Rain Industries Gains 45%, RIL falls 5%; India Looks to Strengthen Europe Ties

- Share.Market

- 11 min read

- 06 Jan 2026

Here’s a quick wrap-up where we break down the performance of key indices, top corporate movers, and the major economic headlines of the day.

Indian equities ended largely lower on Tuesday. Reliance Industries saw it’s largest fall in 10 months, HDFC Bank and ITC also dragged Sensex and Nifty 50 lower. India looks to strengthen Europe ties against the backdrop of Washington’s punitive tariff on Indian goods.

Key Indices – Share Market

Today’s Top News from the Indian Share Market

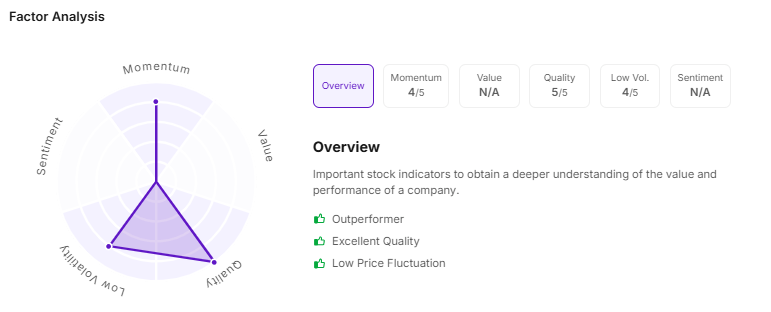

The company’s share price gained as much as 13% on Tuesday amid Electricity Appellate Tribunal’s (APTEL) favourable comments at the hearing on the market coupling norms issued by Central Electricity Regulatory Commission (CERC).

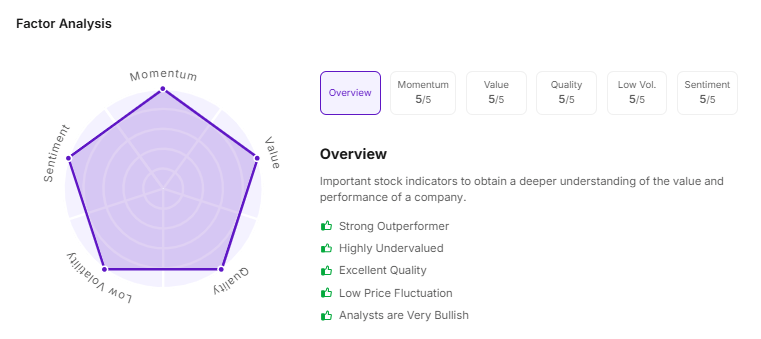

Aluminum prices in the global markets are trading at the highest level in over three years, with prices on the London Metal Exchange crossing the mark of $3,000 per tonne for the first time since 2022. The company extended its gains to touch a new record high of ₹351.70 per share.

The conglomerate surged as much as 5% after its mining and power generator unit as it is about to receive US$50 (₹450 crore) million as buy back proceeds from its Singapore subsidiary. This will augment liquidity to pursue new acquisitions and new/ongoing projects.

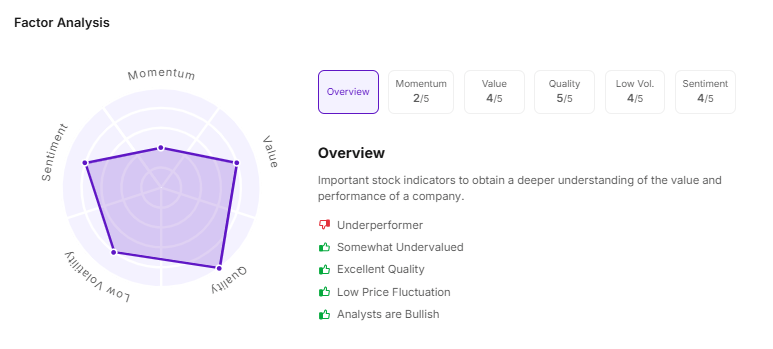

The stock gained ~45% in the past month and 5% today. Rain Industries co-produces calcined petroleum coke (CPC) and coal tar pitch which are key inputs in aluminium production, making it an indirect play on a rising aluminium cycle.

