Share Market Weekly

- sanandanjha

- 5 min read

- 11 Jul 2025

Highlights

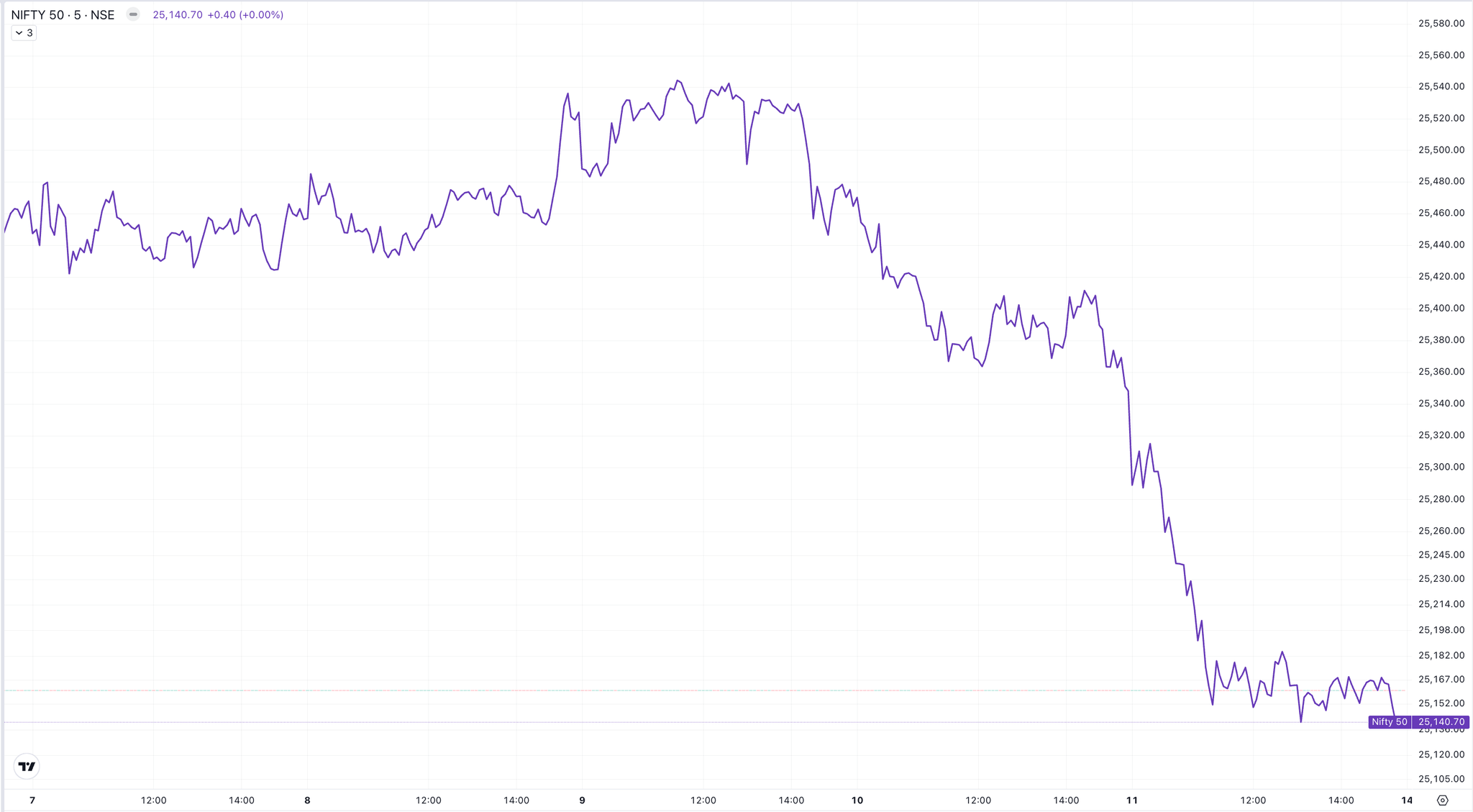

Nifty 50 25,149.85 303.55 (-1.19%)

| Monday | + 0.00% |

| Tuesday | + 0.24% |

| Wednesday | – 0.18% |

| Thursday | – 0.47% |

| Friday | – 0.81% |

What moved the market?

