Share Market Weekly

- Share.Market

- 5 min read

- 08 Aug 2025

Highlights

Nifty 50 24,363.30 🔻 0.95%

| Monday | +0.64% |

| Tuesday | -0.30% |

| Wednesday | – 0.31% |

| Thursday | +0.09% |

| Friday | – 0.95% |

Markets this week

| Nifty Midcap 150 | 20,848.25 (-3.21%) |

| Nifty Smallcap 250 | 16,541.90 (-3.57%) |

| India VIX | 12.03 (+7.41%) |

Stocks in the Spotlight

Top Gainers

| Name of the company | Movement | Factors | ||||

| Momentum | Value | Quality | Low Vol | Sentiment | ||

| Sarda Energy & Minerals Ltd. | 🔼 19.54% | 3/5 | NA | 4/5 | 3/5 | NA |

| Kajaria Ceramics Ltd. | 🔼 11.17% | 5/5 | 2/5 | 5/5 | 5/5 | 5/5 |

Top Losers

| Name of the company | Movement | Factors | ||||

| Momentum | Value | Quality | Low Vol | Sentiment | ||

| PG Electroplast Ltd. | 🔻27.46% | 2/5 | 1/5 | 5/5 | 2/5 | 2/5 |

| PNB Housing Finance Ltd. | 🔻21.85% | 5/5 | 5/5 | 1/5 | 4/5 | 2/5 |

Technical Analysis

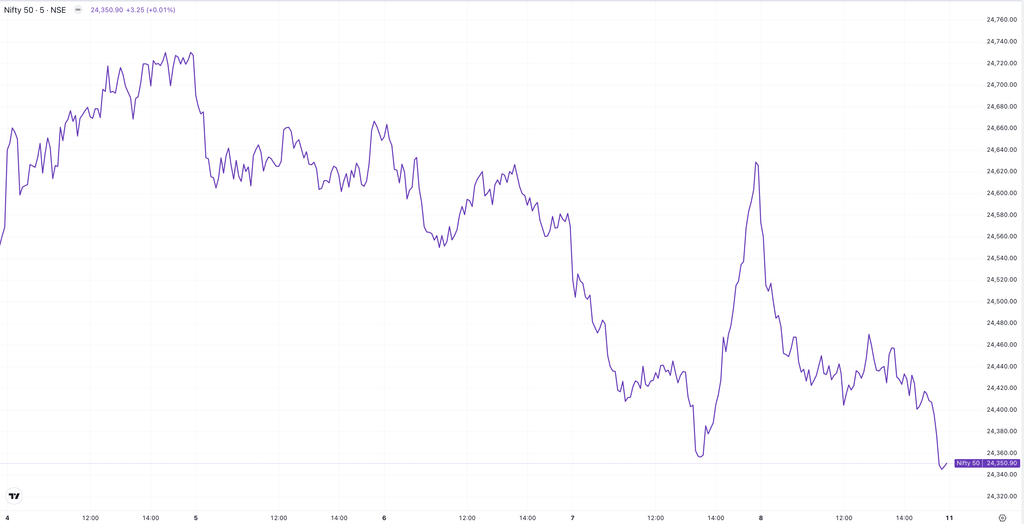

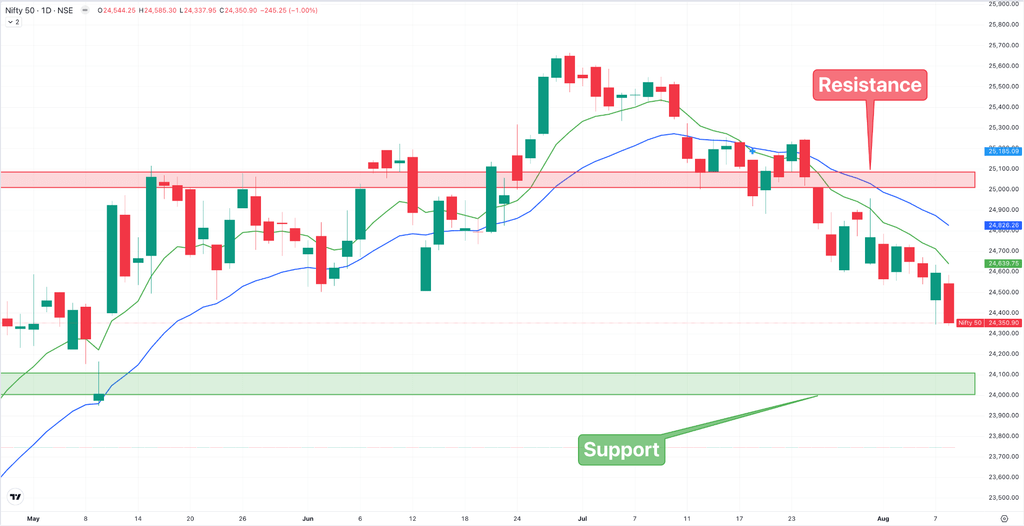

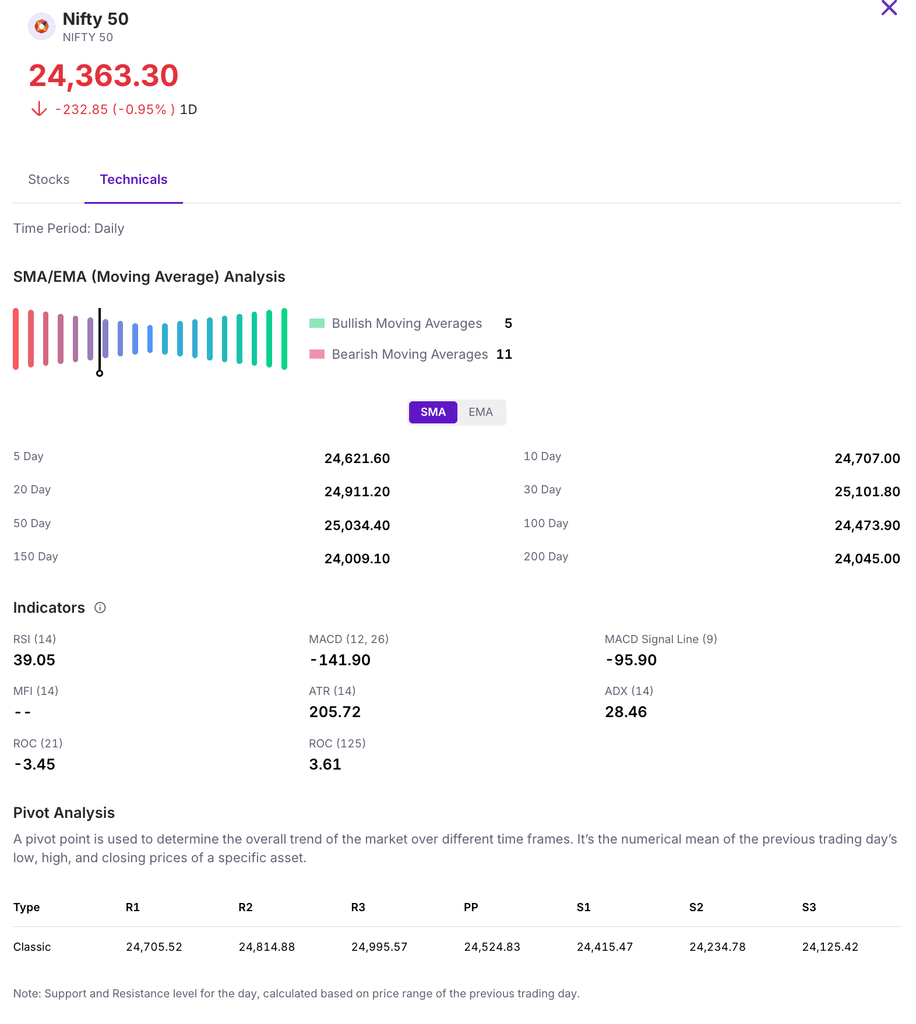

This week, the Nifty 50 fell by 491 points, or 1.98%, to close at 24,363 on Friday. Both its short-term 9-day and 21-day moving averages have turned downward, signaling a weakening trend. On the downside, the index has support between 24,000 and 24,100, while on the upside, resistance is expected around 25,000 to 25,100.

