Share Market Weekly

- Share.Market

- 5 min read

- 01 Aug 2025

Highlights

Nifty 50 24,734.90 🔻 2.60%

| Monday | – 0.63% |

| Tuesday | + 0.57% |

| Wednesday | + 0.14% |

| Thursday | – 0.35% |

| Friday | – 0.82 % |

Markets this week

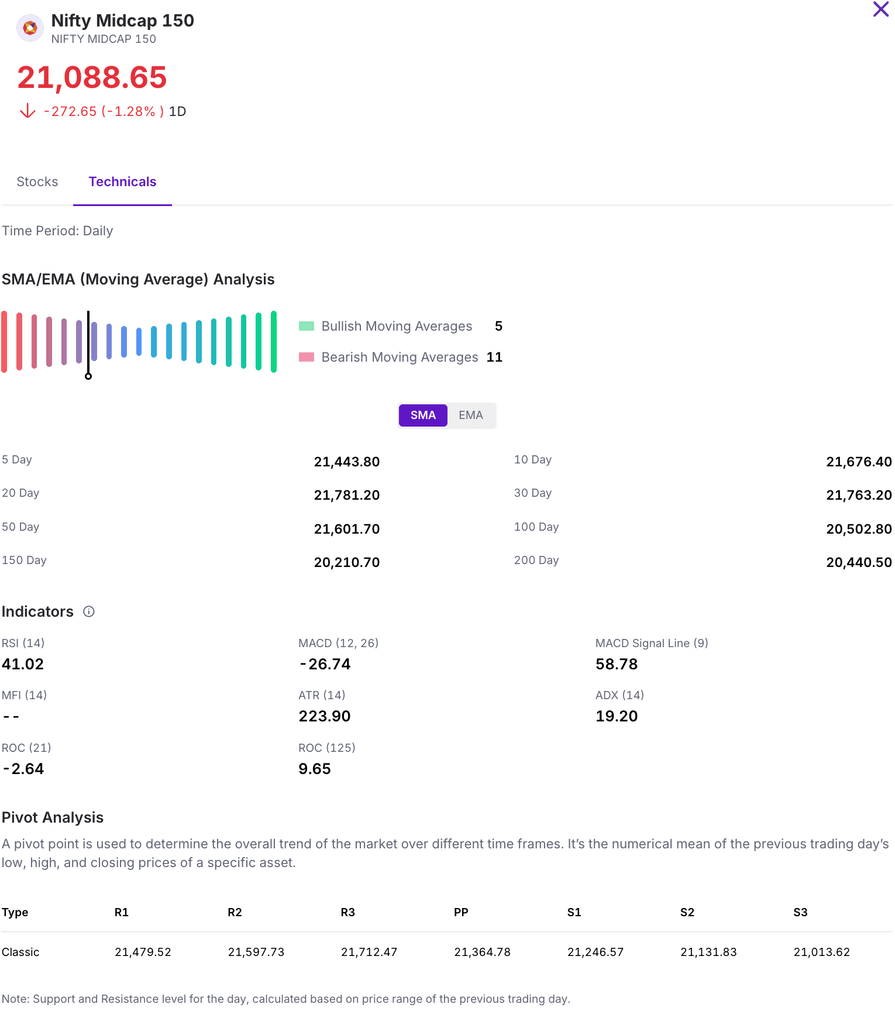

| Nifty Midcap 150 | 21,088.65 (-3.92%) |

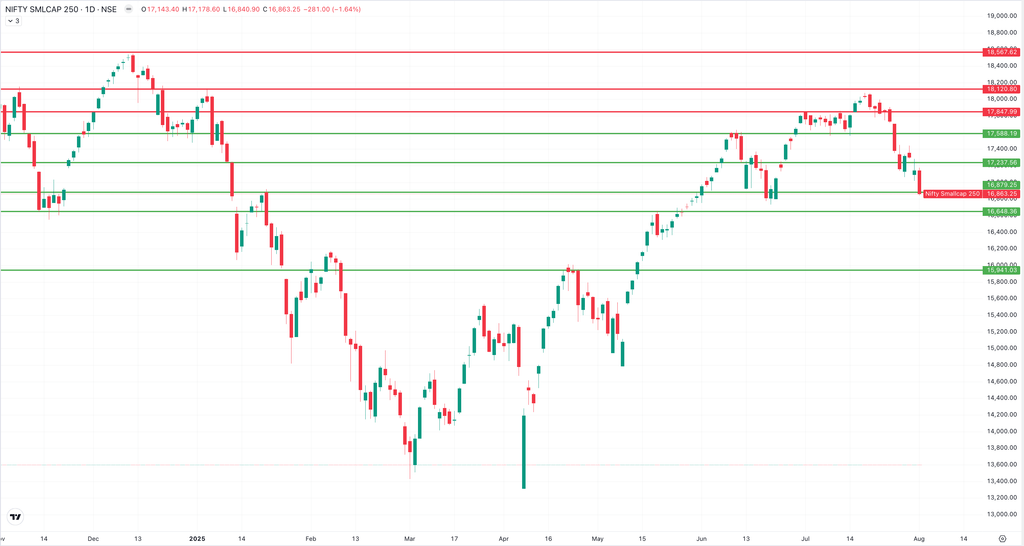

