- Share.Market

- 3 min read

- Published at : 29 May 2025 05:57 PM

- Modified at : 16 Jul 2025 07:52 PM

Welspun Corp Ltd. announced a robust performance for the quarter and full year ended March 31, 2025, with strong operational results, strategic investments, and a growing order book across its global and domestic markets.

Post the announcement, shares of Welspun corp surged, reaching an intraday high of ₹903.90 apiece.

In FY25, Welspun Corp delivered a record EBITDA of ₹1,858 crore, surpassing its guidance for the year. The company recorded consistent improvement across quarters, with Q4 EBITDA growing 22% year-on-year.

The company’s total income for FY25 came in at ₹14,167 crore, compared to ₹17,582 crore in FY24, marking a decline of 19.4%. For Q4FY25, total income stood at ₹3,967 crore, down 12.7% from ₹4,544 crore in Q4FY24.

PAT rose 71.8% year-on-year to ₹1,908 crore in FY25, up from ₹1,110 crore in FY24. For Q4FY25, PAT stood at ₹698 crore, 2.6 times higher than ₹268 crore reported in the same period last year. The increase includes an exceptional item gain of ₹843 crore for the full year.

As of March 31, 2025, Welspun Corp reported an order book valued at approximately ₹19,553 crore. This includes 1,093 KMT in line pipes, 353 KMT in ductile iron (DI) pipes, and 9,025 MT in stainless steel bars and pipes.

As part of its digital transformation efforts, the company rolled out centralized control towers, fully automated plant operations, AI-powered manufacturing execution systems (MES), and real-time digital dashboards. It also introduced labs with zero human interface to enhance process efficiency and traceability across facilities.

In the building materials segment, WCL’s Sintex business made notable progress. It launched the world’s first proven anti-microbial CPVC pipes and commissioned new OPVC pipe plants in Raipur and Bhopal, with BIS certification secured for the Bhopal facility. A third OPVC plant is planned in Chhattisgarh. Alongside product expansion, Sintex continued scaling its premiumisation strategy and retail distribution network across India.

The Board of Directors recommended a dividend of ₹5 per equity share for FY25, subject to shareholder approval.

Over the last three years, this stock has given multibagger returns of more than 333%.

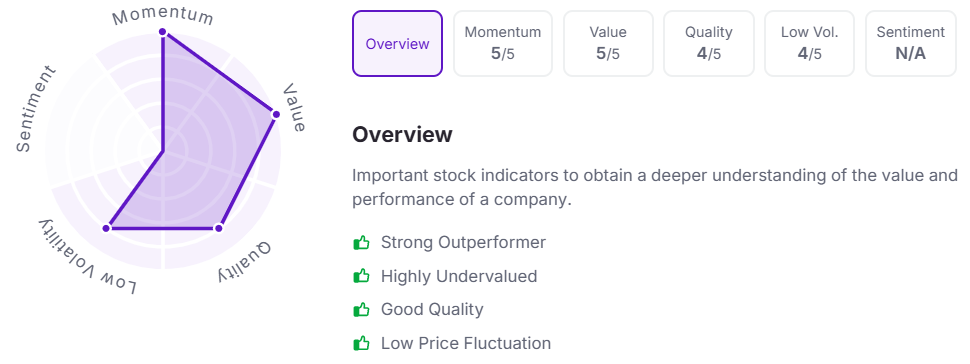

Let’s take a look at its Factor Analysis scores:

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.