Share Market Weekly

- Share.Market

- 5 min read

- 20 Jun 2025

Nifty 50 25,112.40 29.00 (-0.12%)

| Monday | + 0.92% |

| Tuesday | – 0.37% |

| Wednesday | – 0.17% |

| Thursday | – 0.08% |

| Friday | + 1.29% |

What moved the market?

Top Gainers & Top Losers

| Nifty IT | + 0.53% | Bank Nifty | –0.37% |

| Nifty Private Bank | – 0.08% | Nifty Auto | -0.53% |

| Nifty Infra | – 0.36% | Nifty Financial Services | -0.53% |

Broader Markets this week

| Nifty Midcap 150 | 21,285.45 (- 2.57%) |

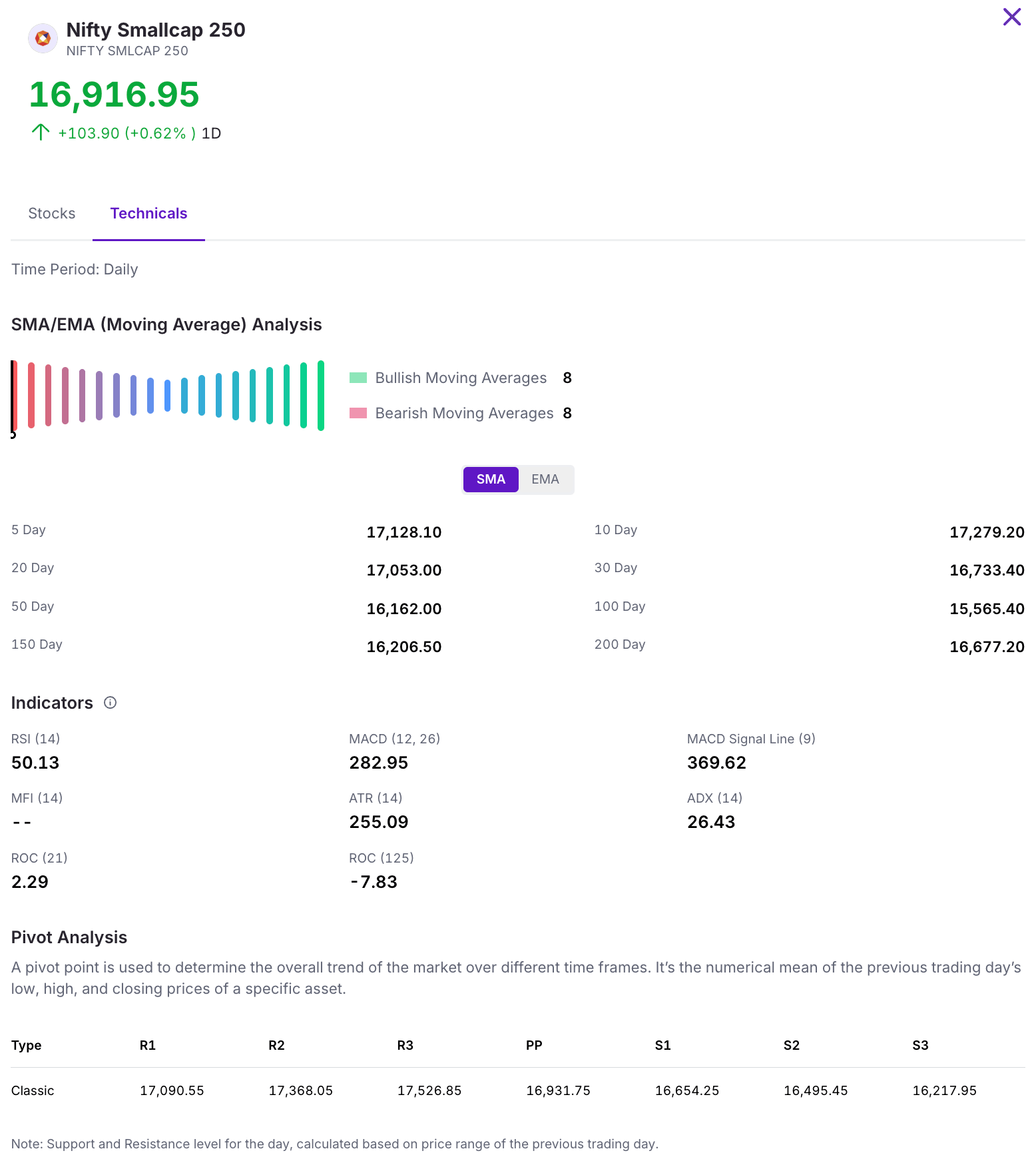

| Nifty Smallcap 250 | 16,916.95 (+3.49%) |

| India VIX | 13.67 |

Stocks in the Spotlight

Top Gainers

| Name of the company | Movement | Factors | ||||

| Momentum | Value | Quality | Low Vol | Sentiment | ||

| Garden Reach Shipbuilders & Engineers Ltd. | 🔼 10.39% | 5/5 | 2/5 | 5/5 | 1/5 | NA |

