- Share.Market

- 4 min read

- Published at : 13 Oct 2025 01:00 PM

- Modified at : 15 Nov 2025 11:18 AM

The shares of Tata Motors, Tata Investment Corporation and Gokul Agro Resources are in focus for their upcoming spin off and stock split. Investors who wish to be eligible must have bought the shares before the ex-date and hold them at least till the record date.

Tata Motors Ltd. has announced the demerger of its commercial vehicle (CV) business, completing a restructuring under a Composite Scheme of Arrangement. The goal of this major corporate action is to separate the CV and Passenger Vehicle (PV) businesses to unlock growth potential and provide sharper focus to each segment.

The company has set Tuesday, October 14, 2025, as the Record Date for the demerger.

According to the Scheme, eligible shareholders will receive equity shares in the newly formed commercial vehicle entity in a 1:1 ratio, meaning one fully paid-up share in the new entity TML Commercial Vehicles Limited (TMLCV) for every one share held in the current Tata Motors Limited.

Post-restructuring, TML Commercial Vehicles Limited (TMLCV) will be renamed as the new Tata Motors Limited and will hold the CV business.

The existing Tata Motors Limited (TML) will be renamed Tata Motors Passenger Vehicles Limited and will carry on the PV business, including its investments in the Electric Vehicle (EV) business and Jaguar Land Rover (JLR).

The company notes that separating the two undertakings, CV and PV, will allow each to operate with a dedicated strategy, focused leadership, and tailored investment decisions. The businesses have different risk profiles and capital requirements. The move is expected to attract specialized investors and enhance the flexibility for existing shareholders.

Over the last five years, this stock has delivered multibagger returns of more than 390%.

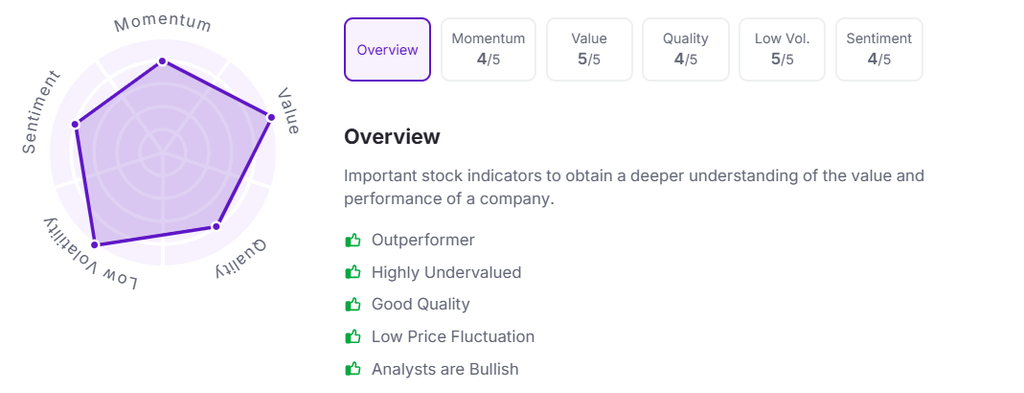

Let’s take a look at its Factor Analysis scores:

Tata Investment Corporation Ltd. invests in a diversified portfolio of quoted and unquoted securities, primarily targeting Tata Group companies with a history of strong performance, using a combined strategy of value and growth.

The company has approved a stock split in the ratio of 1:10, meaning each equity share with a face value of ₹10 will be subdivided into ten equity shares with a face value of ₹1 each. The record date for the split has been fixed as Tuesday, October 14, 2025. While the total value of investment will remain unchanged, the number of shares held by investors will double, improving share affordability and market liquidity.

Over the last three and five years, this stock has given multibagger returns of over 300% and 980%, respectively.

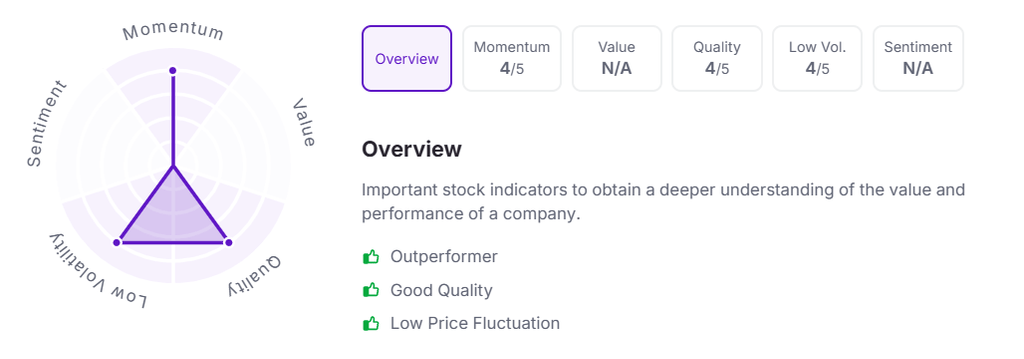

Let’s take a look at its Factor Analysis scores:

Gokul Agro Resources Ltd. is a leading and rapidly growing FMCG company incorporated in 2014, specializing in the production and global distribution of edible and non-edible oils and derivatives. It has strategically expanded its sourcing capabilities by establishing overseas subsidiaries in Singapore and Indonesia to meet increasing domestic demand and achieve its vision of becoming an Indian Multinational Conglomerate.

The company has approved a stock split in the ratio of 1:2, meaning each equity share with a face value of ₹2 will be subdivided into two equity shares with a face value of ₹1 each. The record date for the split has been fixed as Tuesday, October 14, 2025. While the total value of investment will remain unchanged, the number of shares held by investors will double, improving share affordability and market liquidity.

Over the last three and five years, this stock has given multibagger returns of over 360% and 2,660%, respectively.

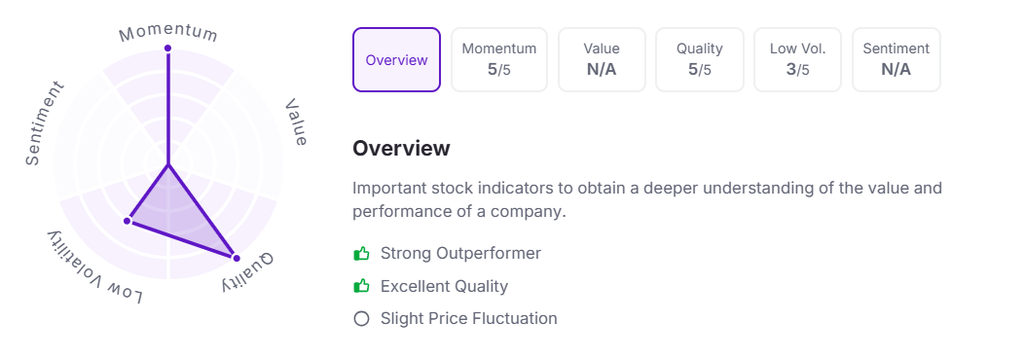

Let’s take a look at its Factor Analysis scores:

Note: The stock prices mentioned are as of 1:00 pm.