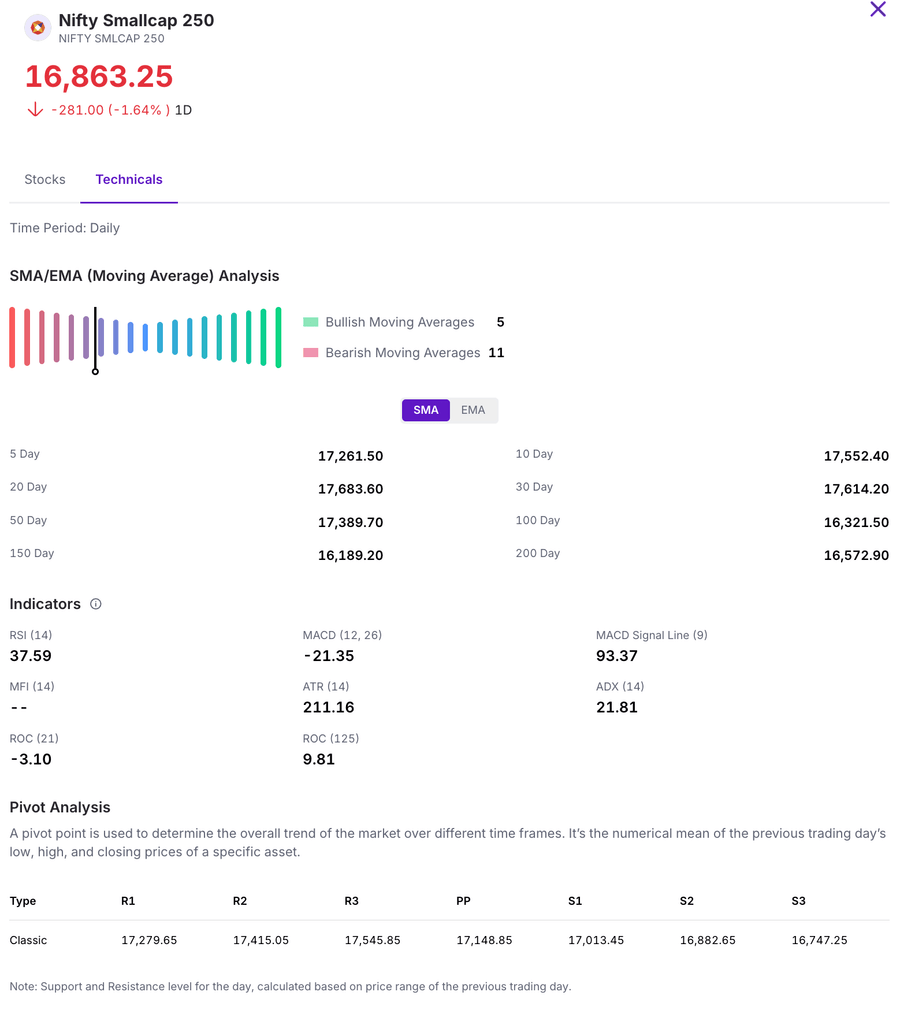

| Nifty Smallcap 250 | 16,863.25 (-5.54%) |

| India VIX | 11.98 (+13.99%) |

Stocks in the Spotlight

Top Gainers

| Name of the company | Movement | Factors | ||||

| Momentum | Value | Quality | Low Vol | Sentiment | ||

| GE Vernova T&D India Ltd. | 🔼 13.57% | 5/5 | 1/5 | 5/5 | 4/5 | 5/5 |

| Kaynes Technology India Ltd. | 🔼 12.56% | 3/5 | 1/5 | 4/5 | 3/5 | 4/5 |

