- Share.Market

- 4 min read

- Published at : 23 Jan 2026 01:31 PM

- Modified at : 23 Jan 2026 01:35 PM

The shares of Wipro, Persistent Systems, SRF, and United Spirits are set for their record date on Tuesday, January 27, 2026. To be eligible for the upcoming dividend, investors must have bought the shares before the ex-date and hold them at least till the record date.

The global IT and consulting company has announced an interim dividend for the financial year 2025-26 of ₹6 per equity share. It has a current dividend yield of 4.50% TTM.

Wipro reported revenue from operations at ₹23,555.8 crore, which showed a 5.54% increase year-on-year (YoY) compared to the corresponding quarter ended December 31, 2024, which reported ₹22,318.8 crore.

The company reported a profit of ₹3,145 crore, which was down YoY compared to the corresponding quarter ended December 31, 2024, which reported ₹3,366.7 crore.

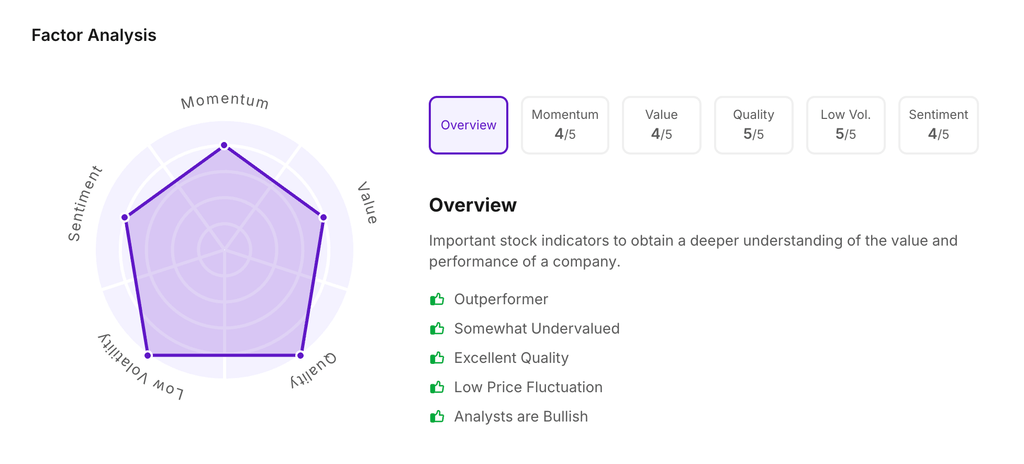

Let’s take a look at its Factor Analysis scores:

The global digital engineering and enterprise modernisation company has announced an interim dividend for the financial year 2025-26 of ₹22 per equity share. It has a current dividend yield of 0.60% TTM.

Persistent Systems reported revenue from operations at ₹3,778.2 crore, up 23.38% YoY compared to the corresponding quarter ended December 31, 2024, which reported ₹3,062.2 crore.

The company reported a profit of ₹439.4 crore, which was up YoY compared to the corresponding quarter ended December 31, 2024, which reported ₹372.9 crore.

Over the last five years, this stock has given multibagger returns of more than 700%.

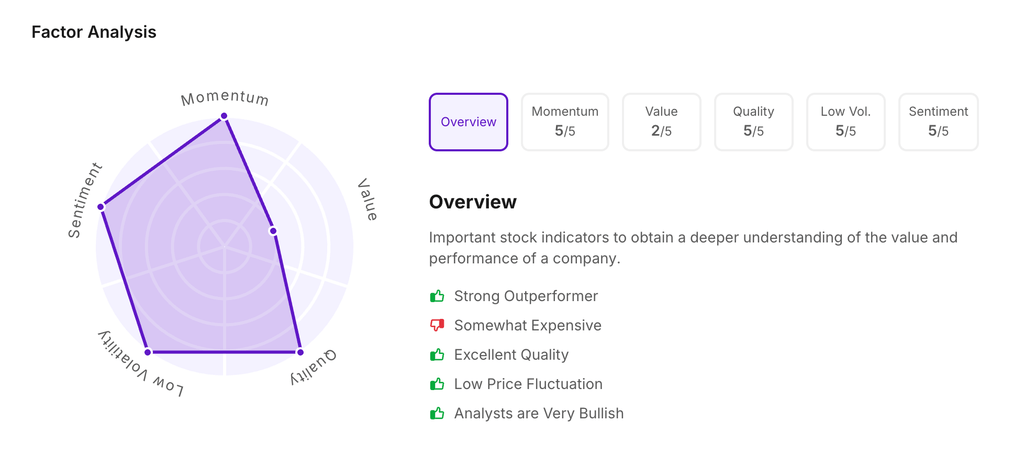

Let’s take a look at its Factor Analysis scores:

The chemical-based multi-business enterprise has announced an interim dividend for the financial year 2025-26 of ₹5 per equity share. It has a current dividend yield of 0.30% TTM.

