- Share.Market

- 3 min read

- Published at : 23 May 2025 04:13 PM

- Modified at : 16 Jul 2025 07:46 PM

TBO Tek Ltd., one of the world’s leading B2B travel distribution platforms, delivered a robust performance for FY25. The company reported a 25% year-on-year increase in revenue from operations, which stood at ₹1,737.5 crores for FY25, up from ₹1,392.8 crores in the previous year. This growth was underpinned by a strategic focus on international markets and the company’s expanding Hotels and Ancillaries segment, which has now emerged as its primary revenue and profit driver.

Gross transaction value (GTV) for the year rose 16% YoY to ₹30,832 crores, while gross profit climbed 29% to ₹1,193 crores. Net profit for the full year came in at ₹229.9 crores, up from ₹200.6 crores in FY24, representing a 15% YoY gain.

TBO’s performance in the fourth quarter also demonstrated resilience, especially considering the seasonal impact of Ramadan on travel activity. Q4FY25 revenue from operations rose to ₹446.1 crores, up 21% YoY. Net profit for the quarter stood at ₹58.9 crores, a 27% increase.

During FY25, TBO expanded into over 15 new countries, including strategic markets such as Australia, France, and Germany. The international business now accounts for over 54% of TBO’s total GTV, up from 43% a year ago.

Much of this growth has been fueled by the Hotels and Ancillaries segment, which contributed 59% of overall GTV and 84% of the gross profit in FY25. The company’s continued investment in its hotel portfolio and increased ancillary offerings have helped drive better take rates and margins compared to its airline ticketing segment. TBO’s platform now hosts over 1 million hotels globally and supports over 189,000 registered buyers.

In India, the company focused on increasing non-air share of wallet among existing clients, strengthening domestic hotel supply, and deepening relationships with high-touch accounts through initiatives like the newly launched Platinum Desk. Meanwhile, in Europe, TBO saw 92% YoY GTV growth in its Hotels+ segment, supported by localized support and an expanding on-ground sales team. Growth in the APAC and MEA regions remained strong as well, at 89% and 23% respectively.

Management highlighted that continued focus on luxury travel, deeper engagement with transacting buyers, and further international expansion will remain central to its growth strategy. The company also plans to incubate new offerings such as connected trips, and expand its Platinum offering targeting premium travel experiences.

Post its results, TBO Tek surged, reaching an intraday high of ₹1,376.00 apiece.

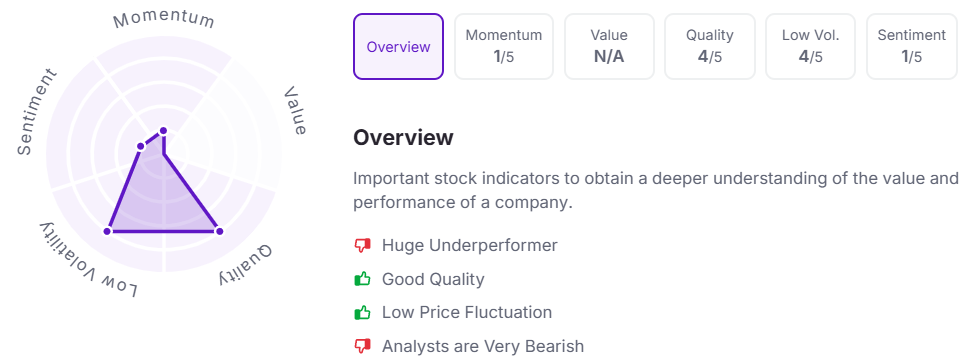

Let’s take a look at its Factor Analysis scores:

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.