Top Losers

| Name of the company | Movement | Factors | ||||

| Momentum | Value | Quality | Low Vol | Sentiment | ||

| PNB Housing Finance Ltd. | 🔻 23.02% | 5/5 | 5/5 | 1/5 | 5/5 | 4/5 |

| IIFL Finance Ltd. | 🔻 19.27% | 5/5 | 3/5 | 1/5 | 4/5 | NA |

Technical Analysis

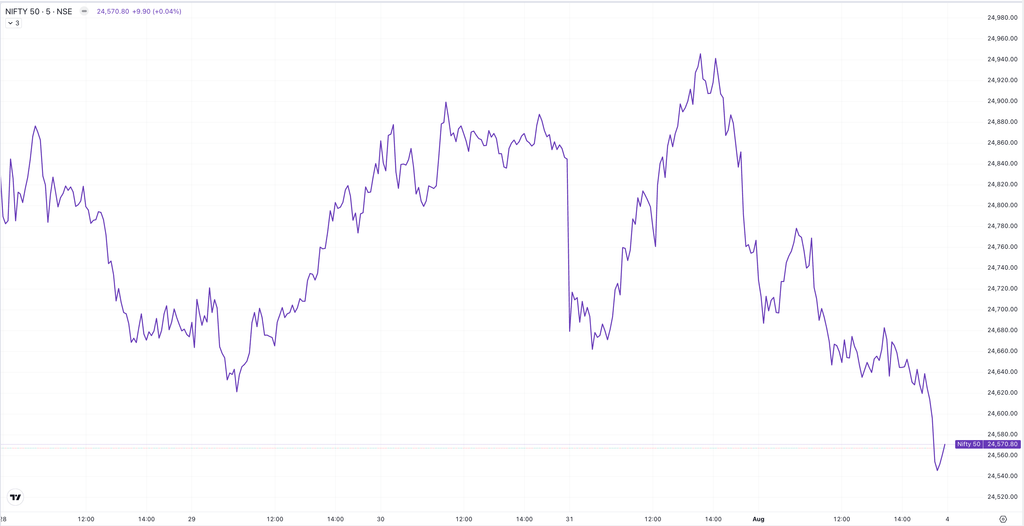

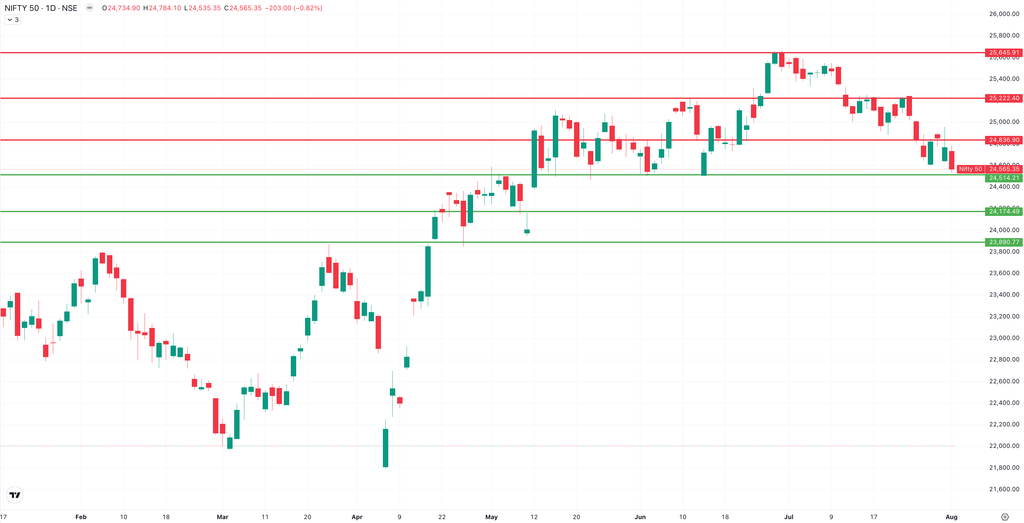

