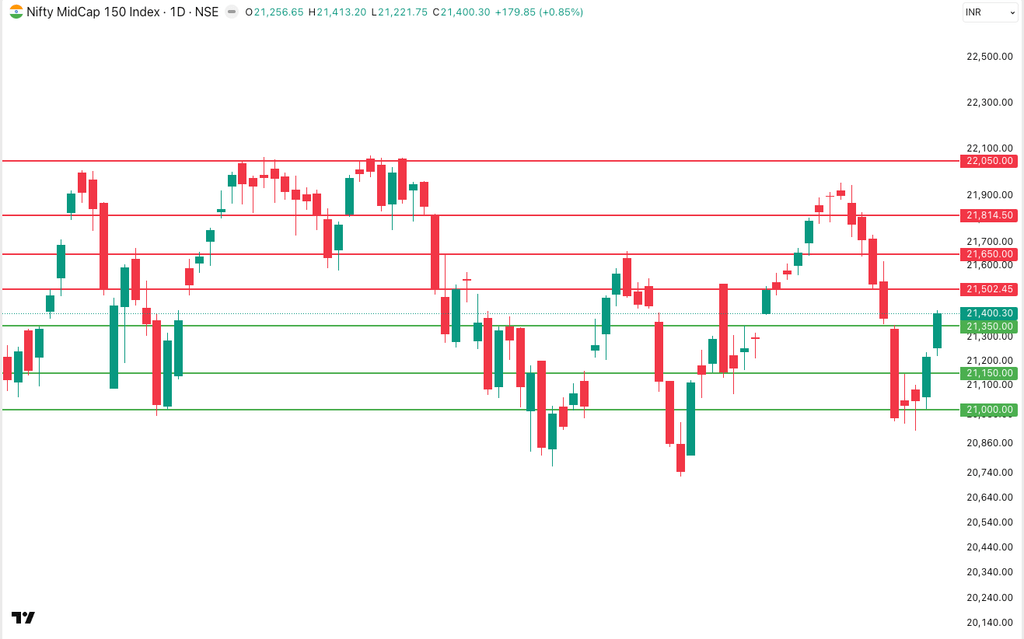

The Nifty Midcap 150 index showed resilience this week, gaining approximately 2.06% to close at 21,400.30. The index may found support around the 21,350 level. Should it dip below this, the next significant support lies in the 21,000 to 21,100 zone. On the upside, a sustained break above the immediate resistance at 21,500 could clear the path for a move towards the 21,750 mark.

The Nifty Smallcap 250 gained about 1.99% this week, ending at 17,015.30 on Friday. A breakout above 17,150 or a breakdown below 16,750 will be key to determining the next leg of its momentum.

This Week’s Spotlight Story

A deep dive into the headline that defined market conversations

RBI Holds Rate Steady, Focuses on Banking Reforms

The Reserve Bank of India’s (RBI) Monetary Policy Committee (MPC) recently maintained the Repo Rate at 5.5% with a ‘Neutral’ stance.

This pause signals a wait-and-watch approach, assessing the impact of earlier rate cuts and lower-than-expected inflation, which has been revised down for the fiscal year.

For the banking sector, the outcome provides stability in borrowing costs, meaning EMIs on floating rate loans are unlikely to change immediately.

More significantly, the RBI announced structural reforms to boost credit flow and resilience.

These include easing norms for banks to finance corporate acquisitions and increasing lending limits against shares and for IPO financing.

The central bank also proposed introducing an Expected Credit Loss (ECL) provisioning framework to align with global best practices, aiming to strengthen the overall financial system’s health.

The stability allows banks to focus on regulatory transitions and improving.

Buzz

Indian Market in September: Big Corporate Moves, IPO Wave, Reform Tailwinds & More

September was a month of contrasts for Indian equities. For most of the month, markets held steady, supported by strong economic indicators and healthy domestic demand. But this calm was shaken in the final week, when global uncertainties, ranging from fresh tariff threats to policy changes in the US, sparked a sharp sell-off led by foreign investors.

That’s a wrap for this week.

As the markets pause to catch their breath, we’ll be back next week with sharper insights and stories to help you invest intelligently.

Disclaimer and Disclosure

Investments in the securities market are subject to market risks, read all the related documents carefully before investing. Registration granted by SEBI, enlistment as Research Analyst with Exchange and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. Kindly refer to https://share.market/ for more details.Investments in WealthBaskets are subject to the Terms of Service. All investors are advised to conduct their own independent research into investment strategies before making an investment decision. Mutual Fund investments are subject to market risks, read all scheme related documents carefully. PPWB acts as a distributor of mutual funds and it is not an exchange traded product. PPWB acts as a distributor of mutual funds and WealthBaskets and it is not an exchange traded product. Disputes with respect to the distribution activity of Mutual Funds and WealthBaskets will not have access to Exchange investor redressal or Arbitration mechanism. The securities are quoted as an example and not as a recommendation. This is for informational purposes and should not be considered as recommendations.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887 and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226. Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA. CIN: U65990KA2021PTC146954