- Share.Market

- 2 min read

- Published at : 05 Nov 2025 05:38 PM

- Modified at : 15 Nov 2025 10:01 AM

Whirlpool of India Ltd. announced its consolidated operating results for the second quarter (Q2) of FY 2025-26, reporting a decline in both revenue and profitability primarily due to challenges in the refrigerator market and increased regulatory provisions.

The company reported Revenue from Operations for Q2 FY26 at ₹1,647 crore, marking a 3.8% decrease year-over-year (YoY). This revenue decrease was mainly attributed to a declining refrigerator industry growth in the quarter. The revenue was also impacted by some loss of market shares driven by extraordinary competitive pricing and promotions.

Profit after tax stood at ₹42 crore, down 21.9% YoY. The overall decline in profitability was mainly due to the impact of lower revenue and incremental E-waste provisions.

The company continued to make progress on its focus areas, which include driving premiumisation, executional excellence, and cost productivity, in the face of a weak macroeconomic environment ahead of the GST 2.0 changes.

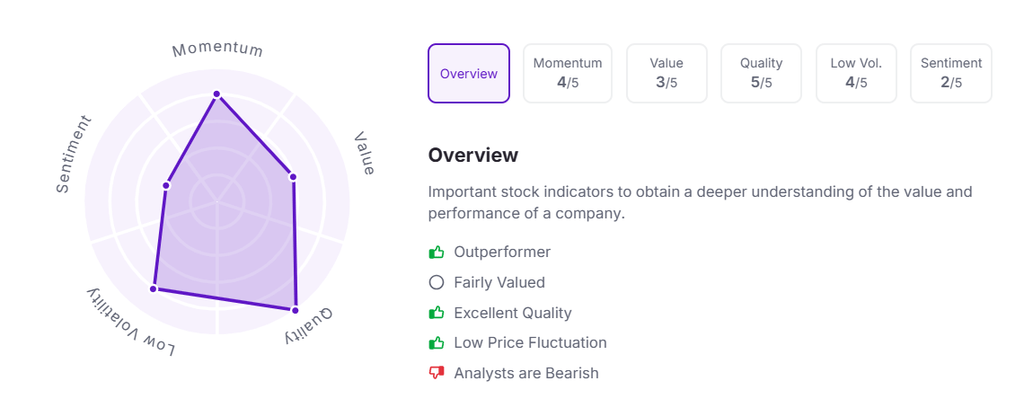

Let’s take a look at its Factor Analysis scores: