- Share.Market

- 3 min read

- Published at : 12 Aug 2025 04:44 PM

- Modified at : 12 Aug 2025 04:44 PM

Tilaknagar Industries Ltd., maker of Mansion House Brandy and one of India’s leading alcoholic beverage companies, reported strong growth for the quarter ended June 30, 2025, driven by higher volumes and market share gains.

Revenue from operations rose 30.6% year-on-year (YoY) to ₹409.1 crore, compared with ₹313.2 crore in the same quarter last year. Even after excluding a subsidy income of ₹38.6 crore received during the period, revenue growth was 20.5% YoY. The company reported a 26.5% YoY increase in volumes, supported by strong performance in its key southern markets.

EBITDA grew 88% YoY to ₹94.5 crore from ₹50.2 crore, marking Tilaknagar’s highest-ever quarterly EBITDA. Excluding the subsidy income, EBITDA stood at ₹55.8 crore, up 25% YoY. EBITDA margin, which measures operating profit as a percentage of revenue, improved to 15.1% from 14.5% on an adjusted basis.

Profit after tax (PAT), excluding exceptional items, more than doubled to ₹88.5 crore, a growth of 120.8% YoY, from ₹40.1 crore in Q1FY25. Adjusted for the subsidy income, PAT increased by 44.5% YoY. Reported earnings per share (EPS) for the quarter stood at ₹4.54. The company maintained a net cash position of ₹163 crore as of June 30, 2025.

Operationally, Tilaknagar recorded market share improvements in each of its key markets during the quarter. The Bombay High Court upheld its ownership of the Mansion House and Savoy Club trademarks, allowing the company to continue exclusive sales under these brands.

In strategic developments, Tilaknagar signed definitive agreements to acquire the Imperial Blue business division from Pernod Ricard India, the third-largest India Made Foreign Liquor (IMFL) brand in the country, subject to approval from the Competition Commission of India. The acquisition is valued at approximately €413 million, including normalised working capital and deferred consideration.

The company also increased its stake in Spaceman Spirits Lab, makers of Samsara Gin and other craft spirits, from 12.98% to 21.36% with an additional investment of ₹10.66 crore. Its board approved a ₹59 crore investment to expand capacity at Prag Distillery from 6 lakh to 36 lakh cases per annum, including licence fees and interest payments.

Over the last three and five years, this stock has given multibagger returns of more than 510% and 2,630%, respectively.

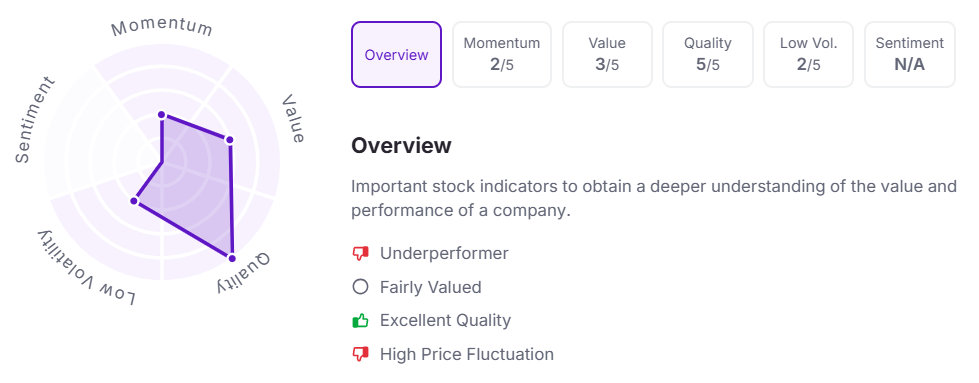

Let’s take a look at its Factor Analysis scores:

Note: The stock price mentioned is as of 3:30 pm.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.