- Share.Market

- 3 min read

- Published at : 01 Sep 2025 06:06 PM

- Modified at : 01 Sep 2025 06:06 PM

Torrent Power Ltd. has secured a landmark contract from MP Power Management Company Limited (MPPMCL) to develop a 1,600 MW coal-based thermal power plant in Madhya Pradesh. The Letter of Award (LOA), received on August 29, marks one of the company’s largest project wins in recent years.

Project Details

The upcoming plant will be based on Ultra Supercritical technology, which offers higher efficiency and lower emissions compared to conventional coal plants. The project carries an estimated cost of ₹22,000 crore and is structured under a 25-year power purchase agreement with MPPMCL.

Torrent Power expects the project to generate around ₹6,500 crore in annual revenue once operational. Importantly, coal requirements for the plant will be secured by MPPMCL under the government’s SHAKTI policy, ensuring supply stability.

Strategic Significance

This project expands Torrent Power’s presence in central India and underscores its commitment to scaling capacity in line with rising power demand. While the company has built a diversified portfolio spanning generation, transmission, and distribution, the Madhya Pradesh plant will reinforce its position in the thermal power space at a time when India continues to balance renewable expansion with baseload thermal capacity.

About Torrent Power

Torrent Power Ltd., headquartered in Ahmedabad, is one of India’s leading integrated power utilities with operations spanning generation, transmission, and distribution. The company operates nearly 4.1 GW of generation capacity across thermal, gas, and renewable sources.

In Q1FY26, the company posted revenue of ₹7,906 crore in Q1 FY26, down from ₹9,034 crore a year ago. The dip was due to lower demand from an early monsoon and higher gas prices affecting merchant gains. Offsetting factors included stronger renewable contributions from new solar capacity and favourable wind, along with improved distribution profitability after adjusting for last year’s one-time tariff income.

Over the last three and five years, this stock has delivered multibagger returns of more than 115% and 275%, respectively.

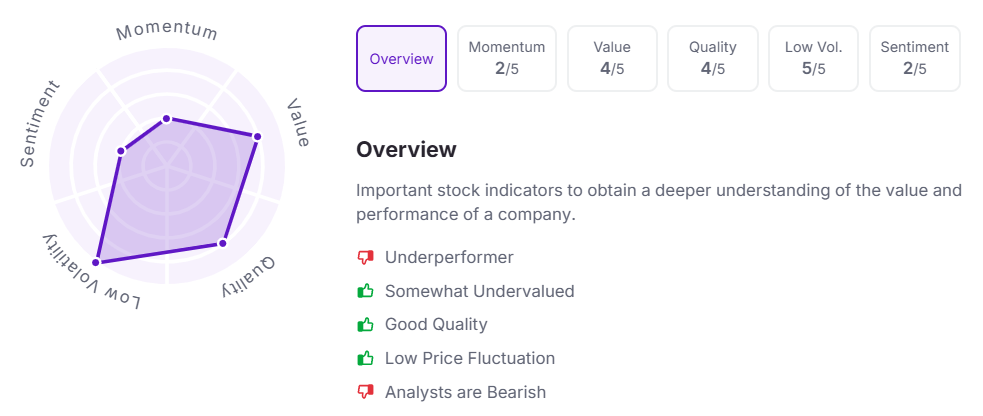

Let’s take a look at its Factor Analysis scores:

Note: The stock price mentioned is as of 3:30 pm.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.