- Share.Market

- 3 min read

- Published at : 04 Jul 2025 11:28 AM

- Modified at : 16 Jul 2025 07:22 PM

The shares of Sun Pharmaceutical Industries and Dodla Dairy are set for their record date on Monday, July 07, 2025. To be eligible for the upcoming dividends, investors must have bought the shares before the ex-date and hold them at least till the record date.

Sun Pharmaceutical Industries Ltd. has announced a final dividend of ₹5.5 per equity share. Its current dividend yield is 0.90%.

Sun Pharma is India’s largest pharmaceutical company and a global leader in specialty generics, with a strong presence in over 100 countries. Its diversified portfolio spans generics, specialty, and consumer healthcare, with Global Specialty now contributing nearly 20% of total sales.

Sun Pharma posted a 9% YoY rise in FY25 revenue to ₹52,041 crore, with adjusted net profit up 19% at ₹11,984 crore and EBITDA up 17.3%. Q4 revenue grew 8.5% to ₹12,816 crore, while adjusted PAT rose 4.8% to ₹2,889 crore. India and Global Specialty businesses drove growth despite a dip in US sales.

Over the last three years, this stock has given multibagger returns of more than 102%.

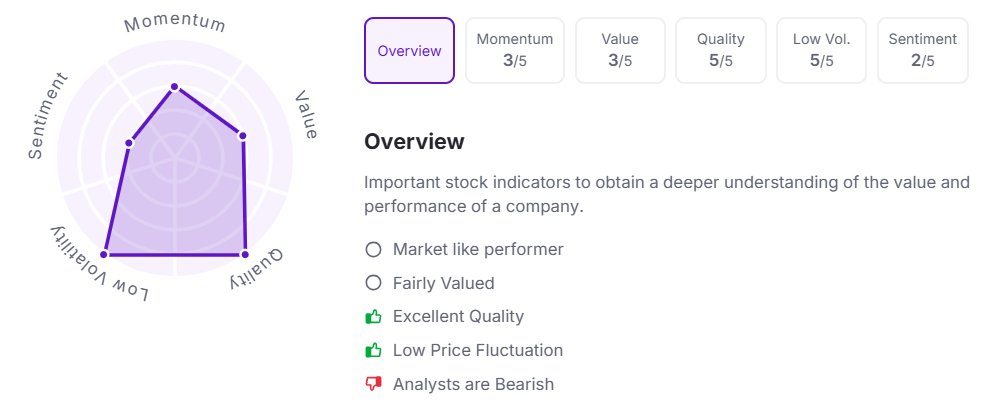

Let’s take a look at its Factor Analysis scores:

Dodla Dairy Ltd. has announced a final dividend of ₹2 per equity share. Its current dividend yield is 0.20%.

Dodla Dairy is a leading integrated dairy company with a strong presence across 13 Indian states and operations in Uganda and Kenya. Its diverse portfolio includes milk, curd, ghee, and value-added products (VAPs), which contributed 35% to FY25 sales. With over 190 chilling centres, 2,900+ agents, and 839 retail parlours, the company continues to expand its reach through a robust procurement and distribution network.

Dodla Dairy reported a 19% YoY rise in FY25 revenue to ₹37,201 crore, led by a 45.9% surge in VAP sales. PAT grew 55.9% to ₹2,599 crore, and EBITDA rose 31.8% to ₹3,808 crore. Q4 revenue stood at ₹9,096 crore, up 15.5%, with PAT up 45.1% at ₹680 crore.

Over the last three years, this stock has given multibagger returns of more than 195%.

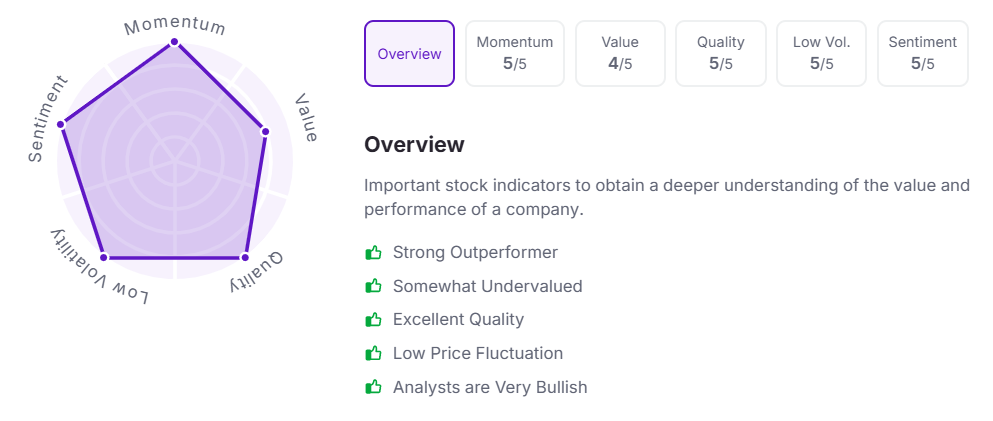

Let’s take a look at its Factor Analysis scores:

Note: The stock prices mentioned are as of 11:25 AM.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.