| BEML Ltd. | 🔼 10.29% | 4/5 | 2/5 | 4/5 | 4/5 | NA |

Top Losers

| Name of the company | Movement | Factors | ||||

| Momentum | Value | Quality | Low Vol | Sentiment | ||

| Tata Teleservices (Maharashtra) Ltd. | 🔻17.27% | – | – | – | – | – |

| Hindustan Zinc Ltd. | 🔻15.21% | 3/5 | 5/5 | 5/5 | 5/5 | 3/5 |

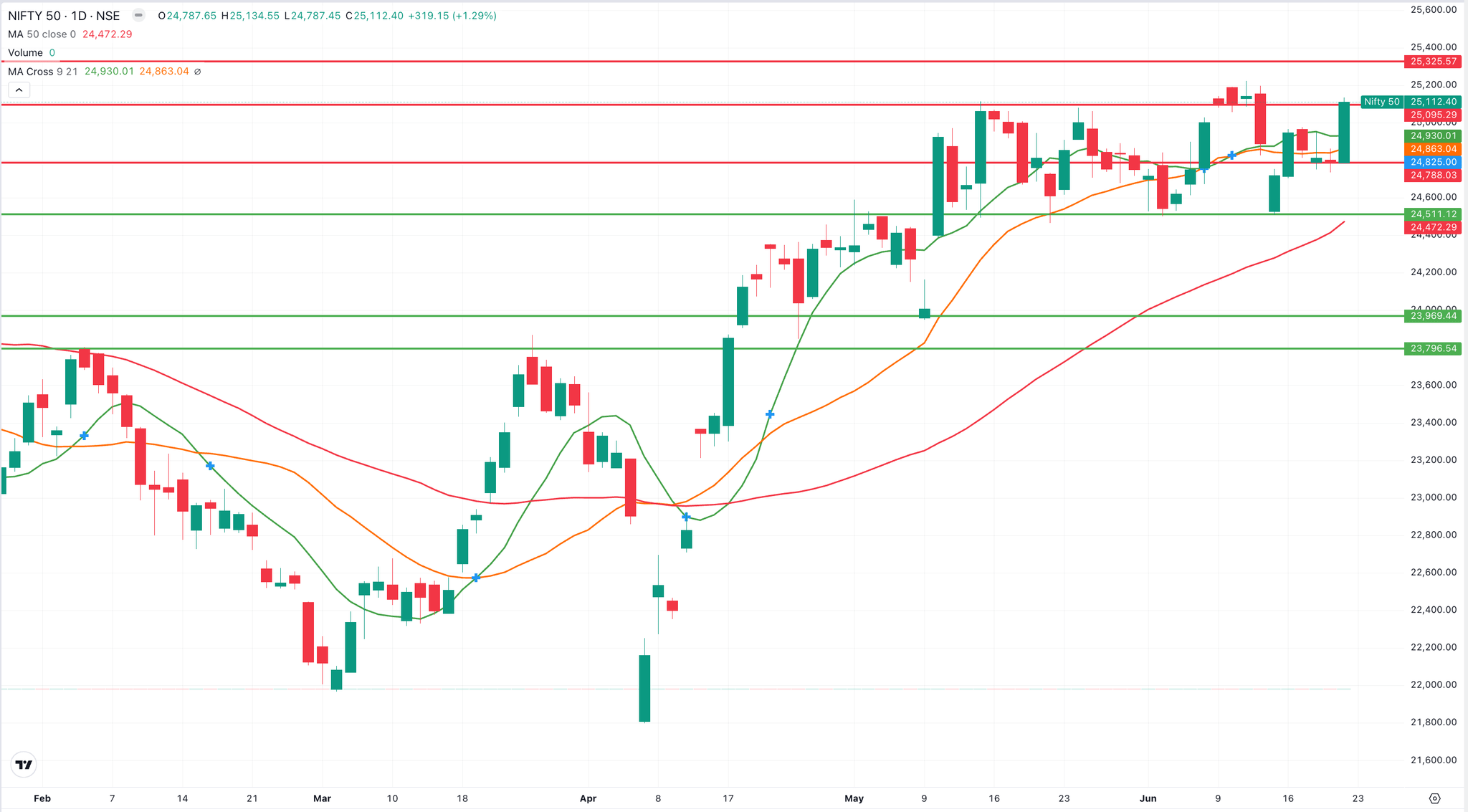

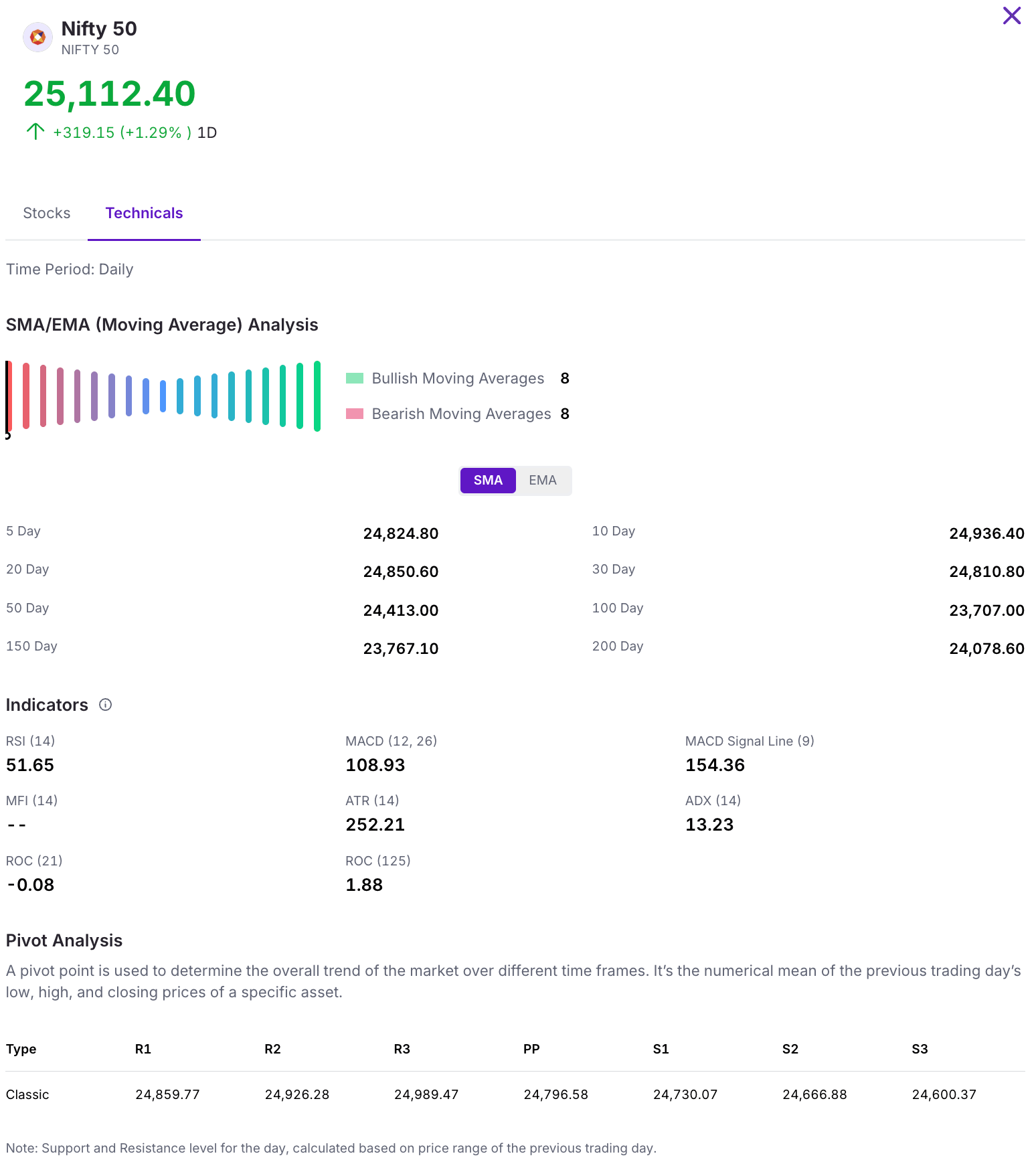

Technical Analysis

The Nifty 50 closed nearly flat for the week, gaining just 0.12%. The index began Monday with a sharp decline, gapping down by over 200 points. However, it recovered steadily and reclaimed its resistance level by Friday’s close.

Currently, the index is moving in tandem with its 10-day and 21-day moving averages, indicating a short-term trend alignment.

Looking ahead, immediate support for the Nifty 50 is seen at 24,500, while resistance is expected near the 25,352 level.

