Share Market Weekly

- Share.Market

- 5 min read

- 25 Jul 2025

Highlights

Nifty 50 24,837.00 375.05 (-1.49%)

| Monday | + 0.49% |

| Tuesday | – 0.12% |

| Wednesday | + 0.63% |

| Thursday | – 0.63% |

| Friday | – 0.90% |

What moved the market?

Top Gainers & Top Losers

| Nifty Healthcare Index | + 0.74% | Nifty IT | – 5.41% |

| Nifty Metal | + 0.69% | Nifty Media | – 5.06% |

| Nifty Pharma | + 0.30% | Nifty Oil & Gas | – 4.07% |

Broader Markets this week

| Nifty Midcap 150 | 21,501.60 (- 2.25%) |

| Nifty Smallcap 250 | 17,379.95 (+3.36%) |

| India VIX | 11.28 (+0.36%) |

Stocks in the Spotlight

Top Gainers

| Name of the company | Movement | Factors | ||||

| Momentum | Value | Quality | Low Vol | Sentiment | ||

| Eternal Ltd. | 🔼 19.61% | 4/5 | 1/5 | 3/5 | 4/5 | 5/5 |

| Olectra Greentech Ltd. | 🔼 16.20% | 2/5 | 1/5 | 5/5 | 4/5 | NA |

Top Losers

| Name of the company | Movement | Factors | ||||

| Momentum | Value | Quality | Low Vol | Sentiment | ||

| Indian Energy Exchange Ltd. | 🔻 29.52% | 5/5 | 4/5 | 5/5 | 4/5 | 1/5 |

| Valor Estate Ltd. | 🔻 21.52% | 5/5 | NA | 2/5 | 3/5 | NA |

Technical Analysis

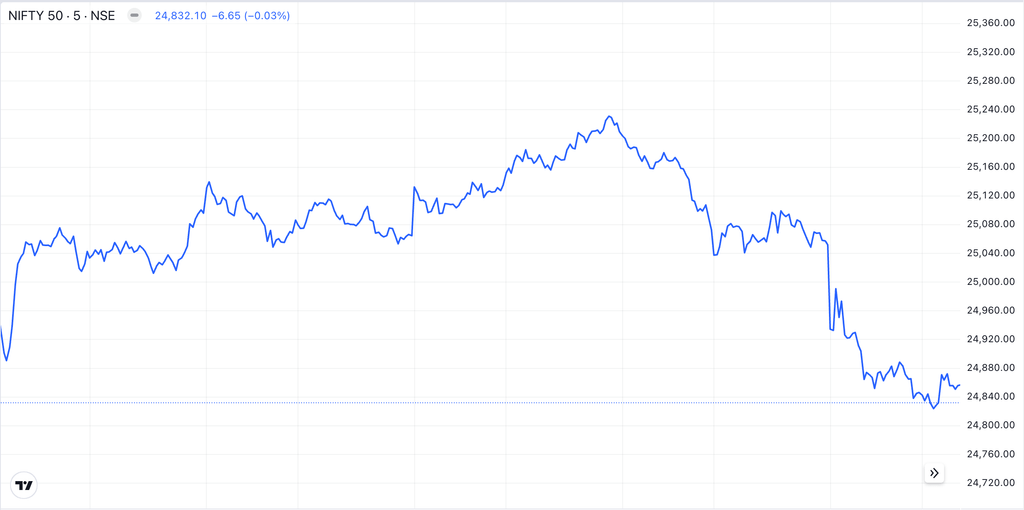

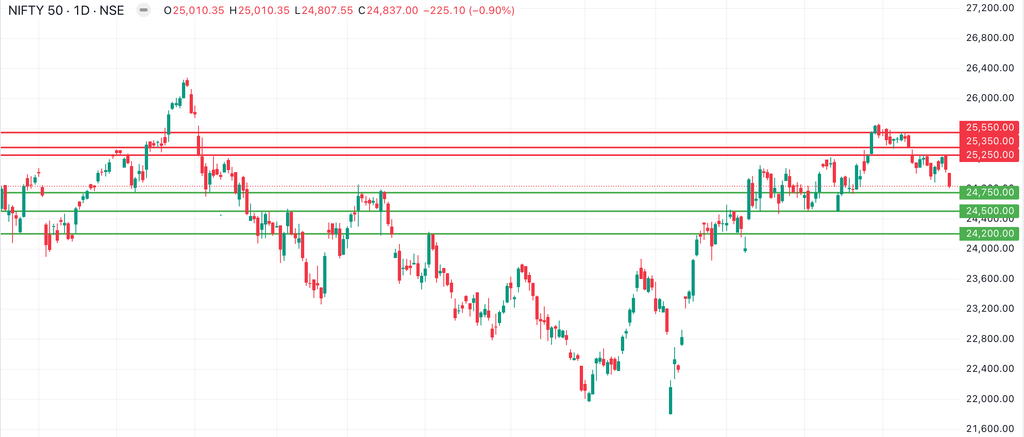

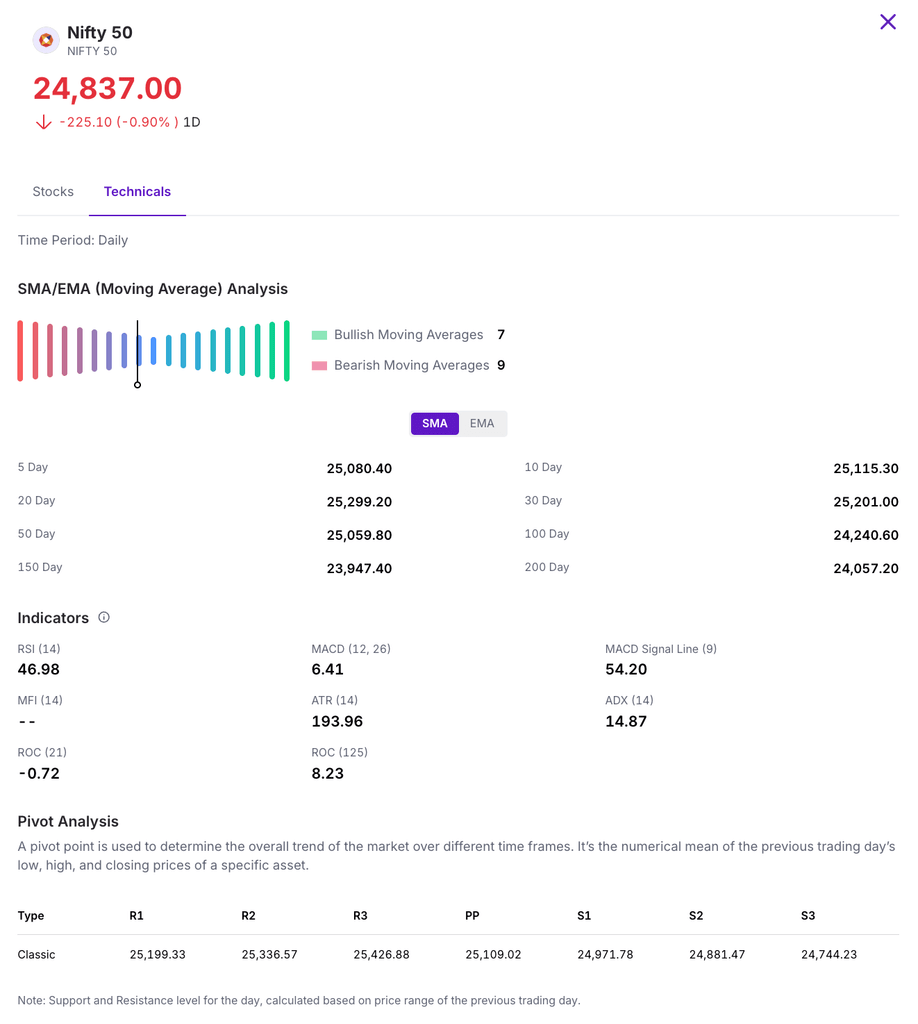

The Nifty 50 index declined by 0.53% this week, falling 131.40 points to close at 24,837.00 on Friday. The index failed to hold its key support level at 25,000, indicating bearish sentiment and overall market weakness. Looking ahead, the next critical support zone lies near 24,750–24,700, which could act as a potential cushion if the downtrend continues.

