- Share.Market

- 6 min read

- Published at : 22 May 2025 03:59 PM

- Modified at : 16 Jul 2025 07:44 PM

The shares of LTIMindtree, CMS Info Systems, Havells India, Chemicals, and, Sula Vineyards are set to trade ex-dividend on Thursday, May 22, 2025. To be eligible for the upcoming dividends, investors must have bought the shares before the ex-date and hold them at least till the record date.

LTIMindtree

LTIMindtree, a global technology consulting and digital solutions company, has announced the final dividend for FY24 – 25 of ₹45 per equity share. The record date for the same is Friday, May 23, 2025.

The company had previously announced an interim dividend of ₹20 per equity share on 25 October 2024 and a final dividend of ₹45 on 10 June 2024. Its current dividend yield is 1.30%.

LTIMindtree is a digital solutions company under the Larsen & Toubro Group. It partners with over 700 enterprises worldwide to drive digital transformation, helping them reimagine business models, improve customer experiences, and accelerate innovation. In FY25, LTIMindtree reported steady growth, with INR revenue increasing 7% to ₹3,80,081 million. Profit after tax reached ₹46,020 million with a PAT margin of 12.1%, slightly down from 12.9% last year.

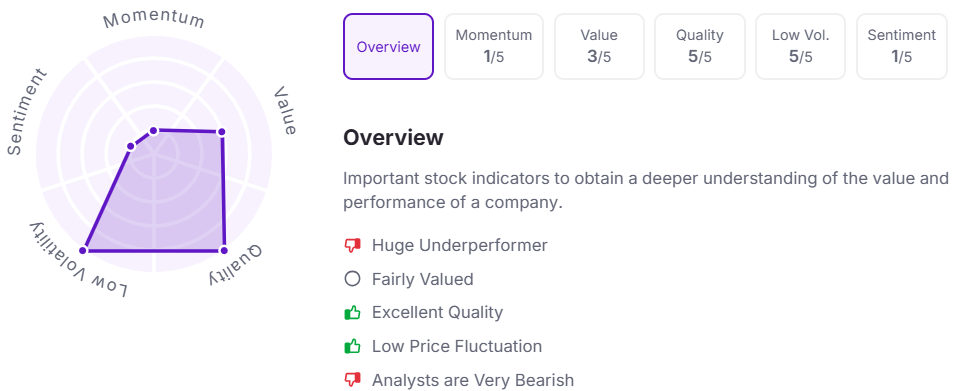

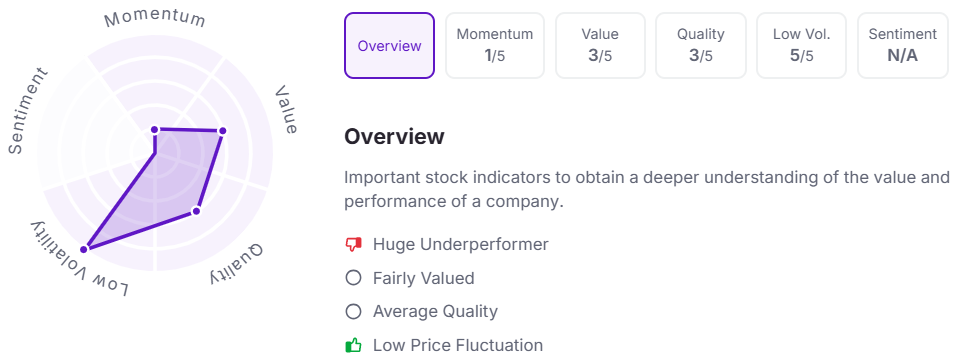

Let’s take a look at its Factor Analysis scores:

CMS Info Systems

CMS Info Systems, a technology solutions company, has announced a final and special dividend for FY24 – 25 of ₹3.25 and ₹3 per equity share. The record date for the same is Friday, May 23, 2025.

The company had previously announced an interim dividend of ₹3.25 per equity share on 11 February 2025 and a final dividend of ₹3.25 on 28 May 2024. Its current dividend yield is 1.40%.

CMS Info Systems Limited is one of India’s leading business services companies. Its offerings span cash logistics, managed services, and technology solutions, including ATM and retail cash management, banking automation, AIoT remote monitoring, and card management services. CMS Info Systems delivered a strong performance in FY25, with revenue growing 7% YoY and PAT rising 7.3%. In Q4 alone, revenue rose 6.5% sequentially to ₹619 crore, driven by momentum in new order wins worth ₹500 crore.

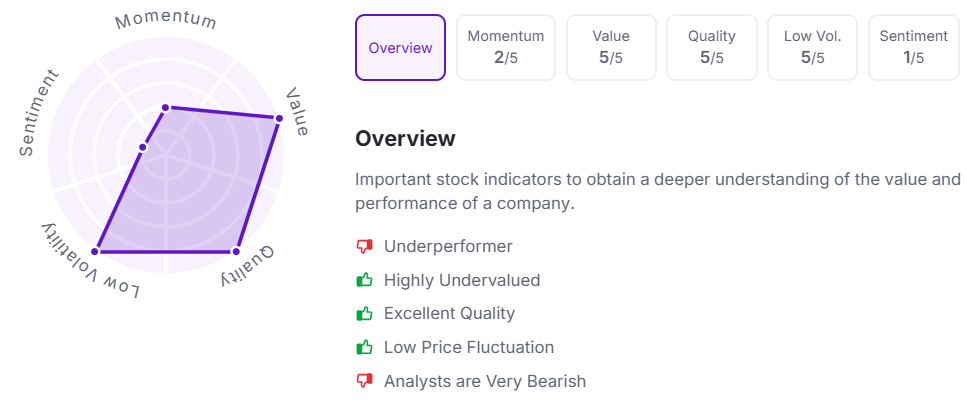

Over the last three years, this stock has given multibagger returns of more than 100%. Let’s take a look at its Factor Analysis scores:

Havells India

Havells India, a leading manufacturer of electrical equipment, has announced a final dividend for FY24 – 25 of ₹6 per equity share. The record date for the same is Sunday, May 25, 2025.

