- Share.Market

- 3 min read

- Published at : 23 Jun 2025 05:57 PM

- Modified at : 16 Jul 2025 08:12 PM

Shares of Zee Entertainment Enterprises Ltd. surged up to 13%, reaching an intraday high of ₹151.44 on Monday, following the company’s release of a detailed strategic update that laid out its vision for long-term growth across television, digital, and new media verticals.

Amid a consolidating media and entertainment industry, Zee reaffirmed its focus on becoming a stronger second player in a two-player market structure. It currently commands a 17% urban TV viewership share (15+ age group), compared to a 34% share held by Peer-1. Zee aims to aggressively scale its reach, leveraging its broad content ecosystem across TV, OTT, music, movies, and global syndication.

At the core of its strategy is ZEE5, its digital platform with over 300 originals and a 4.5+ user rating. Zee plans to unlock cross-platform synergies and expand content offerings to include micro-dramas, live events, edutainment, and emerging sports, targeting a broader, younger audience. It also intends to adopt a unified distribution and monetization approach across its TV and OTT arms.

Zee also addressed how it plans to use its cash reserves in a competitive landscape where rival players are backed by significant capital infusions. Its capital strategy focuses on preserving liquidity, exploring inorganic opportunities in high-growth verticals like sports and gaming, and investing selectively in scalable ventures.

For FY26, Zee aims to break even at the EBITDA level for ZEE5, which posted ₹548 crore in losses in FY25. The company plans to improve execution, enhance content quality, and strengthen its talent base to meet this target.

With strong content assets, cost discipline, and renewed digital focus, Zee is looking to reposition itself as a leaner, more agile media player ready for the next phase of growth.

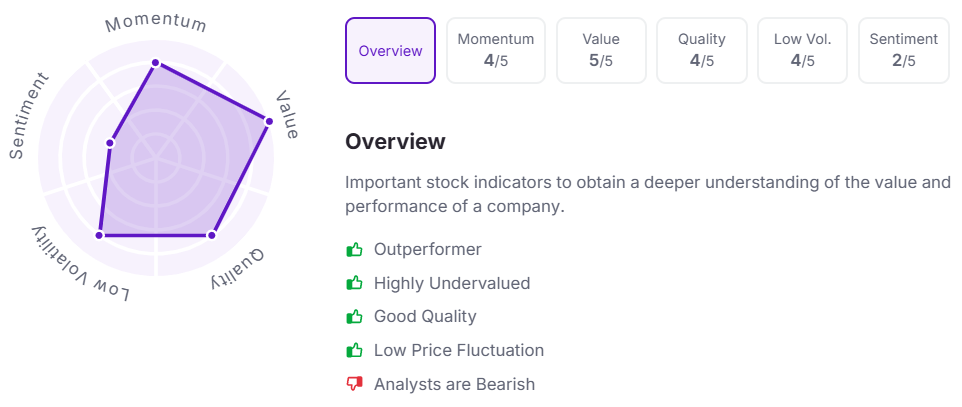

Let’s take a look at its Factor Analysis scores:

Note: The stock price mentioned is as of 3:30 PM.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.