Share Market Weekly

- Share.Market

- 5 min read

- 26 Sep 2025

Highlights

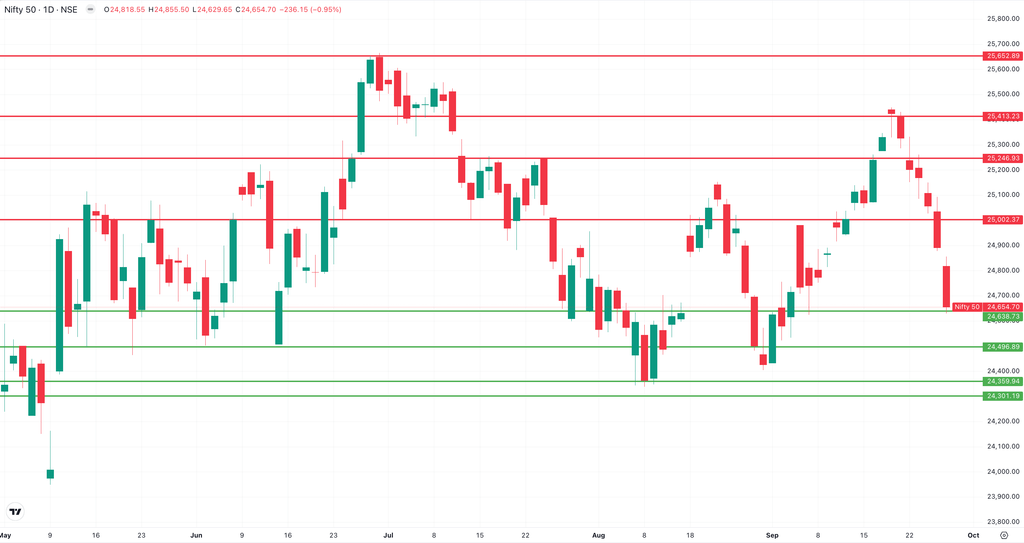

Nifty 50 24,654.70 🔻 2.67%

| Monday | 🔻 0.49% |

| Tuesday | 🔻 0.13% |

| Wednesday | 🔻0.45% |

| Thursday | 🔻 0.66% |

| Friday | 🔻 0.95% |

What moved the market?