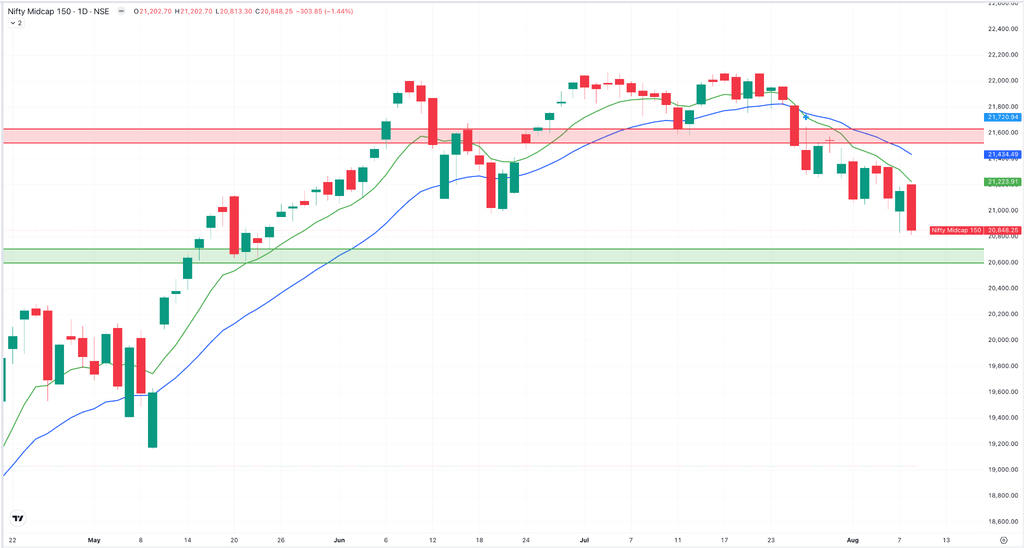

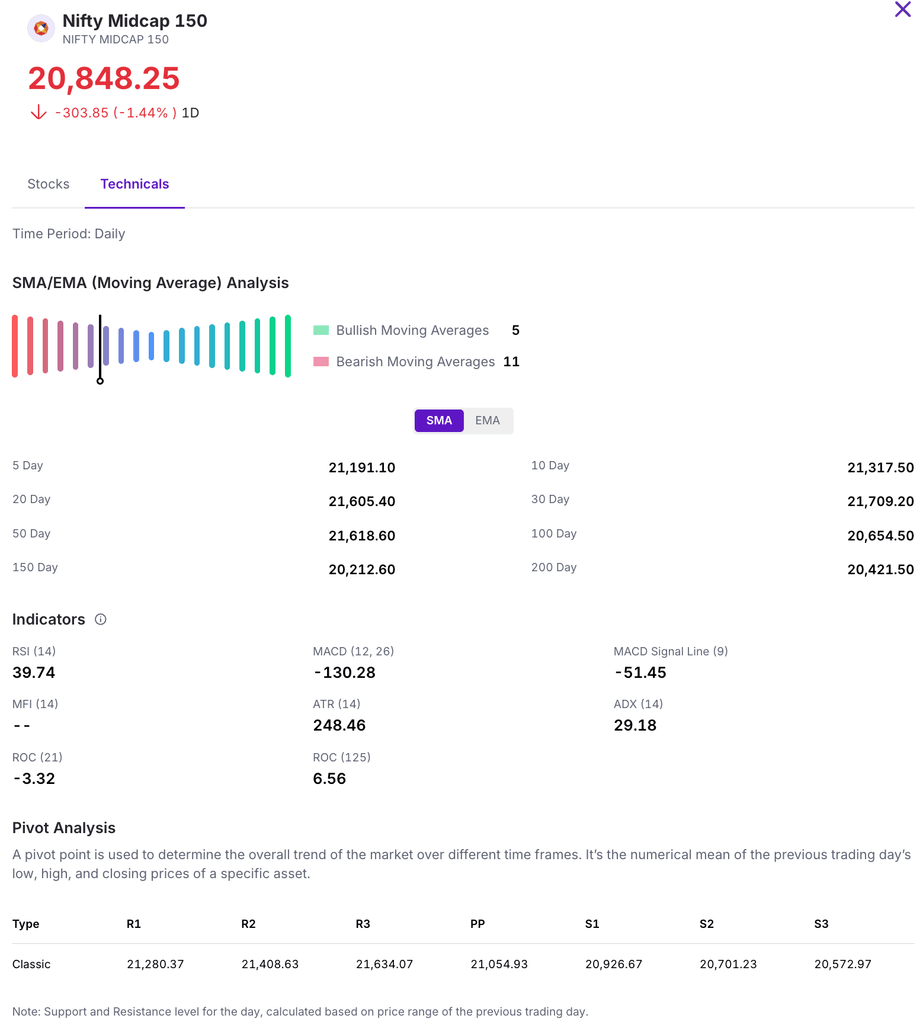

The Nifty Midcap 150 fell 692 points, or 3.21%, this week, slipping below the 21,000 mark to close at 20,848. The index is now testing immediate support in the 20,600–20,700 range, while resistance is placed at 21,000 and 21,500.

