- Share.Market

- 2 min read

- Published at : 09 Jul 2025 03:49 PM

- Modified at : 16 Jul 2025 07:08 PM

Shares of Union Bank of India declined as much as 6% on Wednesday following the lender’s Q1FY26 business update, which revealed a sequential drop in deposits and total business, raising investor concerns despite strong growth in retail lending.

According to provisional figures, global business stood at ₹22.14 lakh crore as of June 30, 2025, down 1.80% quarter-on-quarter (QoQ), though up 5.01% year-on-year (YoY). The decline was led by a 2.54% QoQ fall in global deposits, which came in at ₹12.40 lakh crore.

Domestic CASA (Current Account and Savings Account) deposits also slipped 5.43% QoQ, reflecting a broader industry trend of rising term deposit preference in a high-interest-rate environment. Domestic gross advances, meanwhile, declined marginally by 0.83% QoQ.

However, not all segments weakened. The bank reported a 2.5% QoQ growth in domestic RAM (Retail, Agriculture, MSME) advances, with retail lending surging 5.63% QoQ, signaling continued traction in its retail loan book.

Despite healthy annual growth in key lending segments, the sequential contraction in deposits and total business weighed on market sentiment, leading to a sharp intraday fall in the stock.

Over the last three years, Union Bank has given multibagger returns of more than 300%.

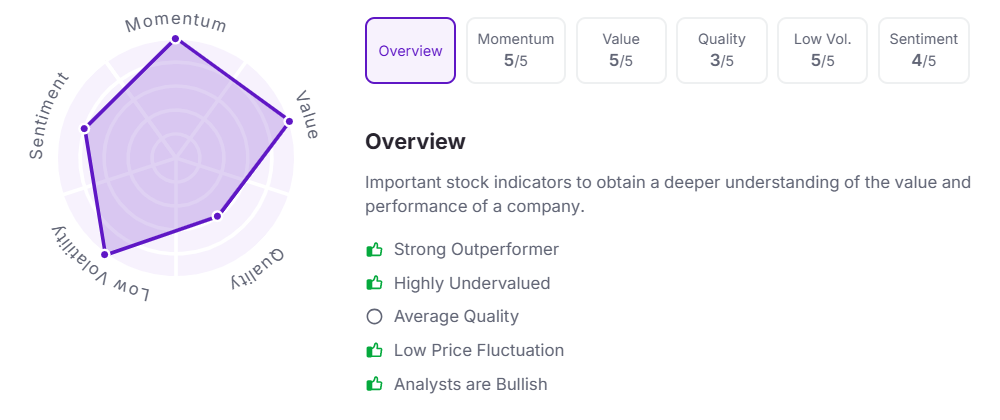

Let’s take a look at its Factor Analysis scores:

Note: The stock price mentioned is as of 3:30 PM.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.