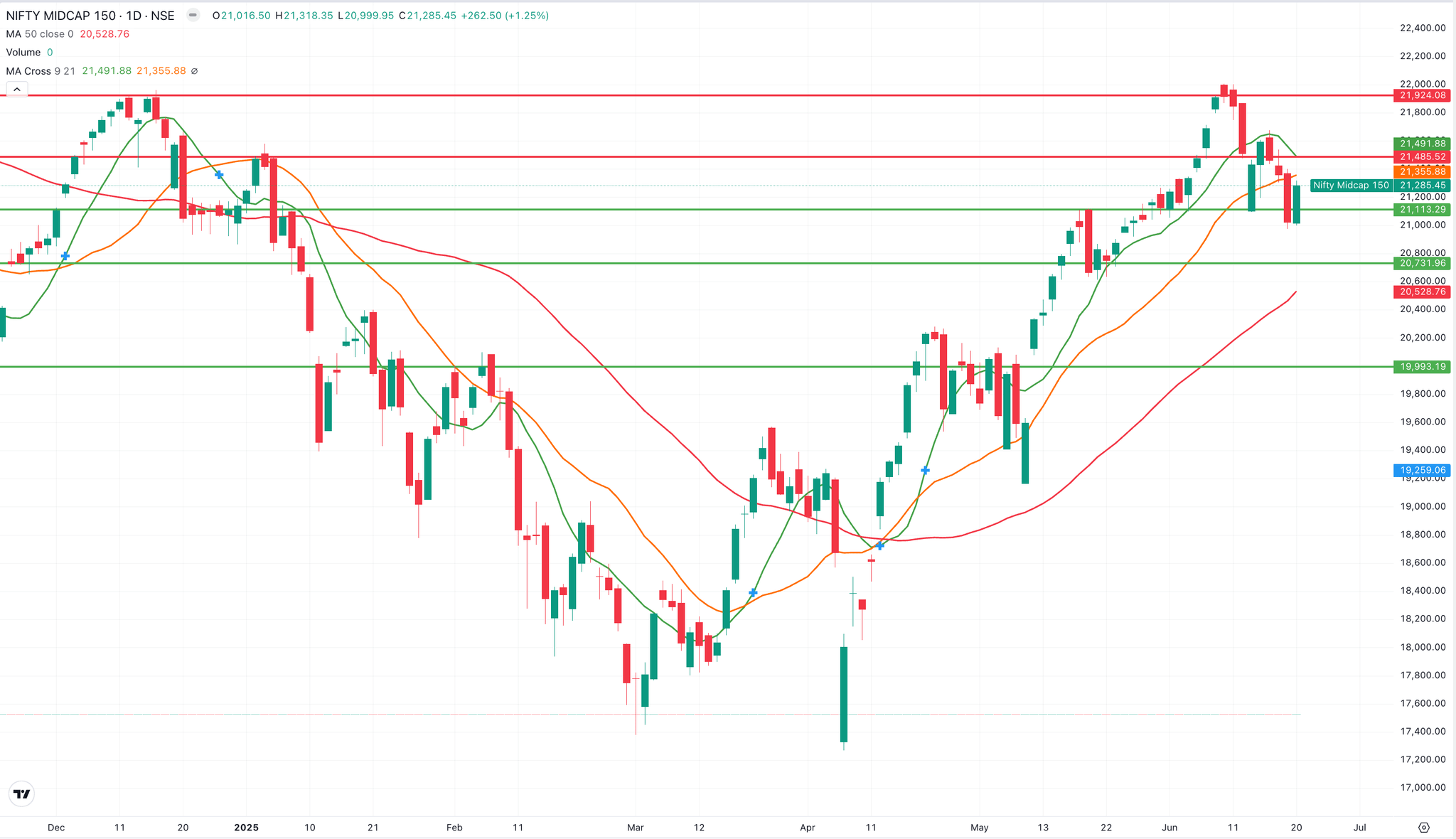

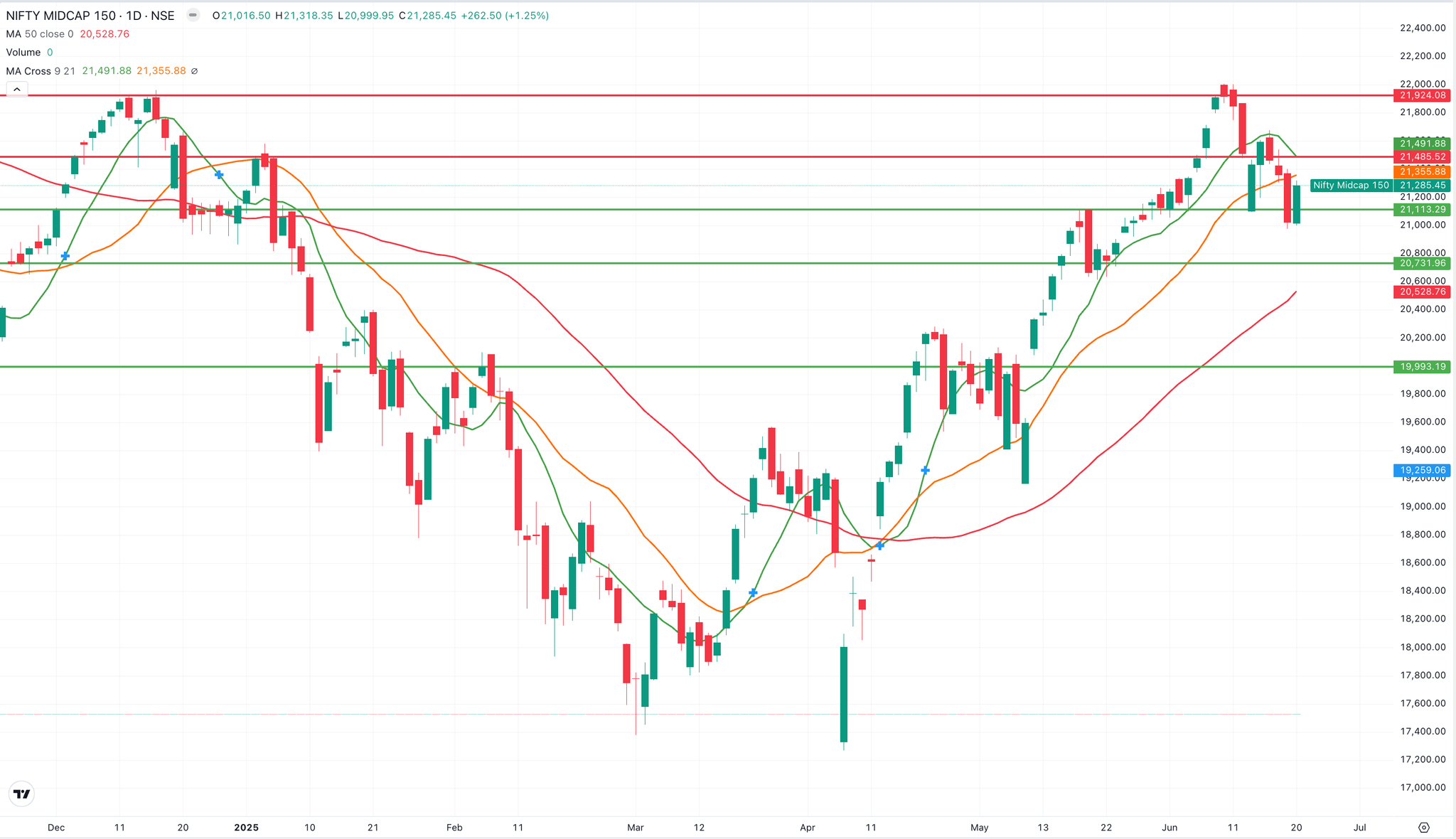

The Nifty Midcap 150 ended the week in the red, falling by approximately 560 points to close at 21,285.45 on Friday, the same as the previous session’s opening price, indicating a strong support level.

Looking ahead, immediate support is expected around the 20,700 mark, while resistance is likely near 21,500, a level that could be tested in the upcoming sessions.

