- Share.Market

- 2 min read

- Published at : 22 Jan 2026 12:51 PM

- Modified at : 22 Jan 2026 12:51 PM

Shares of Waaree Energies gained 13.27% today to reach an intraday high of ₹2,740.00 apiece after the company reported robust quarterly results.

In the October to December quarter (Q3FY26), the company’s revenue from operations increased to ₹7,565.05 crore, up 118.81% compared to ₹3,457.29 crore reported in the corresponding quarter of the previous year (Q3FY25)

Its net profit also jumped 118.35% to ₹1,106.79 crore in Q3FY26, compared to ₹506.88 crore in the corresponding quarter of the previous year.

Waaree Energies’ orderbook stood strong at ₹60,000 crore with ~23 GW module capacity and 5.4 GW cell capacity. It looks to maintain a capex of ₹25,000 crore.

“I am pleased to share that Waaree is the first Indian manufacturer to achieve 1 GW+ of module production and sales in a single month with 52 modules produced per minute,” said Amit Paithankar, Whole Time Director & CEO, Waaree Energies.

The company has raised ₹1,003.00 crore towards establishing a 20 GWH advanced lithium ion cell and battery pack manufacturing facility. Moreover, it has secured a long-term, fully traceable polysilicon supply chain with ~$30mn strategic investment in United Solar Holding (Oman).

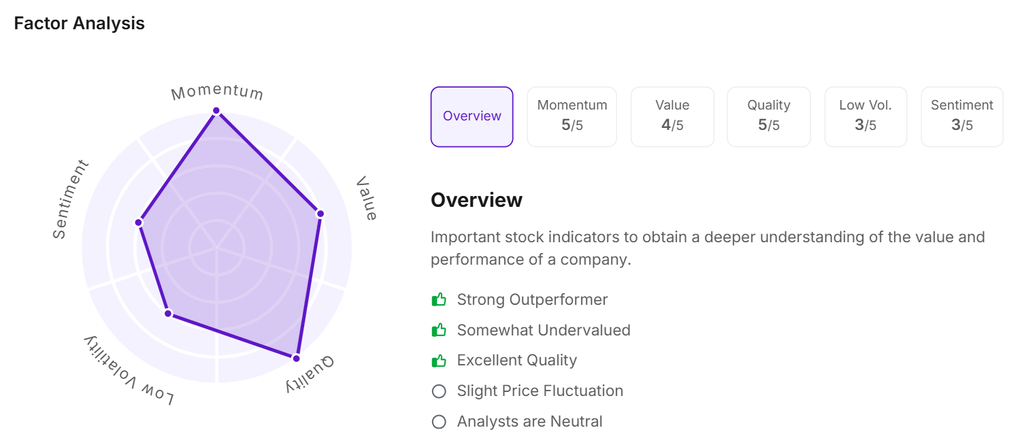

Let’s take a look at its Factor Analysis: