- Share.Market

- 5 min read

- Published at : 15 Jul 2025 10:42 AM

- Modified at : 17 Jul 2025 12:59 PM

The shares of Tata Consultancy Services, Piramal Pharma, and Anant Raj are set for their record date on Tuesday, July 16, 2025.

To be eligible for the upcoming dividends, investors must have bought the shares before the ex-date and hold them at least till the record date.

Tata Consultancy Services Ltd. (TCS), A global IT service, consulting, and business solutions company, has announced an interim dividend of ₹11 per share.

The company reported a steady performance this quarter (Q1 FY26), with revenue rising 1% YoY to ₹63,437 crore and net income increasing by 6% to ₹12,760 crore. The company improved its operating margin to 24.5% and net margin to 20.1%, supported by strong execution and tight cost control.

TCS secured a robust total contract value (TCV) of $9.4 billion, driven by strong demand for AI-led business transformation, cloud modernisation, and vendor consolidation. The management highlighted that the focus on delivering measurable returns on AI investments played a key role in winning new deals.

In terms of business segments, growth in BFSI and technology services remained marginal, while life sciences and communication segments saw a decline. From a geographical lens, the Middle East & Africa and Latin America performed well, but India witnessed a sharp 21.7% year-on-year decline in constant currency terms.

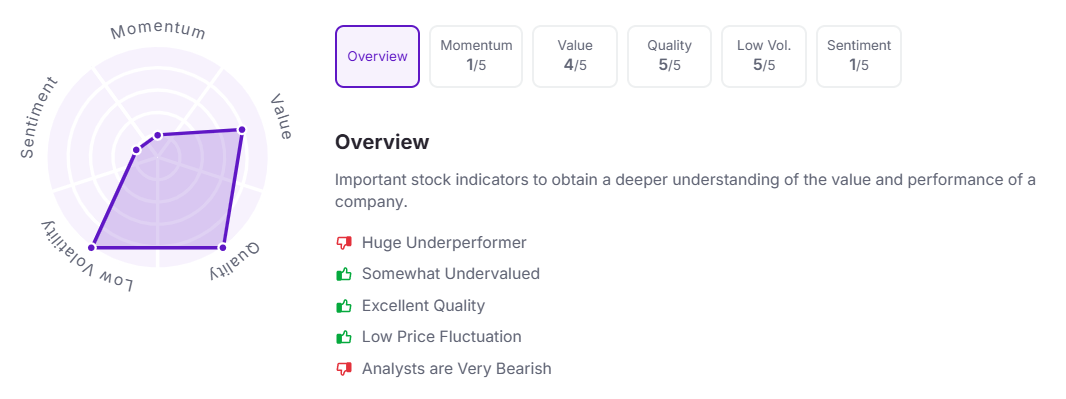

Let’s take a look at its Factor Analysis scores:

Piramal Pharma Ltd. has announced a final dividend of ₹0.14 per equity share.

Piramal Pharma, a leading global pharmaceuticals and wellness company, operates through 3 major segments: Contract development and manufacturing organisations (CDMO), Complex hospital generics (critical care), and consumer healthcare (OTC).

Piramal Pharma continues to strengthen its global presence with a well-diversified revenue base. The company operates 17 manufacturing and development sites and has a commercial presence in over 100 countries, catering to a wide client base of around 500+ CDMO customers.

Notably, 69% of its revenue comes from regulated markets such as North America and Europe, and 59% of its total revenue is contributed by the CDMO (Contract Development and Manufacturing Organisation) segment.

In FY2025, Piramal Pharma reported a 15% year-on-year revenue growth, along with an expansion in EBITDA margins. The share of innovation-related work rose to 54% in FY25 from 50% in FY24, primarily supported by the commercial manufacturing of on-patent molecules. Revenue from on-patent commercial manufacturing saw strong growth of over 50% YoY.

Additionally, the company witnessed a 28% YoY growth in revenue from its differentiated offerings, which now contribute to 49% of CDMO revenues. Margin improvements were supported by strategic procurement, cost optimization, and continued focus on operational excellence.

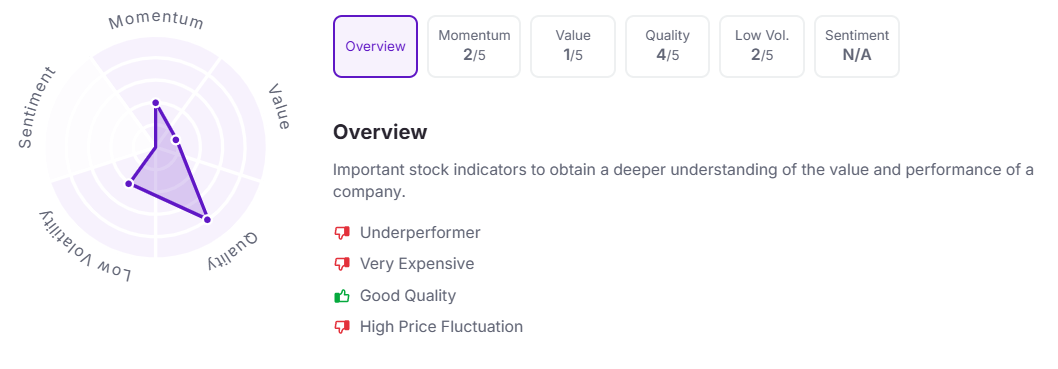

Let’s take a look at its Factor Analysis scores:

Anant Raj Ltd. has announced a final dividend of ₹0.73 per equity share.

Anant Raj is a real estate company with over five decades of experience, developing IT parks, SEZs, malls, and residential projects across Delhi-NCR, Haryana, Rajasthan, and Andhra Pradesh.

It holds ~320 acres of debt-free land in Delhi-NCR and operates a 6 MW data center capacity with cloud services.

In Q4 FY25, Anant Raj’s revenue from operations rose 22% YoY, and EBITDA increased 33% YoY. Net Profit rose 42% YoY to ₹119 crore. For the full year FY25, revenue, EBITDA, and PAT grew by 39%, 43%, and 60% respectively, indicating robust business momentum. The company also made significant progress in deleveraging, reducing net debt to ₹50 crore as of 31st March 2025, down from ₹290 crore a year earlier.

Let’s take a look at its Factor Analysis scores:

Note: The stock price mentioned is as of 10:30 AM.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.