- Share.Market

- 3 min read

- Published at : 01 Aug 2025 04:07 PM

- Modified at : 01 Aug 2025 04:07 PM

Suzlon Energy Ltd. has bagged a 381 MW wind energy order from Zelestra India and its affiliates, marking the latter’s entry into firm and dispatchable renewable energy (FDRE). The deal highlights India’s ongoing shift toward more reliable, scalable, and round-the-clock renewable power.

Post the announcement, shares of Suzlon surged, reaching an intraday high of ₹66.80 apiece.

The project will involve the supply of 127 S144 wind turbines, each rated at 3 MW, to be installed across Maharashtra (180 MW), Madhya Pradesh (180 MW), and Tamil Nadu (21 MW). The Maharashtra and MP capacities fall under SJVN’s FDRE bid, while the Tamil Nadu portion will cater to commercial and industrial (C&I) consumers.

This is Zelestra’s maiden FDRE initiative in India and sets the foundation for its broader plan to deliver 5 GW of hybrid renewable energy projects by 2028. With this latest win, Suzlon’s S144 turbine order book now stands at approximately 91% utilization, underscoring continued demand for its 3 MW platform.

The partnership reflects Zelestra’s commitment to scaling clean energy solutions with assured interconnection timelines, while leveraging Suzlon’s fully integrated model spanning in-house technology, manufacturing, execution, and lifecycle services. The project reinforces Suzlon’s leadership in India’s wind sector and positions it as a key enabler in the country’s journey toward dependable green power.

Zelestra currently has a portfolio of about 29 GW of carbon-free projects across 13 countries, of which 5.4 GW are either operational, under construction, or nearing execution. Suzlon, with over 21.1 GW of global wind installations and 15.1 GW under management in India, continues to drive large-scale decarbonization through turnkey wind energy solutions.

Over the last three and five years, this stock has given multibagger returns of more than 895% and 1,430%, respectively.

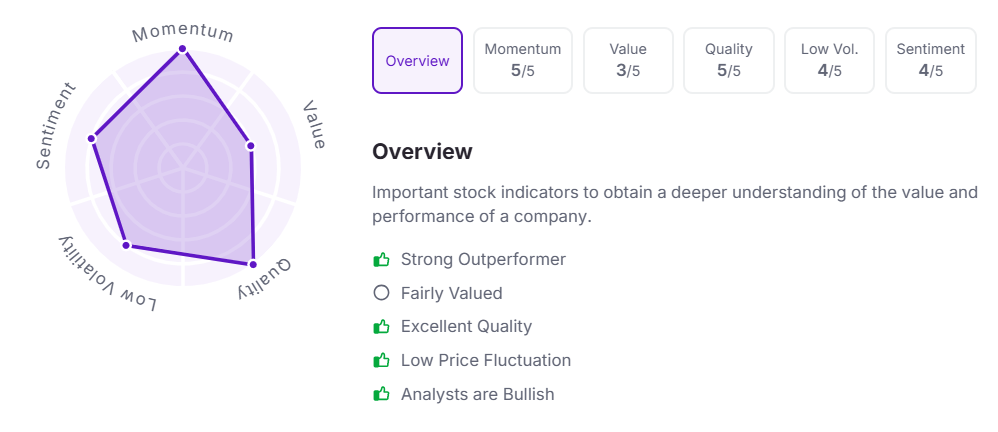

Let’s take a look at its Factor Analysis scores:

Note: The stock price mentioned is as of 3:30 pm.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.