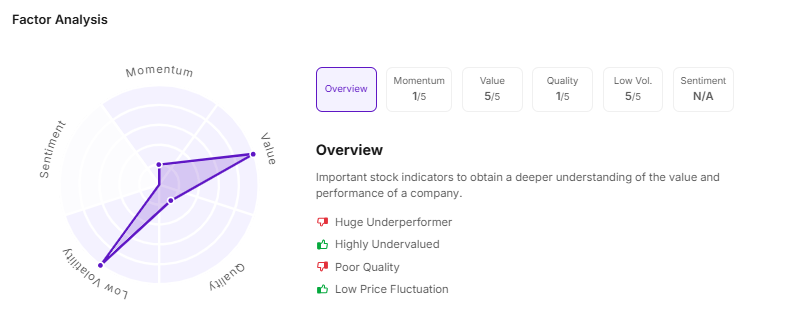

The heavyweight’s share price fell after it denied a media report claiming that its Jamnagar refinery will be receiving three ships of Russian crude oil. It added that it is not expecting such deliveries in January. The stock wiped out more than ₹1 lakh crore in market capitalization.

Broader Market Performance Today

NIFTY MIDCAP 150₹22,510.60 -0.20%

NIFTY SMLCAP 250₹16,791.50 -0.31%

Top Performing Sectors Today

*Prices shown may have delay up-to 15 minutes

Today’s Top Gainers and Losers

*Prices shown may have delay up-to 15 minutes

FII DII Activity (₹ Cr)

| Date | FII (Net Value) | DII (Net Value) |

| 05 Jan 2025 | -36.25 | 1764.07 |

| 02 Jan 2025 | 289.80 | 677.38 |

| 01 Jan 2025 | -3,268.60 | 1,525.89 |

| Month-to-Date | -3,015.05 | 3,967.34 |

What’s Happening Beyond Markets?

- Copper futures climbed above $6 per pound hitting new record highs amid expectations of a further tightening in global supply this year. Prices were supported by rising geopolitical tensions, a robust global demand outlook, particularly from power grid upgrades, renewable energy projects, and data center expansion.

- Gold prices rose above $4,460 per ounce on Tuesday, marking a third consecutive session of gains, driven by increased demand for safe-haven assets amid political turmoil in Venezuela.

- Indian Railways spent over 80% of total Gross Budgetary Support outlays in first three quarters of FY26, i.e., ₹2,03,138 crore of the total allocation of ₹2,52,200 crore. A major portion of this has utilised in the category of safety-related works and capacity augmentation.

- The Reserve Bank of India’s (RBI’s) governor Sanjay Malhotra has emphasized the need for sound underwriting standards and close monitoring of asset quality of non-banking financial Companies (NBFCs).

- India looks to strengthen Europe ties; German Chancellor Merz to visit the country next week. New Delhi looks to deepen economic engagement with Europe against the backdrop of Washington’s punitive tariff on Indian goods.

Back to Basics

Terms that put you one step ahead – every day

Market Coupling and IEX’s Context

Market coupling is a regulatory mechanism designed to unify the Indian power trading landscape by creating a single price for electricity across all trading platforms.

Currently, electricity is traded on three different exchanges—

- the Indian Energy Exchange (IEX),

- Power Exchange of India (PXIL),

- and Hindustan Power Exchange (HPX).

These platforms operate independently, hence, they each discover their own “market price” based on the specific bids they receive. This decentralization has historically favored IEX, which controls about 85% of the market, as its high volume of participants usually leads to more stable and attractive pricing.

Starting in January 2026, this dynamic will change. Under the new CERC norms, a central agency called Grid-India will aggregate all buy and sell bids from every exchange and calculate one single, unified price for the entire country.

For an investor, the impact is significant: it effectively removes the “competitive moat” of IEX. Since the price of electricity will be identical across all platforms, traders no longer have a primary incentive to stick with the largest exchange. This shift aims to boost competition and market efficiency, but it also explains the recent volatility in IEX’s stock as the market adjusts to a more level playing field.

IEX’s share price fell 30% initially, but gained nearly 13% after the Electricity Appellate Tribunal (APTEL) raised serious concerns about how the coupling rules were made. The tribunal questioned the regulator’s independence and even suggested the order could be withdrawn. This gave investors hope that IEX might keep its dominant position after all.

Corporate Actions

| Stock | Ex-Date | Record Date | Event Type | Event Details |

| Kotak Mahindra Bank | 14 Jan 2026 | 14 Jan 2026 | Stock Split | ₹5.00 to ₹1.00 |

Before You Go…

Markets aren’t just charts and tickers; they’re daily tales of ambition and the quiet courage to stay invested.

We’ll be back to cut through the noise, so you can focus on investing intelligently.