Top Gainers & Top Losers

| Nifty FMCG | + 2.70% | Nifty Metal | – 3.26% |

| Nifty Pharma | + 0.52% | Nifty IT | – 3.05% |

| Nifty Financial Services | – 0.03% | Nifty PSU Bank | – 2.33% |

Markets this week

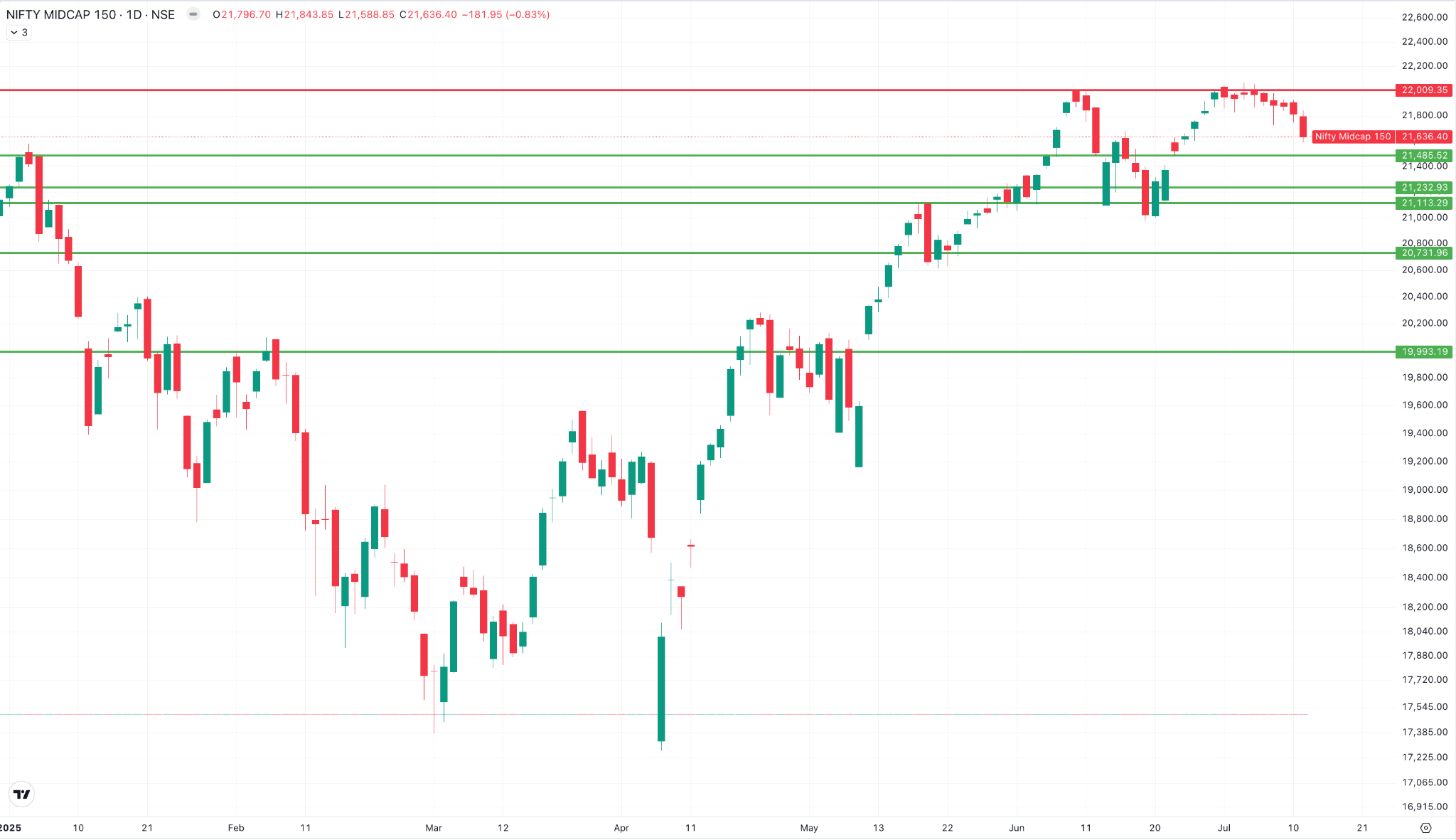

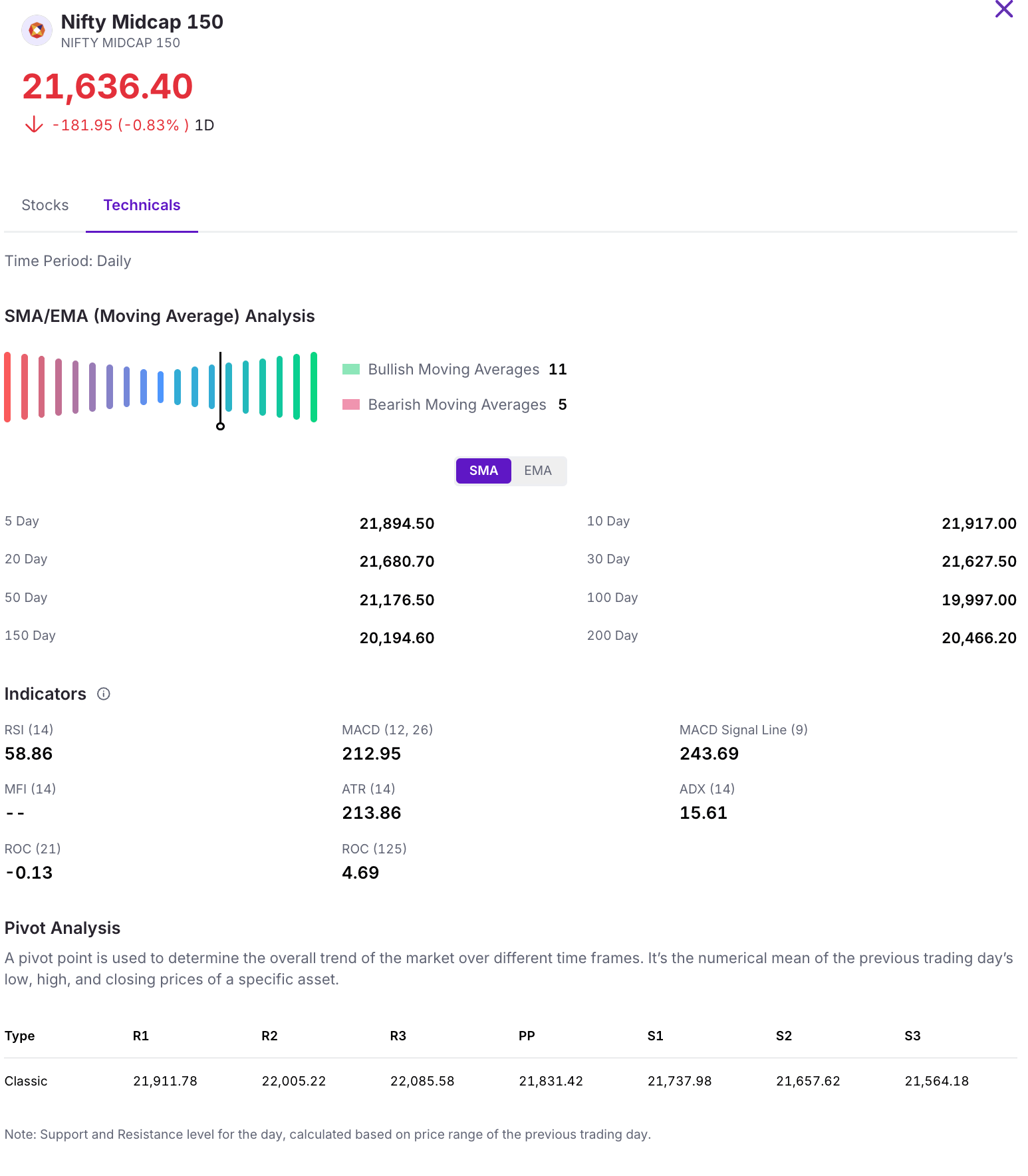

| Nifty Midcap 150 | 21,636.40 (- 0.83%) |

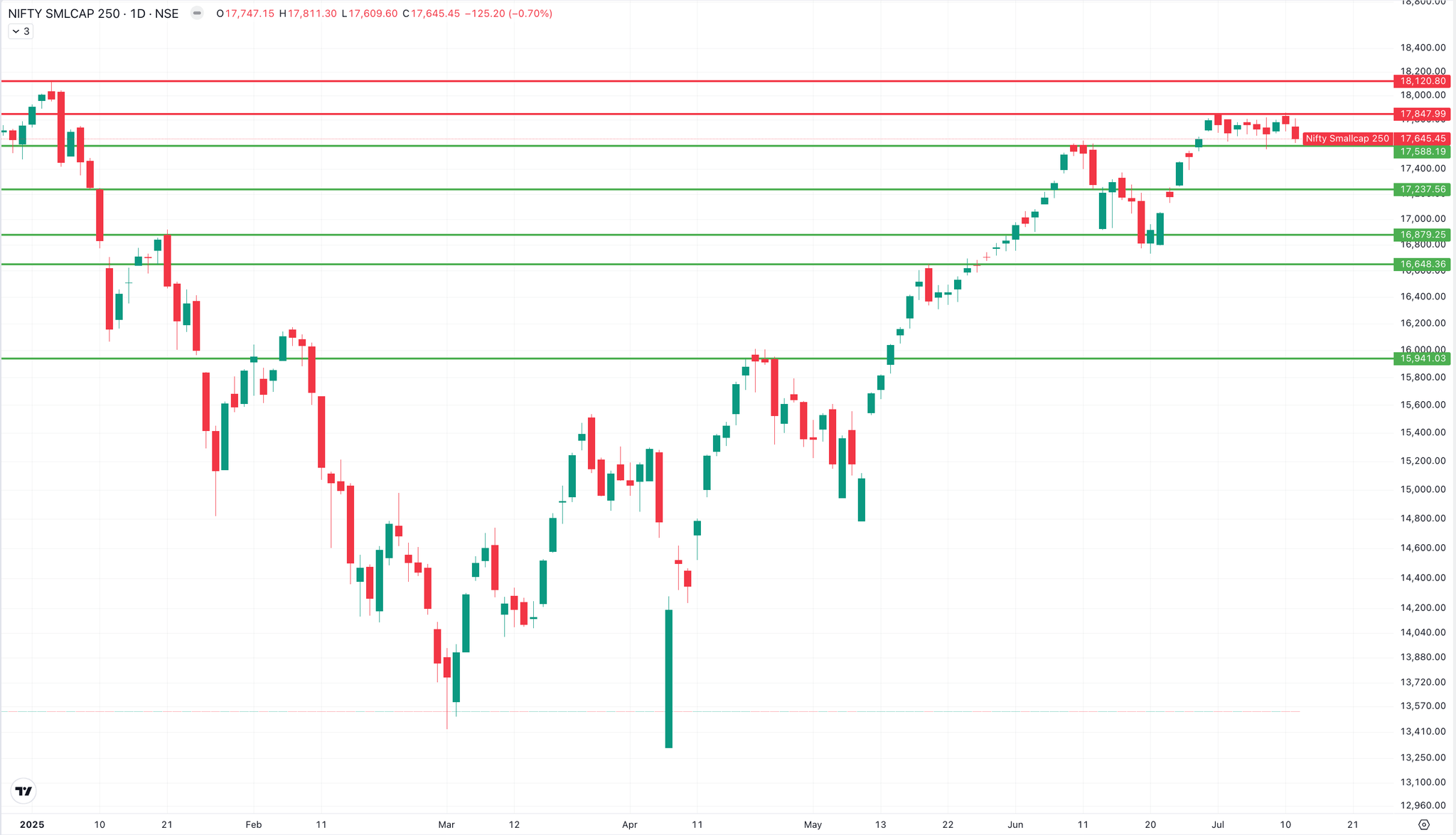

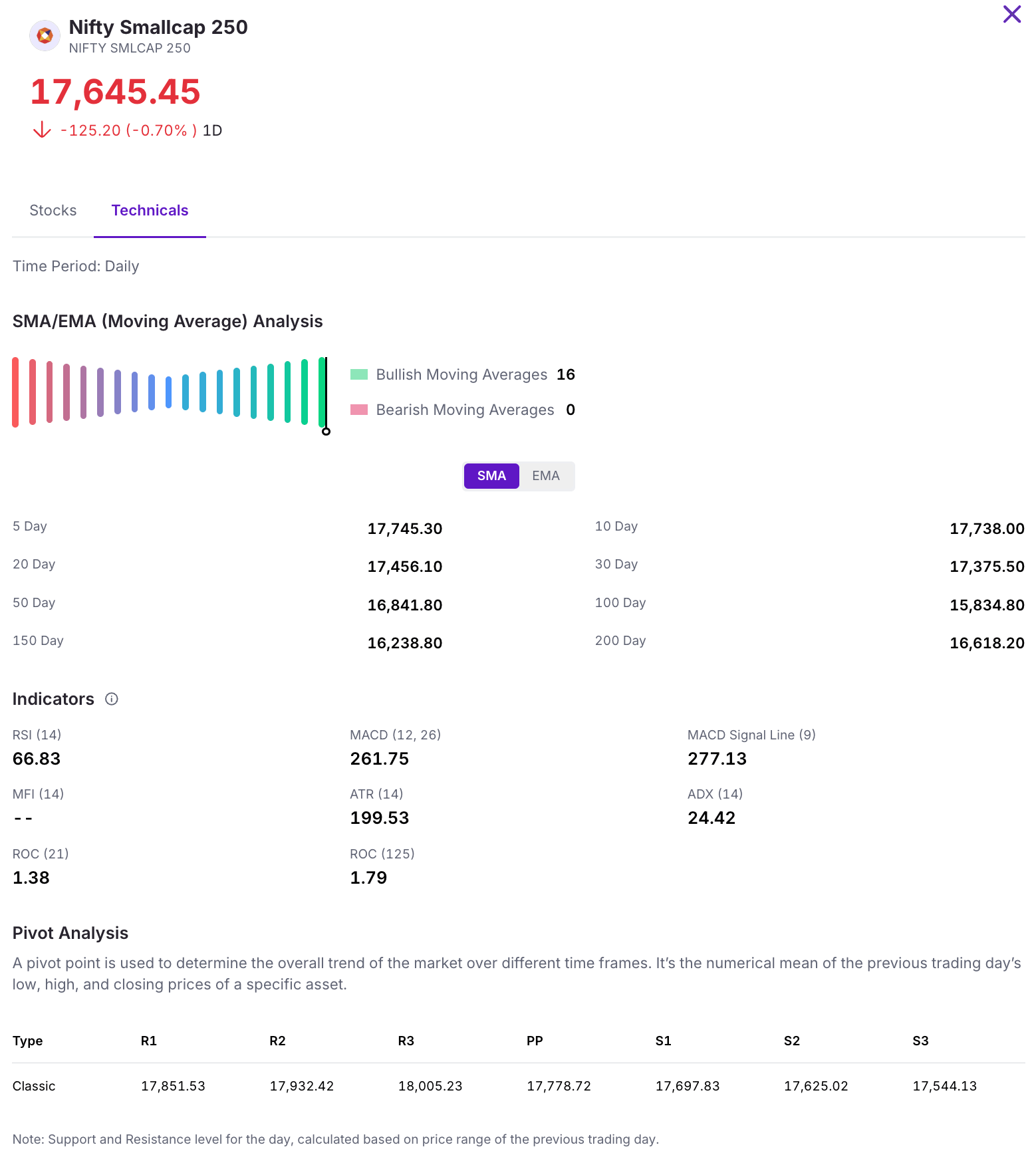

| Nifty Smallcap 250 | 17,645.45 (- 0.70%) |

| India VIX | 11.82 (+ 1.29%) |

Stocks in the Spotlight

Top Gainers

| Name of the company | Movement | Factors | ||||

