- Share.Market

- 6 min read

- Published at : 25 Jul 2025 11:27 AM

- Modified at : 25 Jul 2025 12:16 PM

The shares of Wipro, DLF, KPIT Technologies, Crisil, and Shyam Metalics and Energy are set for their record date on Monday, July 28, 2025. To be eligible for the upcoming dividends, investors must have bought the shares before the ex-date and hold them at least till the record date.

Wipro Ltd. has announced an interim dividend of ₹5 per equity share. It has a high dividend yield of 2.29%.

Wipro is a leading global IT services and consulting company. In Q1FY26, it reported a 2.3% YoY decline in revenue in constant currency, while net income rose 10.9% to ₹3,330 crore. Operating margin expanded by 80 bps YoY to 17.3%. Large deal bookings jumped 131% YoY to $2.7 billion, taking total bookings to $5 billion, the highest in nine quarters.

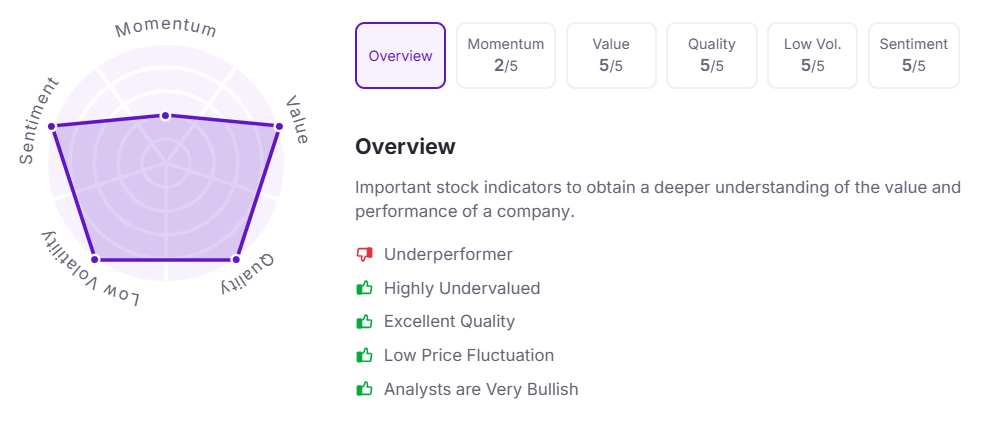

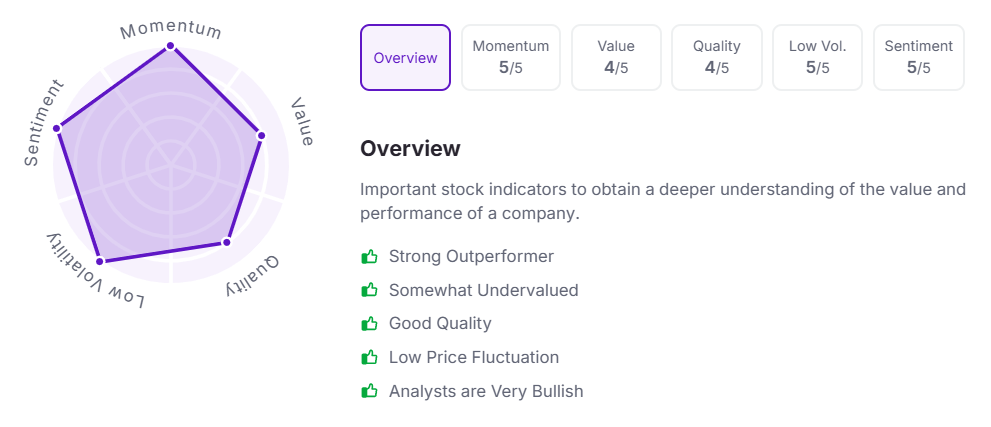

Let’s take a look at its Factor Analysis scores:

DLF Ltd. has announced a final dividend of ₹6 per equity share. It has a dividend yield of 0.60%.

DLF is India’s largest publicly listed real estate developer with a legacy spanning over 78 years. In FY25, the company reported record new sales bookings of ₹21,223 crore, up 44% YoY, with an embedded gross margin of around ₹12,875 crore (61%). Key project launches like The Dahlias and DLF Privana West saw strong demand, contributing ₹13,744 crore and ₹5,600 crore in bookings, respectively. For Q4FY25, consolidated revenue grew 46% YoY to ₹3,348 crore, and PAT rose 37% to ₹1,268 crore. On a full-year basis, revenue was ₹8,996 crore and PAT stood at ₹4,357 crore, marking a 59% YoY growth.

Over the last three years, this stock has given multibagger returns of more than 125%.

KPIT Technologies Ltd. has announced a final dividend of ₹6 per equity share. It has a dividend yield of 0.60%.

KPIT Technologies, a global software partner to the mobility and automotive ecosystem, reported strong FY25 results with revenues of $691 million, marking 18.7% growth in constant currency. Net profit surged 41.2%. The company maintained its streak with 19 consecutive quarters of revenue and EBITDA growth. Q4FY25 revenue stood at $177 million with 11.5% YoY growth. New deal wins worth $280 million were signed during the quarter.

Over the last three years, this stock has given multibagger returns of more than 130%.

