- Share.Market

- 3 min read

- Published at : 03 Sep 2025 06:02 PM

- Modified at : 03 Sep 2025 06:02 PM

TBO Tek Ltd. , a global travel distribution platform headquartered in Gurugram, India, has announced an agreement to acquire U.S.-based Classic Vacations from The Najafi Companies for up to $125 million. The move marks TBO’s entry into the North American luxury travel market and strengthens its position in the premium outbound travel segment worldwide.

Classic Vacations, a well-established player in U.S. luxury travel for nearly five decades, reported revenue of $111 million and operating EBITDA of $11.2 million in 2024. With a network of over 10,000 travel advisors and strong supplier relationships, the company has built significant brand recognition in high-value travel services.

Under the agreement, Classic Vacations will continue to operate as an independent brand while benefiting from TBO’s global technology platform and distribution network. This combination is expected to enhance offerings for travel advisors and expand Classic Vacations’ presence beyond the U.S.

The acquisition reflects TBO’s broader strategy to grow both organically and through acquisitions. By integrating Classic Vacations, TBO aims to accelerate its reach in the global luxury travel sector, with demand projected to rise significantly over the coming decade.

Classic Vacations was previously acquired by The Najafi Companies in 2021 from Expedia Group. Moelis & Company LLC acted as financial adviser and Ballard Spahr LLP as legal adviser to Classic Vacations. Cooley LLP and PwC advised TBO.

Post the announcement, the shares of TBO Tek surged over 15%, reaching an intraday high of ₹1,608.00 apiece.

About TBO Tek

TBO Tek, one of the world’s largest travel distribution platforms, reported a resilient performance in Q1 FY26 despite significant macro headwinds across India, the Middle East, and Europe. Revenue rose 22% year-on-year to ₹511 crore, while gross profit increased 19% to ₹333 crore. The company recorded its highest-ever monthly transacting buyers at 29,570, with strong growth in international markets. Profit after tax stood at ₹63 crore, up 3% year-on-year.

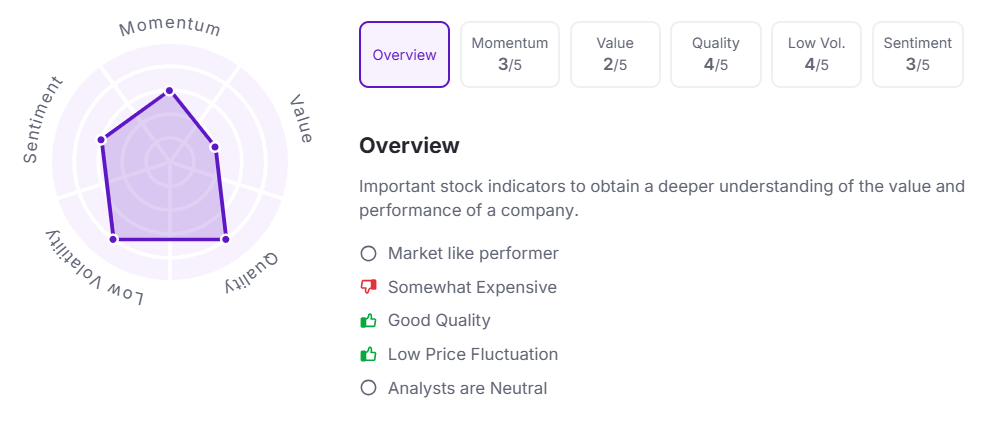

Let’s take a look at its Factor Analysis scores:

Note: The stock price mentioned is as of 3:30 pm.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.