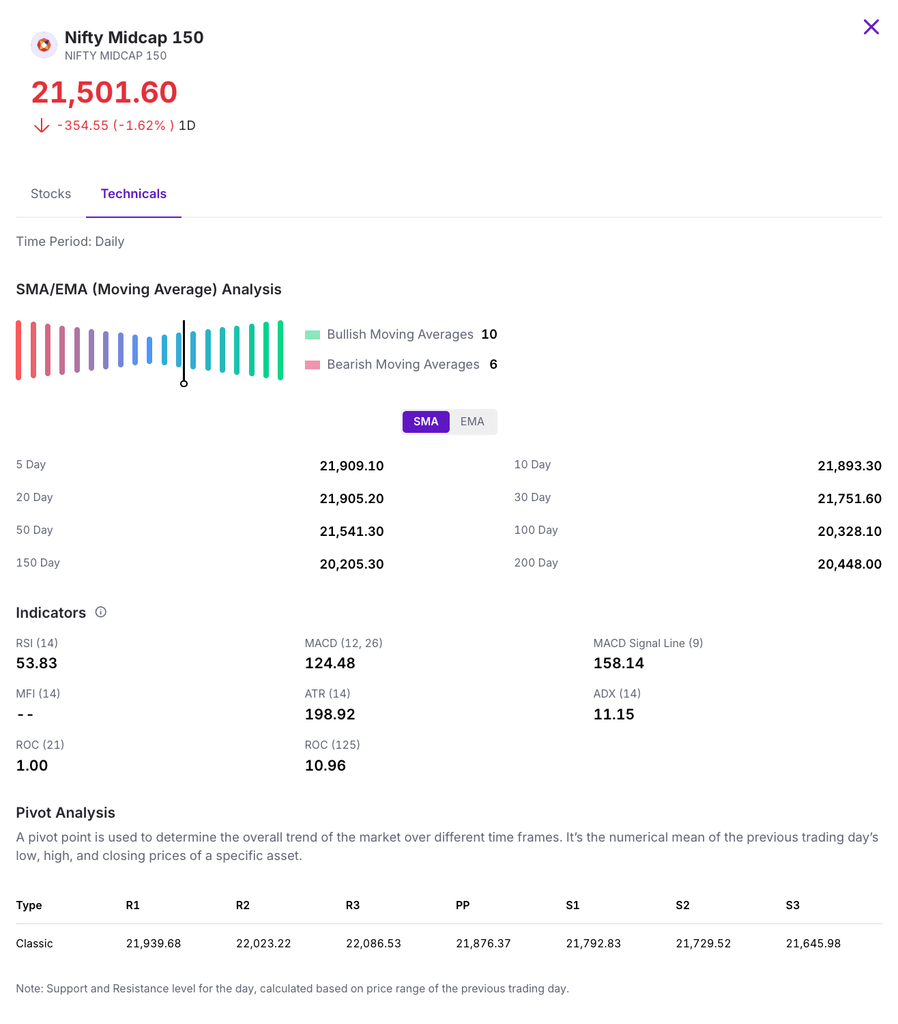

The Nifty Midcap 150 index declined by 1.63% this week, falling 357 points to close at 21,501.60 on Friday, July 25. While the index displayed a largely sideways performance over the week, it lost significant ground on Friday alone, dropping about 1.62% for the day. This indicates bearish sentiment and overall market weakness.

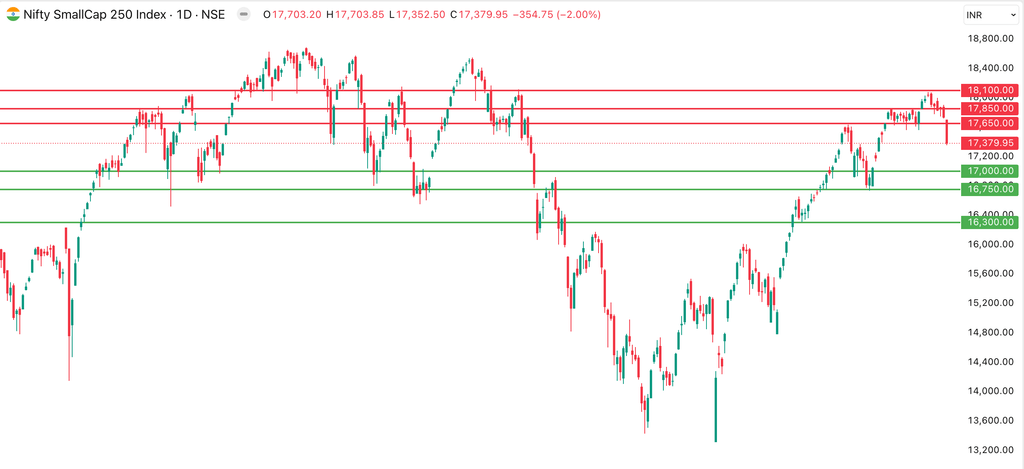

The Nifty Smallcap 250 index declined by 2.96% this week, falling 529 points to close at 17,379 on Friday, July 25. Although the index exhibited a largely sideways performance throughout the week, it lost significant ground on Friday alone, dropping around 2% in a single day. This reflects bearish sentiment and overall market weakness.

This Week’s Spotlight Story

A deep dive into the headline that defined market conversations.

India-UK Free Trade Pact: A Win for Exports, a Watchpoint for Imports

India and the UK have signed a landmark Free Trade Agreement (FTA), aiming to double bilateral trade from $56 billion to $120 billion by 2030.

A major gain for India lies in textile and apparel exports, especially for manufacturers in Tiruppur, Surat, and Ludhiana, as duties of 8–12% on garments are set to be removed, improving competitiveness and margins.

The deal also benefits jewellery and leather exporters, with gems and jewellery worth over $940 million exported last year, now entering duty-free.

Pharmaceutical exports are expected to rise as the FTA eases regulatory hurdles and provides smoother access to the UK’s NHS.

However, the agreement also brings challenges. India will gradually lower tariffs on Scotch whisky and luxury cars, reducing them significantly over the next decade.

While the near-term impact is limited due to import restrictions, this could eventually alter the dynamics in India’s premium automobile and beverage markets.

Buzz

NSDL IPO Simplified: What You Must Know Before Investing

NSDL was created to replace paper share certificates with digital ones, making buying and selling shares faster, safer, and more transparent.

In this piece, we’ll go deeper into the business model, the financial strength, and the long-term potential of NSDL.

That’s a wrap for this week.

As the markets pause to catch their breath, we’ll be back next week with sharper insights and stories to help you invest intelligently.

Disclaimer and Disclosure

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887 and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst with Exchange and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954