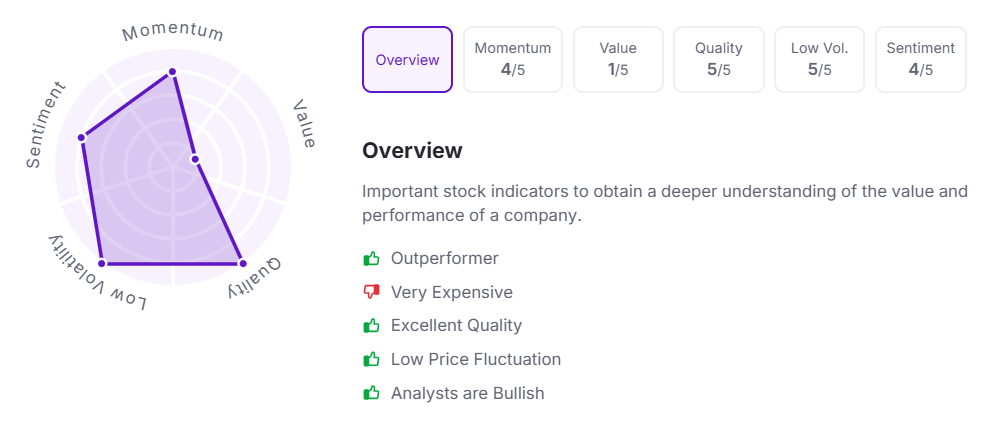

Let’s take a look at its Factor Analysis scores:

Crisil Ltd. has announced an interim dividend of ₹9 per equity share. It has a dividend yield of 1.00%.

CRISIL reported a strong Q1FY25 with income from operations up 10.2% YoY to ₹813 crore and PAT rising 16.1% to ₹160 crore. Profit before tax grew 16.3% to ₹227 crore. The company declared an interim dividend of ₹8 per share. Ratings revenue surged 32.5%, while research and analytics saw modest growth amid global spending pressures.

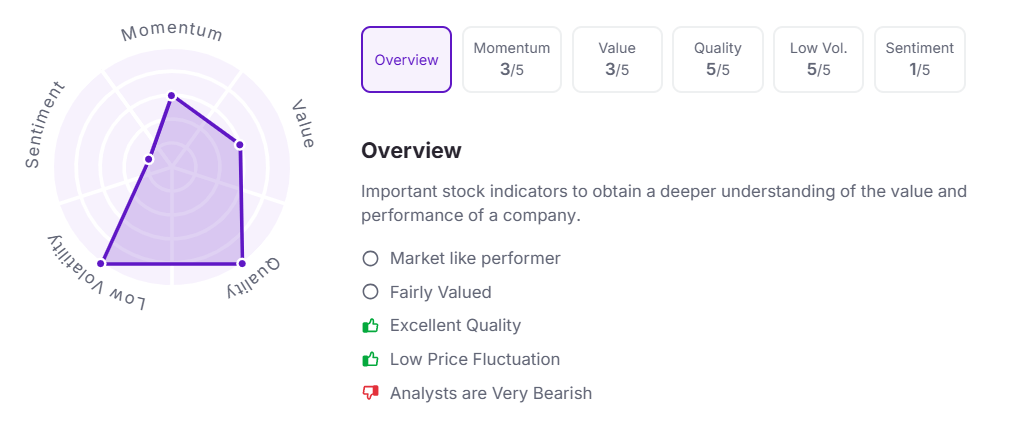

Let’s take a look at its Factor Analysis scores:

Shyam Metalics and Energy Ltd. has announced an interim dividend of ₹1.8 per equity share. It has a dividend yield of 0.50%.

Shyam Metalics is a leading integrated metal producer in India with operations across carbon steel, stainless steel, specialty alloys, and aluminium.

Shyam Metalics reported a 15% YoY rise in Q4FY25 revenue to ₹4,139 crore, driven by strong performance across product categories. Operating EBITDA grew 17% YoY to ₹515 crore, with margins improving to 12.4%. PAT remained steady at ₹220 crore. The company launched a new range of roofing sheets and food-grade aluminum foil under the SEL Tiger brand, expanding its value-added portfolio.

Over the last three years, this stock has given multibagger returns of more than 220%.

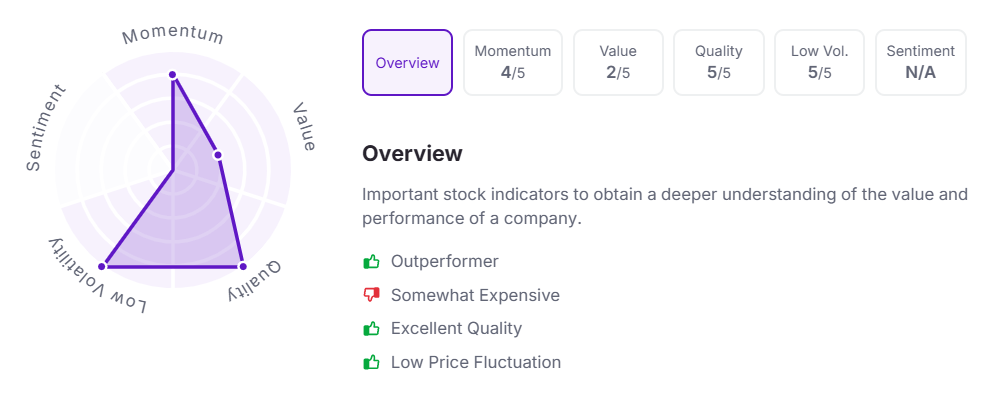

Let’s take a look at its Factor Analysis scores:

Note: The stock prices mentioned are as of 11:25 AM.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.