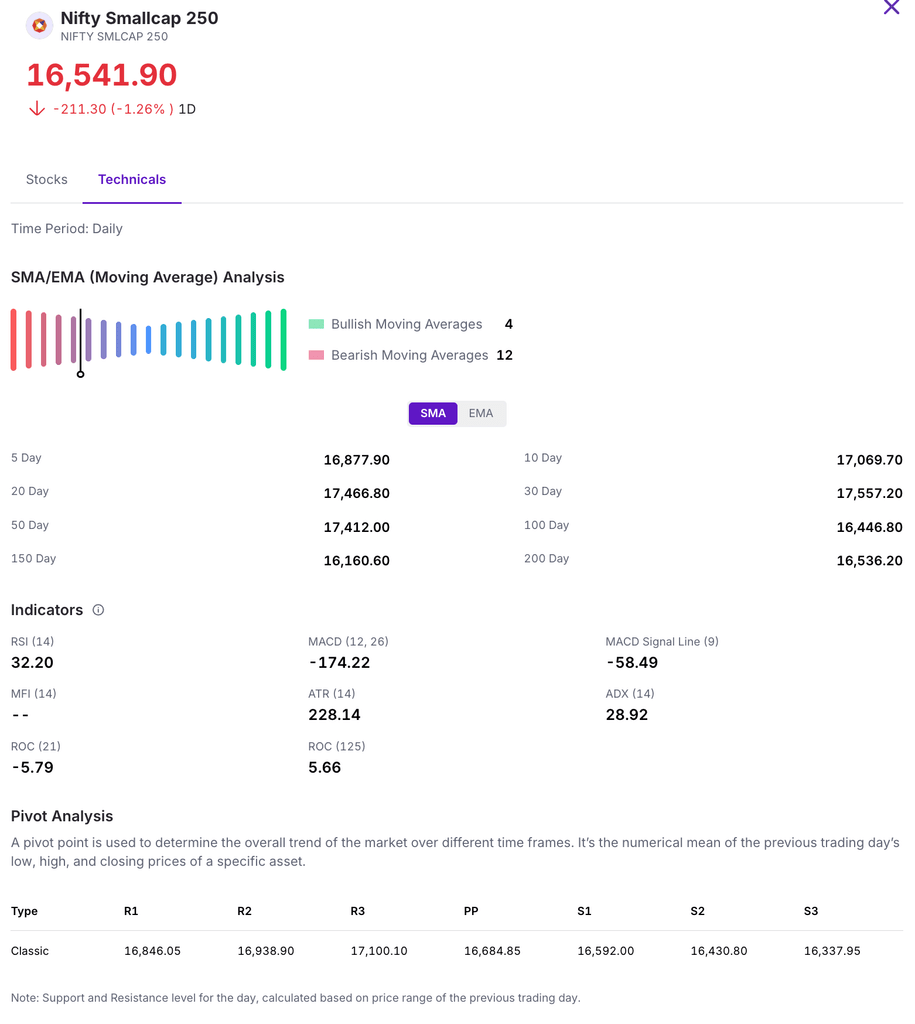

The Nifty Smallcap 250 dropped 759 points, or 4.39%, this week to close at 16,541. For an upside next week, the index must break above the 16,800–16,900 resistance zone. If it fails, immediate support lies between 16,000 and 16,100.

This Week’s Spotlight Story

A deep dive into the headline that defined market conversations

US Doubles Tariffs on Indian Goods: Key Exports at Risk

The US has announced a steep hike in tariffs on Indian goods — from 25% to 50% — threatening major export sectors like auto parts, jewellery, textiles, and seafood. Pharma is safe, for now, but it’s still under review.

India exports ₹61,000 crore worth of auto parts to the US annually, and nearly half of that is now at risk. With costs set to rise on items like car and tractor parts, Indian manufacturers may lose their competitive edge.

Jewellery exports of almost ₹80,000 crore are also under pressure. While the UAE pays just 10% and Mexico 25% in duties, India will now pay 50%, prompting many exporters to consider relocating production.

Seafood, especially shrimp exports worth ₹60,000 crore, could lose ₹24,000 crore in sales as countries like Vietnam and Indonesia enjoy lower tariffs of around 19–20%.

The textile industry is lobbying for removal of the 11% duty on imported raw cotton. In return, India might ease tariffs on US farm goods like almonds, walnuts, and apples.

These new duties, driven by India’s continued Russian oil imports, take effect August 27. Economists warn of potential drops in exports, pressure on the rupee, and weaker investor sentiment if no resolution is found.

Buzz

What is Grey Market Premium: Learn Everything GMP & How IPO Shares are Traded in the Grey Market

Grey Market Premium (GMP) reflects investor sentiment for IPOs before official listing and is widely tracked despite being unregulated. This article explains how IPO shares are traded informally in the grey market, the types of transactions like GMP, Kostak, and Sauda deals, and the risks involved.

That’s a wrap for this week.

As the markets pause to catch their breath, we’ll be back next week with sharper insights and stories to help you invest intelligently.

Disclaimer and Disclosure

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887 and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst with Exchange and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954