Top Gainers & Top Losers

| Nifty IT | 🔻 7.53% | Nifty Media | 🔻 3.49% |

| Nifty Realty | 🔻 5.65% | Nifty Healthcare Index | 🔻 3.44% |

| Nifty Consumer Durables | 🔻 5.16% | Nifty Pharma | 🔻 3.30% |

Markets this week

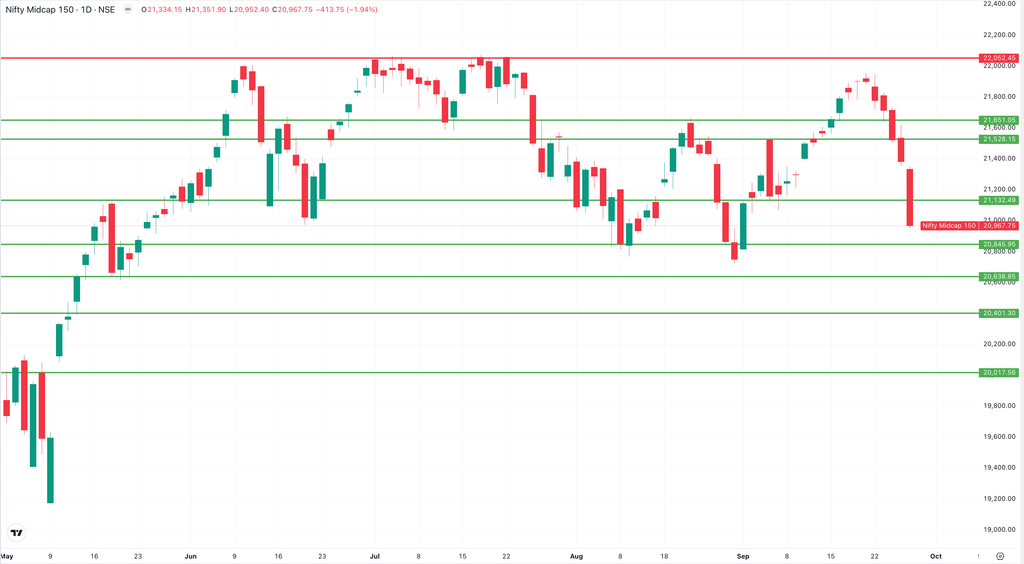

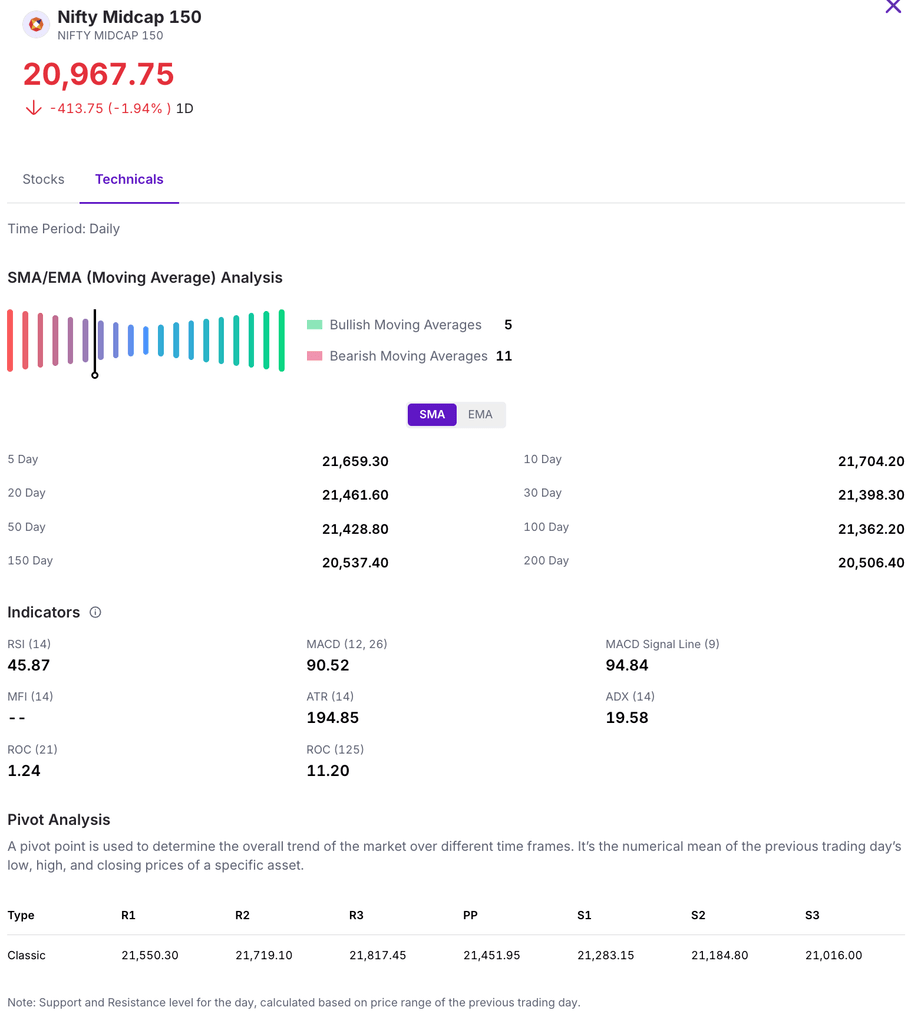

| Nifty Midcap 150 | 20,967.75 🔻 3.95% |

| Nifty Smallcap 250 | 16,683.10 🔻 4.51% |

| India VIX | 11.43 🔼 11.51% |

Stocks in the Spotlight

Top Gainers

| Name of the company | Movement | Factors | ||||

| Momentum | Value | Quality | Low Vol | Sentiment | ||

| Netweb Technologies India Ltd. | 🔼 21.65% | 5/5 | 1/5 | 5/5 | 2/5 | NA |

| Anant Raj Ltd. | 🔼 16.09% | 3/5 | 1/5 | 4/5 | 2/5 | NA |

Top Losers