The company had previously announced an interim dividend of ₹4 per equity share on 22 January 2025 and a final dividend of ₹6 on 31 May 2024. Its current dividend yield is 0.60%.

Havells India is a leading Fast-Moving Electrical Goods company with a strong global footprint, known for its diversified portfolio of brands including Havells, Lloyd, Crabtree, Standard Electricals, and REO. With 15 advanced manufacturing plants across India and over 1,000 exclusive brand stores, Havells serves residential, commercial, and industrial customers with a wide range of electrical products. Havells reported a strong performance in FY25, with net revenue rising 17.2% and net profit growing 16.9%. The growth was supported by robust demand across segments, improved operating leverage, and effective cost control, even as margins remained steady despite higher SG&A and advertising spends.

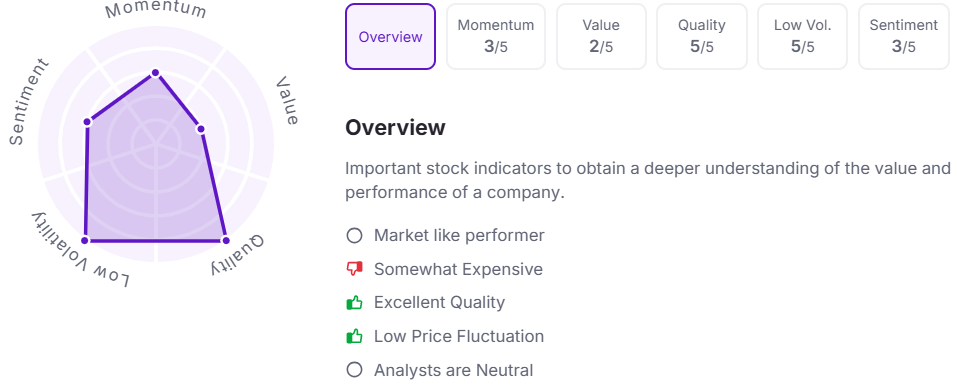

Let’s take a look at its Factor Analysis scores:

Himadri Speciality Chemicals

Himadri, a global specialty chemicals conglomerate, has announced a dividend of ₹0.60 per equity share. The record date for the same is Friday, May 23, 2025.

The company had previously announced a final dividend of ₹0.50 on 7 June 2024. Its current dividend yield is 0.10%.

Himadri Speciality Chemical, headquartered in Kolkata, is known for its deep expertise in carbon-based products and a strong focus on R&D, innovation, and sustainability. With seven manufacturing plants in India and one in China, Himadri has built one of the most extensive value chains in the carbon segment. Himadri reported a strong Q4FY25 performance, with PAT rising 38%, marking a new quarterly record. For the full year, revenue rose 10% and PAT jumped 36%, underlining a solid growth trajectory despite volume pressures.

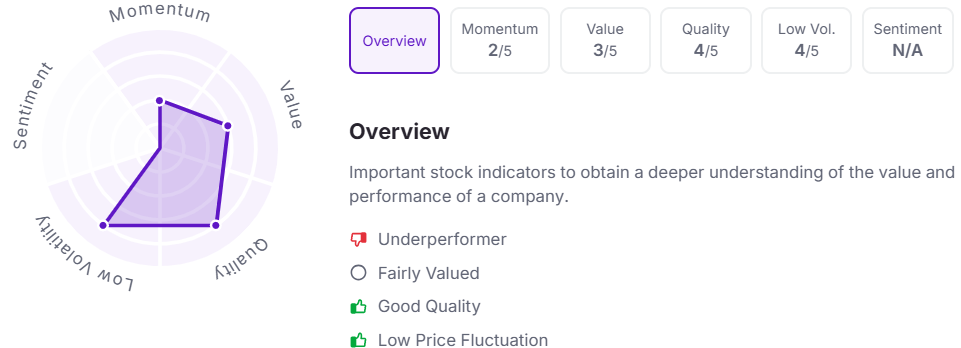

Over the last three years, this stock has given multibagger returns of more than 635%. Let’s take a look at its Factor Analysis scores:

Sula Vineyards

Sula, a winery, has announced the final dividend for FY24 – 25 of ₹3.60 per equity share. The record date for the same is Friday, May 23, 2025.

The company had previously announced a final dividend of ₹4.50 per equity share on 22 May 2024.

Sula Vineyards is India’s largest and most celebrated wine producer, holding over 50% share in the domestic wine market, with a diverse portfolio of nearly 70 labels and five world-class wineries in Maharashtra and Karnataka. Sula posted its highest-ever revenue in FY25, growing 1.8%, driven by strong demand for its Elite & Premium wines, which now account for 77.1% of total sales. Wine tourism revenue also hit a record ₹60.3 crore, up 10.2% YoY, supported by improved resort occupancy and a successful SulaFest 2025.

Let’s take a look at its Factor Analysis scores:

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.