| Momentum | Value | Quality | Low Vol | Sentiment | ||

| Jaiprakash Power Ventures Ltd. | 🔼 26.57% | 4/5 | NA | 1/5 | 4/5 | NA |

| Glenmark Pharmaceuticals Ltd. | 🔼 22.29% | 5/5 | 2/5 | 3/5 | 5/5 | 2/5 |

Top Losers

| Name of the company | Movement | Factors | ||||

| Momentum | Value | Quality | Low Vol | Sentiment | ||

| BSE Ltd. | 🔻 15.92% | 5/5 | 1/5 | 5/5 | 1/5 | 4/5 |

| Trent Ltd. | 🔻 13.36% | 3/5 | 1/5 | 5/5 | 4/5 | 3/5 |

Technical Analysis

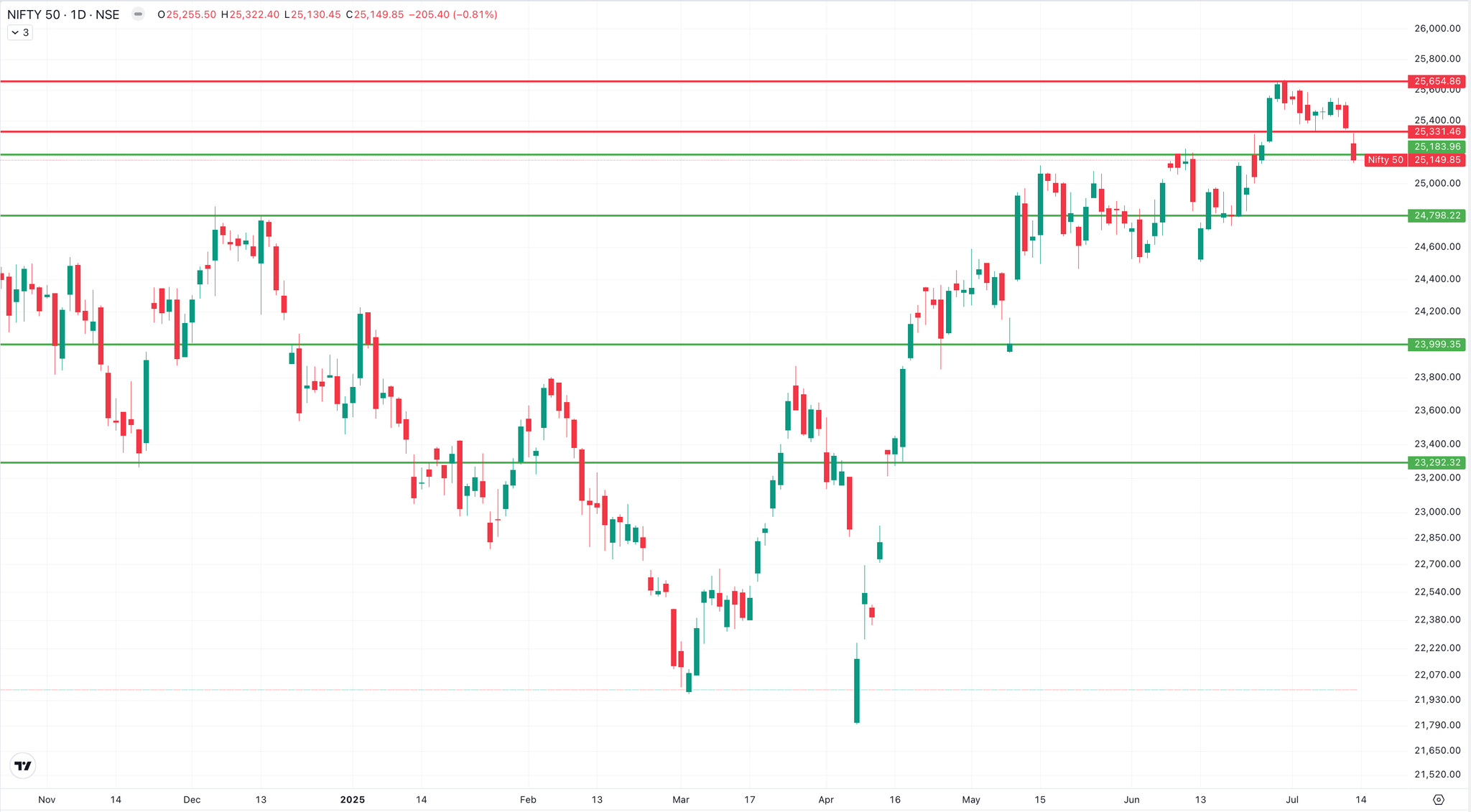

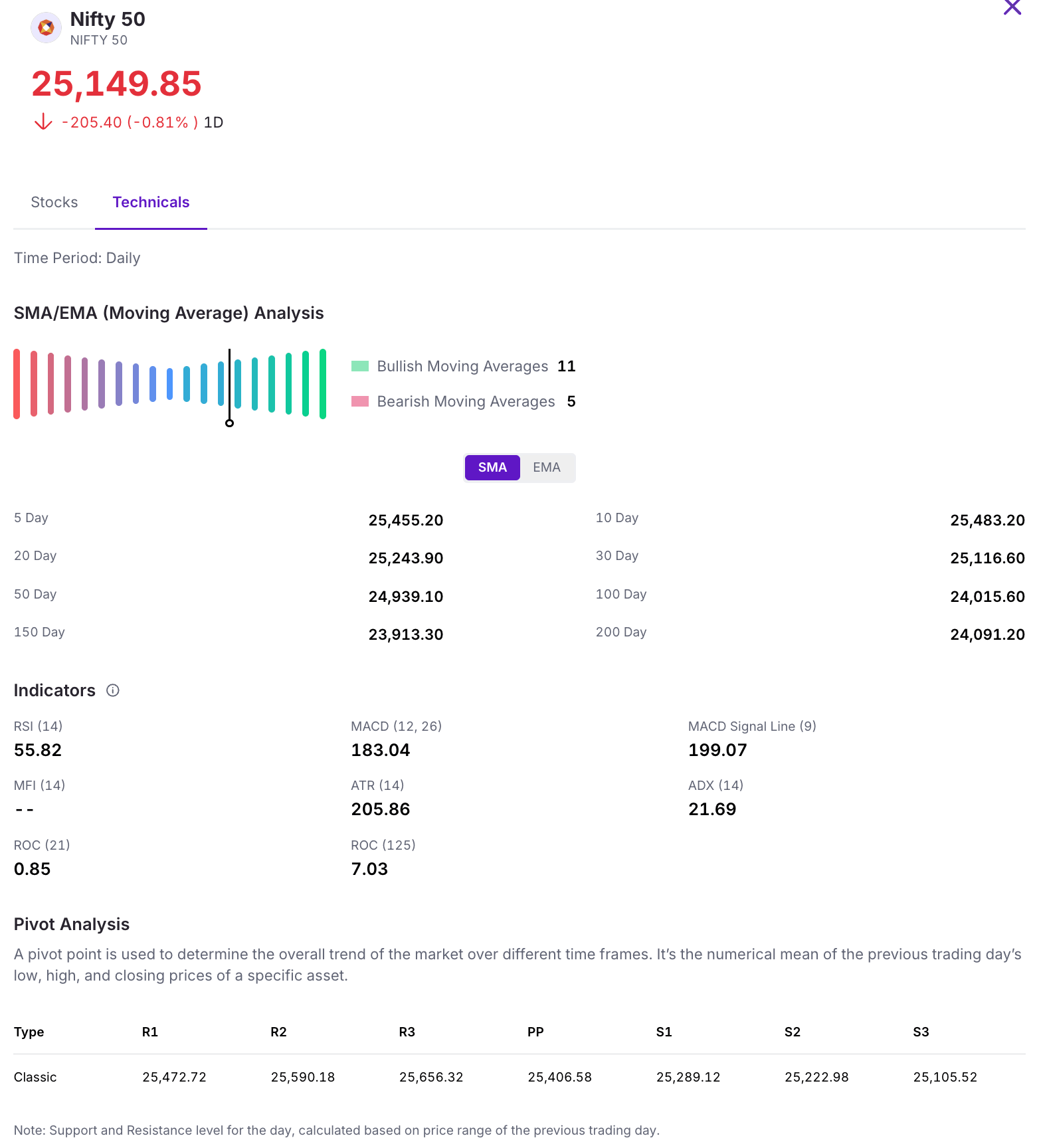

