- Share.Market

- 2 min read

- Published at : 14 Oct 2025 12:53 PM

- Modified at : 15 Nov 2025 11:15 AM

On October 14, 2025, it looked like Tata Motors Ltd.‘s stock experienced a sharp drop, opening on the NSE at ₹400, a massive plunge from its previous closing price of ₹660.75. This 40% fall is just an adjustment and not a real loss of money.

The company underwent a demerger, which separated its two core businesses — Passenger Vehicles (PV) and Commercial Vehicles (CV) into independent, publicly listed entities.

Its CV business will get listed as a separate entity and the original stock price has simply adjusted to reflect the fact that this business’s value is not included.

In simple terms:

- Value is Split: The price of the original Tata Motors stock (≈₹660) was the combined value of the Passenger Vehicle (PV) and Commercial Vehicle (CV) businesses.

- The Price Adjusts: The stock that continued trading as Tata Motors (now representing the PV, EV, and Jaguar Land Rover (JLR) businesses) got adjusted to ≈₹399 because the value of the CV unit was removed. This company will be renamed Tata Motors Passenger Vehicles Limited

- New Shares will be Allotted: For every one share you held in the combined entity, you are now entitled to one fully paid-up share in the demerged entity, TML Commercial Vehicles Limited (TMLCV).

If you were a shareholder as of the record date on 14th October, 2025, you own the same value, it is simply divided across two stocks.

The goal of this major corporate action was to separate the CV and PV businesses to unlock growth potential and provide sharper focus to each segment. The businesses have different risk profiles and capital requirements. The move is expected to attract specialized investors and enhance the flexibility for existing shareholders.

Over the last five years, this stock has delivered multibagger returns of more than 200%.

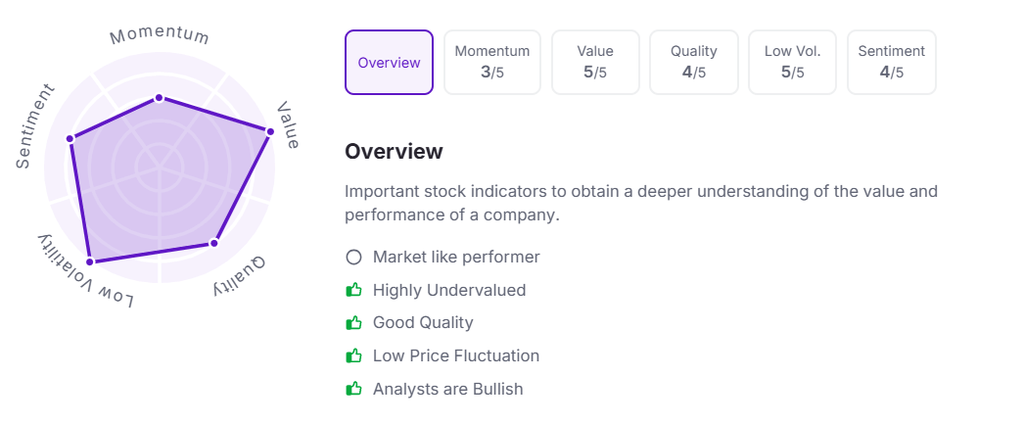

Let’s take a look at its Factor Analysis scores:

Note: The stock price mentioned is as of 12:45 pm.