- Share.Market

- 3 min read

- Published at : 21 May 2025 05:34 PM

- Modified at : 16 Jul 2025 07:42 PM

Trident Ltd reported a strong performance for the quarter ended March 31, 2025, with a sharp rise in profitability despite a softer annual growth trend. The company posted a 126.1% year-on-year jump in FY25 net profit, reaching ₹133 crores compared to ₹590 crores in the same quarter last year. Revenue for the quarter grew 10.82% YoY to ₹1,864 crores.

For the full financial year FY25, Trident’s consolidated revenue stood at ₹6,987 crores, up 2.62% from ₹6,809 crores in FY24. Net profit rose 5.93% to ₹371 crores from ₹350 crores a year ago, reflecting steady operational performance despite cost and demand challenges in parts of its portfolio.

Post the announcement, Trident’s shares surged up to 16%, reaching an intraday high of ₹34.62.

Trident’s yarn segment remained the highest contributor, generating ₹908 crores in Q4 (40% of quarterly revenue) and ₹3,262 crores in FY25 (39% of annual revenue). The towel segment followed with ₹753 crores in Q4 (34%) and ₹2,595 crores for the year (31%). Bedsheets contributed ₹315 crores in Q4 and ₹1,298 crores in FY25, accounting for 14% and 16% of total revenues, respectively. The paper and chemicals business brought in ₹268 crores in Q4 and ₹1,146 crores over the full year, making up 12% and 14% of the respective totals.

The company has declared the 1st interim dividend of ₹0.50 per equity share the Financial year 2025-26.

Despite macroeconomic headwinds and sectoral pressures, Trident maintained operational discipline and continued investments in product innovation. Trident remains focused on expanding its global footprint while driving profitability across its core verticals.

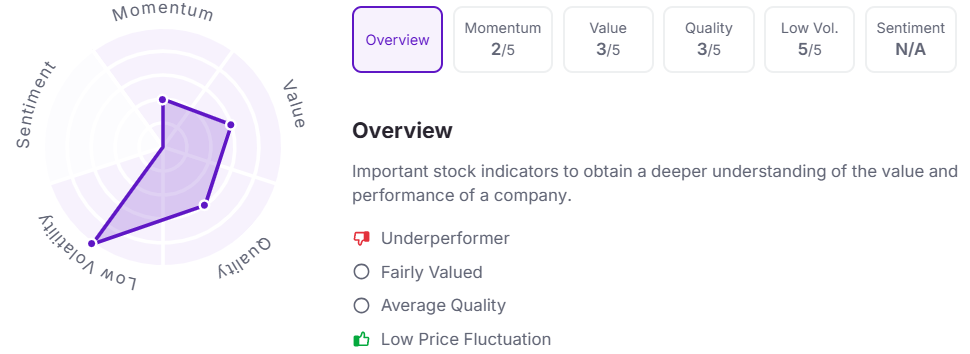

Let’s take a look at its Factor Analysis scores:

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.