- Share.Market

- 4 min read

- Published at : 22 Sep 2025 12:33 PM

- Modified at : 22 Sep 2025 12:37 PM

The shares of Tilaknagar Industries, India Glycols, and Sunteck Realty are set for their record date on Tuesday, September 23, 2025. To be eligible for the upcoming dividends, investors must have bought the shares before the ex-date and hold them at least till the record date.

Tilaknagar Industries Ltd. has announced a final dividend of ₹1 per equity share. It has a current dividend yield of 0.70% TTM.

Tilaknagar Industries is a long-standing Indian alcoholic beverage company with a 90-year legacy. It’s a major player in the Indian Made Foreign Liquor (IMFL) market, with a diverse portfolio that includes its flagship brand, Mansion House Brandy, which is India’s largest and the world’s second-largest selling brandy. The company operates 21 manufacturing units across 12 states in India.

The company’s performance in Q1 FY26 was strong, demonstrating significant growth across key metrics. Revenue grew by 30.6% to Rs. 409 crore, with volume growth reaching 26.5%. The company achieved its highest-ever quarterly EBITDA of Rs. 94 crore, a substantial 88% increase, while profit after tax (PAT) saw an impressive surge of 120.8% to Rs. 89 crore.

Over the last three and five years, this stock has given multibagger returns of more than 415% and 2,625% respectively.

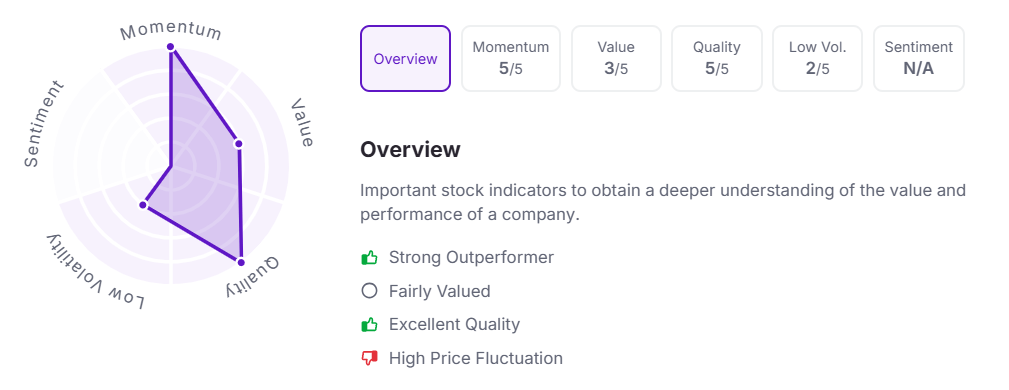

Let’s take a look at its Factor Analysis scores:

India Glycols Ltd. has announced a final dividend of ₹10 per equity share.

India Glycols is a leading manufacturer of industrial and specialty chemicals with a rich history spanning over 35 years. The company’s portfolio includes pharmaceutical, food and beverage, personal care, and industrial sector products. IGL is known for its green engineering and commitment to sustainability, focusing on manufacturing bio-based chemicals and green solvents, and has a presence in over 40 countries.

For Q1FY26, the company report revenue from operations of ₹2,503 crores, up 10%. It reported a profit after tax of ₹73 crores, up 21%.

Over the last five years, this stock has given multibagger returns of more than 525% respectively.

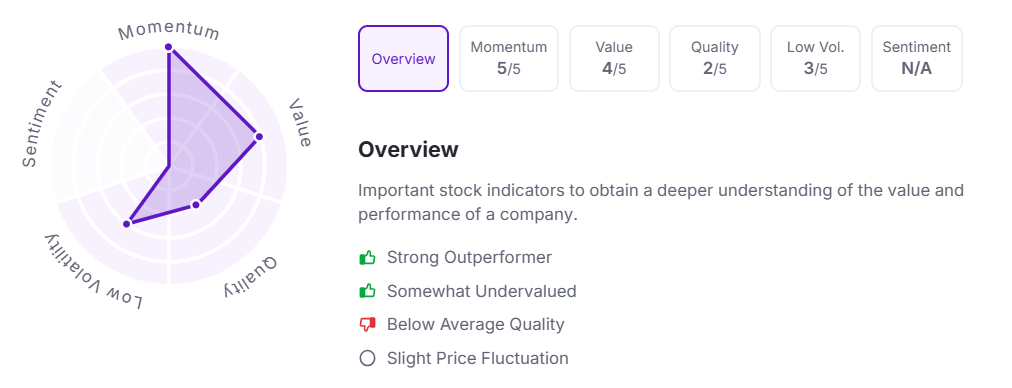

Let’s take a look at its Factor Analysis scores:

Sunteck Realty Ltd. has announced a final dividend of ₹1.50 per equity share. It has a current dividend yield of 0.30% TTM.

Sunteck Realty is a prominent luxury real estate developer based in Mumbai, India. The company has a city-centric portfolio of approximately 52.5 million square feet across 32 projects, with a focus on financial prudence and sustainable growth. Sunteck is known for developing iconic destinations under various brand names, ranging from uber-luxury to aspirational residences.

Sunteck Realty reported a strong operational performance for the first quarter of FY26. Pre-sales grew by 31% YoY to Rs. 657 crore, while collections stood at Rs. 351 crore. The company saw a significant increase in profitability, with EBITDA growing by 52% to Rs. 48 crore and Net Income rising by 47% to Rs. 33 crore.

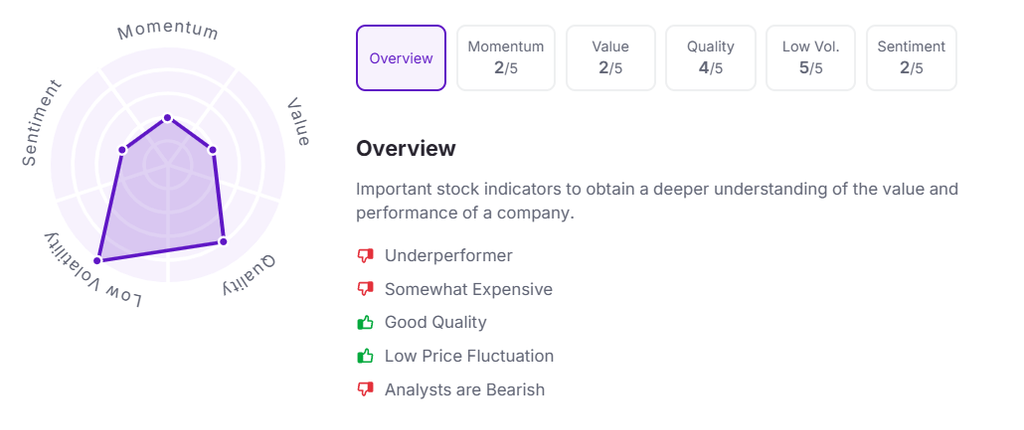

Let’s take a look at its Factor Analysis scores:

Note: The stock prices mentioned are as of 12:30 pm.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.