- Share.Market

- 2 min read

- Published at : 01 Jul 2025 12:59 PM

- Modified at : 16 Jul 2025 07:41 PM

HBL Engineering Ltd. (CMP – ₹633, Stop Loss – ₹580) surged 6% today, rebounding from its support at ₹633 and breaking through key resistance levels at ₹603 and ₹630. A recent divergence trap in the RSI indicates renewed strength, and a potential MACD crossover could further support upward movement. The coming sessions will be crucial in determining follow-through momentum.

HBL Power Systems is involved in the manufacturing of various batteries, e-mobility solutions, and related services.

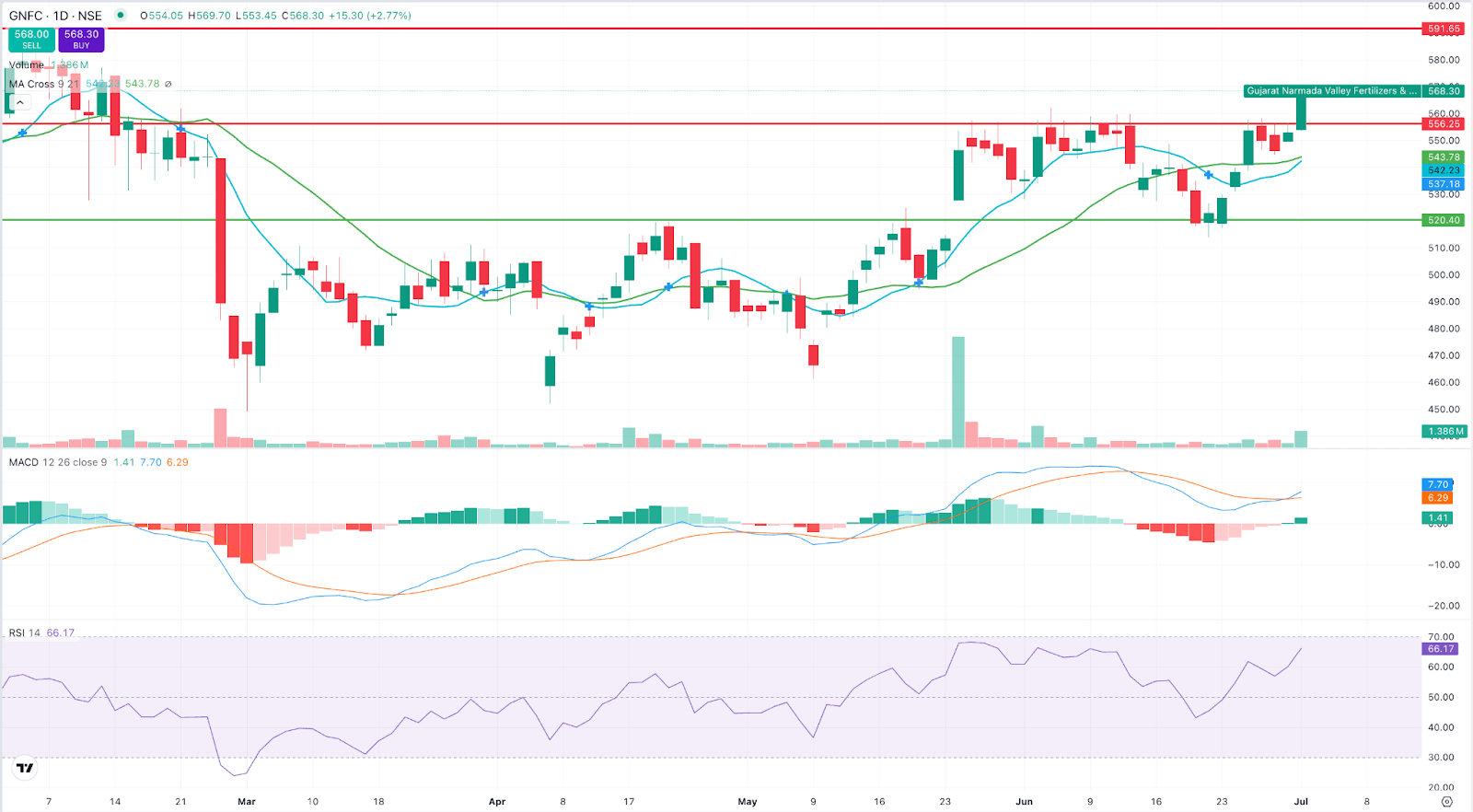

Gujarat Narmada Valley Fertilizers & Chemicals Ltd. (CMP – ₹567, Stop Loss – ₹520) gained 2% today, crossing its resistance at ₹556, with the next resistance at ₹590. A golden crossover between the 10- and 21-day moving averages is anticipated. Both MACD and RSI are showing bullish signals, suggesting potential for continued upside.

GNFC is a leading Indian company engaged in the manufacturing of fertilizers, industrial chemicals, and also provides IT services.

Note: Charts and prices are as of 12:30 PM.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887 and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.