| Name of the company | Movement | Factors | ||||

| Momentum | Value | Quality | Low Vol | Sentiment | ||

| Coforge Ltd. | 🔻 15.68% | 4/5 | 2/5 | 5/5 | 5/5 | 3/5 |

| Balrampur Chini Mills Ltd. | 🔻 12.46% | 5/5 | 4/5 | 4/5 | 5/5 | 1/5 |

Technical Analysis

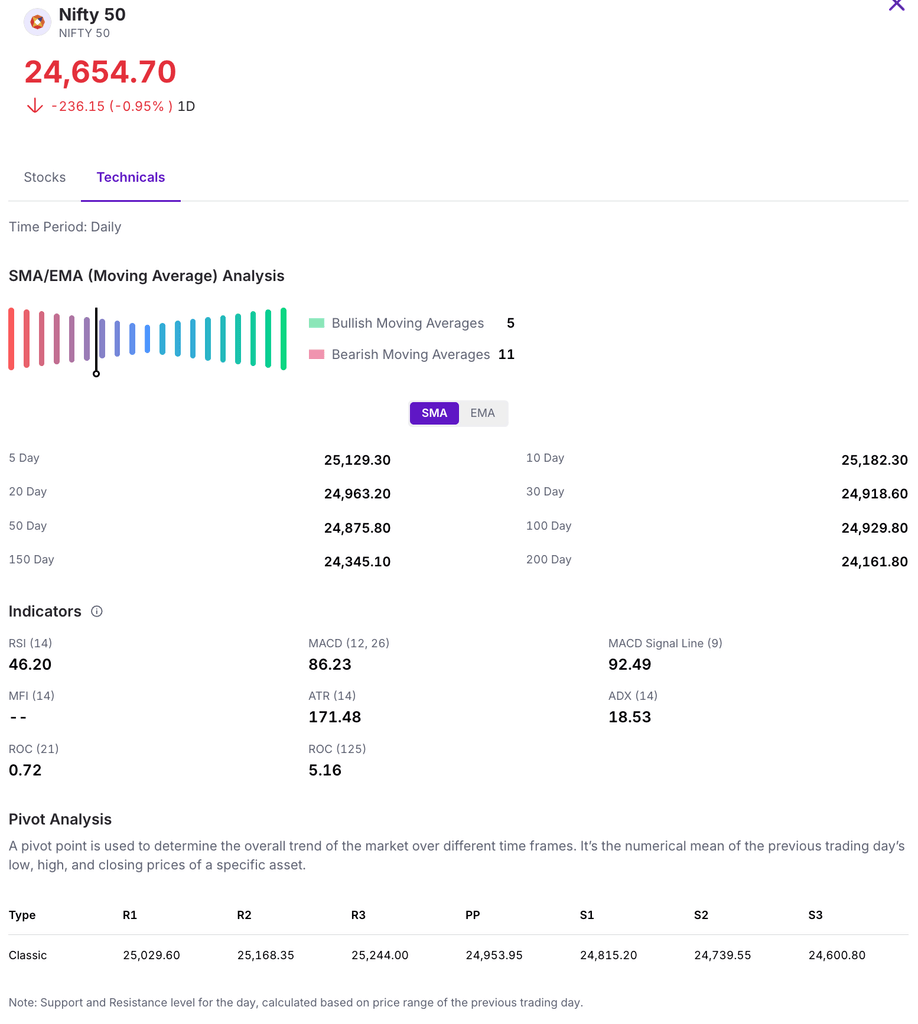

The Nifty 50 dropped 2.67% this week, closing at 24,654.7, pressured by pharma and IT sectors. Immediate Support: 24,500; Immediate Resistance: 25,000

The Nifty Midcap 150 declined 3.95%, ending at 20,967.75, showing weakness amid broader caution. The index found consistent support around the 20,800 level. Should it dip below this, the next significant support is located near 20,600. On the upside, a sustained break above the immediate resistance at 21,500.