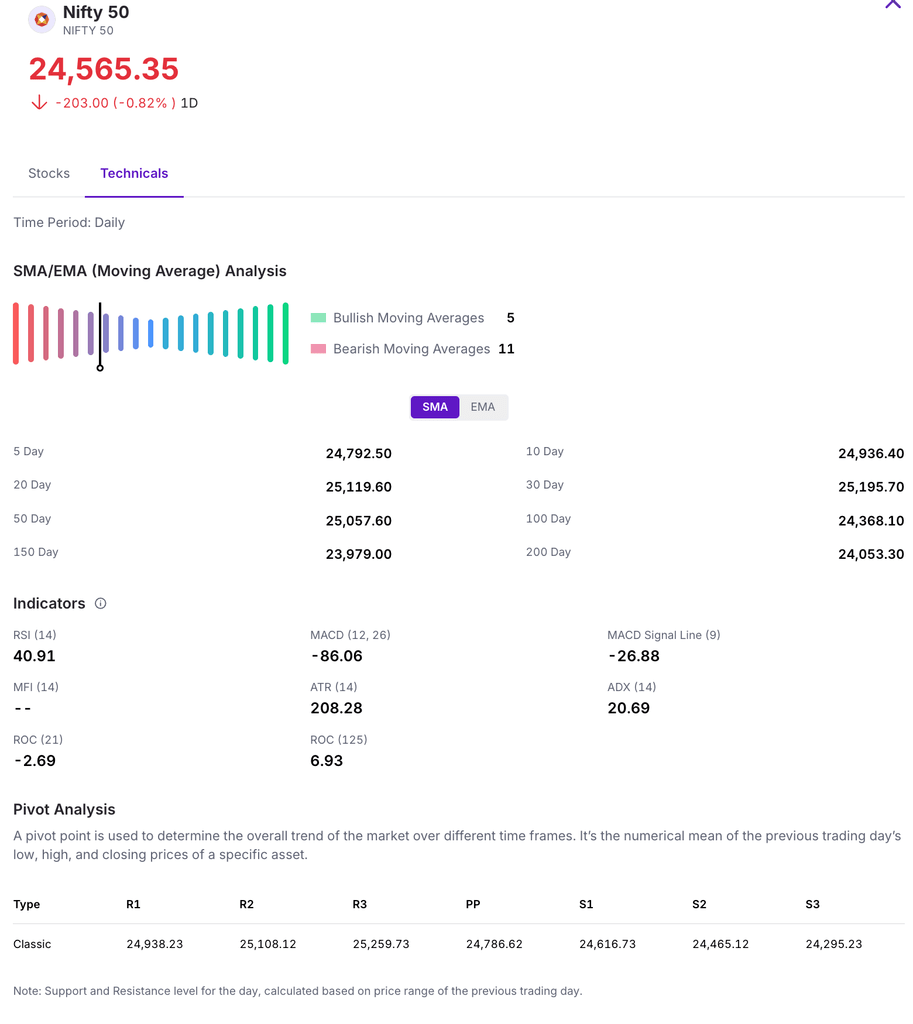

The Nifty 50 index declined by 2.6% this week, falling 654.55 points to close at 24,565.35 on Friday. The index failed to hold its key support level at 24,800, indicating bearish sentiment and overall market weakness. Looking ahead, the next critical support zone lies near 24,000–24,200, which could act as a potential cushion if the downtrend continues.