SRF’s revenue increased 6% from ₹3,491 crore to ₹3,713 crore in Q3FY26 when compared with Corresponding Period Last Year (CPLY).

The company’s profit surged 60% from ₹271 crore to ₹433 crore in Q3FY26 when compared to the corresponding quarter ended December 31, 2024.

Over the last five years, this stock has given multibagger returns of more than 151%.

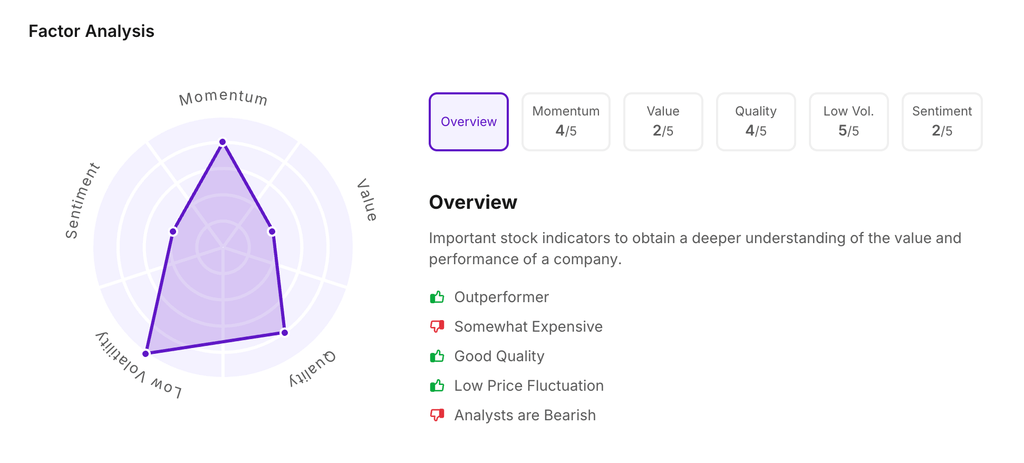

Let’s take a look at its Factor Analysis scores:

The alcoholic beverages company has announced its first interim dividend for the financial year 2025-26 of ₹6 per equity share. It has a current dividend yield of 0.90% TTM.

United Spirits reported a revenue of ₹7,993 crore, which showed a 2.42% increase YoY compared to the corresponding quarter ended December 31, 2024, which reported ₹7,804 crore.

Profit stood at ₹418 crore, growth of 24.7% compared to same period last year.

Over the last five years, this stock has given multibagger returns of more than 116%.

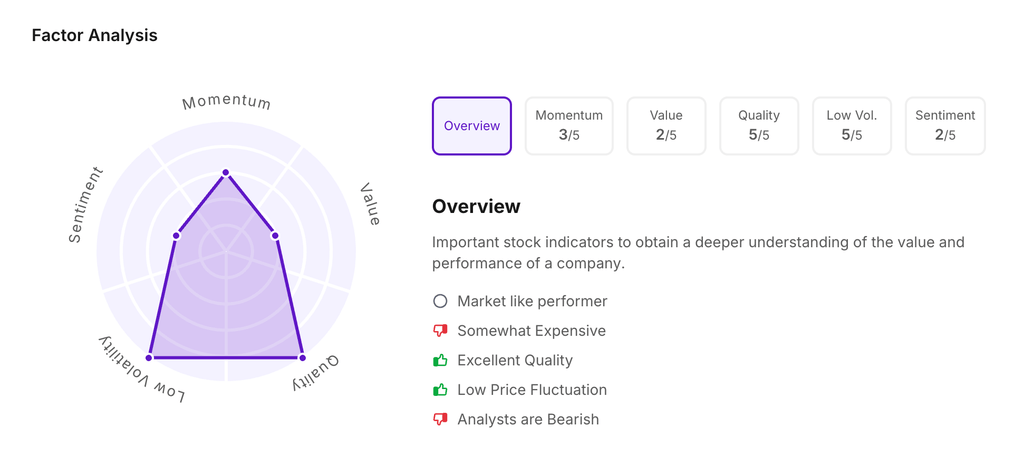

Let’s take a look at its Factor Analysis scores:

Note: The stock prices mentioned are as of 1:29 PM.