- Share.Market

- 4 min read

- Published at : 09 Oct 2025 05:24 PM

- Modified at : 15 Nov 2025 11:26 AM

Tata Steel Ltd. announced its provisional production and delivery figures for the second quarter of the financial year 2026, highlighting a robust performance driven by its India operations’ recovery and strong domestic demand.

Tata Steel India’s crude steel production for Q2FY26 reached 5.67 million tons, marking an 8% increase quarter-on-quarter (QoQ) and a 7% rise year-on-year (YoY). This strong rebound was mainly attributed to the successful normalisation of operations following the completion of the relining of the ‘G Blast Furnace’ at Jamshedpur. On a half-year basis (1HFY26), India’s production stood at 10.90 million tons, a 3% YoY increase.

Delivery volumes in India also saw a significant surge, totaling 5.56 million tons for the quarter. Domestic deliveries grew by a substantial 20% QoQ and 7% YoY, benefiting from improved production volumes and stable market demand across various sectors despite the seasonal rains. Half-year deliveries rose 3% YoY to 10.31 million tons.

The company registered record performance across several key domestic verticals:

- Branded Products & Retail vertical deliveries were approximately 1.9 million tons, recording ‘best ever’ quarterly volumes and surpassing the previous peak set in 4QFY25. The growth was led by brands like Tata Tiscon, which saw a volume increase of over 25% QoQ and 13% YoY.

- Industrial Products & Projects deliveries were also around 1.9 million tons, powered by strong performance in value-accretive segments. The Engineering segment grew 22% QoQ and 16% YoY, and the SmartF@B ready-to-use solutions segment grew 80% YoY driven by new applications.

- Automotive & Special Products vertical deliveries stood at approximately 0.8 million tons. The company is strengthening this segment, with its recently commissioned Continuous Galvanising Line at Kalinganagar securing facility approvals from Original Equipment Manufacturers (OEMs).

- The Gross Merchandise Value (GMV) from the company’s e-commerce platforms, Tata Steel Aashiyana and DigECA, reached ₹1,980 crores, a figure that more than tripled on a YoY basis.

Tata Steel Netherlands reported liquid steel production of 1.67 million tons and deliveries of 1.54 million tons for Q2FY26, with deliveries showing a marginal increase on both a QoQ and YoY basis.

In the UK, Tata Steel continued to service its customers through downstream processing of purchased substrate, with deliveries for the quarter at 0.56 million tons. The quarter also saw the commencement of construction for the Electric Arc Furnace (EAF) project at Port Talbot. Tata Steel Thailand’s production and delivery volumes were 0.36 million tons for the quarter.

Over the past five years this stock has delivered multibagger returns of more than 370%.

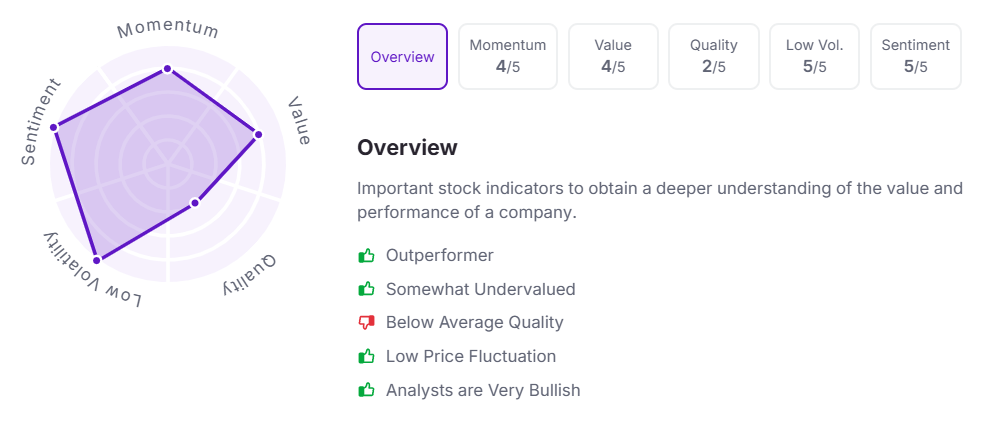

Let’s take a look at its Factor Analysis scores:

Note: The stock price mentioned is as of 3:30 pm.

Disclaimer and Disclosure

Investments in the securities market are subject to market risks, read all the related documents carefully before investing. Registration granted by SEBI, enlistment as Research Analyst with Exchange and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. Kindly refer to https://share.market/ for more details.Investments in WealthBaskets are subject to the Terms of Service. All investors are advised to conduct their own independent research into investment strategies before making an investment decision. PPWB acts as a distributor of mutual funds and WealthBaskets and it is not an exchange traded product. Disputes with respect to the distribution activity of Mutual Funds and WealthBaskets will not have access to Exchange investor redressal or Arbitration mechanism. The securities are quoted as an example and not as a recommendation. This is for informational purposes and should not be considered as recommendations.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887 and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226. Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA. CIN: U65990KA2021PTC146954