- Share.Market

- 3 min read

- Published at : 03 Jun 2025 10:49 AM

- Modified at : 16 Jul 2025 07:55 PM

The shares of Tata Motors and INOX India are set for their record date on Wednesday, June 04, 2025. To be eligible for the upcoming dividends, investors must have bought the shares before the ex-date and hold them at least till the record date.

Tata Motors

Tata Motors Ltd., an Indian multinational automotive company, has announced the final dividend of ₹6 per equity share for FY25. It has a current dividend yield of 0.80%.

Tata Motors, a flagship of the Tata Group, is one of India’s largest automobile manufacturers with a strong presence across passenger vehicles (PVs), commercial vehicles (CVs), and electric mobility. Known for innovation-led growth and a diversified product portfolio.

In May 2025, the company reported a subdued performance, with total sales declining 9% year-on-year to 70,187 units. In the PV category, EV sales rose marginally by 2% YoY to 5,685 units, reflecting steady demand despite broader softness in the segment. While retail trends remained stable, Tata Motors attributed the volume pressure to cyclical factors and continued its focus on expanding capabilities across domestic and global markets.

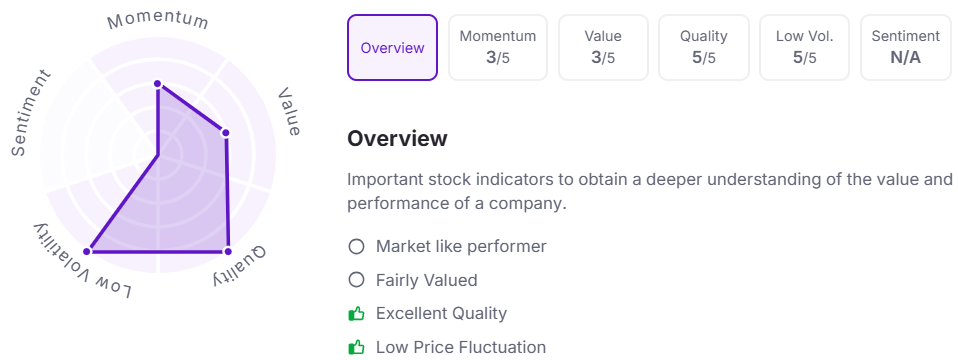

Let’s take a look at its Factor Analysis scores:

INOX India

Inox India Ltd., the largest manufacturer of cryogenic storage tanks, has announced the final dividend of ₹2 per equity share for FY25.

INOX India stands as a global leader in cryogenic technology, catering to the industrial gases, LNG, and scientific applications sectors across more than 100 countries. With facilities in India, Brazil, and Europe, the company is a key enabler of India’s transition to cleaner energy through LNG adoption and innovation in cryo-scientific systems. The successful commissioning of its Savli plant in FY25 added ₹200 crores to turnover and marked a major step in scaling operations with operational excellence.

INOX India closed FY25 with a 16.2% year-on-year revenue growth to ₹1,354 crores, while profit after tax (PAT) rose 15.4% to ₹224 crores. For Q4FY25, revenue climbed 33% YoY to ₹383 crores, led by strong exports (₹205 crores), which contributed 53% of quarterly revenue. PAT jumped 55.5% to ₹66 crores. Order inflow stood at ₹1,533 crores for the year, with a closing backlog of ₹1,356 crores, reflecting robust demand across industrial gases, LNG, and cryo-scientific divisions. Major wins included orders for LNG terminals, helium dewars, and stainless-steel kegs, as well as breakthroughs in semiconductors and clean energy storage.

Let’s take a look at its Factor Analysis scores:

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.