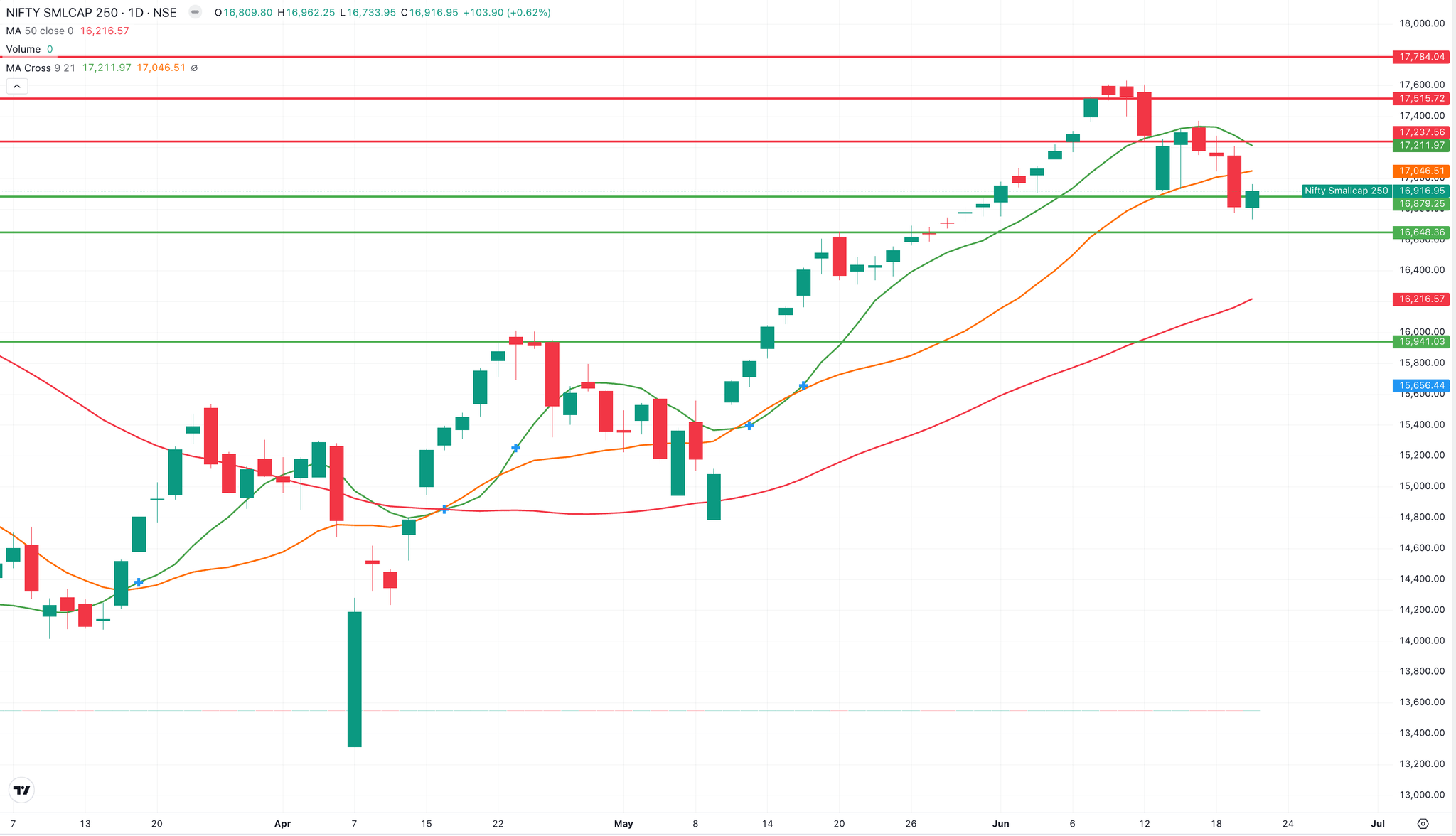

The Nifty Smallcap index remained in consolidation this week, declining by 3.49% with a drop of nearly 600 points from the previous week’s close, to settle at 16,800. The index has strong support around the 16,600 level, while immediate resistance is expected near 17,200.

This Week’s Spotlight Story

A deep dive into the headline that defined market conversations.

Hindustan Zinc’s ₹12,000 Cr Bet: Scaling Up with Zinc, Silver, and More

Hindustan Zinc has approved a ₹12,000 crore project to set up a new metals complex in Rajasthan. The facility will add 250 KTPA of capacity and marks the first step in a larger expansion plan. Over the next five years, the company aims to double overall production to 2 million tonnes per annum.

The expansion isn’t just about zinc. It includes an additional 30 KT of silver capacity. Silver, already Hindustan Zinc’s second-largest business, is set to become more central. The company plans to raise refining capacity to 1,500 TPA from the current 800 TPA. Management sees a tight supply ahead and expects silver prices to touch $41–$42/oz by early 2027.

The project will be funded through internal accruals and debt. Full-scale expansion is expected to cost ₹32,000–₹35,000 crore in phases. The first phase will take about 36 months, with cash flows kicking in from year four.

There’s also early interest in rare earths. Hindustan Zinc has signalled it’s ready to invest once the regulatory space opens. It’s a long-term plan, but one that aligns with global shifts in supply chains and critical minerals.

Buzz

Major Shifts: NSE & BSE Weekly Derivatives Expiry Days Are Changing – What Traders Need to Know

Get ready for a significant update in India’s derivatives market! Starting September 1, 2025, the expiry days for weekly equity derivatives contracts on the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE) will be realigned.

That’s a wrap for this week.

As the markets pause to catch their breath, we’ll be back next week with sharper insights and stories to help you invest intelligently.

Disclaimer and Disclosure

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887 and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst with Exchange and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954