The Nifty 50 ended the week in negative territory, falling by 303 points to close at 25,149. The index broke below its key support level of 25,183, indicating growing bearish sentiment. This marks the third consecutive session of market decline. Looking ahead, the Nifty 50 has crucial support at 24,800, while resistance is expected near the 25,330 level.

The Nifty Midcap 150 closed in the red this week, declining by approximately 303.75 points to settle at 21,636 on Friday. Looking ahead, strong support is expected at 21,400, while resistance is at 22,000 levels, which is being tested again.

The Nifty Smallcap index ended the week on a flat note, closing at 17,645. The index continues to find strong support around the 17,500 level, while immediate resistance is expected in the 17,800 to 18,000 range.

This Week’s Spotlight Story

A deep dive into the headline that defined market conversations.

Tariff Proposals Raise Concerns for Pharma, Minimal Impact on Copper

Donald Trump’s proposed 50% tariff on copper imports. While copper tariffs could disrupt global industrial supply chains, the impact on India is expected to be minimal.

India exports less than $300 million worth of copper to the U.S., and top domestic player Hindalco ships none due to strong local demand.

Annual copper consumption in India stands at around 2 million tonnes, compared to just 30 tonnes exported to the U.S. With infrastructure, EVs, and renewables driving usage, domestic needs are only expected to rise.

India, now a net importer of copper since Vedanta’s 2018 smelter shutdown, is ramping up exploration and policy reforms, including changes to the MMDR Act and new licensing for copper blocks.

The real pressure point is pharma. The U.S. is India’s largest pharma export market, with shipments rising to $9.8 billion in FY25.

A 200% tariff would erase Indian drugmakers’ core cost advantage, especially in federal health programs and low-income segments. Indian pharma companies could lose tenders and market share to U.S. rivals.

While some Indian firms have local manufacturing plans, Trump’s relocation timeline of “a year or so” may be too short to adapt.

The proposed tariffs signal a tougher trade climate, pushing Indian exporters to rethink costs, supply chains, and U.S. operations.

Buzz

Does MACD Actually Work in Indian Markets? We Backtested 25 Years of Data — Here’s What We Found

Can one of the world’s most popular technical indicators actually help you trade better in India? We tested it across Nifty 50, Next 50, Midcap 150, Smallcap 250, and Nifty 500 for 25 years. The results were surprising.

That’s a wrap for this week.

As the markets pause to catch their breath, we’ll be back next week with sharper insights and stories to help you invest intelligently.

Disclaimer and Disclosure

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887 and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst with Exchange and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954