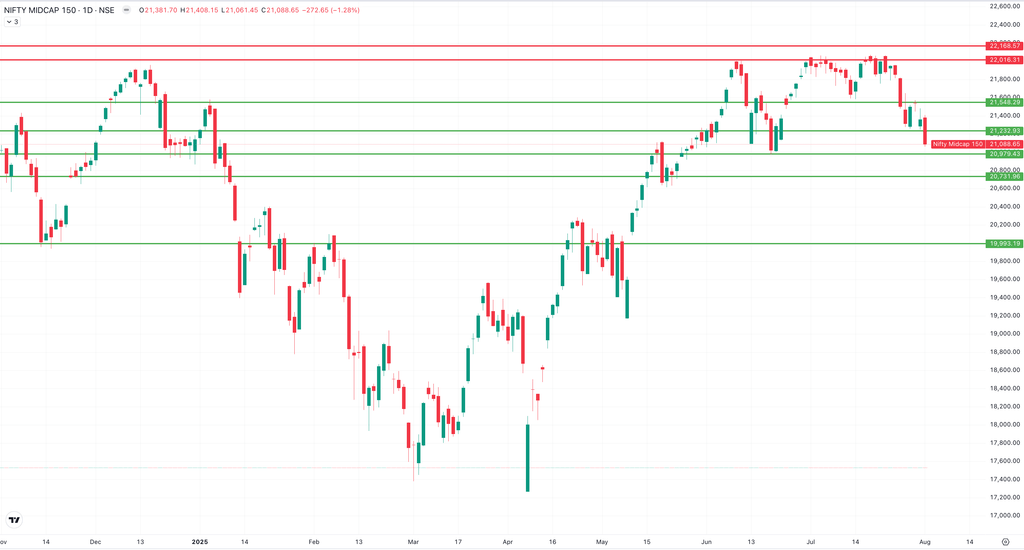

The Nifty Midcap 150 index declined by 3.92% this week, falling 860.60 points to close at 21,088.65 on Friday, August 1. While the index fell sharply over the week, it lost significant ground on Friday alone, dropping about 1.28% for the day. This indicates bearish sentiment and overall market weakness.

The Nifty Smallcap 250 index declined by 5.54% this week, falling 989.65 points to close at 16,863.25 on Friday, August 1. Although the index exhibited a sharp decline throughout the week, it lost significant ground on Friday alone, dropping around 1.64% in a single day. This reflects bearish sentiment and overall market weakness.

This Week’s Spotlight Story

A deep dive into the headline that defined market conversations

Swiggy’s Q1 Losses Widen Despite Strong Growth in Orders and Revenue

Swiggy’s consolidated net loss jumped to ₹1,197 crore in Q1 FY26, nearly double last year’s loss of ₹611 crore. This came despite a 54% YoY rise in revenue to ₹4,961 crore. The bigger loss reflects continued investments, especially in quick commerce.

The food delivery business remained steady, with Gross Order Value growing ~19% to ₹8,086 crore. Swiggy added 1.2 million monthly transacting users, the highest jump in two years. However, operating margins dropped due to delivery incentives and appraisal costs.

Instamart, Swiggy’s quick-commerce arm, posted a 108% YoY GOV growth. Average order value rose to ₹612, driven by more non-grocery items and larger baskets. The unit added 41 dark stores in the quarter, taking active space to 4.3 million sq. ft. While contribution margins improved to 4.6%, EBITDA losses still stood at -15.8%.

Its Out-of-Home segment’s GOV grew 61% YoY, driven by dining offers and event-led demand. The segment maintained a positive EBITDA margin for the second consecutive quarter.

Swiggy’s losses are still high, but it is beginning to show operating leverage. More users are spending more across different categories on the platform. The company says it has passed the peak of quick-commerce losses. Going forward, it plans to pace its investments more cautiously while aiming for scale-led profitability.

Buzz

Trump Imposed a 25% Tariff on India, India’s GDP Growth Cut to 6.3% & More

July 2025 tested investor confidence with persistent Foreign Institutional Investor (FII) outflows, muted earnings, and trade uncertainty. Despite equity market declines, strong Domestic Institutional Investor (DII) support and multi-year low inflation signaled macro resilience. Let’s take a closer look at what happened in July

That’s a wrap for this week.

As the markets pause to catch their breath, we’ll be back next week with sharper insights and stories to help you invest intelligently.

Disclaimer and Disclosure

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887 and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst with Exchange and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954