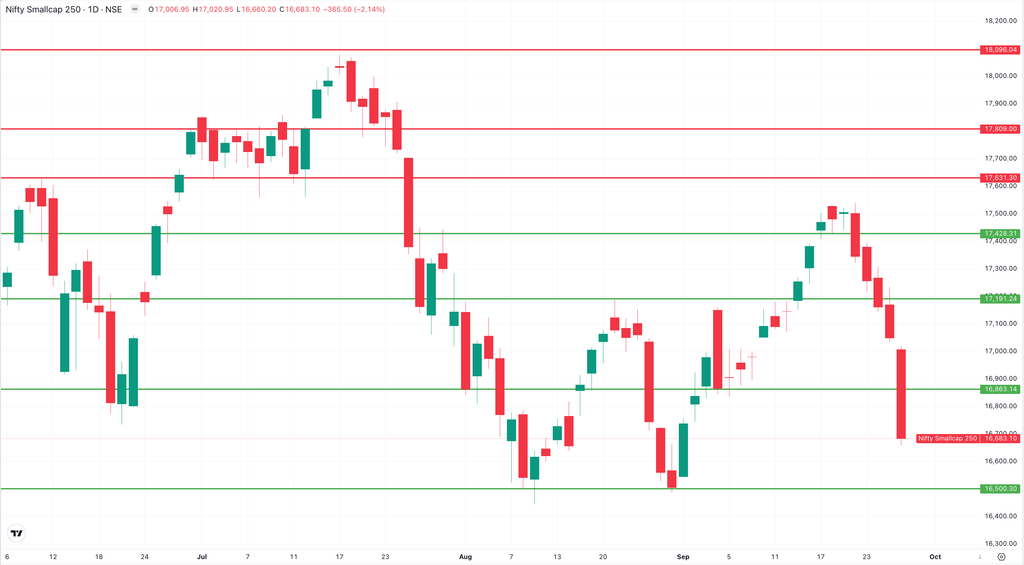

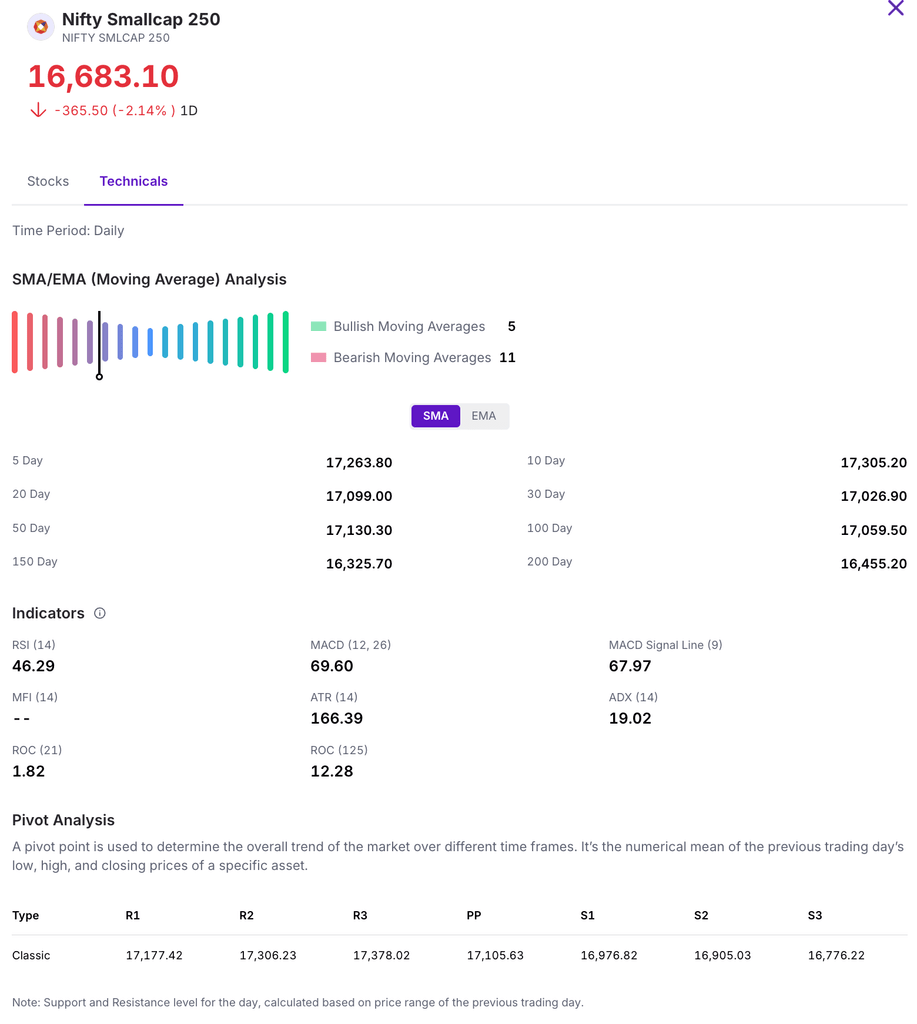

The Nifty Smallcap 250 also slipped 4.51%, closing near 16,683, reflecting similar risk-off sentiment. Immediate support: 16,500; Immediate Resistance: 16,860

This Week’s Spotlight Story

A deep dive into the headline that defined market conversations

Fresh Tariffs Shake Indian Markets

US President Donald Trump’s administration has announced a fresh round of tariffs, significantly impacting sectors critical to India’s export economy.

The most disruptive move is the impending 100% tariff on all imported branded and patented pharmaceutical products, effective October 1, 2025, unless firms establish US manufacturing plants.

This policy triggered an immediate selloff in Indian pharma stocks, with the Nifty Pharma index and heavyweights like Sun Pharma plunging, despite India being a major exporter of generic drugs.

Other new levies include a 25% tariff on heavy-duty trucks, 50% on kitchen cabinets and bathroom vanities, and 30% on upholstered furniture.

These moves, intended to protect American industries, compound the pressure on India’s exports, which are already struggling under existing reciprocal tariffs of up to 50% on labor-intensive goods like textiles and gems.

Buzz

A Simple Guide for Investors: Why Are So Many Companies Going Public?

In this article, we’ll explain why so many companies are choosing to list right now. We’ll also explore who is actually investing in these IPOs, the key risks you need to be aware of, and a quick checklist that every investor should review before investing.

That’s a wrap for this week.

As the markets pause to catch their breath, we’ll be back next week with sharper insights and stories to help you invest intelligently.

Disclaimer and Disclosure

Investments in the securities market are subject to market risks, read all the related documents carefully before investing. Registration granted by SEBI, enlistment as Research Analyst with Exchange and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. Kindly refer to https://share.market/ for more details.Investments in WealthBaskets are subject to the Terms of Service. All investors are advised to conduct their own independent research into investment strategies before making an investment decision. Mutual Fund investments are subject to market risks, read all scheme related documents carefully. PPWB acts as a distributor of mutual funds and it is not an exchange traded product. PPWB acts as a distributor of mutual funds and WealthBaskets and it is not an exchange traded product. Disputes with respect to the distribution activity of Mutual Funds and WealthBaskets will not have access to Exchange investor redressal or Arbitration mechanism. The securities are quoted as an example and not as a recommendation. This is for informational purposes and should not be considered as recommendations.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887 and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226. Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA. CIN: U65990KA2021PTC146954